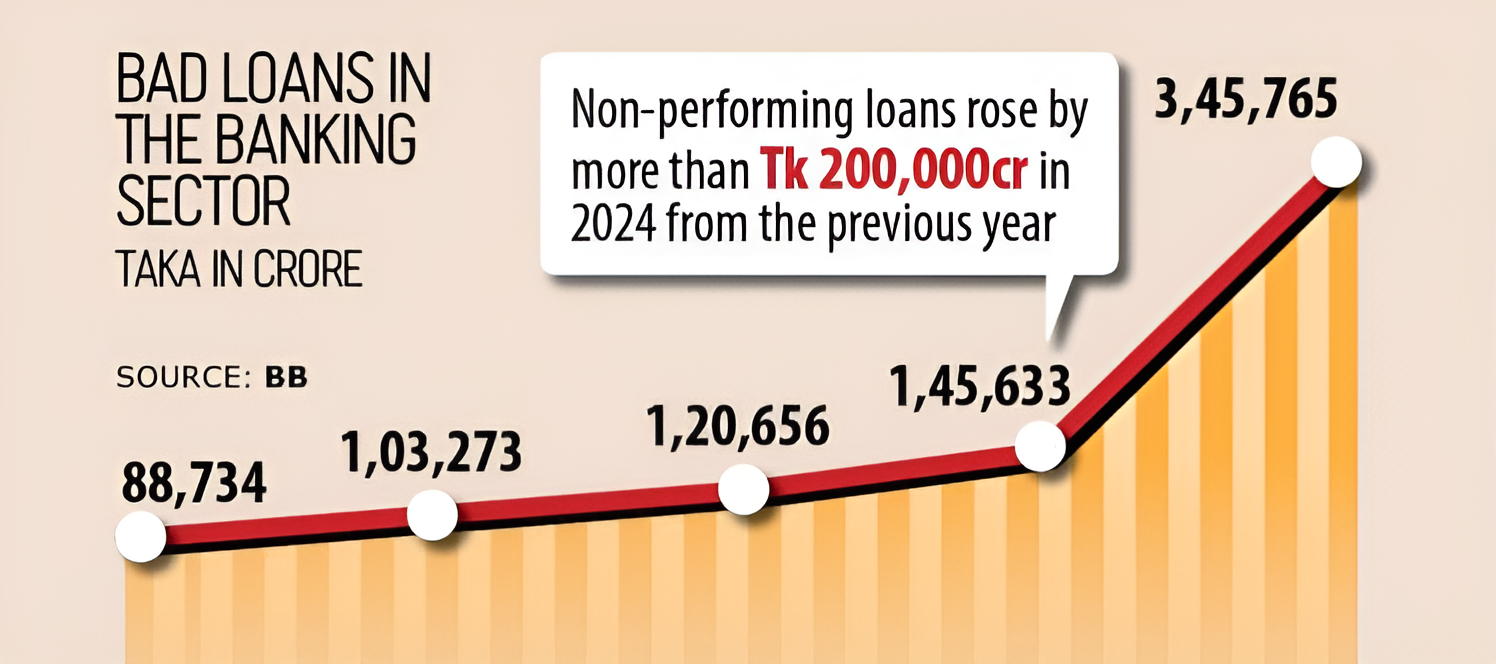

The issue of non-payment of bank loans is expanding at an alarming rate throughout Bangladesh. Non-performing loans (NPLs) during the second half of 2024 grew BDT 1.34 lac crore which led to a new total of BDT 3.45 lac crore. The amount of defaulted bank loans currently stands at 20.2% of all loans since borrowers have stopped making repayments.

NPLs have increased because of economic difficulties combined with Bangladesh Bank’s stricter rules defining loan performance. The stricter loan classification rules from Bangladesh Bank reduce repayment delay options for struggling borrowers which results in more non-performing loan designations.

Multiple experts predict that if NPL growth continues unabated banks will face obstacles when extending loans which could impact national economic conditions. Some actions by banks together with government interventions will need to be established to manage this situation for ensuring banking system stability.

Source: Business Inspection BD

Share via: