The government is planning to increase the minimum tax rate for companies and individuals in the upcoming national budget. According to officials, this move may significantly increase the tax burden on both local and foreign businesses.

Minimum Tax Rate May Be Doubled for Companies

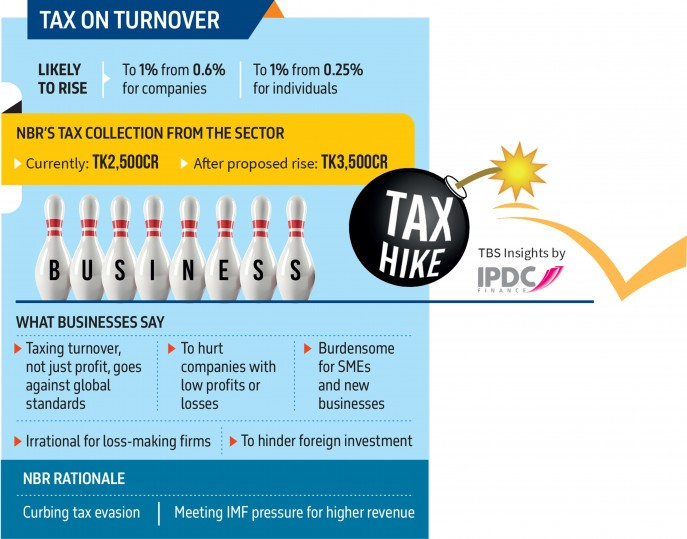

The interim government is preparing to raise the minimum tax on company turnover from the current 0.6% to 1%, despite heavy criticism from both local and foreign investors. Additionally, individual taxpayers may also face a fourfold increase in their minimum tax rate.

Why This Step?

Officials from the National Board of Revenue (NBR) said that the decision is influenced by two key reasons:

-

The government’s revenue collection authority is not strong enough to stop tax evasion.

-

The International Monetary Fund (IMF) is pressuring Bangladesh to increase revenue.

An NBR senior official, who preferred to stay anonymous, confirmed this information. He told The Business Standard (TBS):

“There is pressure from the IMF to boost revenue collection. Many companies are accused of hiding their actual profits and transactions. That’s why we’re considering increasing the minimum tax.”

Turnover Tax for Individuals May Also Rise

The official also said that the turnover tax for individual taxpayers may also increase from the current 0.25% to 1%. A final decision could be made in a meeting with the finance advisor this week.

One Possible Relief:

The official added that currently there is no rule for adjusting or carrying forward the minimum tax in the next year. But in the upcoming budget, there might be a proposal to allow taxpayers to carry forward this tax in the following years for adjustment.

How Much Extra Revenue Might Be Collected?

Currently, the government earns around Tk 2,500 crore in revenue from minimum taxes on companies and individual turnover. If the proposed rate increases are implemented, NBR expects to collect an additional Tk 3,500 crore.

Read More: NBR Divided Overnight, Official Order Announced

Criticism from Businesses and Economists

Many businesses and financial analysts strongly oppose the government’s plan. They argue that:

-

Minimum tax forces even low-profit or loss-making companies to pay taxes.

-

This unfairly punishes honest and compliant taxpayers.

The Foreign Investors’ Chamber of Commerce and Industry (FICCI) has long opposed this tax. They say that it increases the actual tax burden for compliant companies.

FICCI president Mohammad Javed Akhter said:

“We had expected NBR to gradually remove this tax. Instead, they are planning to increase it, which is unexpected and wrong.”

He added that this decision would increase the pressure on compliant businesses, especially small and medium-sized enterprises (SMEs) and new businesses.

Aminur Rahman, former NBR member (Income Tax Policy) and a current member of the Revenue Reform Committee, told:

“The basic rule of taxation is that those who earn income should pay tax. But forcing all businesses to pay a fixed minimum tax—regardless of profit—is against that principle and also goes against international standards.”

He further added that the Revenue Reform Committee is planning to recommend removing the minimum tax system altogether. Increasing the rate, instead of abolishing it, raises serious questions.

Rupali Chowdhury, Managing Director of Berger Paints Bangladesh and former FICCI president, said:

“In Bangladesh, it usually takes at least five years for a new company to break even. Forcing them to pay minimum tax during that time is not fair.”

Low Compliance in Tax Return Filing

According to NBR data, in the fiscal year 2023–24, out of 288,000 registered companies and organizations, only 24,381 submitted tax returns.

Currently, five categories of individuals and companies pay a minimum tax ranging from 0.25% to 5%:

-

Carbonated beverage companies: 5%

-

Tobacco companies: 3%

-

Mobile phone operators: 2%

-

Individual taxpayers with over Tk 3 crore annual turnover: 0.25%

-

Other companies: 0.6%

-

Exporters: 1%

Out of the companies that submitted tax returns, only about 200 are outside the 0.6% minimum tax group. The remaining 24,000 companies are under the 0.6% rule. However, only around 8,000 of them actually pay the tax, which means the burden will fall mainly on these compliant companies if the rate increases.

Tax Experts Also Concerned

Snehasish Barua, a partner at chartered accounting firm Snehasish Mahmud & Co., said:

“Increasing the minimum tax based on gross receipts will create extra pressure on honest taxpayers who declare their real turnover in audited financial statements. This will also increase their production costs, as suppliers will count this tax as part of their cost.”

An Example of the Burden

Let’s say a company has an annual turnover of Tk 100 crore. At the current 0.6% rate, it pays Tk 66 lakh as minimum tax. But if its profit is low, its actual tax liability at the 27.5% rate might only be Tk 50 lakh. That means it pays Tk 16 lakh more than it should.

Now, if the minimum tax rate is increased to 1%, the company will pay Tk 1 crore in tax—double its actual liability based on profit. This means the real tax burden becomes 55%, not 27.5%. And if the company makes a loss, the entire tax comes from its capital.

SK Jami Chowdhury, managing partner at Chowdhury Emdad & Co., said:

“We audit around 150 companies each year. At least 100 of them pay minimum tax. Around 15% of those are actually loss-making but still have to pay the tax.”

He warned:

“If the proposed increase is implemented, the pressure on these companies will only grow.”

NBR’s Justification

Why is NBR still going forward with this move? An NBR official explained:

“Many companies do not show profits to avoid taxes. If we don’t collect a minimum tax, the government won’t receive any revenue.”

But former NBR member Aminur Rahman disagreed. He said:

“It’s not fair to penalize honest companies to make up for those who cheat. Cutting off the head is not a cure for a headache.”

Source: TBS

Share via: