You must have heard the names of brands like BKash, Nagad, Upay, SSLCOMMERZ, Tap, Trust Axiata Pay, Cryptocurrency, Bitcoin etc. And you know that these companies provide different services. But do you know— all of these companies are part of the same industry. And what is that industry? That industry is Fintech. Fintech is one of the fastest-growing industries in Bangladesh. This industry has completely changed how we look at money, how we use money, how we save and grow money, and how we invest it.

What is Fintech?

So first, let’s understand what Fintech actually is. Fintech is short for Financial Technology. By combining finance and technology, we get Fintech. As the name suggests, it refers to companies that use technology to provide financial services and deliver them to customers, making their experience easier and more engaging. Fintech includes digital transactions, lending apps, online stock trading, and investment platforms.

Imagine you’re a university student in Dhaka, living in a house near your campus. One morning, your mother from Chittagong calls and says,“Ma, bKash diye taka pathailam. Check kore dekh.” You open your BKash app and ding! the money has already arrived. No need to go to a bank or stand in line at a counter. Now, you use Trust Axiata Pay to pay the Desco electricity bill for your mess, Tap to split your foodpanda lunch bill with your roommate, Then In the evening, you use Upay to save a bit into a digital savings feature, or maybe send a little money to your younger brother in Sylhet all from your mobile phone.

Early Days of Financial Services in Bangladesh

Historically, Bangladesh’s financial sector was dominated by traditional banking institutions, such as Sonali Bank, Agrani Bank, and Janata Bank, along with a few private commercial banks like BRAC Bank and Eastern Bank. For decades, banking was a slow process. People, especially in rural areas, had limited or no access to banking services due to poor infrastructure, a lack of digital education, and mistrust of formal financial institutions.

Many operated in a cash-based economy, relying on informal money lenders, NGOs, or hawala systems for savings and loans. This exclusion hindered economic growth, limited access to credit, and reduced the effectiveness of government financial aid programs. As the country’s economy began to grow and remittances increased, there was a clear need for faster, safer, and more inclusive financial solutions.

When More People Are Using Mobile for Banking

The journey of fintech in Bangladesh is a story of transformation from a cash-reliant, traditional banking sector to a digitally driven financial ecosystem that now serves millions across urban and rural areas.

Mobile Financial Services (MFS)

The turning point came in 2011 when bKash, a subsidiary of BRAC Bank, launched as the country’s first large-scale mobile financial service (MFS) provider. bKash revolutionized the financial landscape by allowing people to transfer money using their mobile phones, without needing a bank account. In a country where over 70% of the population owned mobile phones but less than 20% had formal bank accounts at the time, bKash quickly became a household name. Its user-friendly interface, wide network of agents, and support from development organizations helped it expand rapidly.

Following the success of bKash, other players entered the market, including Rocket by Dutch-Bangla Bank, Nagad backed by the Bangladesh Post Office, and more recently, Upay by UCB. These services enabled basic transactions such as cash-in, cash-out, person-to-person transfers (P2P), utility bill payments, and mobile recharges. During emergencies like natural disasters and the COVID-19 pandemic, MFS became essential in distributing government subsidies and relief funds, further solidifying their role in financial inclusion.

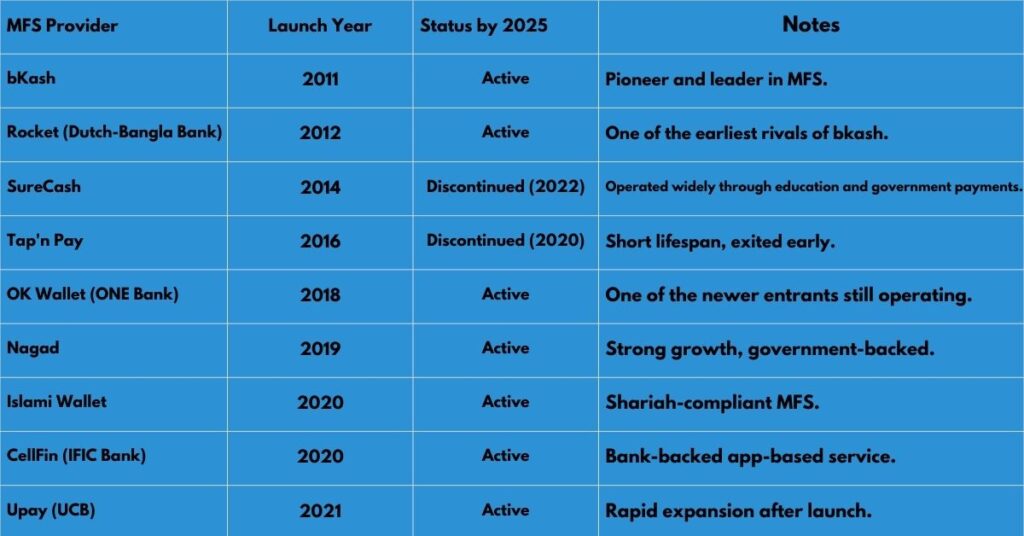

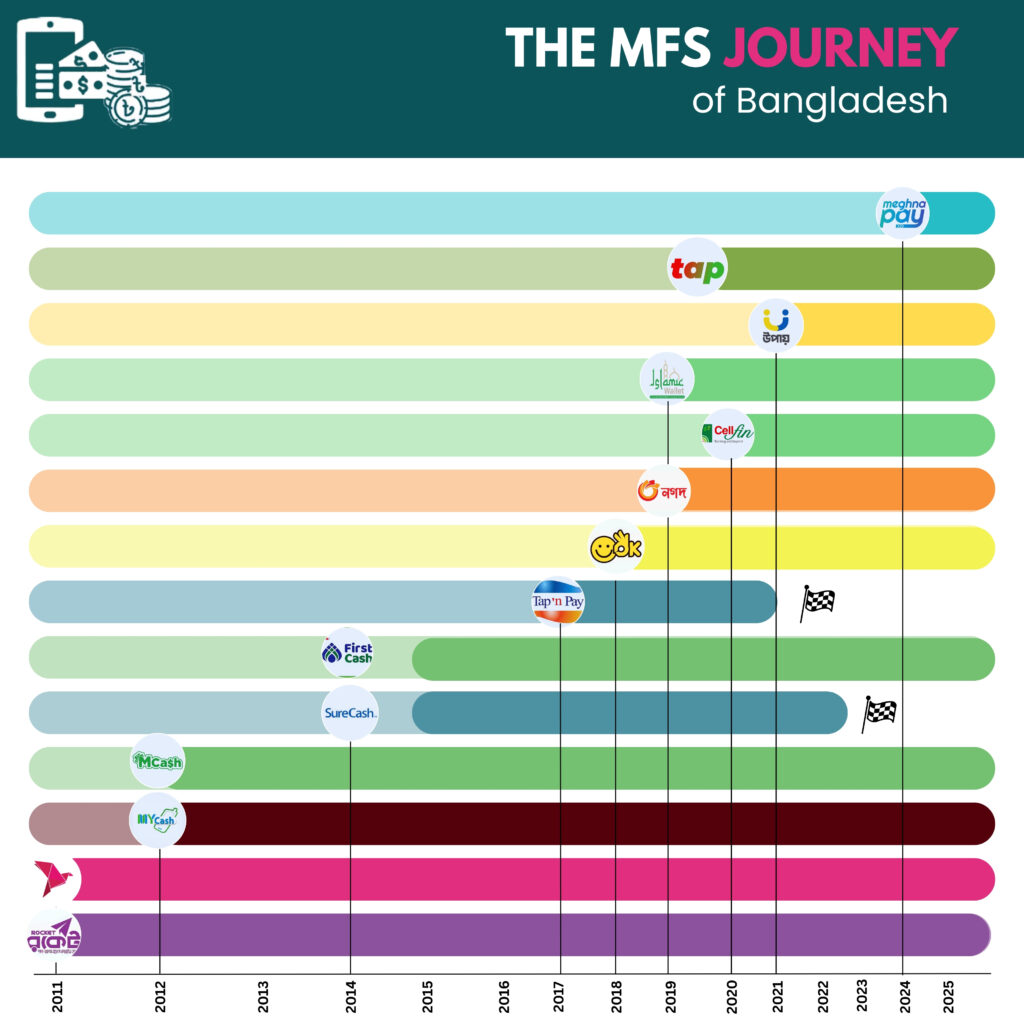

The timeline spans from 2011 to 2025. Each horizontal bar represents a specific MFS provider.The start of the bar shows when the provider entered the market.

Digital Payments and E-Wallets

As smartphone usage grew and internet connectivity improved, digital payment platforms began to evolve beyond basic mobile money transfers. E-commerce platforms like Daraz, Chaldal, and food delivery services such as Foodpanda and Pathao contributed to the increasing demand for e-wallets and QR-based payments. bKash itself evolved into a full-service wallet, offering merchant payments, international remittances, ticket booking, savings features, and even micro-loans.

In 2020, bKash partnered with Ant Financial (Alibaba Group) and Mastercard, paving the way for digital wallet users to make payments at both local and international levels. Nagad also transformed into a lifestyle wallet, offering cashback, educational payments, and broader integration with government services. Meanwhile, banks and fintech startups collaborated to launch bank-linked apps like NexusPay (from DBBL), Tap (from Trust Bank), and CellFin (from Islami Bank). Digital wallets were no longer just about transferring money; they became essential tools for online shopping, bill payments, entertainment subscriptions, and peer-to-peer lending.

Major Business Segments of the Fintech Industry

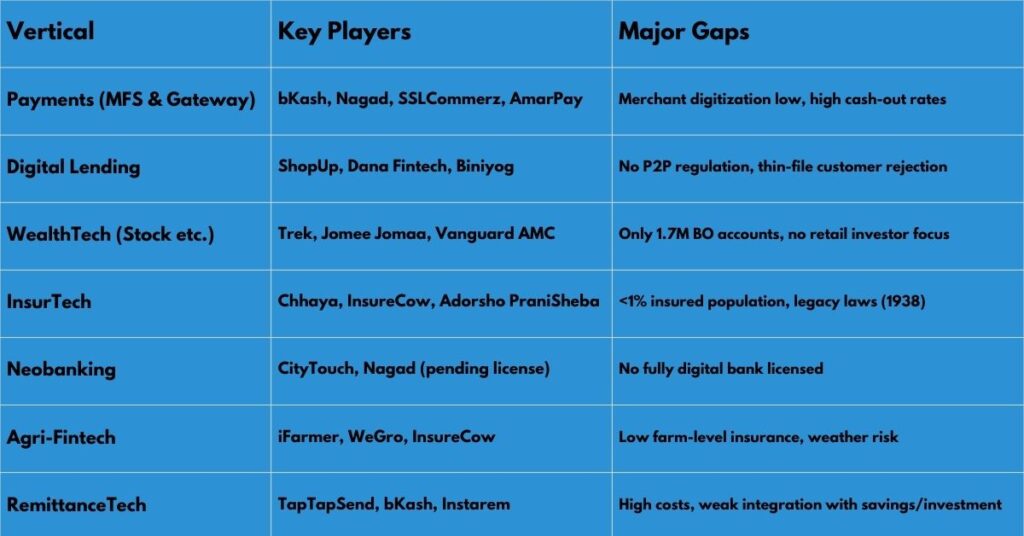

Bangladesh’s fintech ecosystem is rapidly evolving, with each segment contributing to greater financial inclusion and economic development. Continued innovation, supportive regulations, and increased digital literacy will be crucial in sustaining this growth trajectory.

Digital Payments

Digital payments are the cornerstone of Bangladesh’s fintech revolution. With over 100 million registered MFS (Mobile Financial Services) accounts and millions of transactions processed daily, this segment has made financial services more inclusive and accessible. It has eliminated the need for physical cash and significantly reduced the unbanked population by offering convenient and secure options for transferring money, paying utility bills, buying goods online, or receiving remittances. Mobile operators and banks have collaborated to extend services even to remote rural areas.

• bKash: Launched in 2011, bKash has become synonymous with mobile money in Bangladesh. It offers services ranging from money transfers and bill payments to savings and microloans.

• Nagad: Introduced by the Bangladesh Post Office in 2019, Nagad has rapidly gained popularity, becoming the country’s second fintech unicorn after bKash .

• Rocket: Operated by Dutch-Bangla Bank, Rocket was among the pioneers in mobile banking, providing a range of financial services through mobile platforms.

• Payment Gateways: Platforms like SSLCOMMERZ and ShurjoPay facilitate online transactions by integrating various payment methods, including cards and mobile wallets .

Applications:

• Peer-to-Peer Transfers (P2P): Easily send money to family or friends using mobile apps.

• Merchant Payments: Scan QR codes to pay in retail stores, e-commerce websites, and local shops.

• Utility & Bill Payments: Pay electricity, water, gas, internet, and mobile bills without standing in queues.

• Salary Disbursement: Employers pay salaries digitally, ensuring transparency and faster access.

• Government Disbursements: Social welfare, student stipends, and COVID-19 relief funds have been distributed via bKash and Nagad.

Revenue Models:

• Transaction fees charged to users per transfer.

• Commissions from merchants for processing payments.

• Subscription fees for premium services or enterprise solutions.

Cryptocurrency and Digital Assets ₿

Cryptocurrency and Digital Assets ₿

Although the trading and holding of cryptocurrencies are officially restricted in Bangladesh, interest in digital assets remains high. Thousands of freelancers use Bitcoin or Ethereum to receive international payments because of its speed, low fees, and independence from traditional banking systems. Globally, cryptocurrencies are increasingly seen as alternative investments, stores of value, and mediums of exchange.

• Cryptocurrencies: Bitcoin, Ethereum, and Tether are among the most commonly used digital assets.

• Exchanges: While local exchanges are non-existent due to legal restrictions, global platforms like Binance and Coinbase are accessed through VPNs and other means.

Applications:

•Remittances: Freelancers often receive crypto as payment and later convert to fiat through informal peer channels.

•Investment & Trading: Global users trade digital assets on platforms like Binance or Coinbase.

•Decentralized Finance (DeFi): Cryptocurrencies are used in lending, borrowing, and staking platforms.

•NFTs and Digital Collectibles: Users create, sell, or buy unique digital assets using blockchain.

•Cross-Border Microtransactions: Ideal for low-fee, fast global payments in sectors like freelancing and gig economy.

Revenue Models:

•Trading and exchange fees.

•Wallet service charges.

•Token issuance through Initial Coin Offerings (ICOs) or Initial DEX Offerings (IDOs).

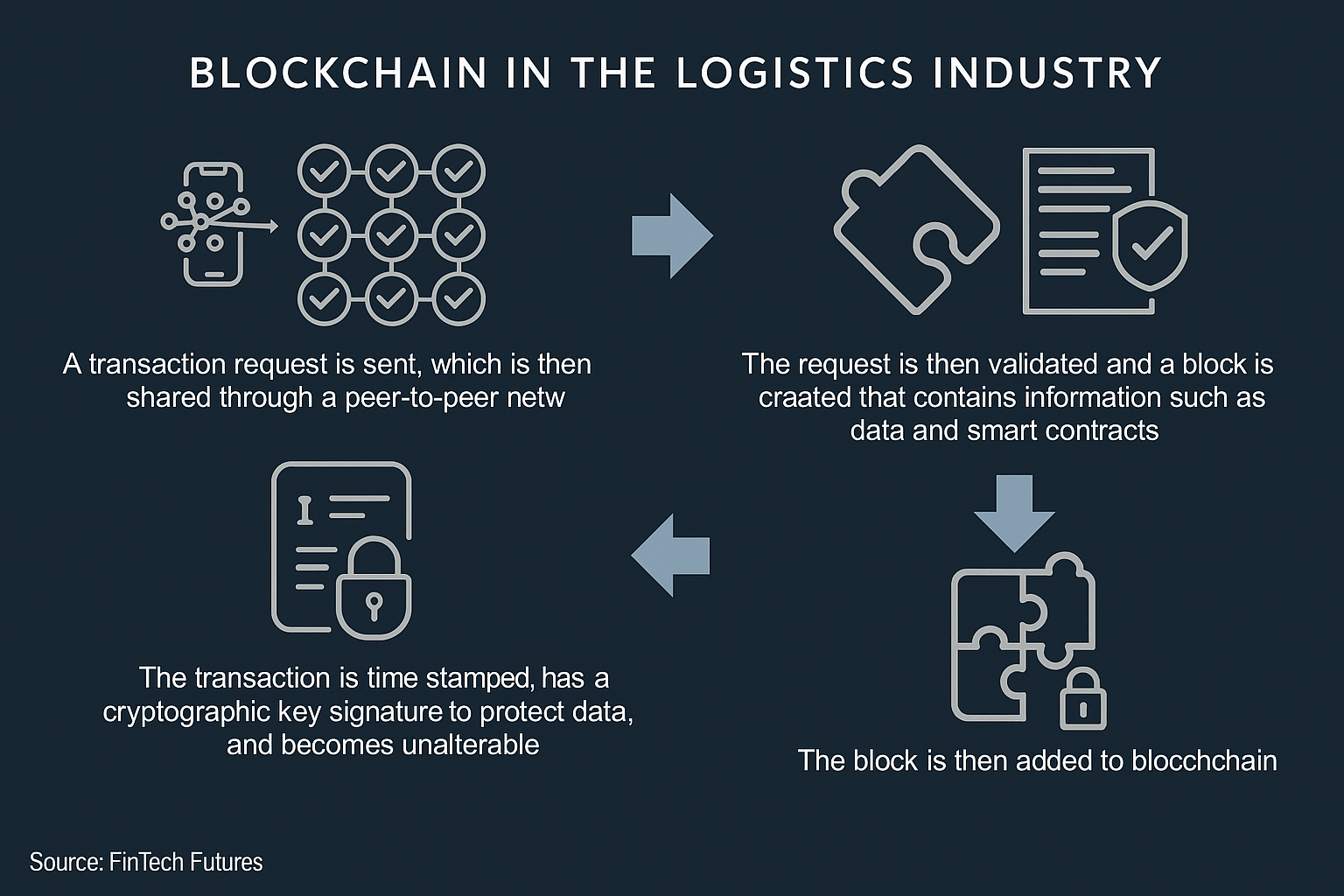

Blockchain and Distributed Ledger Technology (DLT)

Beyond powering cryptocurrencies, blockchain technology has enormous potential in sectors requiring trust, transparency, and decentralization. In Bangladesh, the government and private sector are exploring blockchain for land registration, e-governance, and remittance processing. As a tamper-proof and immutable record-keeping system, blockchain can combat fraud, reduce costs, and improve efficiency.

Applications:

•Land Ownership Records: Digitizing land documents to prevent duplication, fraud, and illegal occupation.

•Smart Contracts: Automated, self-executing contracts with no need for intermediaries—used in supply chains, finance, and real estate.

•Transparent Donations: NGOs use blockchain to track fund usage and build donor trust.

•Cross-Border Payments: Ensures faster, cheaper remittance transfers without middlemen.

•Medical Records: Blockchain ensures secure and private sharing of health data between hospitals and patients.

Revenue Models:

•Enterprise solutions tailored for specific industries.

•Blockchain-as-a-Service (BaaS) offerings.

