Unemployment and Inflation in Bangladesh Are More Than Just Numbers

Unemployment and inflation in Bangladesh have reached alarming levels in 2025. But behind the cold numbers and economic terms lies something more cruel and more painful. These are not just financial issues. They are about people. They are about broken routines, postponed dreams and the quiet pain of not knowing what comes next.

Every day across Bangladesh, families are making impossible choices. Do they pay the rent or buy enough rice for dinner? Should a student skip another semester because the family can’t afford tuition? Is it even worth applying for jobs when the inbox is full of unanswered applications? This is the reality of unemployment and inflation in Bangladesh. It’s a national problem, yes. But it is also a deeply personal one.

Unemployment and inflation in Bangladesh are more than just economic figures they are the silent stories that shape the lives of millions. Behind each statistic is a face, a family, a dream. It’s the quiet ache of a father watching his children grow up in a world where work is scarce. It’s the hidden despair of a mother who, despite her best efforts, can’t stretch her meager income to meet the needs of her family. It is the uncertainty that clouds the future of our young generation, leaving them questioning whether their ambitions can ever be more than a distant dream.

They are the weight of anxiety that settles in the hearts of those who wake up each day with a sense of dread, unsure of where their next meal or opportunity will come from. When inflation drives up the cost of living, when jobs become a rare commodity, it’s not just the economy that suffers it is the very fabric of hope, trust and stability that holds society together.

As the economy stumbles, so too does the belief that tomorrow can be better than today. People start to lose confidence, feeling as though no matter how hard they work, they cannot climb out of the hole they’ve been thrown into. Dreams are deferred and the future seems less like a possibility and more like a distant fantasy. It’s not just an economic crisis it is a crisis of the spirit.

But Bangladesh is a country that knows resilience. We have faced adversity before and we will face it again. In the crowded alleys of Dhaka, the distant villages of Barisal and the coastal towns of Chittagong, people continue to fight. They adapt, they persevere, they keep going not because it’s easy but because they have no choice. It’s that resilience that gives us hope and this is very spirit that will see us through even the darkest of times. The numbers may look grim. But the people are not defeated. With the right vision, rooted in exclusivity, empowerment, and sustainability the nation can write a new chapter.

The Daily Struggles of Ordinary Lives

Inflation is not just a rise in prices. It is a reduction in dignity. A reduction in possibilities. When the price of onions doubles, it means a family has to skip nutritious meals. When the price of bus fares goes up, it means a worker has to walk long distances to save money. When tuition fees rise, a child’s dream of education is quietly buried.

On the other side, unemployment feels like being locked out of life itself. For thousands of job seekers, particularly young people with degrees, rejection becomes routine. A job is more than income. It is structure. It is self-respect. And when that is taken away, it hurts in ways that no graph can show.

These two forces rising prices and disappearing jobs combine to create a daily crisis for millions of Bangladeshis. It’s not a crisis you’ll always see on television or in policy briefings. But it is unfolding in every market, every alley and every home.

The Invisible Pain of Underemployment

Unemployment might be counted. But underemployment is often hidden. This is the silent epidemic. A university graduate is selling snacks at a roadside stall. A trained mechanic is pushing a cart instead of using his tools. A young woman with strong computer skills is doing unpaid household work. These people are technically not unemployed. But they are not truly employed either.

Underemployment not only wastes talent but also leads to economic inefficiency. When people cannot contribute fully to the economy, the economy cannot grow to its full potential. And when millions are stuck in jobs that do not match their skills, both morale and productivity suffer. This quiet form of economic suffering needs more attention. Because behind every underemployed person is a story of frustration, wasted effort, and shrinking hope.

Inflation and the Shrinking Power of Money

Inflation is often called a silent thief. And rightly so. It does not steal loudly. But it steals consistently. Every month, a few more taka disappear from what families can afford. Consider the basics. The price of lentils, rice, eggs, cooking oil, and vegetables has risen sharply. Even a basic household now struggles to afford nutritious meals. Add rent, transport, education, and health costs and you can see how a family that once felt middle class is now barely surviving.

What makes inflation harder is that wages do not keep up. Even for the employed, every salary increment is wiped out by rising costs. What looked like progress a year ago feels like standing still or even slipping backward. This erosion of purchasing power is especially harsh on the elderly, single parents, and informal workers. They don’t have financial buffers. For them, inflation means choosing between medicine and food, or school fees and utility bills.

The Vicious Cycle of Economic Instability

Unemployment and inflation in Bangladesh are not isolated. They feed into each other, creating a vicious cycle. When inflation rises, the central bank often increases interest rates to control it. But that makes loans more expensive for businesses. Higher business costs mean fewer expansions and fewer hires. That results in fewer jobs.

When fewer people have jobs, demand for goods and services falls. But producers, already facing high input costs, do not lower prices. Instead, they reduce quality or production — slowing the economy further. This push-and-pull dynamic leaves ordinary people stuck in the middle, absorbing the blows while policymakers juggle numbers.

Mental Health and Social Strain

It’s time we talk about the emotional side of this crisis. Joblessness is not just an economic problem. It is a mental health problem. Being unemployed for months or years can lead to anxiety, depression, and a sense of personal failure. For young people, the constant rejection can break self-confidence. For parents, not being able to provide leads to deep guilt and frustration.

For the elderly, watching younger generations struggle brings sadness and helplessness. Communities feel this too. When more people are out of work, social tension rises. Family disputes increase. Crime rates can go up. Drug and alcohol abuse may spread. The impact of unemployment and inflation in Bangladesh is not just financial. It is emotional. And it is tearing at the fabric of society.

How Businesses Are Coping and Struggling

From small shops to large factories, every business in Bangladesh is feeling the heat. For small businesses, rising supplier prices mean smaller profit margins. Many are closing down or cutting staff. Manufacturers are also suffering. Import costs are up due to currency devaluation.

Fuel prices have jumped. Utility bills are higher. All of this squeezes their ability to retain or hire new workers. Startups and tech firms that once promised innovation are now facing investor hesitation. When inflation is high, and job markets are unstable, funding dries up. The dreams of digital Bangladesh stall. The private sector cannot thrive without stability. And right now, stability feels distant.

Read More: Teesta Mega Project: A Economical Impact Analysis

Economic Impact of Unemployment and Inflation in Bangladesh

| Category | Impact Description |

|---|---|

| Consumer Spending | Inflation reduces purchasing power, leading to lower demand for goods and services, which slows economic growth and affects small and large businesses alike. |

| Business Investment | Rising costs and market uncertainty discourage local and foreign investment, delaying job creation and expansion. |

| Government Budget Strain | Increased demand for subsidies and aid programs while tax revenues decline, leading to budget deficits and reduced infrastructure development. |

| Job Market Instability | Employers reduce hiring due to high costs, while skilled workers accept underpaid or irrelevant jobs, decreasing productivity. |

| Migration and Brain Drain | Skilled professionals emigrate due to lack of opportunity and instability, weakening national capacity and innovation. |

| Income Inequality | The poor are hit hardest by inflation and joblessness, widening the wealth gap and increasing social tension. |

| Agricultural Challenges | Rising input costs reduce farming profitability, threatening food security and increasing rural poverty. |

| Education Disruption | Families struggling with inflation often pull children out of school, limiting future workforce quality and national progress. |

| Social Stability | Unemployment and financial pressure increase mental health issues, family stress, and crime, weakening community resilience. |

| Development Goals at Risk | Inflation and joblessness delay progress toward SDGs and middle-income status, threatening long-term economic vision. |

Turning Pain into Purpose through Smart Policy

If there is one takeaway from the growing economic impact of unemployment and inflation in Bangladesh, it is this the cost of inaction is far higher than the cost of reform.

By implementing policies that directly support vulnerable communities, empower entrepreneurs, and keep inflation in check, Bangladesh can stabilize and even grow through this crisis.

-

Expand investment in green jobs and digital jobs

-

Make vocational training and microcredit widely accessible

-

Prioritize domestic industry protection in trade policies

-

Improve food and energy security through local innovation

-

Establish inflation-adjusted wages and subsidies

The Impact on National Growth

The economic toll of unemployment and inflation in Bangladesh is massive.

-

Lower Consumer Spending

When people cut back on expenses, businesses suffer. That slows down sales and leads to more layoffs. -

Reduced Investment

Both local and foreign investors are hesitant in uncertain times. That delays projects, limits job creation, and blocks innovation. -

Declining Productivity

Underemployed and demotivated workers produce less. Skills are wasted. Economic momentum slows. -

Rising Debt

Families and businesses are borrowing more to survive. But this leads to a growing burden of debt and more risk in the long term.

The Need for a New Economic Model

Clearly, the current economic model is under pressure. To move forward, we need to rethink how we measure success. It is not just about GDP growth or export numbers. It is about how many people are employed, how fairly income is distributed, and how resilient our communities are. This is where Muhammad Yunus’s Three Zero Theory becomes specially relevant.

Applying Yunus Three Zero Theory to Bangladesh

- Zero Poverty

Social businesses can help families build income sustainably. These are not charities. They are businesses that reinvest profits to grow impact rather than enrich owners. With microcredit and mentorship, people can create jobs for themselves and others.

- Zero Unemployment

Youth entrepreneurship must be encouraged, not feared. Instead of waiting for government jobs, young people can be trained and financed to create their own paths. Innovation hubs, business incubators, and startup funds should be available across districts, not just in Dhaka.

- Zero Net Carbon Emissions

A greener economy can create jobs in agriculture, energy, transport, and construction. Solar technicians, waste managers, eco-tourism operators these are the jobs of the future. And they’re jobs Bangladesh can lead in if supported. This vision gives us a way forward. It is not easy. But it is possible.

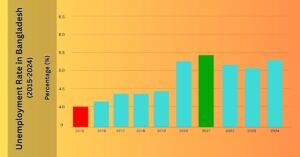

According to estimates closely aligned with data from the World Bank and the Bangladesh Bureau of Statistics, Bangladesh’s unemployment rate has experienced modest fluctuations over the past decade. From 2015 to 2019, the rate remained relatively stable, hovering around 4.0% to 4.3%, reflecting a steady, if limited, labor market.

However, in 2020 the COVID-19 pandemic caused a sharp rise in unemployment, peaking at approximately 5.3% as businesses closed and economic activity slowed significantly. In the following years, the rate slightly increased to 5.4% in 2021 before beginning a gradual decline, reaching about 4.9% by 2024.

While this downward trend signals some recovery the unemployment rate has not yet returned to its pre-pandemic levels. The data underscores a persistent challenge: despite resilience, the job market has yet to fully absorb the growing labor force, specially among youth and informal sector workers.

Sources:

-

-

World Bank, Unemployment, total (% of total labor force)-https://data.worldbank.org/indicator/SL.UEM.TOTL.ZS?locations=BD

-

Bangladesh Bureau of Statistics (BBS) – http://www.bbs.gov.bd

-

- International Labour Organization (ILO), ILOSTAT Database – https://ilostat.ilo.org

What Needs to Change Immediately

To truly address unemployment and inflation in Bangladesh there are some urgent steps are needed:

-

Wage and income adjustment for both public and private sectors so they keep pace with inflation

-

Expansion of vocational and digital training to prepare youth for new industries

-

Support for SMEs and entrepreneurs through tax breaks, low-interest loans, and infrastructure

-

Price monitoring and anti-hoarding measures to keep essentials affordable

-

Decentralized job creation beyond major cities to reduce pressure on urban centers

These are not luxuries. They are survival strategies.

The Hope That Still Exists

Despite everything, there is resilience. People are still working. Still creating. Still hoping. Farmers are turning to rooftop gardening. Students are freelancing online. Mothers are starting home-based businesses.

There is ingenuity everywhere in Bangladesh. What people need is not more struggle, but more support. The private sector, civil society, and policymakers must come together not just to stabilize the economy but to rebuild it with compassion. Not just with policies, but with purpose.

Conclusion A Story Still Being Written

Unemployment and inflation in Bangladesh are shaping the future of the country in ways that go beyond economics. They are touching every home, every table, and every heart. But Bangladesh has faced hardship before. And it has always found strength not in fear, but in resilience. Not in silence, but in community.

This is not about returning to the past, where life might have seemed simpler or more predictable. It’s about rising up to create a future that is more just, more equitable, and more compassionate. A Bangladesh where no one has to choose between their dignity and their survival. Where hard work leads to opportunity, not desperation. Where the dreams of our youth are not suffocated by the weight of an unforgiving economy.

It’s a vision not of perfection, but of possibility. And it’s a vision we can realize if we begin today, with empathy, with understanding, and with an unwavering commitment to ensure that no one is left behind. This crisis is an invitation an invitation to transform, to rise, and to build a Bangladesh where every person, regardless of their background or circumstances, has the opportunity to thrive. Let us not just manage this crisis. Let this be our wake up call. The time to act is now. The promise of a better tomorrow begins with the choices we make today.

References:

- Bangladesh Bank (BB). Monetary Policy and Economic Reports.https://www.bb.org.bd

- Planning Commission of Bangladesh. National Development and Five-Year Plans.http://www.plancomm.gov.bd

- Centre for Policy Dialogue (CPD). Research and Policy Advocacy on Employment and Inequality.https://cpd.org.bd

- Muhammad Yunus- Three Zeros Vision and Social Business Models.https://muhammadyunus.org

- UNDP Bangladesh. Sustainable Development Goals and Human Development. Reports.https://www.undp.org/bangladesh

- International Monetary Fund (IMF). Bangladesh Country Reports and Inflation Outlooks. https://www.imf.org

Share via: