1. Introduction

The pharmaceutical industry is a vital sector of the global economy, dedicated to the discovery, development, production, and marketing of drugs and medications. Its primary purpose is to create products that can prevent, treat, or cure diseases. It’s a highly regulated field, with a focus on ensuring the safety and effectiveness of its products. The industry has several key areas including, Research and Development (R&D), Manufacturing, Marketing and Sales.

In Bangladesh, the pharmaceutical industry is a remarkable success story. It has grown from almost nothing to become one of the country’s most advanced sectors. It now meets about 97–98% of the country’s medicine needs and exports to over 150 countries, earning foreign money and boosting the economy. Producing generic drugs (medicines that work the same as brand-name drugs but cost much less, making healthcare more affordable) at low cost makes medicine more affordable for people. Behind this success are skilled pharmacists, scientists, and companies that work hard to produce safe, effective, and low-cost medicines.

The industry grew after the National Drug Policy of 1982 and the TRIPS (Trade-Related Aspects of Intellectual Property Rights) waiver for Least Developed Countries, which allowed local companies to produce generic versions of patented drugs. This helped the industry develop into a strong sector. Bangladesh has a few big companies (like Square, Beximco, Incepta) and many smaller ones. Some multinational companies also operate here. The industry has grown in sales, exports, and market size, meeting national and international demand.

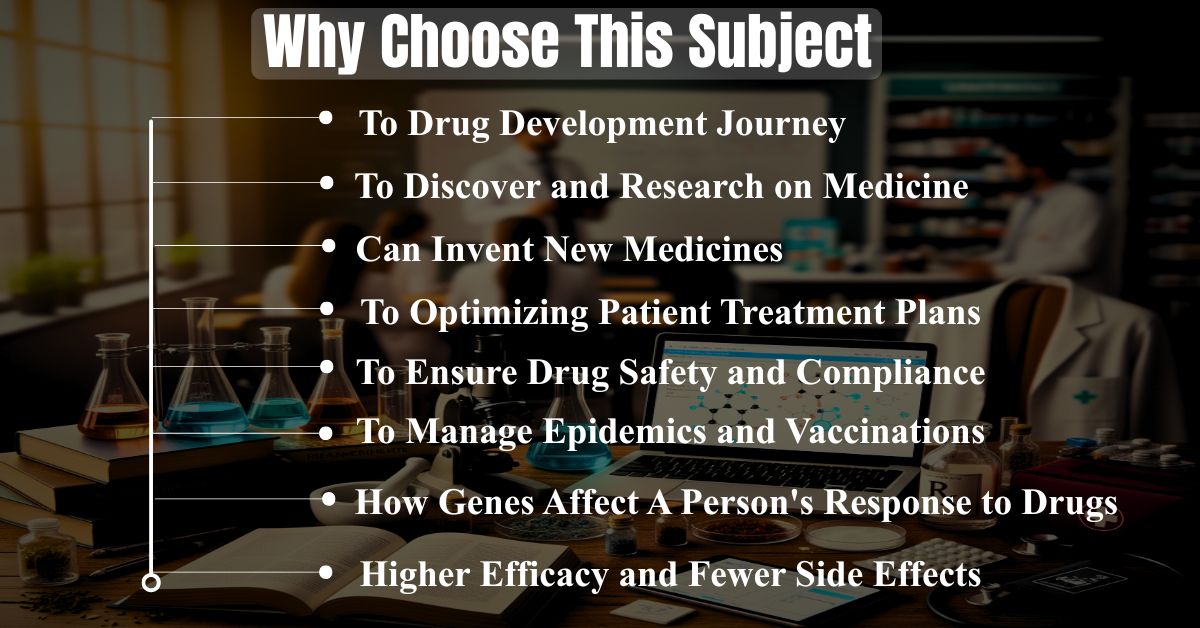

2. Pharmacy as a Subject: Foundation of the Industry

Pharmacy is the science of discovering, preparing, and safely using medicines. It’s a critical field that serves as the backbone of the entire pharmaceutical industry.

2.1.Key Branches of Pharmacy

Pharmacy is not just one subject, it’s a diverse field with several specialized branches.

- Pharmaceutics: This branch focuses on how to turn a drug into a medicine. It deals with the design and production of different drug forms, such as tablets, capsules, liquids, or injections, ensuring they are stable and effective.

- Pharmacology: This is the study of how drugs affect the body. Pharmacologists investigate a drug’s effects, its side effects, and how it interacts with other medications. This knowledge is crucial for creating safe and effective treatments.

- Clinical Pharmacy: This is the practical side of pharmacy that involves working directly with patients and doctors. Clinical pharmacists advise on medication choices, monitor patients for side effects, and ensure people use their medicines correctly to get the best health outcomes.

- Pharmacognosy: This branch is about finding medicines in nature. It involves studying drugs derived from plants, animals, or microorganisms. For example, many traditional remedies and modern medicines have their origins in natural sources.

- Pharmaceutical Chemistry: This branch focuses on the chemical structure of drugs. It involves designing and synthesizing new drug molecules and understanding their chemical properties to improve their effectiveness and safety.

2.2.Skills Pharmacy Students Learn

Students in pharmacy programs acquire a wide range of skills which is essential for the pharmaceutical industry.

- Drug Formulation: They learn the practical skills needed to create different drug delivery systems. This includes knowing how to mix ingredients, calculate dosages, and prepare medicines in various forms.

- Patient Care: Through clinical training, students learn how to communicate with patients, advise them on medication use, and manage medication therapies. This skill is vital for roles in hospitals and community pharmacies.

- Research Methods: Pharmacy education provides a strong foundation in scientific research methods. This prepares students to participate in the discovery of new drug compounds and the development of new treatments.

2.3.Why Pharmacy is the Backbone of the Industry

Pharmacy is the backbone of the pharmaceutical industry because it gives the main knowledge and skills needed to make medicines. Pharmacists work from the start of discovering a drug to the final stage when patients use it. Without them, companies could not create safe and effective medicines or guide patients on how to use them properly. Pharmacy is what changes simple chemicals into life-saving medicines.

3.1. High Demand and Diverse Career Paths

Pharmacists are essential in every part of the healthcare system. The demand for qualified professionals remains strong globally, with roles in:

- Hospitals and Clinics: Pharmacists work along with doctors and nurses to ensure patients receive the correct medications.

- Research Labs and the Pharmaceutical Industry: They are crucial in discovering and developing new drugs, running clinical trials, and ensuring product safety and quality.

- Retail and Community Pharmacies: They are often the most accessible healthcare providers, advising patients on a wide range of health issues.

3.2. Excellent Career Opportunities at Bangladesh and Abroad

A pharmacy degree is highly respected and offers strong earning potential. Pharmacists can find well-paying jobs in their home country and, because the profession is needed everywhere, they have high global mobility. This means a pharmacy degree can open doors to working in many different countries around the world.

3.3. Entrepreneurship Potential

A pharmacy degree provides the knowledge and skills needed to start a business. Young entrepreneurs can:

- Open their own community pharmacies.

- Start pharmaceutical companies that manufacture drugs.

- Launch biotech startups that focus on new innovative treatments.

3.4. Social Impact and Contribution

Pharmacy is a career which dedicated to helping people. Pharmacists play a vital role in ensuring safe medication use, preventing drug interactions, and counseling patients. They are directly involved in saving lives and improving community health, which provides a deep sense of purpose and job satisfaction.

4.Limitatios in Pharmacy Education in Bangladesh

Pharmacy education in Bangladesh has some problems that affect the quality of graduates and their work. Most of the focus is on industrial pharmacy, while important areas like clinical pharmacy and patient care are often ignored. This creates a gap in skills and limits the role of pharmacists in the healthcare system.

4.1. Limited Seats and High Competition

Many students are discouraged from pursuing pharmacy due to a severe shortage of university seats. Both private and public universities often accept only around 100 students per session, making admission highly competitive. Many good students who want to study pharmacy can’t get a chance, even if they are talented. This reduces the number of skilled pharmacists the country can produce each year.

The pharmacy curriculum in many Bangladeshi universities is heavily product-oriented, with over 90% of the courses focusing on pharmaceutical sciences, such as manufacturing and quality control. Because of this, students learn how to work in factories but are not well-prepared to work in hospitals or directly with patients. This imbalance means graduates are well-prepared for jobs in drug manufacturing but lack the skills to work effectively in hospitals, community pharmacies, and patient care settings. [1]

4.2. Lack of Practical Training

Many universities in Bangladesh don’t have advanced research labs or modern equipment. Even though the syllabus includes new and advanced topics, students can’t practice with the latest technology. This creates a big gap between theory and real skills, leaving graduates unprepared for today’s pharmaceutical industry, which depends heavily on modern research and development. [2]

4.3. Shortage of Experienced Faculty

Many universities face a shortage of PhD-level or internationally trained teachers. A lack of highly qualified faculty directly impacts the quality of education. Without experienced professors who can mentor students and guide research, the academic environment struggles to foster innovation and produce graduates who are ready to compete on a global scale. The roles of graduate pharmacists in the healthcare system are not always well-defined or recognized by other healthcare professionals and the government. [3]

4.4. Weak University-Industry Collaboration

Many universities in Bangladesh have poor connections with the pharmaceutical industry. This means students get few chances for internships, industrial training, or joint research projects. As a result, many graduates lack the real-world skills and practical knowledge that companies are looking for, forcing companies to spend extra time and resources on training new hires. [4] [2]

5. Bangladesh’s Pharmaceutical Industry

The Bangladeshi pharmaceutical industry is one of the most active and advanced sectors in the country. It has grown from depending on imports to becoming a big exporter of generic medicines worldwide.

5.1.Current Position and Market Share

The pharmaceutical industry in Bangladesh is almost fully self-sufficient in making medicines.

- Self-Sufficient in Medicine: About 97–98 out of every 100 medicines used in Bangladesh are made inside the country. This means Bangladesh hardly needs to import finished medicines anymore.[5][6]

- Market Size: The local medicine market is very large and growing fast. Right now, it is worth about 3 billion US dollars, and by 2025 it may grow to over 6 billion.[7][8]

- Who Sells the Medicine: Around 9 out of every 10 medicines in Bangladesh are made and sold by local companies. Foreign companies only sell a small share.

- The Catch (Raw Materials): Even though Bangladesh makes the medicines, most of the raw ingredients (APIs) still come from countries like China and India. Work is going on to produce more of these ingredients locally.

5.2. Bangladeshi Medicines in the World Market

Bangladeshi medicines are now sold in more than 150+ countries, showing how big the industry has become and how well it competes in global trade.[7]

- Global Footprint: Bangladesh not only exports to nearby Asian and African countries but also to strict markets like the USA, UK, and EU.

- Why It Matters: To sell in countries like the US or UK, companies must prove their factories meet the world’s highest quality standards. Getting approval from agencies like the US FDA or UK MHRA is like a global seal of trust.

•The LDC Advantage (TRIPS Waiver):

Bangladesh, as a Least Developed Country (LDC), got a special rule from the World Trade Organization (WTO). Until 2033, Bangladeshi companies are allowed to make generic versions of patented drugs without legal issues. This helped the industry grow fast and produce many modern, high-value medicines at lower costs.[10]

•What They Export Generic Medicines:

Most exports are generic drugs cheaper copies of branded medicines that work the same.[11]

-

Focus on Affordability: Companies make affordable versions of off-patent and on-patent drugs (thanks to the LDC waiver).

-

Diverse Portfolio: Exports cover all major medicine types, including:

-

Anti-cancer drugs

-

Antivirals (for HIV, Hepatitis

-

Antibiotics

-

Cardiovascular and diabetes medicines

-

Vaccines and hormonal drugs

-

- Competitive Edge: By making drugs locally and buying raw materials cheaply from China and India, Bangladesh can sell medicines at very low prices worldwide.

•The Success – Meeting Global Standards

Bangladesh’s export success is possible because leading companies have invested a lot in quality.[11]

- Investment in GMP: Companies like Beximco, Square, Renata, and Eskayef upgraded their factories to meet Good Manufacturing Practice (GMP) standards.

- Global Certifications: Many Bangladeshi companies now have approval from top regulators such as:

-

US FDA (Food and Drug Administration)

-

UK MHRA (Medicines and Healthcare Products Regulatory Agency)

-

EU GMP (European Union Good Manufacturing Practice)

-

- The Proof: These certifications show Bangladeshi medicines are safe, effective, and made with global quality, making the country a trusted supplier of low-cost generic medicines.

5.3.The Big Players in Bangladesh’s Pharmaceutical Industry

The Bangladeshi pharmaceutical industry has four big players, Square, Beximco, Incepta, and Renata. Each follows its own strategy, but together they have turned Bangladesh’s pharma sector from a small local industry into a major global supplier of generic medicines. Top 20 pharmaceutical companies are, Square Pharma, Incepta Pharma, Beximco Pharma, Healthcare Pharma, Renata PLC, Opsonin Pharma, Eskayef Pharma, Aristopharma, ACME Laboratories, ACI Limited, Radiant Pharma, Popular Pharma, Drug International, UniMed UniHealth Pharma,, Novo Nordisk Pharma, General Pharma,Beacon Pharma, NIPRO JMI Pharma, The IBN Sina Pharma, Ziska Pharma

1. Square Pharmaceuticals: The Industry Leader & Pioneer (Top 1) [12]

Square Pharmaceuticals is the industry leader and pioneer in Bangladesh’s pharmaceutical sector. It is a Bangladeshi multinational pharmaceutical company. The company is now one of the largest and most valuable publicly traded companies in Bangladesh, with a significant market capitalization.

- Role: Square is the top company and the backbone of the industry. Its strength comes from size, quality, and a huge distribution network.

- Pioneering Exports: Square was the first Bangladeshi pharma company to export medicines (back in 1987), showing great foresight and setting an example for others.

- Scale and Distribution: It holds 17–18% of the local market, with the biggest sales team and strong distribution reaching almost every pharmacy and hospital. This wide network keeps costs low and profits high.

- Quality Commitment: Square always maintains global quality standards and has approvals like the UK MHRA, which allow exports to tough international markets.

2. Incepta Pharmaceuticals: The Innovator & Biotech Specialist (Top 2) [13]

Incepta Pharmaceuticals is a leading Bangladeshi company known for its innovation and specialization in biotechnology, developing and manufacturing a wide range of advanced pharmaceutical products, including vaccines, biosimilars, and high-tech dosage forms. The company focuses on bringing new technologies to the market, such as insulin, mRNA technology for vaccines, and other biotechnological products, establishing itself as a research-based global healthcare company with a strong presence both domestically and internationally.

- Role: Incepta stands out with strong research and development, focusing on advanced, hard-to-make medicines.

- Biotech Leadership: It leads in biotech products and vaccines, making items like human insulin, freeze-dried injectables, monoclonal antibodies, and even snake venom antiserum.

- Market Disruption: By launching generic versions of expensive life-saving drugs (thanks to the TRIPS waiver), it makes treatments more affordable and gains a quick advantage.

- Consistency: Though it started later (in 1999), its innovation-focused approach has made it the second-largest pharma company in Bangladesh.

3. Beximco Pharmaceuticals: The Global Player (Top 3) [14]

Beximco Pharmaceuticals is a global player because it’s the first Bangladeshi company to export to the US and the first in the world to offer a generic version of remdesivir for COVID-19. It has a significant international presence, with a manufacturing base certified by major global regulatory authorities and a diverse product portfolio of over 300 generic medicines marketed in more than 50 countries. The company also holds multiple global awards, recognizing its role in making affordable medicines accessible worldwide.

- Role: Beximco is the most aggressive in going global and often the first to enter new, strict Western markets.

- US FDA Pioneer: In 2015, it became the first Bangladeshi pharma company to get US FDA approval and to export prescription drugs to the US. This achievement proved Bangladesh’s medicine quality to the world.

- International Financing: Beximco is listed on the London Stock Exchange’s AIM, giving it access to global capital for expansion and advanced factories.

- Wider Global Footprint: It exports to more than 50 countries, including the US, UK, Canada, Australia, and the EU making it the most internationally recognized Bangladeshi pharma company.

4. Renata Limited: The Legacy & Specialty Player (Top 5–7) [15]

Renata Limited is a major pharmaceutical and animal health company in Bangladesh. It is known as a legacy player due to its long history, and it’s a specialty player for its leadership in animal health and focus on innovation in human pharmaceuticals. The company is currently ranked as one of the largest in Bangladesh, with significant exports and a market capitalization of over $1 billion.

- Role: Renata mixes a strong heritage with focus on special, high-margin areas.

- Legacy of Quality: Once part of Pfizer Bangladesh, Renata has carried forward multinational-quality practices, earning a strong reputation.

- Specialty Focus: It leads in the animal health market and makes niche human health products, with some approved by strict regulators like the UK MHRA.

- Strategic Partnerships: Renata also supplies nutrition products to global organizations like UNICEF, showing its ability to deliver specialized, high-quality products.