•Licensing and integration services for existing systems.

Digital Lending and Buy Now Pay Later (BNPL)

Digital lending and BNPL services are revolutionizing access to credit in Bangladesh. With limited access to traditional bank loans for small entrepreneurs and low-income individuals, fintech lending apps use AI and alternative data like mobile usage or e-commerce activity to assess creditworthiness. This reduces risk and expands financial inclusion. Meanwhile, BNPL allows consumers to pay in interest-free installments, promoting affordability.

•ShopUp: Provides digital credit to small businesses, facilitating inventory purchases and operational expenses.

•AamarPay: Offers BNPL services, allowing consumers to make purchases and pay in installments.

Applications:

•Microloans for SMEs: ShopUp and Pathao’s fintech wing help small retailers restock products with immediate loans.

•Instant Consumer Credit: BNPL platforms like AamarPay offer interest-free purchases for electronics, education, or household items.

•Student Loans: Future potential includes tuition loans for students from verified platforms.

•Credit Scoring Innovation: Use of non-traditional credit metrics like mobile phone bills or utility payments.

•Emergency Loans: Get instant access to small loans via mobile apps in case of medical or financial emergencies.

Revenue Models:

•Interest rates on loans and credit lines.

•Late payment fees.

•Commissions from merchants for facilitating sales.

Insurtech

Insurance penetration in Bangladesh is low due to complex paperwork, low awareness, and mistrust. Insurtech aims to solve these issues by offering bite-sized micro-insurance, instant policy issuance, and paperless claims processing. These innovations are especially beneficial for low-income populations who need affordable, understandable, and quick insurance solutions.

•Bimafy: A local platform offering digital insurance solutions, including health and life coverage.

•Policybazaar: An Indian aggregator platform that provides comparisons and purchases of various insurance products .

•Lemonade: A U.S.-based insurtech company known for its AI-driven approach to insurance and customer service .

Applications:

•Micro-Insurance: Affordable life and health coverage for daily wage earners, rickshaw pullers, or small shopkeepers.

•Instant Claim Settlement: Faster reimbursement via mobile apps, sometimes within hours.

•Crop and Weather Insurance: Helping farmers mitigate the risks of climate-related damages.

•Health and Travel Insurance: Instant policy generation for students, travelers, and employees.

•Bundled Insurance with Services: bKash users can add life insurance while making transactions.

Revenue Models:

•Premiums collected from policyholders.

•Commissions from insurance providers for policy sales.

•Subscription fees for platform access and services.

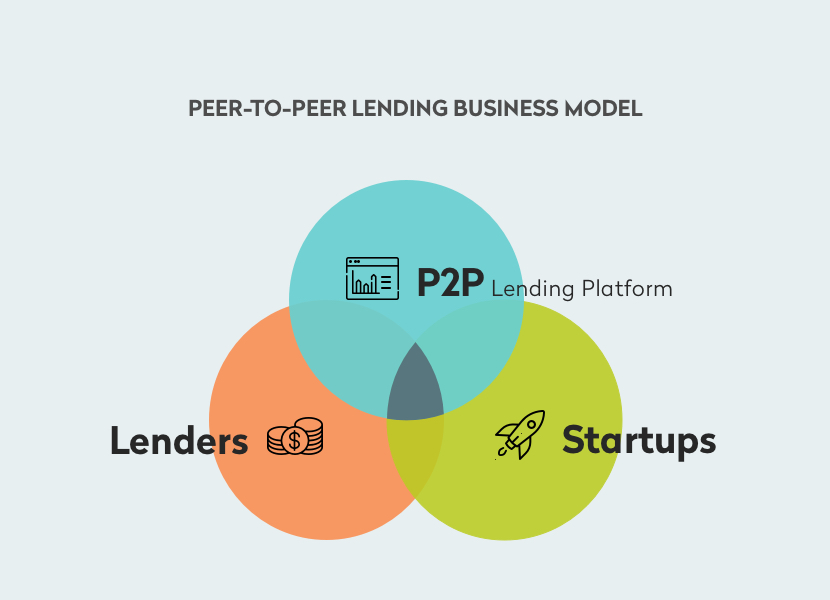

Crowdfunding and Peer-to-Peer (P2P) Finance

Crowdfunding offers an alternative to bank loans or venture capital by enabling individuals and businesses to raise money directly from the public. In Bangladesh, although regulatory restrictions are still developing, several platforms have emerged, especially for social causes, education, and small business funding. The model also allows diaspora communities to contribute directly to grassroots projects.

• Projekt.co, GoRiseMe, Fundsme, and Oporajoy: Local platforms facilitating fundraising for various causes and businesses .

Applications:

•Social Impact Campaigns: Fundraising for medical emergencies, school renovations, and disaster relief.

•Startup Funding: Entrepreneurs showcase their ideas and raise seed capital from interested backers.

•Education Support: Students crowdfund tuition fees or study abroad expenses.

•Equity Crowdfunding: (Still emerging) Investors receive a small share in exchange for their investment.

•P2P Lending: Individuals can lend to others at negotiated interest rates without a bank acting as intermediary.

Revenue Models:

•Commission fees on successful fundraising campaigns.

•Platform usage fees for premium services.

•Advertisement and promotional services for campaigns.

Read More: Youth Self Employment Empowered with Tk100 Crore Budget Fund Plan

Bangladesh’s Fintech Opportunity (2025–2028):

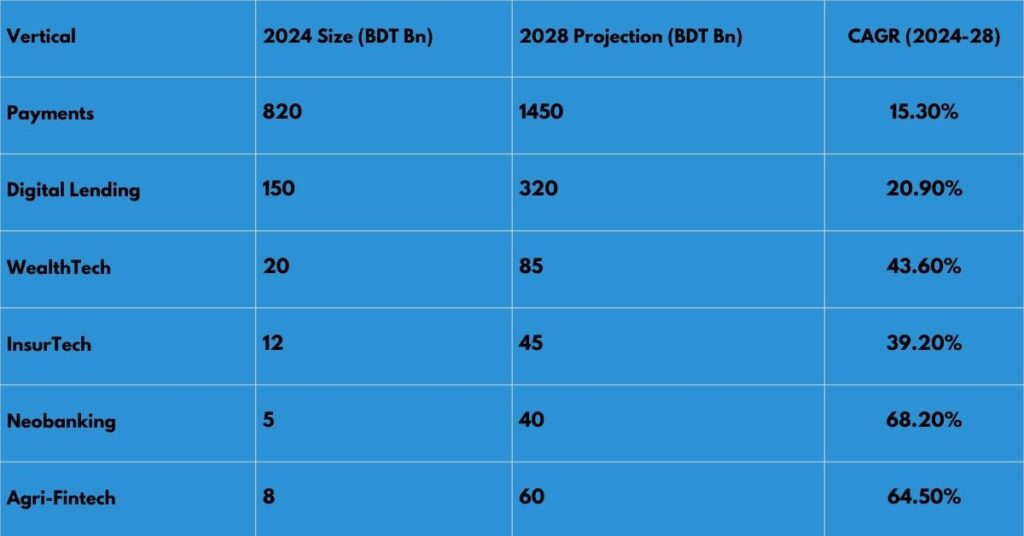

Fintech in Bangladesh is at an inflection point. While over 100 million users transact through bKash, Nagad, and other MFS players, we’ve barely scratched the surface when it comes to digital credit, investing, neobanking, and inclusive insurance. The ecosystem is evolving fast — but regulatory constraints, digital literacy gaps, and product-market mismatches threaten to stall progress.

Fintech Landscape & Key Players (2024)

Market Size & Growth (2024–2028)

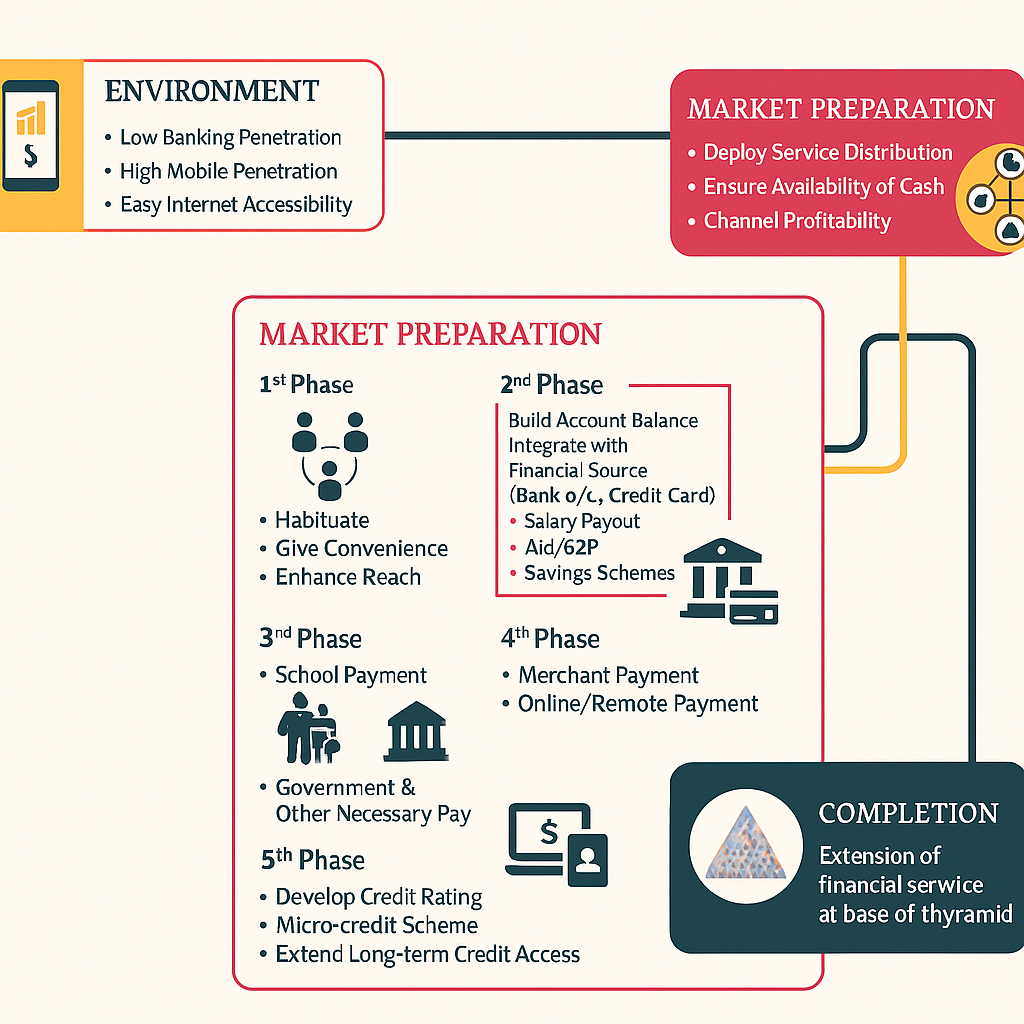

Approach for Expanding Financial Services

This structured approach highlights how digital and mobile financial services can be gradually introduced and scaled to financially underserved populations, starting from basic access and ending with full integration into the formal financial system.

ENVIRONMENT: Foundational Enablers

Before deploying financial services, it’s crucial to evaluate the existing ecosystem. The following three conditions form the backbone:

•Low Banking Penetration: Many populations remain unbanked or underbanked, lacking access to traditional financial institutions.

•High Mobile Penetration: Even in remote areas, mobile phone usage is widespread, providing a powerful tool to deliver financial services.

•Easy Internet Accessibility: Affordable and expanding internet access helps facilitate digital transactions and financial literacy.

MARKET PREPARATION: Strategic Setup

These are the preliminary steps required before deploying specific financial services:

•Deploy Service Distribution: Establish a network of agents, merchants, and digital platforms to ensure service delivery reaches even rural users.

•Ensure Availability of Cash: Create cash-in and cash-out points to allow users to deposit or withdraw funds easily.

•Channel Profitability: Ensure the service delivery model is economically viable for partners, agents, and stakeholders, to sustain growth.

FIVE PHASES OF MARKET PREPARATION

1st Phase: Introduction and Engagement

•Habituate Users: Educate and familiarize people with digital finance.

•Provide Convenience: Offer user-friendly services like mobile top-ups or bill payments.

•Enhance Reach: Expand the user base by leveraging existing mobile and retail networks.

2nd Phase: Account Development and Integration

•Build Account Balance: Encourage users to deposit and maintain a balance.

Integration with Financial Sources:

•Link to bank accounts or credit cards.

•Enable salary disbursement for workers.

•Facilitate Aid/G2P (Government-to-Person) programs (e.g., pensions, subsidies).

•Introduce savings schemes to instill financial discipline.

3rd Phase: Institutional Payments

•School Fees: Enable school fee payments through mobile platforms.

•Government and Other Payments: Add services like utility bills, taxes, and government service fees.

4th Phase: Commercial Expansion

•Merchant Payments: Allow consumers to pay for goods/services digitally at stores or online.

•Online and Remote Payments: Facilitate e-commerce transactions and peer-to-peer transfers.

5th Phase: Credit and Financial Growth

•Develop Credit Rating: Use transaction data to build digital credit profiles.

•Micro-credit Schemes: Provide small loans to individuals or small businesses.

•Extend Long-Term Credit: Introduce formal loan products for business or personal development.

COMPLETION: Financial Empowerment at Scale

•Extension of Financial Service at the Base of the Pyramid

At this stage, financial services are accessible, affordable, and integrated into the daily lives of even the poorest segments of society. This fosters entrepreneurship, savings, investment, and long-term economic resilience.

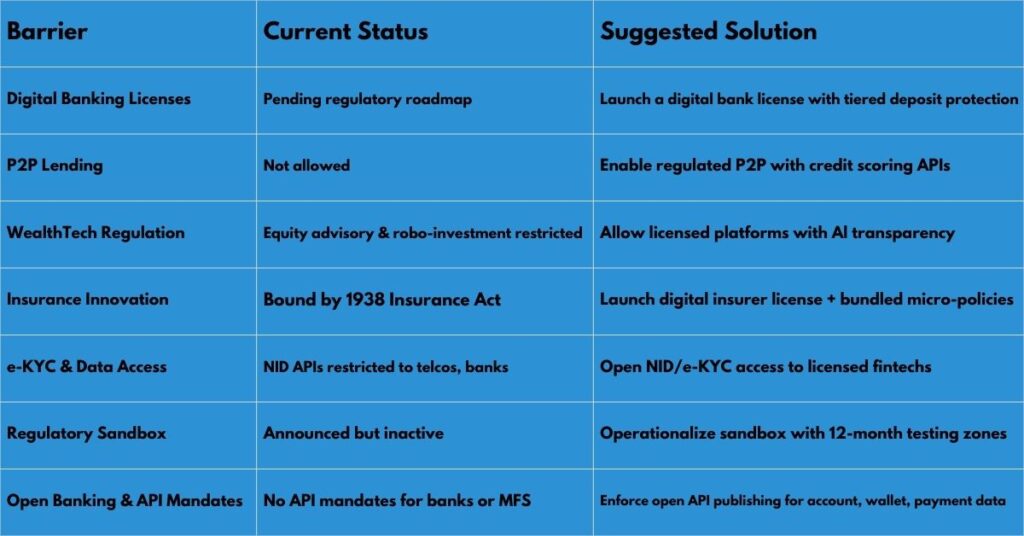

Regulatory Barriers & What Needs to Change

The fintech sector in Bangladesh and globally is experiencing rapid growth, transforming how people access and manage money. However, with innovation comes a new set of complex challenges. From regulatory uncertainties to trust issues among users, fintech startups and even large platforms must navigate several hurdles to ensure sustainability and mass adoption. Below are some of the key challenges currently faced by the fintech ecosystem:

Regulatory Uncertainty

One of the most pressing challenges for fintech companies is the lack of clear and consistent regulatory frameworks. In many developing countries, including Bangladesh, financial regulations have not evolved fast enough to keep up with digital innovation. As a result, fintech firms often operate in grey areas, unsure of which rules apply to their services—especially those involving cryptocurrency, digital lending, and cross-border payments.

Regulatory bodies like Bangladesh Bank and the Bangladesh Securities and Exchange Commission (BSEC) have taken steps to manage this fast-moving sector, but comprehensive laws tailored for fintech are still under development. This uncertainty can discourage investment, slow down product development, and create legal risks for startups. On the other hand, overly strict or outdated regulations may stifle innovation and limit financial inclusion—two key promises of fintech.

Cybersecurity and Data Privacy Concerns

With the rise of digital finance, cybersecurity has become a critical concern. Fintech platforms store vast amounts of sensitive user data, including financial records, national ID numbers, and transaction histories. This makes them prime targets for hackers and cybercriminals. A single data breach can result in financial losses for users and cause irreparable damage to a company’s reputation.

In Bangladesh, where cybersecurity infrastructure is still developing, many fintech startups struggle to invest in robust protection systems. Additionally, there is a lack of a strong data protection law similar to the European Union’s GDPR (General Data Protection Regulation). This gap leaves users exposed to risks and reduces their confidence in digital platforms. Trust in the system will only improve if platforms are transparent about how they store and use data, and if the government enforces data protection rules effectively.

Low Financial Literacy

Even though mobile banking and digital payments are growing in popularity, a large portion of the population still lacks basic financial and digital literacy. Many people do not fully understand how digital wallets work or how to safeguard their personal information online. This limits the adoption of fintech products beyond urban centers.

In rural areas of Bangladesh, users may prefer traditional cash transactions or depend on local agents instead of using mobile apps. This digital divide is a major barrier to inclusive growth in the fintech sector. Companies need to invest in awareness campaigns, simple interfaces, and regional language support to bridge this gap. Without user-friendly solutions and proper education, fintech will struggle to reach its full potential.

Trust Issues in Digital Platforms

Trust is a key element in financial transactions. Unlike traditional banks that have physical branches and long-standing reputations, many fintech startups are new and operate entirely online. This lack of a physical presence can create doubts among potential users, especially older generations or those in remote areas.

Past incidents of fraud, unauthorized access, or failed transactions have also contributed to growing skepticism. In some cases, agents or intermediaries misuse customer information, leading to identity theft or financial loss. For fintech to gain widespread acceptance, companies must build trust through strong customer service, secure transactions, and partnerships with reputable institutions like licensed banks or telecom operators.

Funding and Scalability for Startups

While global interest in fintech is strong, startups in countries like Bangladesh often face difficulties in securing adequate funding. Local venture capital markets are still developing, and many investors hesitate to support fintech ventures due to the associated regulatory and technical risks. Even when initial funding is secured, scaling up operations—especially outside major cities—poses challenges due to infrastructure limitations and high operational costs.

Moreover, many fintech startups are heavily reliant on promotional offers or transaction-based revenues, which may not be sustainable in the long run. Without long-term financial planning and strategic partnerships, these companies risk stagnation or failure. Encouraging public-private collaborations, offering government grants, and creating startup incubators focused on fintech could help address these obstacles.

Stock Trading & WealthTech: Bangladesh’s Most Underrated Fintech Frontier

Despite the noise around MFS and lending, digital investing is the real sleeping giant. Bangladesh has a young, tech-savvy population—but only a fraction engage in wealth creation. While ~40 million bank accounts exist, just 1.7 million BO (beneficiary owner) accounts are active in the stock market. Most are inactive. Even fewer are under 30. That’s a massive gap between financial access and financial participation.

The Core Problems

•Access Complexity: Opening a BO account still requires paperwork and in-person steps.

•Lack of Trust: Retail investors fear manipulation, pump-and-dump schemes.

•No Onboarding Funnel: Students & young professionals have no structured entry.

•No Innovation: Existing apps mirror websites—no gamification, education, or UX flow.

•No Diaspora Access: NRBs (Non-Resident Bangladeshis) can’t easily invest in DSE/CSE or access foreign stocks

Source: VAT on Mobile Phones May Increase in Upcoming Budget of 2025-26

The Massive Opportunity

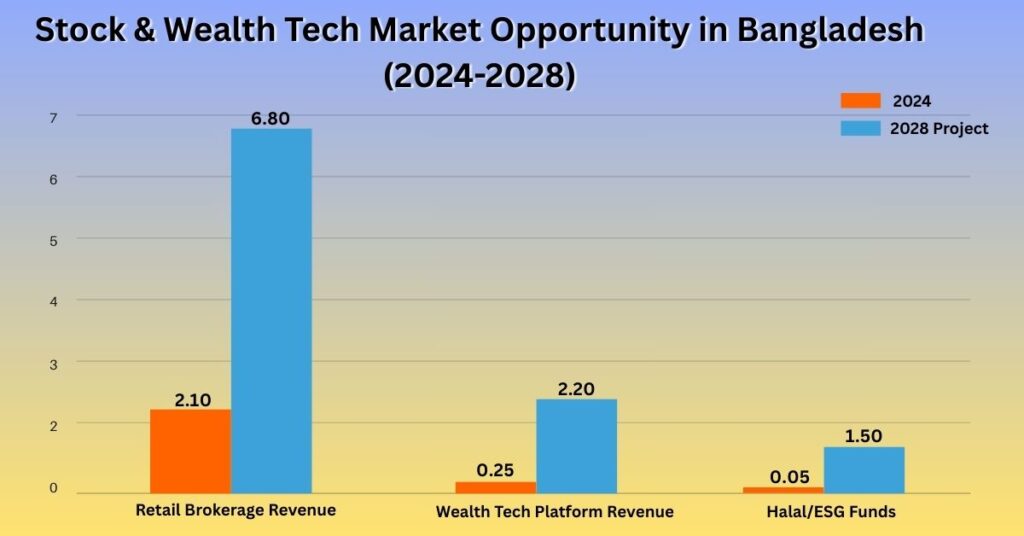

Market Size Projection (2024-2028)

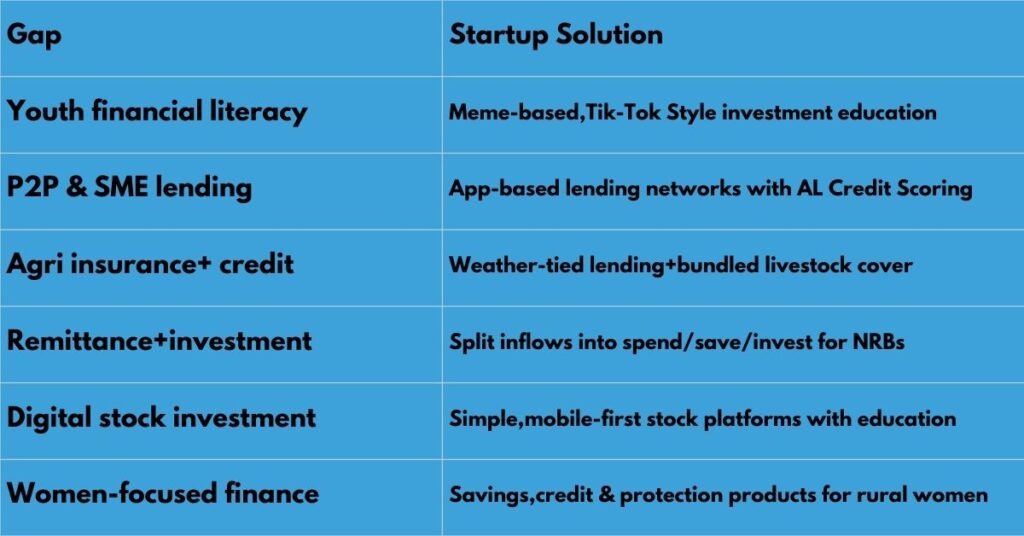

What Startups Can Do

Conviction: Why This Must Be Built

- Millennials and Gen Z make up 65%+ of Bangladesh’s population — they aren’t investing.

- India added 40M+ Zerodha-style retail investors in 5 years.

- Indonesia’s Ajaib acquired 2.5M users in under 2 years by focusing on students.

- Bangladesh has no real equivalent — yet.

- With the right onboarding UX, financial literacy, and regulatory alignment, we can unlock a new generation of long-term wealth creators.

This isn’t just a business opportunity — it’s a generational unlock.

Startup Playbook: What to Build Next

We have the tools. We have the user base. What we need is clarity, courage, and collaboration. Bangladesh doesn’t need a Silicon Valley replica. It needs a fintech revolution grounded in rural realities, youth ambition, and diaspora capital.

Case Studies of Successful Fintech Companies in Bangladesh

bKash: A National Success Story

Launched in 2011, bKash is the most recognized and widely used fintech platform in Bangladesh. It was founded as a joint venture between BRAC Bank and Money in Motion, with later investments from the International Finance Corporation (IFC), the Bill and Melinda Gates Foundation, and Ant Financial (a part of China’s Alibaba Group).

bKash started with a simple goal: to provide easy and safe money transfers for people without bank accounts. Today, it serves over 70 million users, covering urban and rural areas. It offers services like mobile recharge, bill payments, remittances, merchant payments, and personal loans. bKash’s wide agent network and user-friendly app make it accessible even to people with limited digital knowledge. One of the key reasons for its success is its early entry into the market and strong trust among users. bKash has helped millions of people join the financial system for the first time, making it a model for digital financial inclusion.

Nagad: Disrupting the MFS Space

Nagad, launched by the Bangladesh Post Office in 2019, quickly became a strong competitor to bKash. By using a different approach to mobile registration—called Digital KYC—Nagad was able to register users faster and at lower costs. Its focus on low service charges and instant account activation attracted a large number of users within a short period.

