Discover how every 100 Taka contributes to Bangladesh’s national budget, funding salaries, development, subsidies, debt servicing, and essential public services.

Have you ever stopped to wonder how every 100 Taka you pay in taxes actually contributes to running the country? Understanding how the government allocates this money helps us appreciate the bigger picture behind public services and national development.

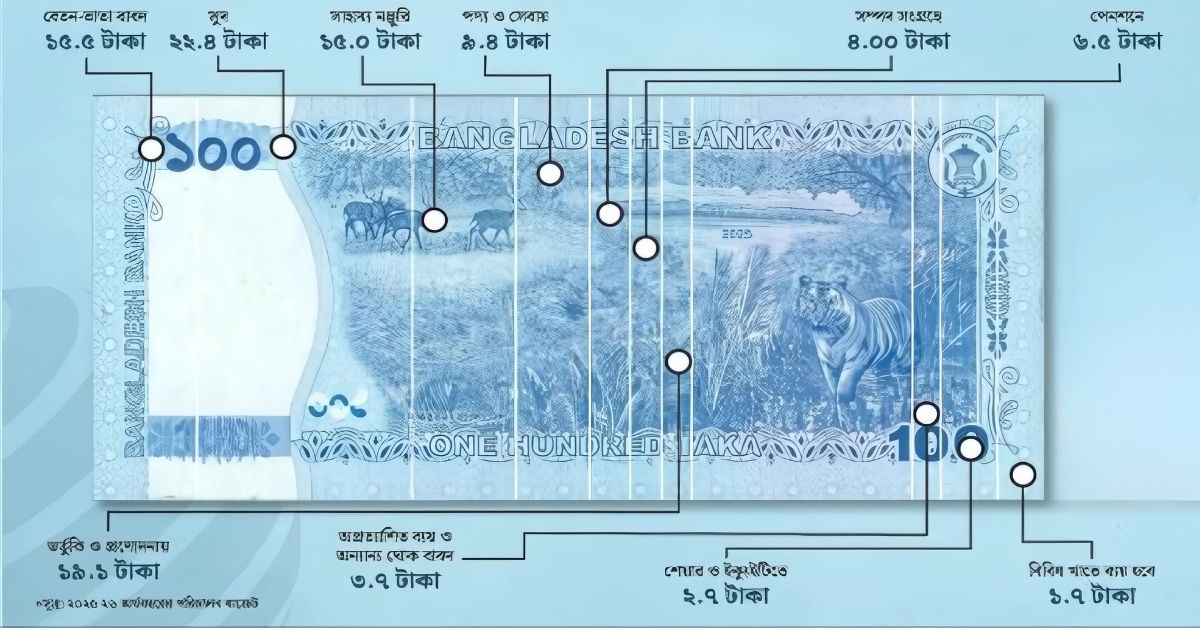

An insightful infographic from Dhaka Post for the 2023-24 fiscal year reveals exactly how each 100 Taka of government revenue is spent. This breakdown offers a clear view of where your money goes and how it supports various vital sectors.

What Does Every 100 Taka Contributes To?

When you pay 100 Taka as tax, it doesn’t just disappear it’s divided carefully among many essential government functions. These funds keep Bangladesh’s economy moving, provide services to citizens, and invest in the future of the nation.

Here’s a friendly explanation of how your 100 Taka contributes:

1. Salaries and Allowances – ৳18.0

The largest share of your tax money goes towards paying the salaries and allowances of government employees. These are the people who work every day to run administrative offices, schools, hospitals, and other public services that affect your life directly.

2. Debt Servicing – ৳24.0

A significant portion is used to pay interest on the country’s debts, both domestic and foreign. This spending is crucial to maintain Bangladesh’s financial stability and creditworthiness.

Read More: Dhaka-Tangail Highway Fire Erupts on Moving Truck, Triggers Massive Traffic Jam

3. Subsidies and Incentives – ৳17.0

Your 100 Taka contributes to subsidies that support agriculture, energy, and essential commodities. These subsidies keep prices stable and help farmers and producers continue their work, which in turn benefits all of us.

4. Development Projects – ৳22.9

Nearly a quarter of the budget is invested in development projects such as building roads, schools, and hospitals. This is the backbone of Bangladesh’s long-term growth and improved quality of life.

5. Purchase of Goods and Services – ৳2.4

Funds are used to buy office supplies, vehicles, and other necessary goods and services required for government operations.

6. Pensions – ৳5.5

Your tax money helps provide pensions to retired government employees, ensuring they live with dignity after years of service.

7. Grants and Aid – ৳1.1

Some of the money is allocated for donations, grants, and aid programs that support local governments, organizations, and disaster relief efforts.

8. Unexpected Expenses – ৳3.7

Governments must be prepared for emergencies like natural disasters or pandemics. This portion of your tax is set aside to handle unforeseen costs efficiently.

9. Investment in Shares and Equities – ৳2.7

A small but important fraction of your 100 Taka is invested in shares and equities, aiming to grow the country’s economic assets over time.

10. Other Miscellaneous Expenses – ৳1.7

This includes various smaller expenditures necessary for running the state smoothly but not covered in the larger categories.