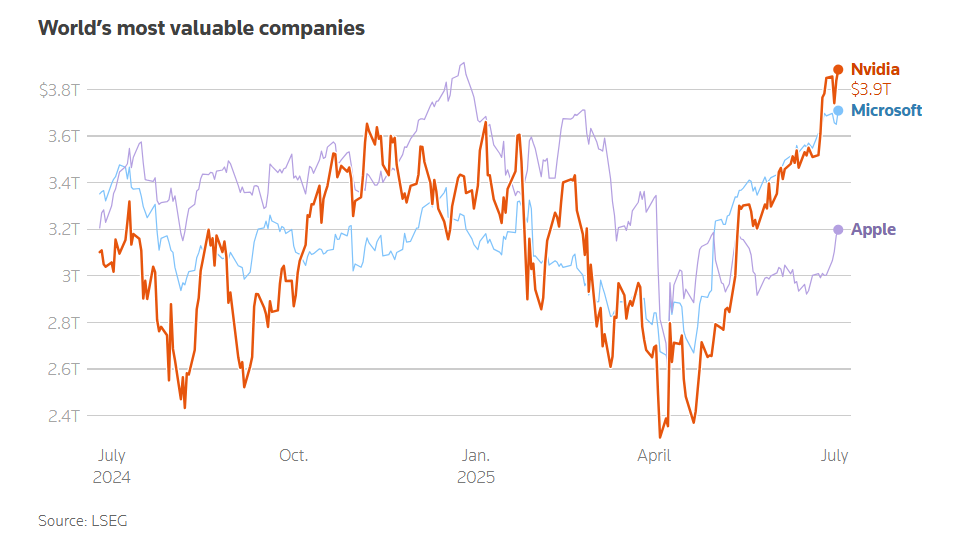

Nvidia, the tech company best known for making powerful computer chips, recently came close to becoming the most valuable company in history. Its market value briefly hit $3.92 trillion, driven by massive interest in artificial intelligence (AI).

From Gaming to Global Tech Giant

Nvidia started in 1993 and was mainly focused on making graphics chips for video games. But now, its technology is the backbone of many AI systems. The company has grown nearly eight times in value since 2021 — from $500 billion to nearly $4 trillion in 2025.

Stock Soars with AI Demand

On Thursday, Nvidia’s stock rose by 2.4% in early trading, reaching $160.98 per share. That briefly pushed its market cap above Apple’s record of $3.915 trillion, set in December 2024. However, later in the day, Nvidia’s stock closed slightly lower at $159.60, keeping it just under Apple’s record.

Powering the AI Race

Nvidia’s latest chips are leading the way in training complex AI models. As tech giants like Microsoft, Amazon, Meta, Google, and Tesla race to build AI-powered data centres, they’re all heavily relying on Nvidia’s advanced processors.

Read More: Walmart Revolutionary Story from Beginning to Global Retail Gaint

Microsoft currently sits in second place with a market value of $3.7 trillion, followed by Apple at $3.19 trillion.

AI Fuels Big Gains

Joe Saluzzi, a stock market expert, said:

“When the first company hit a trillion dollars, it was a big deal. Now Nvidia is near four trillion. It shows how fast AI spending is growing.”

Nvidia’s chips, once built for gaming, are now critical to the development of generative AI — the technology behind tools like ChatGPT. The company’s earnings have grown so fast that even with the rising stock price, it trades at a lower-than-usual price-to-earnings ratio of 32 — compared to its five-year average of 41.

Nvidia Bigger Than Entire Countries’ Markets

Nvidia is now worth more than the entire stock markets of Canada and Mexico combined. It’s also larger than the total value of all publicly listed companies in the UK.

Wall Street’s Favourite AI Company

Nvidia has become central to many retirement and investment funds. It now represents 7% of the S&P 500 index, and when combined with Microsoft, Apple, Amazon, and Google, these five companies make up 28% of the index.

However, some experts are still cautious. Kim Forrest of Bokeh Capital said:

“AI is a powerful tool, but the current models may not live up to the hype.”

Overcoming Setbacks and Tariff Fears

Earlier this year, Nvidia’s stock dipped after former President Donald Trump proposed global tariffs, which caused worry in the markets. But since April, the stock has bounced back over 68%, as hopes for trade deals calmed investor fears.

Nvidia also faced a scare when Chinese startup DeepSeek launched a low-cost AI model that outperformed others. This led some to think that demand for Nvidia’s expensive chips might fall. But Nvidia’s technology is still seen as essential for the most advanced AI systems.

A New Era in Tech

In late 2024, Nvidia replaced Intel on the Dow Jones Industrial Average, showing how the focus in tech has shifted from traditional computing to AI and graphics hardware.

With continued growth and major companies depending on its technology, Nvidia is now one of the clearest indicators of how far — and how fast — the AI revolution is moving.

Source: TBS