5.4.Contribution: Employment and GDP

The pharmaceutical industry is one of Bangladesh’s most advanced and fastest-growing sectors. It is a “thrust sector” that plays a big role in the economy by creating jobs and adding to GDP.[16]

1. Strong Contribution to GDP

- GDP Share: The sector adds around 1% to Bangladesh’s total GDP.

- High Growth Rate: It grows very fast, about 12–15% every year, often higher than the country’s overall GDP growth.

- Self-Sufficiency & Savings: Local companies meet 97–98% of Bangladesh’s medicine demand, saving a huge amount of foreign currency that would otherwise be spent on imports.

- Revenue: The pharmaceutical sector is recognized as one of the government’s top revenue earners and is frequently cited as the second-largest export sector for the country, after the Ready-Made Garments (RMG) industry.

2. Huge Employment Source

This sector is one of the most technologically advanced and high-growth industries in the country, and the employment data highlights its nature as a skill-intensive sector. The total workforce employed in the pharmaceutical sector in Bangladesh is very small, which is typical for a high-tech manufacturing industry.

- Skilled Workforce: The pharmaceutical sector employs approximately 0.24% to 0.34% of Bangladesh’s total employed population. The industry directly employs 75,000–115,000 skilled professionals, such as pharmacists, scientists, engineers, and quality control experts. In certain high-volume areas of the pharmaceutical sector, the demand for new jobs is exceptionally high due to employee turnover, average turnover rate (Especially Sales/MIO) is 20% to 35% (annually).

- Indirect Jobs: Its large distribution and sales networks create many more indirect jobs, supporting both urban and rural workers across the country.

5.5.Policy Foundation: The 1982 Drug Control Ordinance

The Drug (Control) Ordinance, 1982 was the most important policy step in Bangladesh’s pharmaceutical history. It turned the industry from an import-dependent market into a strong, self-reliant sector.[17]

Key Impacts of the Ordinance

- Rationalized the Market: Banned more than 1,600 harmful or unnecessary drugs (like ineffective tonics and vitamin mixes), cleaning up the market.

- Reduced MNC Dominance: Limited the role of multinational companies (MNCs). Before 1982, 8 MNCs controlled about 70–80% of the market. After the law, local companies gained control.

- Boosted Local Production: With less MNC competition, Bangladeshi companies got the space to make affordable, essential generics. This pushed them to invest, expand, and improve quality.

- Public Health First: The focus shifted from selling high-profit, non-essential drugs to producing essential medicines at low prices, improving access to healthcare for ordinary people.

6. Bangladesh Pharmaceutical Sectors Production & Capacity

The pharmaceutical industry in Bangladesh is one of the country’s most successful and fast-growing sectors. Its strength mainly comes from producing generic medicines that serve the local market and are now reaching global markets.

Bangladesh’s pharmaceutical industry is a self-sufficient, fast-growing, and export-oriented sector. It has a strong cost advantage and benefits from TRIPS exemptions, which make it highly competitive globally. But to secure its future after LDC graduation, it must reduce API import dependency and invest heavily in R&D and advanced technology.[7]

6.1. Production and Capacity Details [17]

•Domestic Demand Met9: 97%-98% of the total domestic requirement for finished medicines is met by local manufacturers.

•Market Size (Domestic): Projected to surpass USD 6 billion by 2025.

•Number of Companies: Approximately 250 registered pharmaceutical companies, with a little over 100 actively operating, including large local firms and multinational corporations.

•Export Destinations: Medicines are exported to over 150 countries, including highly regulated markets like the USA, UK, EU, Canada, and Australia.

•Export Earnings (FY 2024-25): Exports rose to approximately USD 177.42 million in the first ten months of FY 2024-25.

•Primary Production: The industry primarily produces branded generic drugs, which account for almost 80% of the locally produced drugs.

•Product Range: Capabilities across all major therapeutic areas, including anti-infectives, cardiovascular, metabolic, respiratory, and nervous system drugs. They also produce complex formulations like insulin, hormones, anti-cancer drugs, MDIs, DPIs, and lyophilized injectables.

| Metric | Details |

|---|---|

| Market Value (Projected 2025) | > US$6 Billion |

| Local Demand Met | 97–98% |

| Share of Local Companies | > 90% |

| Generic Drug Share | > 75% |

| Number of Companies | ~250 |

6.2. API Manufacturing and Backward Linkage in Bangladesh

A big weakness in Bangladesh’s pharmaceutical sector is its dependence on imported raw materials, especially Active Pharmaceutical Ingredients (APIs), which are the main ingredients needed to make medicines.[18]

•Raw Material (API) Production in Bangladesh

Even though Bangladesh can produce most finished medicines, it still relies heavily on imported raw materials, especially Active Pharmaceutical Ingredients (APIs). [18]

- Import Dependence: About 80–90% of APIs are imported from countries like China, India, and Korea.

- API Market Value: The demand for APIs in Bangladesh is expected to reach around US$1.4 billion by 2025.[19]

- Local Production: Only around 15 local companies make a small number of APIs (about 40 types).[18]

•Government Steps to Reduce Dependence

To solve this problem, the government has taken some steps:

1. API Industrial Park:[7]

- A 200-acre industrial park has been built in Munshiganj.

- Its purpose is to help local companies produce APIs inside the country.

2. Incentives for Producers:[7]

- The government is giving tax benefits and export subsidies to API manufacturers.

- These benefits encourage companies to invest more in local API production.

7. Bangladesh Pharmaceutical Sectors Growth & Trends

The Bangladesh pharmaceutical sector is a high-growth industry, a major success story for the country, largely driven by the ability of local companies to produce generic drugs at competitive prices. It’s a vital part of the national economy, meeting over 97% of the domestic demand for medicines and exporting to over 150 countries. [20][21]

Read more: Walmart Revolutionary Story from Beginning to Global Retail Giant

7.1. Growth and Market Overview

The sector has demonstrated robust growth, with the market size projected to surpass $6 billion by 2025, with some estimates suggesting an annual growth rate of over 12% during the 2019-2025 period.[7]

•Key Growth Drivers

- Self-Sufficiency: The industry has changed from relying heavily on imports to meeting almost all local demand. This was made possible mainly by the National Drug Policy of 1982, which encouraged local production.[20]

- TRIPS Waiver: As a Least Developed Country (LDC), Bangladesh benefits from a special TRIPS waiver under the WTO. This allows local companies to make generic versions of patented drugs without paying royalties, giving them a big advantage. This waiver has been extended until 2033 for pharmaceuticals.[7] [22]

- Expanding Domestic Market: Rising income, a growing middle class, population growth, longer life expectancy, and more chronic diseases are increasing demand for medicines within Bangladesh.[7]

- Export Growth: Bangladeshi medicines are sold worldwide, including in strict markets like the EU, UK, and Australia. Many companies are also working to get US FDA approvals to expand exports further.[7]

7.2. Current Trends and Challenges

1. API Industrial Park Development[18]

- The government is building a 200-acre API Industrial Park in Munshiganj to reduce reliance on imported raw materials (currently over 85% imported).

- The park will include facilities like a Common Effluent Treatment Plant (CETP) and aims to boost local API production, save foreign currency, and increase exports.

2. Post-LDC Graduation Challenges[23]

Bangladesh is scheduled to officially graduate from LDC status in 2026. While the TRIPS waiver for pharmaceuticals has been extended until 2033, the sector faces other challenges post-graduation:

- Loss of Export Subsidies: The discontinuation of export subsidies may moderately impact export earnings.[20]

- Market Access: Losing preferential trade access (duty-free markets) in some key destinations may necessitate negotiating new bilateral or regional trade deals.

- IPR Compliance: After the pharmaceutical-specific TRIPS extension expires in 2033, local firms will face stricter Intellectual Property Rights (IPR) compliance for new molecules, requiring a massive push in Research and Development (R&D).

3.Focus on R&D and Technology

- Need for Innovation: To remain competitive and move up the value chain post-LDC and post-TRIPS waiver, the industry needs to significantly increase investment in R&D and move towards complex and high-value products like biosimilars, anti-cancer drugs, and specialized formulations (e.g., inhalers, lyophilized injectables).[17]

- Compliance: Continuous upgrading of manufacturing facilities to meet stringent international standards like US FDA and EU GMP is crucial for sustained export growth.[17]

- Biotechnology: The sector is gradually exploring biotech-based pharmaceuticals, requiring substantial investment and policy support.

8. Bangladesh’s Pharmaceutical Sectors Investment & Capital

The Bangladeshi pharmaceutical industry is overwhelmingly dominated by local investment, with a strong foundation in producing generic medicines. Foreign Direct Investment (FDI) plays a smaller, yet important, role, often focused on high-end or specialized segments. The government actively supports the sector with significant incentives, particularly to encourage domestic production of raw materials.

8.1. Local vs. Foreign Investment

The Bangladeshi pharmaceutical sector is a prime example of a market successfully cultivated by domestic companies thanks in part to historical protective measures and the expiration of patents under the WTO’s TRIPS agreement for Least Developed Countries (LDCs).

•Local Investment Dominance: Local manufacturers cater to approximately 98% of the country’s domestic demand for medicines. The market share is highly concentrated, with the top local companies dominating the sales. Local companies are the primary drivers of production, employment, and exports to over 150 countries.[7][20]

•Foreign Direct Investment (FDI):[24]

- FDI in the broader Chemicals & Pharmaceuticals sector generally accounts for a relatively small share of Bangladesh’s total FDI stock (around 2.6% of total FDI stock as of mid-2024).

- Historically, the government has favored local industries, with regulations controlling the import of drugs that compete with locally manufactured pharmaceuticals.

- Foreign investment often comes through joint ventures or for producing specialized, advanced, or patented treatments, especially as the country prepares for its graduation from LDC status (which means losing the TRIPS patent waiver benefit in 2033). Experts suggest that greater FDI and collaboration with global pharma powerhouses are needed to cope with post-LDC challenges.

8.2. FDI Inflow (Foreign Direct Investment) in Bangladesh Pharmaceuticals

While specific recent figures solely for the pharmaceutical sector’s net FDI inflow aren’t always segmented from the broader “Chemicals & Pharmaceuticals” sector, the overall trend for the sector is:[7]

- Small Share of Total FDI: The sector typically accounts for a minor percentage of Bangladesh’s total annual FDI inflows compared to other sectors like Textiles, Banking, and Power.

- Trend: The overall FDI inflows into Bangladesh have seen fluctuations, and the pharmaceutical segment within this has not been a primary magnet for foreign capital compared to regional peers. However, the government has set a target in its policy to attract substantial FDI for the development of the Active Pharmaceutical Ingredients (API) sector.

- Perceived Negative Impact: Some research has surprisingly suggested that long-term FDI inflow might have a negative impact on the growth of Bangladesh’s pharmaceutical industry, possibly due to crowding-out effects or the nature of the investment focusing on non-essential, patented drugs.

- Grouping: Bangladesh Bank typically groups the data as “Chemicals & Pharmaceuticals.” The figures represent the combined net FDI for both industries.

- Recent Surge (FY24): The most recent reported figure for FY 2023-2024 shows a significant jump to $123.79 million from $44.00 million in FY 2021-2022, suggesting a recent spike in foreign interest in this combined sector.

- Data Availability: The most precise, annual, sector-wise breakdowns often require referencing the detailed tables within the individual Bangladesh Bank Foreign Direct Investment and External Debt reports for each year, which are published semi-annually. The general public data frequently relies on figures highlighted in financial news reports that reference the Bangladesh Bank data.

| Year | Official Net FDI (US$ Billion) | Verified Official Net FDI (US$ Billion) | Pharmaceuticals & Chemicals Sector Share (%) | Estimated FDI in Pharma (US$ Million) | Notes / Observations |

|---|---|---|---|---|---|

| 2018 | 3.61 (UNCTAD inward flow) | 3.613 (BB, CY data) | ~1.8 (Stock share: BB) | ~65 | Peak inflows in Q4 2018 ($1.609B); strong momentum from diversified manufacturing and initial pharma investments. |

| 2019 | 3.23 (UNCTAD) | 1.857 (BB Net FDI CY) / 2.56 (UNCTAD Net FDI) | ~1.9 (Stock share: BB) | ~61 | Steady inflow; local expansion, foreign technical collaborations. |

| 2020 | 2.56 (BB / UNCTAD: 2.564) | 1.465 (BB CY Net FDI) / 2.564 (UNCTAD inward flow) | ~1.8 (Stock share: BB) | ~46 | COVID-19 dampened inflows globally; pharma maintained resilience due to essential drug exports. |

| 2021 | 2.896 (UNCTAD) / 1.57 (BB revised) | 1.583 (BB CY Net FDI) / 2.896 (UNCTAD inward flow) | 1.94 (BB Stock share) | 45 – 56 | Official sector share confirmed at 1.94% (BB/UNCTAD); actual net FDI lower than earlier estimates. |

| 2022 | 3.480 (UNCTAD) / ~1.72 (Macrotrends Net FDI) | 1.518 (BB CY Net FDI) / 3.480 (UNCTAD inward flow) | ~2.1 (Stock share: BB) | ~72 | Overall rise; pharma market reached $3.5B; foreign reinvestments continued. |

| 2023 | 3.00 (UNCTAD) / ~1.48 (Macrotrends Net FDI) | 1.484 (BB CY Net FDI) / 3.00 (UNCTAD inward flow) | ~2.3 (Stock share: BB) | ~69 | Divergence between gross and net flows; increased joint ventures and R&D projects. |

| 2024 | 1.27 (Net FDI, BB) | 1.27 (BB CY Net FDI) | 2.6 (FDI Stock share) | 33 (FY24 Equity in Pharma & Chem) | Official reports indicate lowest net FDI in 5 years; however, sector’s stock share rose due to reinvestments and capacity expansion. |

| 2025 (Projected) | ~1.50 (est., Q2 $303.27M trend) | Projection: $1.712 B (BB FY25) | ~2.7 (Est. Stock share) | ~40 | Preliminary data show modest rebound driven by reinvested earnings and expansion of export-oriented pharma production. |

8.3. Government Support (Incentives, Subsidies)

The Government of Bangladesh provides a comprehensive set of support measures, with a strong focus on boosting exports and developing the Active Pharmaceutical Ingredient (API) sector to reduce import dependence. [7] [20] [25]

To encourage overseas sales, the government provides cash incentives (subsidies) on the value of goods exported:

- Pharmaceutical Products: An export incentive of 6% is applicable on the export of general pharmaceutical products, including medical/surgical instruments and appliances (until December 31, 2025).

- Active Pharmaceutical Ingredients (API): A specific export incentive of 5% is provided for exporting APIs from Bangladesh (until December 31, 2025).

Recognizing that Bangladesh imports over 85% of its API needs annually (costing over $1 billion), the government prioritizes developing local API manufacturing through the National Active Pharmaceutical Ingredients (API) and Laboratory Reagents Production and Export Policy 2018.

- Tax Holiday (Income Tax Exemption): 100% tax holiday for producers of at least five specific API molecules, or 75% tax holiday for producers of at least three specific API molecules. This is a critical incentive, extended until December 31, 2032.

- Customs Duty & VAT Waivers: Customs duty exemption on the import of raw materials used to manufacture APIs (SRO No. 127-AIN/2020/78/Customs). Also includes waivers on VAT and VAT deduction at source on purchase and sales of locally made APIs and their raw materials up to 2032.

- Cash Incentives on Value Addition: A 20% cash incentive if producers add a minimum 20% value.

- Financing Support: Extended term loans for factories and equipment (up to 12 years). API producers are also entitled to back-to-back letters of credit facilities.

8.4. API Industrial Park (API Park)

The government is establishing a 200-acre API Park in Munshiganj, managed by the Bangladesh Small and Cottage Industries Corporation (BSCIC), to create a dedicated, modern, and environmentally compliant industrial hub.[26][27]

- Objective: To achieve self-sufficiency in API production, gain a competitive edge in the global marketplace, and create an environmentally suitable manufacturing base (including a Common Effluent Treatment Plant – CETP).

- Status & Challenges: Despite being planned for over a decade, implementation has been slow. While plots have been allocated to major pharmaceutical companies, most land remains vacant. Key challenges include the lack of uninterrupted utility services (like 24-hour electricity and gas supply) and complex bureaucratic processes for obtaining clearances/No Objection Certificates (NOCs).

9. Workforce and Skills in Bangladesh’s Pharmaceutical Sector

The pharmaceutical industry in Bangladesh is technologically advanced and provides a lot of white-collar jobs. Most workers are involved in generic drug manufacturing, but there is growing demand for skilled roles in areas like API production.

9.1. Sector Employment Size [28][17] [29][23]

The pharmaceutical industry is a substantial source of employment in Bangladesh:

- Total Employment: Around 75,000 to 115,000 (0.24% to 0.34%) people work in the sector, including both skilled and unskilled workers.

- White-Collar Hub: It is the largest white-collar sector in manufacturing, employing many professionals such as pharmacists, chemists, and engineers and more than other industries like the RMG sector.

- Work Distribution: Most employees work in Manufacturing (production, quality control) and Sales/Marketing (Medical Promotion Officers, Product Managers).

9.2. Skill Levels (High-Tech Jobs vs. Low-Skill Labor)[23][18][17]

The skill composition is currently dominated by capabilities in generic formulation and quality compliance, while facing a shortage in advanced research and development (R&D) skills.

High-Tech / High-Skill Jobs

These roles are filled by university graduates with degrees in Pharmacy, Chemistry, or Engineering.

| Area | Key Roles | Current Skill Status |

|---|---|---|

| Quality & Regulatory | QA Manager, QC Analyst, Regulatory Affairs Professional | Strong in local GMP compliance; need more skills for international standards (US-FDA, EU GMP). |

| R&D & Innovation | Formulation Scientist, R&D Chemist, Analytical Chemist | Focused on generic drug development; major gaps exist in API process development and Biologics production. |

| Management | Plant Manager, Product Manager, Supply Chain Executive | Require both technical and leadership/business skills, which are often lacking. |

Low-Skill / Mid-Skill Labor

This segment is crucial for the high-volume production environment.

- Production Operators & Technicians: Form the core manufacturing workforce, requiring training in specific machine operations and adherence to Good Manufacturing Practices (GMP).

- Sales Professionals (MPOs): Medical Promotion Officers (MPOs) are often B.Sc. or Pharmacy graduates who require strong communication and sales skills, though their role is less “high-tech” and more commercially driven.

9.3. Training and Education Facilities [30][18][31]

The pharmaceutical talent pipeline relies on both formal academia and targeted vocational programs.

•Formal Education

•University-Level Programs:

- Bachelor of Pharmacy (B. Pharm. Hons): Offered by numerous public and private universities and is the foundational degree for technical roles.

- Master of Pharmacy (M. Pharm): Provides specialization in areas like Pharmaceutics, Pharmaceutical Chemistry, and Pharmacology.

- The curricula are accredited by the Pharmacy Council of Bangladesh (PCB), which ensures standards for professional registration.

•Skill Gap in Curriculum: While foundational knowledge is good, a common critique is that academic curricula often lack sufficient practical focus on API manufacturing, advanced biotechnology, and clinical trial management, which are necessary for the industry’s next growth phase.

•Industry-Specific and Government Initiatives

- Good Manufacturing Practice (GMP) Training: This is the most common form of in-house training, often mandatory for all manufacturing staff, from operators to managers. The goal is to ensure compliance with the quality standards set by the Directorate General of Drug Administration (DGDA).

- API Park Training Initiative: The government’s establishment of the Active Pharmaceutical Ingredient (API) Industrial Park is a major initiative to achieve self-sufficiency in raw materials. This requires highly specialized training in chemical synthesis and process engineering, which is a key future training priority for both the government and the industry associations (like the Bangladesh Association of Pharmaceutical Industries – BAPI).

- Corporate Development: Large companies invest heavily in training for soft skills, leadership, and advanced sales techniques for their marketing and managerial cadres. External private institutes also offer diplomas and professional certification courses in QA/QC, Regulatory Affairs, and Pharmaceutical Product Management.

- National Skills Development: The National Skills Development Authority (NSDA) is involved in formulating broader national action plans for skill development, which includes identifying and supporting high-demand sectors like pharmaceuticals to prepare the workforce for the post-LDC (Least Developed Country) transition era.

10. Infrastructure, Technology, and Research in Bangladesh’s Pharmaceutical Sector

The pharmaceutical industry in Bangladesh has advanced production technology but faces challenges in energy, logistics, and research.

10.1. Availability of Energy, Transport, and Logistics[32][9][21]

The challenges in energy and general infrastructure contrast with the specialized distribution systems required for pharmaceuticals.

•Energy Availability for Production

- Status: Leading pharmaceutical manufacturers maintain high standards by investing in captive power generation (generators) and uninterruptible power supply (UPS) systems. This ensures the continuous operation necessary to comply with Good Manufacturing Practice (GMP) standards.

- Challenge: The heavy reliance on self-generated power is due to the inconsistent supply of natural gas and high tariffs for electricity from the national grid, which significantly increases the operational costs of factories. Some companies are exploring alternatives like Liquefied Petroleum Gas (LPG) for boiler operations to mitigate these risks.

10.2. Transport and Logistics for Distribution[33][23]

•Status: The industry boasts a highly efficient national distribution network with sophisticated logistics for domestic and international markets. Cold chain management (refrigerated transport, temperature-controlled depots) is well-established for sensitive products like vaccines and biologics, meeting Good Distribution Practice (GDP) requirements.

•Challenge: Severe traffic congestion in major cities and the overall state of the national road and port infrastructure remain significant bottlenecks for cost-effective transportation.

•API Supply Chain: The industry is highly dependent on the import of Active Pharmaceutical Ingredients (APIs) (over 85%), creating vulnerability to global supply chain disruptions and requiring robust logistics for inbound raw materials.

10.3. Level of Automation and Digital Adoption in Factories[33]

The pharmaceutical sector is one of the most technologically advanced manufacturing industries in Bangladesh.

•Level of Automation

- Advanced Manufacturing: Leading companies utilize modern, automated machinery for high-speed manufacturing, including automated filling, packaging, and high-tech equipment for sterile production (e.g., Form-Fill-Seal (FFS) lines). These facilities often meet the standards required for exporting to highly regulated markets like the UK, EU, and Australia.

- Industry 4.0 Adoption: A study suggests that approximately 55% of pharmaceutical companies surveyed are either adopting or willing to embrace Industry 4.0 technologies, such as Process Analytical Technology (PAT) and Quality by Design (QbD), to enhance production efficiency and quality control.

- Warehouse Automation: Automation is also being applied in warehouse operations and supply chain management by about 50% of surveyed companies, indicating a move toward digitized inventory and logistics.

•Digital Adoption

- Core Systems: The industry widely uses Enterprise Resource Planning (ERP) systems for managing production planning, batch tracking, inventory, and regulatory reporting, which is critical for maintaining data integrity and traceability across the supply chain.

- Future Focus: The overall drive towards digitalization is viewed as crucial for improving efficiency, reducing costs, and ensuring compliance, especially as the country prepares for its LDC graduation.

10.4. Research and Innovation Ecosystem[17][21]

The ecosystem is currently geared towards generic production but is attempting to make a strategic shift towards self-sufficiency and high-value biologics.

•R&D Labs and Focus

- Generic-Centric R&D: The primary focus of R&D is generic formulation development, process optimization, and conducting mandatory studies like Bioequivalence (BE) studies for export purposes. The core strength is replicating and developing cost-effective versions of off-patent drugs.

- Low Investment: Investment in R&D as a percentage of total sales remains suboptimal and very low compared to global research-based pharmaceutical companies, limiting the capacity for genuine new drug discovery.

•Biotech Research

- Emerging Biosimilars: The industry is moving into biotech, focusing on biosimilars (generic versions of biological drugs like insulin, vaccines, and monoclonal antibodies). This requires complex, specialized facilities and significant technological upgrades, often achieved through technology transfer agreements.

10.5. Collaborations and Strategic Projects[21]

•API Industrial Park (API Park): The most significant government-led initiative to boost the R&D ecosystem is the establishment of the API Park in Munshiganj. This park aims to facilitate local manufacturing of APIs, thereby reducing import dependency and building a domestic base for chemical synthesis and innovation. The park’s readiness is a key factor in the industry’s future competitiveness.

•Industry-Academia Linkage: Institutional collaboration between the industry and local academia for high-level drug discovery or advanced pharmaceutical sciences remains weak. Strengthening this linkage is crucial for developing the skilled workforce and innovation capacity needed post-LDC graduation.

11. Medicine Availability and Costing in Bangladesh

11.1. Medicine Availability

The availability of medicines in Bangladesh is a complex issue with significant variations between the public and private sectors, different types of medicines (essential vs. non-communicable disease), and ongoing challenges in the supply chain.

Read more: Discovering PetParty’s Handmade World: Your Pet, Your Style

1. Public Sector vs. Private Sector Availability [17] [40]

•Public Sector:

- Availability: Generally lower, especially for certain medicine types. Studies have shown mean availability of Lowest Price Generics (LPGs) in public facilities to be around 37% in recent years. However, in some public facilities like Community Clinics, availability of certain key essential drugs can be higher.

- Cost: Medicines dispensed in public health facilities are often provided for free to patients, significantly improving affordability, though low availability forces patients to the private market.

- Focus: Historically focuses on the National Essential Drug List (EDL), though this list is sometimes outdated, leading to the supply of non-EDL drugs.

- Disparities: Availability can vary by facility type and location, with some studies showing significantly higher availability in areas like Dhaka compared to others.

•Private Sector (Pharmacies and Clinics)

- Availability: Generally higher than in the public sector. Mean availability of LPGs in private retail pharmacies and clinics is often higher (e.g., around 54%-63% in some studies).

- Cost: Medicines are paid out-of-pocket by patients, and the median price of LPGs in the private sector can be twice as high as in public procurement, leading to affordability issues, particularly for the poor.

- Originator Brands: Availability of Originator Brands (OBs) is very low across all sectors but slightly better in private settings.

2. Availability of Essential Medicines and NCD Medicines [17] [41] [40]

- Essential Medicines (General): Availability of essential drugs for common illnesses in primary healthcare (PHC) facilities can be poor, sometimes varying significantly between different types of PHC centers.

- Non-Communicable Disease (NCD) Medicines: Availability of medicines for chronic conditions like hypertension and diabetes is a significant concern. They are often less available than medicines for infectious diseases. Insufficient budget allocation (e.g., only about 4.2% of the health budget for NCDs in some periods) contributes to persistent shortages of anti-hypertensive and other NCD medicines, especially at the grassroots level (Community Clinics and Upazila Health Complexes). Unaffordability is a major issue in the private sector for NCD treatments, with key medications like bisoprolol, metformin, and atorvastatin being particularly difficult to afford.

3. Supply Chain and Production Landscape [7]

- Domestic Production Strength: Bangladesh’s pharmaceutical industry is highly developed, meeting about 98% of the domestic demand for finished drug products. This strong local manufacturing capacity, often attributed to the TRIPS waiver for LDCs (extended until 2033), ensures a broad supply of generic medicines.

- Supply Chain Challenges (Public Sector): Inefficiencies and challenges in public sector procurement and distribution systems (e.g., Central Medical Stores Depot/Essential Drug Company Limited) can lead to stock-outs and inconsistent supply at health facilities. Limited infrastructure and sometimes poor inventory management practices at facility level contribute to the problem.

- API Dependency: The industry still heavily relies on imported Active Pharmaceutical Ingredients (APIs), with over 85% of API needs being imported. This dependence creates vulnerability in the supply chain, especially during times of global crises. The government is promoting API manufacturing to address this.

4. Affordability and Financial Burden [40]

The most critical challenge to access is affordability. A high proportion of total health expenditure in Bangladesh comes directly out-of-pocket from patients, which can push vulnerable populations into poverty, especially when they need to purchase medicines from the more expensive private sector due to public sector stock-outs.

11.2. Medicine Costing in Bangladesh

The cost of medicine in Bangladesh is a complex issue, characterized by several key factors:

1. General Price Level and Affordability: [25]

- Relatively Low Average Prices: Historically, Bangladesh has had relatively low average medicine prices compared to many other countries, partly due to the presence of a strong domestic pharmaceutical manufacturing industry and certain patent exemptions (as a Least Developed Country, though this is changing).

- High Out-of-Pocket (OOP) Expenditure: Despite potentially lower unit prices, the overall cost of healthcare is a major burden. OOP expenditure on health is extremely high in Bangladesh (one report suggests it’s the second-highest in the world at 68.5%), and a significant portion of this (around 73%) goes toward purchasing medicines. This means individuals pay for most of their medications directly, which can severely impact poor and middle-class households.

- Price Hikes: There have been recent reports (around late 2024) of significant, even rampant, price hikes for various drugs, including life-saving ones, antibiotics, and painkillers, with increases ranging from 10% up to 100% in some cases. This is often attributed to rising costs of imported raw materials (due to the high US dollar exchange rate), power, gas, and a perceived lack of regulatory oversight.

2. Government Regulation and Price Control: [37] [38] [39]

- Price Control Mechanism: The government, through the Directorate General of Drug Administration (DGDA) and the Drugs (Control) Ordinance, 1982, has the legal authority to fix the maximum price for drugs.

- Recent High Court Ruling: A significant development is a High Court ruling (around August 2025 in the search results) that restored full government control over the pricing of 739 life-saving medicines, nullifying a 1994 circular that had shifted pricing power for most drugs to private manufacturers. This ruling is aimed at curbing price increases and making essential drugs more affordable.

- Essential Drugs Company Limited (EDCL): EDCL, the state-owned pharmaceutical manufacturer, focuses on ensuring an uninterrupted supply of quality essential medicines to public hospitals and has announced price reductions on some essential medicines.

3. Price Variation and Competition:[36]

- Brand Variation: Prices for chemically identical medicines can vary significantly between brands, sometimes by a margin of 16% to 200%. This is often linked to branding, marketing, and the perceived quality difference, which may not always reflect actual quality.

- Sector Variation: Prices can be lower in the public sector compared to private retail pharmacies and clinics, although availability in the public sector is a known issue, forcing many to purchase privately.

4. Doctor Consultation and Prescription Costs (Approximate):

While specific medicine costs are hard to list comprehensively due to market fluctuations and brand variety, a common part of the overall medical cost is the doctor’s consultation:

- In-Person Consultation: The fee for a specialist doctor’s visit can vary widely based on the doctor’s experience, reputation, and the location (e.g. Dhaka). Online consultation prices can range from around Tk 500 to Tk 1,900 BDT or more, as seen in online health platforms.[35]

- Home Doctor Visit: A doctor’s visit to your home might cost significantly more, sometimes in the range of Tk 5,000 to Tk 7,000 BDT per session, which typically includes the doctor’s transportation but excludes the cost of prescription drugs.[34]

12. Hospital Pharmacy: A Missing Pillar in Healthcare

12.1. Why Hospital Pharmacy is Absent in Bangladesh

1.Policy and Legal Void

- Lack of Mandatory Policy: There is no specific, enforced government policy or legal mandate that requires all hospitals (public and private) to establish and maintain a professional HPD staffed by graduate pharmacists. While the National Drug Policy (NDP) of 1982 and subsequent revisions aimed to improve drug quality, they did not effectively create Hospital Pharmacy Cadres (HPCs) for the clinical role.[42]

- Absence of Government Posts: Until very recently, the government did not create dedicated, permanent, high-ranking posts for graduate pharmacists in public hospitals, leading to a massive human resources gap. [43]

2. Historical Focus on Industry

- Product-Centric Education: Pharmacy education in Bangladesh historically focused almost exclusively on industrial pharmacy (manufacturing, quality control, R&D). The curriculum allocated minimal time to clinical pharmacy, hospital practice, and patient care. [17]

- Brain Drain: The lack of clinical roles and poor career prospects in hospitals pushed graduate pharmacists almost entirely into the booming pharmaceutical manufacturing sector or abroad, leaving hospitals with a severe shortage of clinically trained personnel.[17]

3. Manpower and Cultural Barriers

- Misclassification of Role: The pharmacist’s role is largely misunderstood by policymakers, hospital management, and the public as mere dispensing or inventory control (logistics), rather than a clinical member of the healthcare team focused on preventing medication errors and optimizing therapy.[44]

- Lack of Collaboration: There is often a perceived barrier and lack of inter professional acceptance between physicians and pharmacists, hindering the implementation of essential services like clinical rounds and therapeutic drug monitoring. [45]

- Staffing Reality: Most hospital “pharmacies” are simply retail drug stores or are managed by Diploma (B-Grade) or Certificate (C-Grade) pharmacists/technicians, who lack the advanced clinical training required for patient safety roles like drug interaction screening and dosage adjustments. [42]

12.2. Role and Benefits of Mandatory Hospital Pharmacy

The mandatory inclusion of a professional HPD directly addresses the major sources of patient harm and inefficiency in the current system.[17]

- Ensure Correct Dosage/Reduces Medical Errors: Reviewing prescriptions for appropriate dose, frequency, and route based on the patient’s condition (e.g., kidney/liver function), a service often missed by non-clinical staff.

- Prevent Misuse/Improves Treatment Efficacy: Identifying and resolving Drug-Drug Interactions (DDIs), contraindications, and irrational prescribing before the medicine is administered.

- Monitor Patient Safety/Lowers Costs: Optimizing antibiotic use to combat Antimicrobial Resistance (AMR) and reducing the length of hospital stays resulting from preventable Adverse Drug Reactions (ADRs).

- Patient Counselling/Improves Adherence: Educating patients on proper usage, storage, and potential side effects, especially for chronic diseases and discharge medications.

12.3. Need to Make Hospital Pharmacy Compulsory

To successfully implement this globally recognized standard, a multi-phased and coordinated national initiative is required in all government and private hospitals. [17] [20]

1. Policy and Legal Enforcement (Immediate)

- Mandatory Licensing Requirement: The Directorate General of Health Services (DGHS) and Directorate General of Drug Administration (DGDA) must amend hospital licensing rules to make a Hospital Pharmacy Department (HPD), led by a Graduate (A-Grade) Pharmacist, a mandatory condition for license issuance and renewal.

- Create Government Cadre: The Ministry of Health and Family Welfare (MoHFW) must immediately create a dedicated Hospital Pharmacist Cadre (HPC), defining clear, attractive career paths, ranks, and salaries for graduate pharmacists in all government hospitals (e.g., minimum 1 pharmacist per 50 beds).

- Mandate Pharmacy and Therapeutics Committee (PTC): Compel every hospital to establish a PTC consisting of physicians, nurses, and the Chief Pharmacist, to govern drug selection, rational drug use, and policy within the facility.

2. Service Implementation and Infrastructure (Short-Term)

- Clinical Service Integration: Require the Hospital Pharmacist to be a core member of the patient care team by mandating participation in physician-led ward rounds for medication review and dosage adjustment.

- Unit Dose Dispensing (UDD): Implement a Unit Dose Dispensing (UDD) system for inpatients (where each dose is prepared individually for a 24-hour period), replacing the error-prone “floor-stock” system currently in use.

- Digitalization: Mandate the use of an Integrated Digital Inventory Management System in the HPD to track drug expiry, control temperature, and manage stock, ensuring quality and preventing shortages.

3. Education and Professional Development (Long-Term)

- Curriculum Reform: The Pharmacy Council of Bangladesh (PCB) must accelerate the shift towards a clinical curriculum (e.g., the Doctor of Pharmacy/PharmD model) with compulsory, structured hospital clinical residency/internship before registration, to train a new generation of patient-focused pharmacists.

- Targeted Training: Invest in post-graduate training and certifications for existing pharmacists to bridge the knowledge gap and prepare them for specialized roles like clinical pharmacy, oncology pharmacy, and intensive care unit (ICU) pharmacy.

13. Global Comparison: Lessons for Bangladesh

The strategic approaches of pharmaceutical companies vary considerably according to their market size and positioning, generally classified into Top-Tier (Big Pharma), Mid-Tier (Specialty or Mid-Size Pharma), and Low-Tier (Local or Generic Pharma). Each tier demonstrates distinct priorities in areas such as research and development (R&D), quality compliance, and market strategy largely shaped by their respective financial capacities, operational scale, and competitive objectives.

13.1. Top-Tier Global Pharmaceutical Companies (Big Pharma)

Top-tier global pharmaceutical companies commonly referred to as “Big Pharma,” including giants such as Pfizer, Roche, and Novartis, distinguish themselves through their unwavering focus on innovation and robust regulatory compliance, which together underpin their sustained market leadership, global reach, and reputation for trust and reliability.

Strategy Point:

- Heavy Investment in Research & Development (R&D): These companies invest billions annually (e.g., on the order of €10 billion a year for Big Pharma) to discover and develop New Molecular Entities (NMEs), effective drug delivery systems, and conduct extensive clinical trials. Their large pipeline increases their probability of success. [46]

- Robust Regulatory Compliance: They maintain strict compliance with global standards, including those set by the U.S. FDA, European Medicines Agency (EMA), and Good Manufacturing Practices (GMP). This is crucial for building trust, and a few have achieved certifications like UK MHRA, EU GMP, and USFDA approval. They cultivate a quality-first culture and utilize robust Quality Management Systems (QMS). [47]

- Strategic Partnerships and Acquisitions: They frequently collaborate with research institutes, biotech firms, and academic institutions to share resources and technology. They often focus on acquiring high-potential assets in the final stages of development to generate a faster return on investment. [48]

- Advanced Technology Adoption: This includes leveraging Artificial Intelligence (AI) to transform R&D and decision-making, and implementing technologies like Process Analytical Technology (PAT) for real-time manufacturing monitoring, which builds quality into the product from the outset (Quality by Design or QbD). [49]

- Focus on High-Value Therapeutic Areas: Top companies often lead in areas such as oncology, immunology, vaccines, and metabolic diseases. For example, Novartis is known for cutting-edge medical innovation, and Novo Nordisk is a leader in diabetic medication.[50]

13.2. Challenges and Strategies of Middle-Tier Pharmaceutical Companies [48]

Mid-sized pharmaceutical companies operate within a distinct landscape of challenges and opportunities shaped by their capital structure often family-owned or heritage-driven and their smaller, more focused product pipelines compared to Big Pharma. These characteristics influence their strategic agility, partnership approaches, and long-term sustainability in a highly competitive market.

1. Core Challenge (Limited R&D Budget):

Their R&D budgets are significantly smaller than Big Pharma’s (often less than annual sales of the major players). This means they have little room for error in their investments.

2. Strategy:

- Niche Market Focus: They find success by targeting smaller patient groups or geographical areas where Big Pharma is not yet present due to high risk or lack of focus. This allows them to maximize their impact and differentiate themselves.

- Value Chain Control: Mid-size players often aspire to control the entire value chain from R&D to production, marketing, and distribution. This focus on operational excellence and knowledge of the value chain strengthens their credibility and independence.

- Market Entry (Emerging Markets): For small to mid-sized companies entering emerging markets, options include partnering with Big Pharma, working with a distributor, or partnering with a commercial solutions provider, each involving trade-offs between ease of implementation and strategic control.

3. Universal Challenges:

They face the same industry-wide hurdles as top-tier companies, including strict regulatory standards, complex supply chains, and the urgent need to innovate amid increasing pressure to cut drug prices.

13.3. The Case of the Bangladesh Pharmaceutical Industry

The pharmaceutical industry in Bangladesh represents a strong example of a mid-tier global player, demonstrating remarkable self-sufficiency by meeting nearly the entire domestic demand for medicines. However, its export growth remains constrained by a persistent reliance on imported raw materials and active pharmaceutical ingredients (APIs), which limits competitiveness in regulated international markets. [7] [21]

- Domestic Self-Sufficiency: Bangladesh’s local pharmaceutical industry meets approximately 97% to 98% of the domestic demand for finished-form medicinal products.

- Import Dependency for Raw Materials: Despite domestic self-sufficiency in finished drugs, the industry is heavily reliant on imports for Active Pharmaceutical Ingredients (APIs) and other raw materials, sourcing over 85% to 90% of its API needs (e.g., importing APIs at an annual cost of USD 1.3 billion).

- Export Status and Destinations Pharmaceuticals are a major export sector, with products being sent to over 150 countries, including highly regulated markets such as the USA, UK, EU, Canada, and Australia. In the first ten months of FY2024–25, exports reached USD 177.42 million.

- Competitive Advantage (TRIPS Waiver): As a Least Developed Country (LDC), Bangladesh currently benefits from the WTO’s TRIPS (Trade-Related Aspects of Intellectual Property Rights) waiver until 2033. This allows local companies to produce and export generic versions of patented drugs without paying royalties, providing a significant cost advantage.

14. Challenges & Limitations

Even though Bangladesh’s pharmaceutical industry has grown a lot, meets almost all of the country’s medicine needs, and exports to more than 150 countries, it still faces serious problems that could limit its future growth and success.

14.1. Dependency on Imported APIs (Active Pharmaceutical Ingredients)[18][21]

The biggest weakness in the industry is that it depends a lot on importing raw materials, especially the main ingredients (APIs) used to make medicines.

- High Import Bill: The pharmaceutical industry buys more than 90% of its APIs and raw materials from other countries. This leads to very high yearly import costs, which puts a heavy burden on the country’s foreign currency reserves.

- Supply Chain Vulnerability: Relying on other countries for raw materials makes the supply of medicines vulnerable. Any global market problems, sudden price changes (especially from major suppliers like China and India), or political conflicts can disrupt the supply chain.

- Cost and Competitiveness: Relying on imported raw materials raises production costs, making Bangladeshi medicines less competitive internationally. This will be even more challenging when Bangladesh graduates from Least Developed Country (LDC) status, as it will lose certain trade-related exemptions under intellectual property rules.

- Mitigation Efforts: The government is building an API Industrial Park in Munshiganj and giving tax benefits to local medicine makers. This is meant to help them produce raw materials locally and rely less on imports.

14.2. Lack of Hospital Pharmacy and Structured Patient Care

A big problem in the healthcare system is that hospitals don’t have well-organized pharmacy services or a patient-focused clinical pharmacy system.[51] [52] [53]

- Underutilization of Pharmacists: In many public and some private hospitals, medicine services are often handled by staff who are not trained pharmacists, or just through a regular drug store. Graduate pharmacists, who could provide clinical services, advise patients, manage medicine stocks, and prevent medication mistakes, are mostly not involved.

- Impact on Patient Care: Without professional pharmacists and patient-focused care, medicines are often used incorrectly, patients may not follow their treatments properly, and there’s a higher chance of harmful side effects. This directly lowers the quality of healthcare and patient outcomes.

- Policy Gap: Organizations like the WHO have asked the government to make a rule for hiring trained pharmacists in hospitals. This would help ensure proper pharmacy practices and better patient care.

14.3. Weak R&D and Innovation Culture

The industry has mostly grown by making copies of existing drugs, so it doesn’t focus much on creating new, original medicines.[17] [21]

- Low Investment: Investment in R&D is generally very low, as companies prioritize generic manufacturing for quicker profit, with little focus on developing new drugs, novel formulations, or complex biotech products.

- Limited Competitiveness: This hampers the sector’s long-term competitiveness, especially as the TRIPS waiver for LDCs expires post-graduation. The industry will need to shift towards innovation and compliance with more stringent global intellectual property and regulatory standards to sustain growth.

- Technological Gaps: There’s a shortage of advanced technology and specialized expertise needed for complex chemical synthesis, biologics, and other next-generation therapies.

14.4. Skilled Manpower Shortage and Brain Drain

The sector suffers from a shortage of highly skilled professionals and a loss of talent to other countries (brain drain). [17]

- Lack of Specialized Skills: There is a significant shortage of high-quality researchers, analytical chemists, pharmacologists, and professionals mastering complex technologies like modern biotechnology.

- Brain Drain Factors: Highly educated professionals often seek better opportunities abroad due to factors like inadequate compensation, limited scope for advanced R&D work, poor living conditions, and political instability.

- Industry-Academia Gap: A weak link between educational institutions and the industry limits the production of an appropriately skilled workforce.

14.5. Regulatory Gaps and Corruption

Challenges in the regulatory environment create opportunities for corruption and inefficiencies.

- Weak Enforcement and Gaps: The Directorate General of Drug Administration (DGDA) faces challenges due to weak enforcement, limited testing infrastructure, and insufficient manpower, allowing counterfeit and substandard medicines to persist in the market, especially from smaller, non-compliant factories.

- Corruption and Unethical Practices: Corruption exists in the supply chain, including informal payments, and a significant issue is the illegal and unethical promotion of drugs by companies, involving bribery and kickbacks to doctors and pharmacies to influence prescription practices, often leading to overpricing and irrational use of medicines.

- Bureaucracy: Excessive red tape and bureaucratic delays in processes like export clearances and certification hinder international competitiveness.

14.6. Environmental Concerns in Manufacturing

The industry faces significant environmental sustainability issues, particularly concerning pollution from manufacturing processes.[17]

- Pharmaceutical Pollution: Unregulated discharge of effluent containing Active Pharmaceutical Ingredients (APIs) and antibiotics into waterways (especially rivers) poses a grave danger to environmental and human health. High concentrations of antibiotics can drive Antimicrobial Resistance (AMR).

- Lack of Compliance: While larger companies may comply with international standards, many smaller or poorly regulated facilities contribute to significant pollution due to inadequate waste treatment and lack of modern technology.

15. Solutions and Recommendations for Bangladesh’s

Bangladesh’s pharmaceutical industry to keep growing steadily, the country needs well-planned actions that focus on improving local raw material production (backward linkage), training skilled workers, encouraging innovation, and updating regulations especially to prepare for the time after it moves out of the Least Developed Country (LDC) status.

15.1. Expanding Pharmacy Education and Advanced Training

To transition from a generic formulation hub to an innovation-driven economy, the talent pipeline must be upgraded.[37][23]

- More Seats for Graduates: Significantly increase enrollment capacity (seat numbers) in B.Pharm and M.Pharm programs in both public and quality private universities to meet the growing demand from the industry, hospitals, and regulatory bodies.

- Advanced Training and Specialization: Creating and making it mandatory to have advanced training programs like Post-Graduate Residency and Fellowship courses in areas such as Clinical Pharmacy, Regulatory Affairs, Pharmaceutical Biotechnology, and Quality Assurance. These programs should be developed in partnership with top pharmaceutical companies to ensure practical, industry-relevant training.

- PhD Programs and Research Focus: Establish PhD programs that are fully paid for and connected to the pharmaceutical industry, focusing on drug discovery, manufacturing processes for active ingredients (APIs), and bio-similars. The goal is to develop highly skilled researchers and a strong culture of advanced scientific research in Bangladesh.

15.2. Building a Comprehensive Hospital Pharmacy System

Integrating pharmacists into the healthcare team is critical for patient safety and structured care, a current systemic weakness.[51] [54]

- Mandatory Inclusion in All Hospitals: The government should introduce a rule requiring all hospitals government or private with a certain minimum size (like 50 beds) to have a fully equipped Hospital Pharmacy Department (HPD). This department must be run by graduate pharmacists (A grade pharmacist), and having it would be mandatory to get a hospital license and operate legally.

- Defining Clinical Roles: Officially define and establish roles for Clinical Pharmacists to participate in ward rounds, conduct medication reconciliation, provide drug information, screen for drug-drug interactions, and counsel patients upon discharge.

- Digital Systems for Inventory and Safety: Mandate the implementation of digital inventory control (e.g., SAP) and electronic health records (EHRs) in hospital pharmacies to manage drug stock, track dispensing, and support pharmacovigilance.

15.3. Investing in Research & Development (R&D)

R&D is the long-term pillar for sustaining competitiveness after the loss of TRIPS waivers.[55][23]

- Government–Private Partnerships (GPPs): Establish a co-funding mechanism where the government matches private sector R&D investment for high-priority areas like biosimilars, vaccines, and API process development. This can be channeled through grants or tax rebates.

- Centralized Research Institutes: Fund the establishment of national-level centers of excellence for pharmaceutical R&D, equipped with high-end analytical instruments, which can be jointly utilized by small and medium-sized firms and academia.

- R&D Tax Incentives: Offer super-deductions on taxes for expenses incurred on local R&D to substantially increase private sector investment in novel research.

15.4. Achieving Active Pharmaceutical Ingredient (API) Independence

Bangladesh depends heavily on imported raw materials more than 90%for its pharmaceutical industry. Reducing this dependence is important both for the country’s economy and for ensuring public health safety. [17]

- Expedited API Industrial Parks: Fast-track the completion and full operationalization of the API Industrial Park in Munshiganj, ensuring all core utilities, especially the Central Effluent Treatment Plant (CETP), are world-class to meet environmental compliance.

- Unconditional Incentives: Offer a long-term tax holiday (e.g. 10-15 years) and other financial incentives (low-interest loans, cash incentives) to all API manufacturers, streamlining the process and removing bureaucratic hurdles that currently limit uptake.

- Focus on Complex Intermediates: Shift the focus beyond basic APIs to the manufacture of complex chemical intermediates, which form the immediate upstream of API production, to deepen backward integration.

15.5. Stronger Laws and Modernized Regulation

Regulatory quality is the foundation for market integrity and international acceptance.[54]

- Stricter GMP Enforcement: The Directorate General of Drug Administration (DGDA) must receive significant human and financial resource upgrades to conduct more frequent, unannounced, and rigorous inspections to enforce Good Manufacturing Practices (GMP) across all facilities.

- Modernize Regulatory Framework: Update the existing drug regulatory framework to align with ICH (International Council for Harmonisation) guidelines and Good Regulatory Practices (GRP) to improve efficiency, transparency, and global recognition.

- Combat Counterfeits: Implement digital track-and-trace mechanisms on all drug packaging to effectively monitor the supply chain and curb the circulation of substandard and falsified medicines.

15.6. Encouraging Startups and Biotech Entrepreneurship

starting new companies or projects is important to bring energy and innovation into the pharmaceutical industry, especially in specialized, high-value fields like biotechnology.[56]

- Targeted Seed Funding: Establish a dedicated biotech and pharmaceutical startup fund (similar to the iDEA project) to provide early-stage capital (grants and seed investment) to young pharmacists and scientists for innovative projects like diagnostic kits, herbal/traditional medicine R&D, and niche bio-similars.

- Incubator and Mentorship Programs: Create pharmaceutical technology incubators within or near universities/API parks that offer shared lab facilities, legal counsel (especially for IP and patents), and mentorship from seasoned industry veterans.

- Simplify Licensing: Streamline and fast-track the licensing and registration process for pharmaceutical startups to reduce the time-to-market for innovative products.

15.7. International Collaboration and Technology Transfer

This is crucial for acquiring the advanced know-how needed for global competition.[57][7]

- Strategic Partnerships: Actively facilitate joint ventures and technology transfer agreements between leading Bangladeshi firms and international pharma leaders from advanced countries (e.g., Europe, US, Japan) for the production of high-value products like vaccines and cutting-edge biotech therapeutics.