With over 80 million registered users, Nagad is now a serious player in Bangladesh’s fintech ecosystem. It provides similar services as bKash but emphasizes affordability and simplicity. Nagad also introduced features like QR-based payments and mobile salary disbursements. Its government backing gave it credibility and access to public service transactions, such as distributing government allowances and education stipends. Nagad’s rapid growth shows how innovation, pricing, and strategic partnerships can disrupt even well-established markets.

Pathao Pay: Building Fintech into Everyday Life

Pathao, one of Bangladesh’s leading ride-sharing and logistics platforms, has leveraged its massive user base to launch Pathao Pay, a digital wallet feature embedded in the Pathao app. With this service, users can easily pay for rides, deliveries, and food orders directly through a cashless system.

Pathao Pay is gradually expanding to offer QR payments at retail stores, utility bill payments, and peer-to-peer transfers. Its integration into a lifestyle super app reflects a global trend seen in companies like Indonesia’s Gojek and China’s WeChat. While still in the early stages of its fintech journey, Pathao’s digital payment ecosystem shows promise in merging transportation, e-commerce, and finance under one platform.

TallyKhata: Digitizing Small Business Finances

TallyKhata, developed by Progoti Systems Ltd., is a digital bookkeeping and finance management app aimed at micro, small, and medium-sized enterprises (MSMEs). In Bangladesh, many small shop owners still use pen and paper to manage accounts, leading to inefficiencies and lack of access to credit.

TallyKhata offers solutions such as sales tracking, ledger management, customer payment reminders, and digital invoices. Over time, it aims to link users with formal financial institutions to provide access to credit based on recorded transaction history. By helping informal businesses become creditworthy, TallyKhata is playing a vital role in financial inclusion and digital transformation among grassroots entrepreneurs.

iFarmer: Fintech for Agriculture

iFarmer is a fintech-agritech hybrid that helps farmers access finance, quality inputs, and fair markets. It connects rural farmers with urban investors through a platform where users can co-invest in livestock and crops. Profits are shared after harvest.

The company also partners with financial institutions to provide farmers with collateral-free loans. Using data and AI, iFarmer assesses credit risk and farm productivity, ensuring smarter lending decisions. This model not only empowers farmers but also engages the growing interest in impact investing. iFarmer’s success showcases how fintech can reach rural Bangladesh and strengthen food security through inclusive finance.

Other Notable Mentions

•SureCash: Known for its work in education payments, SureCash enables school and college fees to be paid digitally through partnerships with thousands of institutions and banks.

•Dana Fintech: A rising player in embedded lending, Dana helps platforms integrate instant loan offerings using alternative credit scoring based on digital behavior.

•FinSource and Monsha Ventures: Newcomers focusing on data analytics, B2B lending, and integration of financial services into logistics and supply chain businesses.

A timeline overview of the evolution of MFS

Global Comparisons: Lessons from India, Kenya, and China

As Bangladesh’s fintech ecosystem evolves, valuable lessons can be drawn from the experiences of other countries that have successfully scaled digital finance. Nations like India, Kenya, and China offer compelling case studies, each showcasing different models of innovation, regulation, and mass adoption. By comparing these global leaders with the current state of fintech in Bangladesh, we can better understand where the country stands—and what steps could help it accelerate progress.

India: Government-Driven Infrastructure and Ecosystem Growth

India has emerged as a global fintech powerhouse, largely due to government-led digital infrastructure initiatives. The launch of the Unified Payments Interface (UPI) in 2016 revolutionized money transfers in the country. UPI enabled instant, low-cost, and interoperable digital payments across all banks and wallets. Platforms like Paytm, PhonePe, and Google Pay quickly scaled by building on this open-source payment backbone.

In contrast, Bangladesh lacks an equivalent to UPI. Mobile financial services (MFS) are still fragmented, with limited interoperability between wallets and banks. Although the central bank has shown interest in launching a National Payment Switch (NPSB) for broader integration, progress has been slow. Learning from India, Bangladesh could benefit by creating a government-supported, real-time payment system that allows seamless transactions across platforms.

Kenya: Mobile Money for the Underserved

Kenya’s M-Pesa, launched by Safaricom, is often regarded as the most successful mobile money platform globally. It transformed how people send and receive money, pay bills, and access microloans—especially in rural, unbanked areas. M-Pesa’s success lies in its simplicity, wide agent network, and ability to work without a smartphone or internet access.

In Bangladesh, bKash and Nagad mirror much of M-Pesa’s model. They offer mobile wallets that cater to the masses, especially those with limited access to traditional banking. Both countries have shown that targeting the financially excluded rural population and building trust through strong agent networks are keys to mass adoption.

China: The Power of the Super App

China offers a different trajectory. Platforms like Alipay (from Alibaba) and WeChat Pay (from Tencent) have created “super apps”—integrating payments with messaging, shopping, ride-sharing, investments, credit scoring, and more. In China, nearly every daily transaction—from buying groceries to taking a taxi—can be done via QR code through one app.

Bangladesh is inching toward this model with apps like Pathao, which now includes Pathao Pay, ride-hailing, food delivery, and e-commerce. However, these platforms are still at an early stage of integration. If local startups can expand their services and offer an all-in-one lifestyle app with secure payment features, they could replicate parts of the Chinese model at a local scale.

These global comparisons make it clear: Bangladesh has made significant strides in digital finance, especially through mobile money. But to reach the next level, it must:

- Develop interoperable, low-cost payment systems like India’s UPI.

- Strengthen agent networks and offline access like Kenya’s M-Pesa.

- Encourage ecosystem-building and platform integration, inspired by China’s super apps.

- Improve digital ID infrastructure, cybersecurity, and data protection laws to build trust.

By studying these successful global models and adapting them to its own socio-economic context, Bangladesh can create a more inclusive, secure, and scalable fintech future.

Conclusion

We already have many of the essential ingredients for a fintech revolution in Bangladesh—the necessary tools, a rapidly growing and tech-savvy user base, and increasing access to mobile and internet technology. What remains critical is the clarity of vision to chart the right course, the courage to take bold steps and innovate beyond traditional models, and the spirit of collaboration between government, private enterprises, startups, financial institutions, and civil society.

Bangladesh does not need to become a mere copy of Silicon Valley or try to replicate fintech ecosystems from other countries. Instead, it must develop a unique fintech revolution that reflects the country’s own social, economic, and cultural realities. This means designing solutions that address rural challenges, empower underserved communities, and align with the aspirations of a young and dynamic population. Furthermore, Bangladesh’s vast diaspora represents an untapped source of capital, knowledge, and networks that can help scale fintech innovations globally.

References: