Introduction

Iran-Israel War is the most phenomenon topic Now. When war breaks out, it is never just about missiles and borders. It is about mothers clutching their children in darkened rooms, young people wondering if they will see another morning, and families across distant continents staring at screens filled with fear.

The Iran-Israel War has shaken more than just the political map of the Middle East. It has shaken the confidence of a world already living on edge.

Even if you are thousands of miles away from the conflict, you have likely felt it. Maybe it is the rising price of fuel or the sudden dip in your retirement portfolio. Maybe it is just the growing anxiety every time you scroll through headlines. Global markets do not exist in isolation.

They reflect our collective moods, our hopes, and our fears. And right now, they are in flux. The war is still unfolding, missiles may still fly and speeches may still ignite tempers, but already the world is grappling with a far-reaching question — what are the aftermath and economic effects of this conflict, especially on the fragile architecture of the global stock markets?

Markets are not just reacting to what happened. They are trying to make sense of what could happen next. Defense stocks have surged. Oil and energy are once again at the center of every discussion. Tech and travel are reeling. Currencies are jittery. In places like Bangladesh, India, Turkey, or even parts of Europe, the tremors are being felt in unexpected ways.

But this is not just about numbers. It is about people. Investors are not just looking at spreadsheets. They are looking at their future. Parents wondering if they can still afford their child’s education. Retirees worrying if their savings will hold up. First-time investors wondering if they should run or stay the course.

We will walk through the strategic responses of global markets following the Iran-Israel War. We will break down how different sectors have behaved, how regional economies are coping, and what this means for investment planning going forward. More importantly, we will offer a grounded approach to navigating these uncertain times with both caution and courage.

Global Economic Shockwaves from the Iran-Israel War

The Iran-Israel war has not remained confined to the borders of the Middle East. Its impact has unleashed a wave of economic shockwaves felt across continents, disrupting supply chains, energy markets, currency stability, and investor sentiment worldwide. Here’s how the global economy is being shaken by the conflict:

1. Energy Market Disruption

The most immediate and severe shock has come from the global oil market. Iran, as a major OPEC member and gatekeeper of the Strait of Hormuz a vital passage for one-fifth of the world’s oil supply has the power to influence global energy stability. The war has led to:

-

Spike in Oil Prices: Brent crude soared past $100 per barrel as fears of supply disruption intensified.

-

Uncertainty in Gas Supply: Natural gas prices in Europe surged due to concerns over security in the Gulf and supply chain rerouting.

These price shocks have pushed inflation upward in both oil-importing and oil-exporting nations, complicating monetary policy efforts.

2. Inflationary Pressure Across Economies

The war has reignited global inflation just as many economies were recovering from the post-COVID spike. Transport costs have risen, insurance premiums on shipping have increased, and raw material costs are climbing. Countries dependent on oil and imported goods such as Bangladesh, India, Germany, and Japan are particularly vulnerable. Central banks are being forced to:

-

Reconsider interest rate cuts originally planned for economic stimulation.

-

Shift towards defensive monetary strategies to curb second-round effects on food, transportation, and consumer goods.

3. Supply Chain Vulnerabilities

Global supply chains, already weakened by COVID-19 and the Russia-Ukraine war, are once again under pressure. Key shipping routes around the Persian Gulf are being avoided or rerouted due to military threats. This has led to:

-

Delays in shipment of goods ranging from electronics to essential commodities.

-

Higher logistics costs, which are being passed on to consumers.

Countries that depend on Middle Eastern transit for exports or imports are seeing disruptions that ripple into domestic production and retail.

4. Currency Volatility and Capital Flight

Emerging markets are facing sharp currency depreciations due to capital outflows. Investors are pulling funds from riskier regions and reinvesting in perceived safe havens like the U.S. dollar, Swiss franc, or gold. This has caused:

-

Currency depreciation in countries like Turkey, Egypt, Pakistan, and South Africa.

-

Sudden capital flight, raising borrowing costs for governments and businesses in developing economies.

In contrast, safe-haven assets are experiencing a bullish run as global investors flee volatility.

5. Stock Market Turmoil

Stock indices across the world are reacting to war headlines in real time. Global benchmarks like the S&P 500, FTSE, and Nikkei have experienced wild fluctuations. The tech and travel sectors are among the hardest hit, while defense and energy stocks have surged.

-

Tech stocks declined amid fears of cyberattacks and global digital instability.

-

Defense stocks soared, especially in the U.S., Israel, and Europe.

-

Energy companies gained, capitalizing on rising oil and gas prices.

The volatility has created both fear and opportunity for investors triggering sharp rebalancing of portfolios.

6. Gold and Crypto as Alternative Havens

During war and uncertainty, alternative assets often gain investor attention. This time is no different:

-

Gold hit record highs, as investors sought refuge from market chaos.

-

Bitcoin and Ethereum witnessed sharp movements initial dips followed by surges as they were treated both as risky bets and stores of value depending on the investor profile.

While not traditionally stable, cryptocurrencies are increasingly playing a role in wartime financial behavior, particularly among younger investors.

7. Global Trade Slowdown

The World Trade Organization (WTO) and International Monetary Fund (IMF) have already downgraded global growth forecasts in response to the conflict. The war is expected to:

-

Reduce global trade volume, especially in regions with exposure to the Middle East.

-

Lower GDP growth projections, especially for oil-dependent, manufacturing-heavy, and politically vulnerable economies.

Trade-dependent regions like Southeast Asia, the Eurozone, and East Africa are already seeing weakening demand, investment reluctance, and reduced export orders.

The Iran-Israel war has become a new epicenter of global economic instability, pushing the world closer to a systemic shock. These ripple effects are not temporary, they mark the beginning of a long recalibration of economic priorities, investment patterns, and international financial relationships.

Sector-Wise Market Response and Volatility

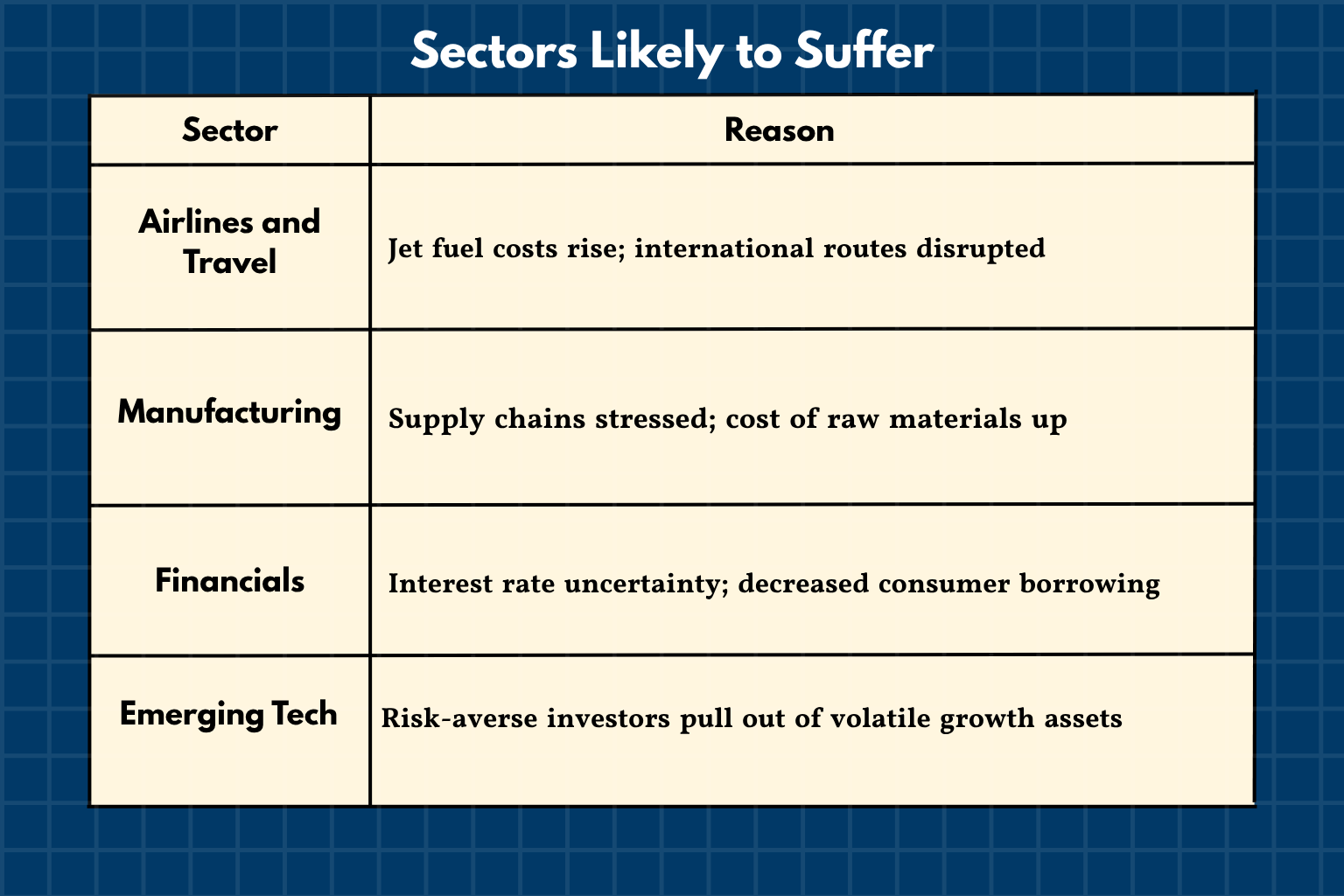

- Sectors Likely to Suffer: War-Induced Downturns

As the Iran-Israel war escalates, several global industries are under increasing strain. The conflict has disrupted core economic fundamentals like fueling inflation, choking supply chains, and triggering investor risk aversion. The sectors most likely to suffer are:

1. Airlines and Travel

-

Why They’re Suffering: Jet fuel prices have surged due to oil market instability, and many international routes passing through or near the Middle East are either canceled or rerouted.

-

Impact: Airlines face rising operational costs, declining bookings, and growing safety concerns—especially for carriers operating in or over conflict zones.

2. Manufacturing

-

Why They’re Suffering: Global supply chains are being stressed again, much like during the pandemic, but this time with added geopolitical risks. Key raw materials are becoming more expensive and harder to transport.

-

Impact: Delays in production, rising input costs, and falling output are hurting manufacturers, especially in automotive, electronics, and heavy machinery.

3. Financials

-

Why They’re Suffering: War always brings monetary policy uncertainty. With inflation rising and central banks unsure whether to tighten or loosen policy, interest rates become unpredictable.

-

Impact: Consumers borrow less, investors retreat, and banks face pressure from both asset quality and market volatility. Financial stocks have seen sharp corrections.

4. Emerging Tech

-

Why They’re Suffering: Risk-averse investors are fleeing from volatile, unproven growth sectors are many of which are not yet profitable and rely on a favorable funding environment.

-

Impact: Sectors like electric vehicles, AI startups, and blockchain technology firms are losing capital support, leading to lower valuations and delayed innovation pipelines.

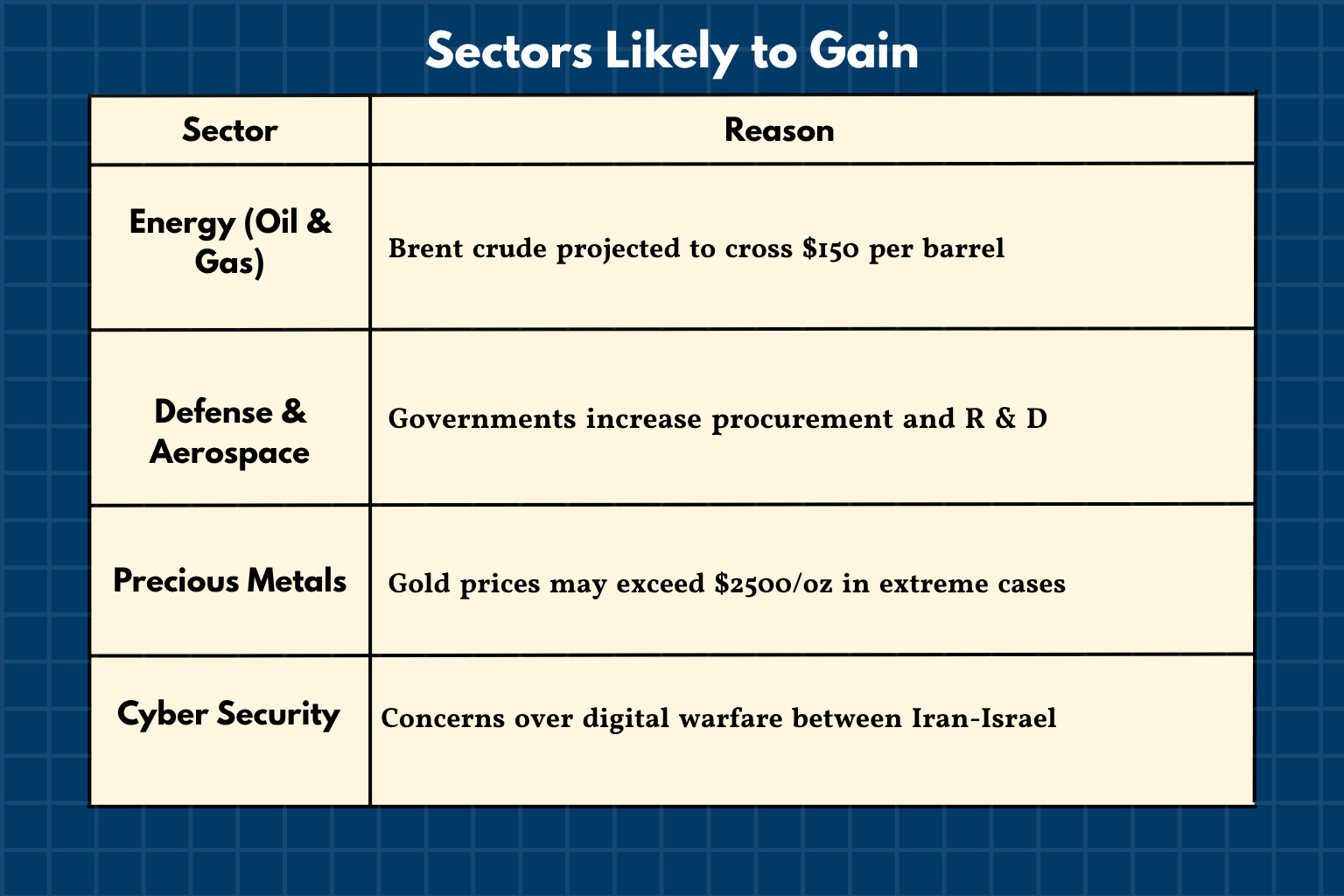

- Sectors Likely to Gain: War-Driven Opportunities

While many sectors are reeling from the Iran-Israel conflict, others are experiencing renewed interest and upward momentum. These sectors benefit directly from war-related shifts in global demand, pricing, and national security priorities. The following are the most prominent sectors expected to outperform during the crisis:

1. Energy (Oil & Gas)

-

Why They’re Gaining: Brent crude prices are projected to surpass $150 per barrel due to fears of supply disruption in the Gulf. As Iran controls key chokepoints like the Strait of Hormuz, any escalation triggers a premium on every barrel.

-

Impact: Major oil companies are reaping windfalls. Oil-exporting countries are experiencing capital inflows, and energy ETFs are outperforming broader indices. This boom, however, comes with heightened volatility and geopolitical risk.

2. Defense & Aerospace

-

Why They’re Gaining: Government defense budgets are expanding rapidly as nations prepare for wider military engagement. Procurement of drones, missile defense systems, surveillance equipment, and fighter jets has increased.

-

Impact: Contractors and aerospace firms tied to the U.S., NATO, and Israeli defense programs such as Lockheed Martin, Northrop Grumman, and Elbit Systems—are enjoying surging order volumes and stock price appreciation.

3. Precious Metals

-

Why They’re Gaining: Gold, the ultimate safe haven, is regaining its appeal. With fears of prolonged conflict and currency instability, investors are retreating from equities and parking money in tangible stores of value.

-

Impact: Gold prices may break records and could exceed $2,500/oz in extreme scenarios. Silver and platinum are also benefiting from the broader precious metals rally, especially among retail investors and sovereign wealth funds.

4. Cybersecurity

-

Why They’re Gaining: With digital warfare already suspected between Iranian and Israeli actors, fears of state-sponsored cyberattacks are rising. This includes risks to government systems, financial infrastructure, and utilities.

-

Impact: Firms providing cyber defense solutions like Palo Alto Networks, Fortinet, and CrowdStrike are seeing increased demand from both public and private clients. Long-term growth prospects for the sector remain strong as cyber threats become central to national security.

Read More: Roscosmos Set to Launch Innovative Starlink Alternative This Year, Says Roscosmos Chief

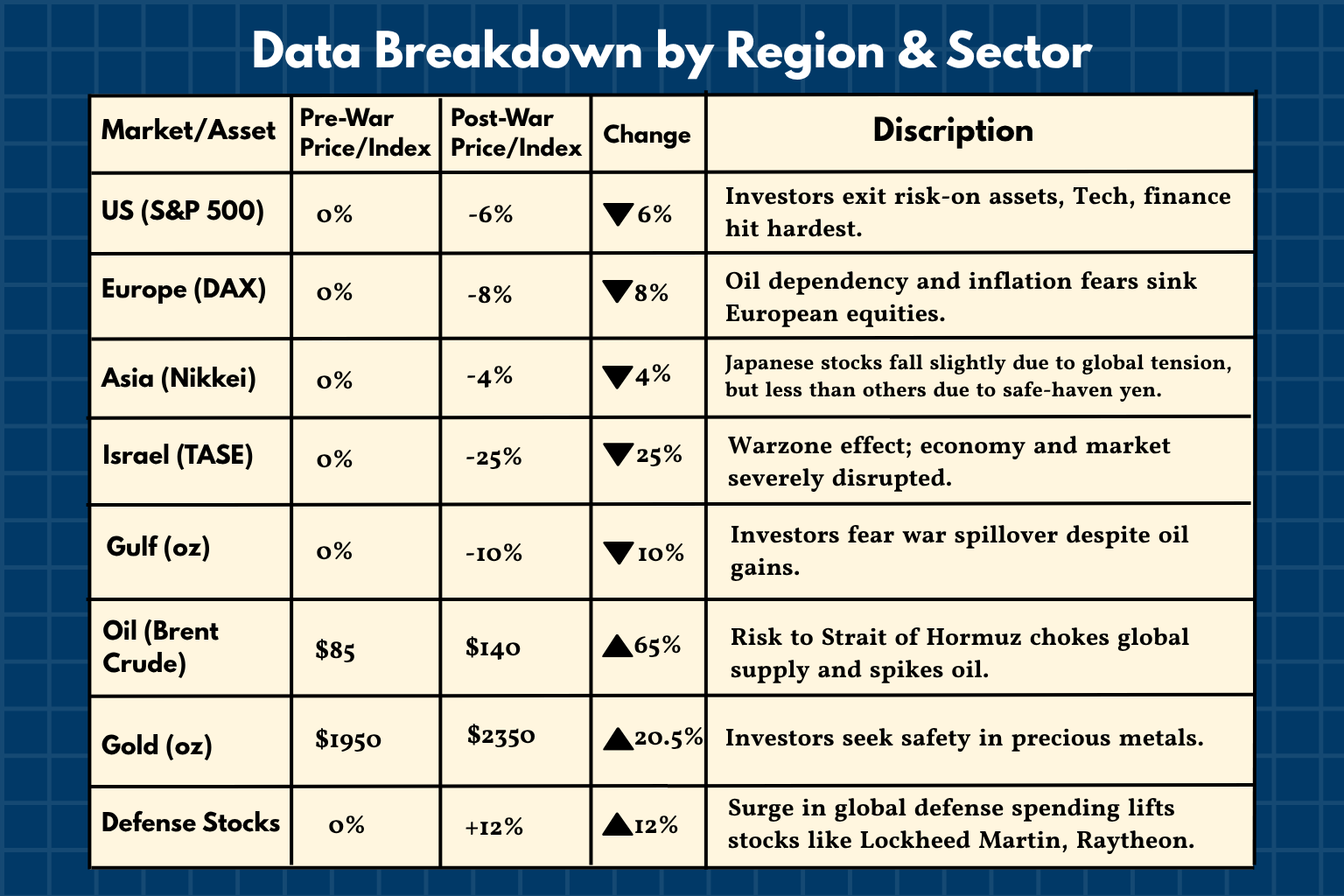

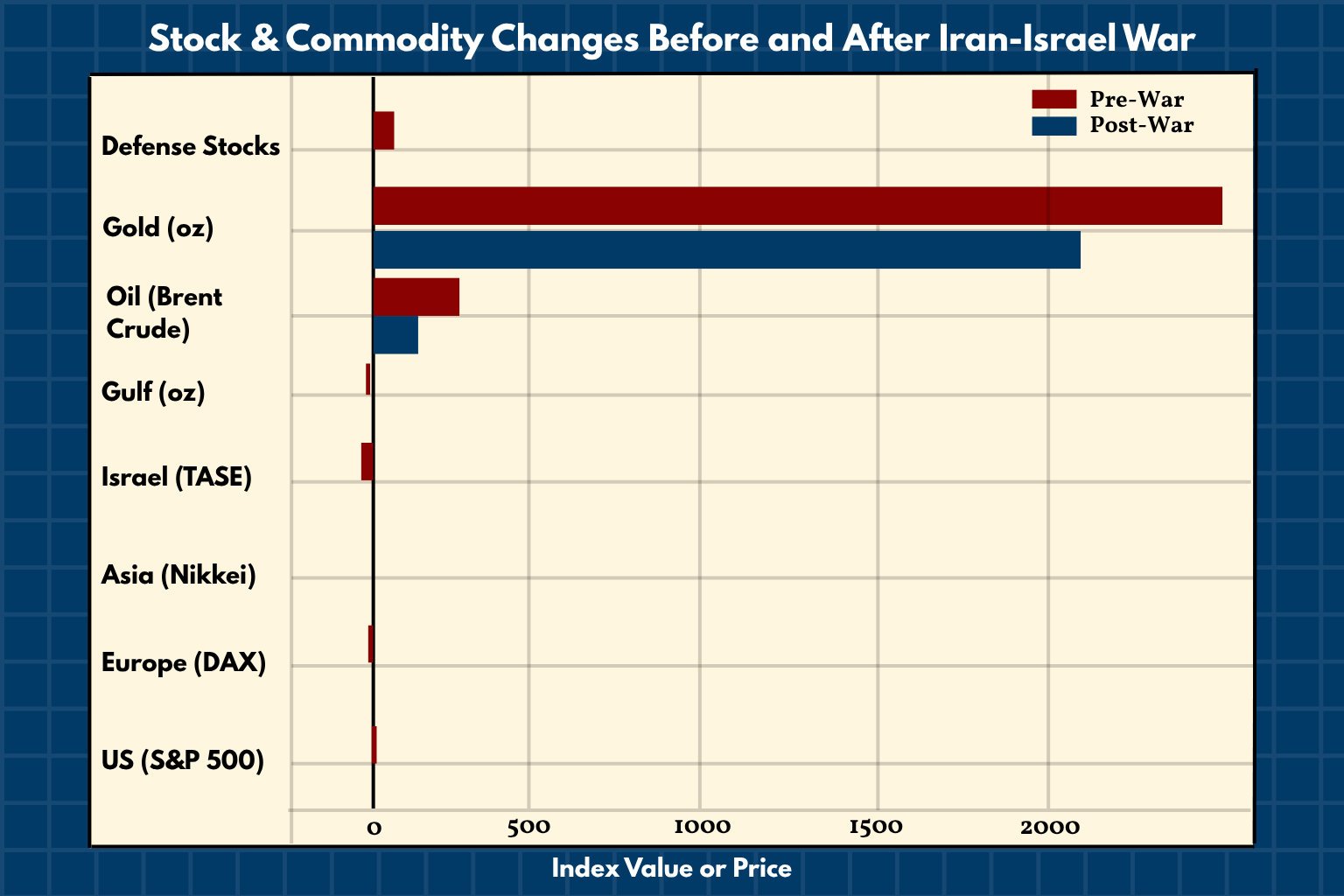

Regional and Asset Performance: War’s Direct Market Impact

The Iran-Israel war has led to swift and dramatic shifts across global financial markets. From Wall Street to the Tel Aviv Stock Exchange, investors are rapidly repositioning their portfolios in response to geopolitical risks, inflation fears, and commodity spikes. The table below reveals how different regions and asset classes have fared since the war erupted:

Key Takeaways

-

Risk-off behavior dominates, especially in Western and Middle Eastern equities.

-

Commodities are absorbing capital as inflation and supply fears escalate.

-

Defense and gold are outperforming, offering a hedge against geopolitical volatility.

-

Oil is the most volatile asset, with massive gains that could ripple across every economic layer, from transportation to food prices.

It’s a stark reminder that in times of war, markets don’t just reflect value they reflect fear, strategy, and survival instincts.

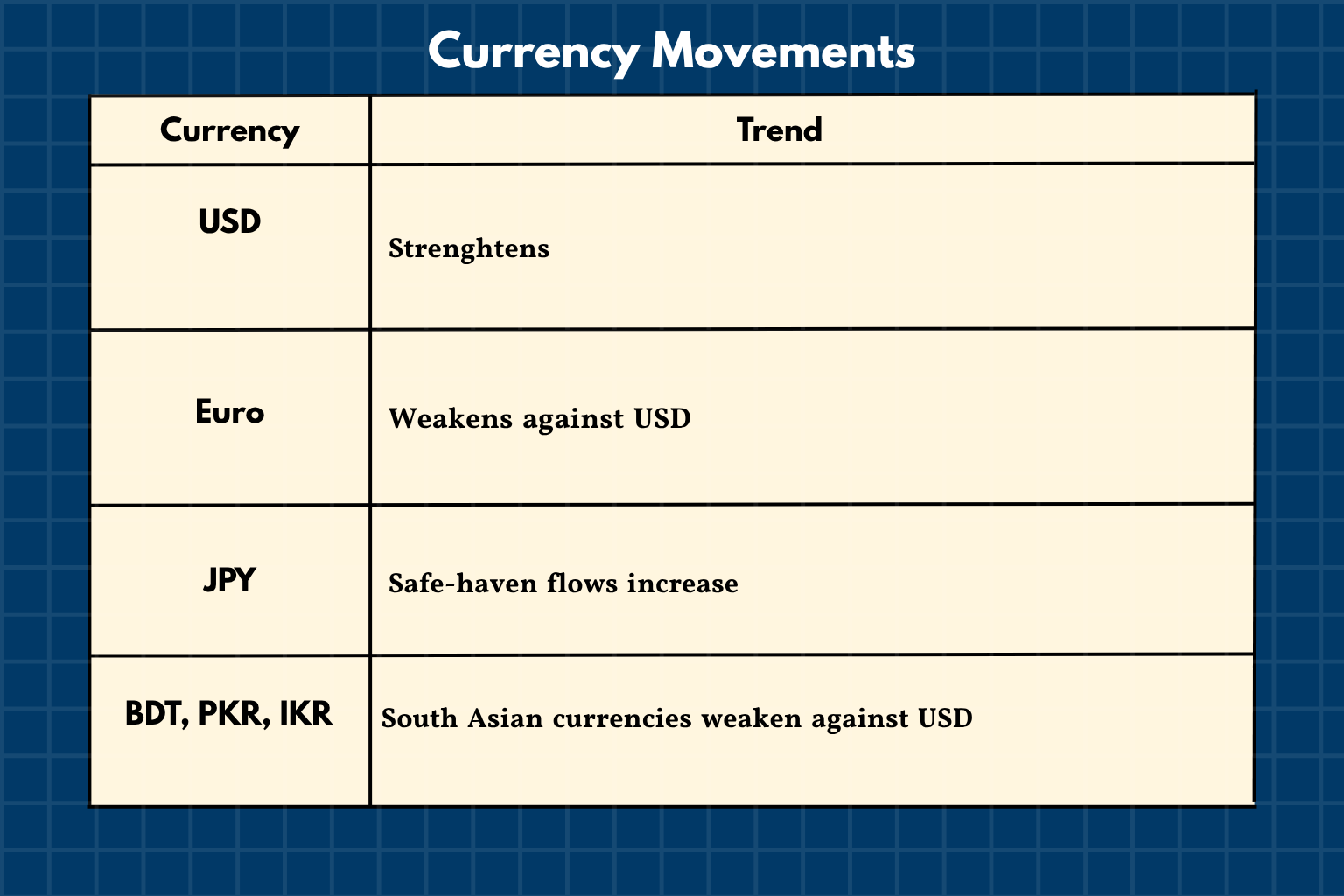

Currency Movements: Flight to Safety and Regional Shocks

In any major geopolitical crisis, currencies don’t just reflect economics, they reflect fear, power, and global confidence. The Iran-Israel war is no exception. Currency markets have responded swiftly, showing a classic “risk-off” pattern: investors are fleeing from unstable regions and shifting their capital to safe havens.

US Dollar (USD): The Default Refuge

-

Movement: Strengthened significantly against most global currencies.

-

Reason: The USD remains the world’s go-to safe haven in times of crisis. As global investors exit equities and emerging markets, they park capital in dollar-denominated assets like U.S. Treasuries and money markets.

-

Impact: Dollar strength is pressuring weaker currencies and increasing the debt burden of countries with dollar-denominated loans.

Euro (EUR): Struggling Under Energy Stress

-

Movement: Mild depreciation against the USD.

-

Reason: Europe’s dependence on imported energy from the Middle East makes the euro vulnerable. Higher oil prices mean higher import bills and growing inflation, especially in energy-dependent economies like Germany and Italy.

-

Impact: The eurozone faces pressure to keep interest rates higher for longer, limiting growth.

Japanese Yen (JPY): Gaining on Safe-Haven Status

-

Movement: Strengthened slightly.

-

Reason: The yen, like the dollar, is historically seen as a safe haven during crises. Japanese investors are also repatriating capital, adding strength to the currency.

-

Impact: Japan’s export sector may face short-term headwinds due to the stronger yen, but financial markets are relatively stable.

Israeli Shekel (ILS): Sharp Decline

-

Movement: Fell over 10% against the USD since war escalation.

-

Reason: As the epicenter of the conflict, Israel faces both economic and financial uncertainty. Foreign investors are withdrawing capital, while domestic markets remain under pressure.

-

Impact: The Israeli central bank may be forced to intervene or adjust interest rates to prevent further depreciation.

Iranian Rial (IRR): Deepening Devaluation

-

Movement: Unofficial exchange rates show steep depreciation.

-

Reason: Sanctions, war spending, and economic isolation continue to hammer the rial. The conflict has made it even harder for Iran to access global markets.

-

Impact: Domestic inflation could worsen, and black-market currency trading may rise even further.

Gulf Currencies (AED, SAR, QAR)

-

Movement: Mostly stable, but under watch.

-

Reason: Gulf currencies are pegged to the USD, which provides some protection. However, regional investors are cautious, especially if the conflict expands.

-

Impact: Central banks may need to defend pegs with dollar reserves if pressure continues. Any major escalation could trigger outflows and stress.

Emerging Market Currencies (INR, BDT, PKR, ZAR)

-

Movement: Weakening trend across the board.

-

Reason: Capital flight, inflation fears, and higher oil prices are hitting these currencies. Countries like India and Bangladesh, which import large amounts of oil, are facing increased trade deficits.

-

Impact: Central banks are under pressure to stabilize exchange rates while avoiding growth-killing interest rate hikes.

Investor Insight

-

Safe Havens Rise: USD, JPY, and gold are benefiting the most.

-

Regional Risk Grows: Currencies closest to the war (ILS, IRR) are under the most pressure.

-

Emerging Markets Struggle: As oil prices rise and capital exits, weaker economies are facing dual shocks currency devaluation and rising import costs.

Safe Havens and Risky Assets in the Post-War Period

In the aftermath of the Iran-Israel war, global investors are making sharp distinctions between where capital feels secure and where uncertainty is too high to bear. This crisis has redrawn the global investment map, separating safe havens from risky assets in ways that reflect not just economics, but psychology.

- Safe Havens: Where Investors Are Parking Capital

These are the assets that investors are gravitating toward in search of stability, liquidity, and resilience amid global chaos.

1. Gold

-

Gold remains the ultimate fear asset. Its price has surged past $2,350/oz as investors seek to protect their wealth from inflation, currency depreciation, and market volatility.

2. US Dollar (USD)

-

As always, the dollar is the global go-to during a crisis. With demand for US Treasuries and dollar-denominated assets rising, the USD has strengthened against most currencies.

3. Japanese Yen (JPY)

-

Known for its historic safe-haven status, the yen is gaining modestly. Japanese investors repatriating capital also help support it.

4. Defense Stocks

-

Unlike typical safe havens, defense stocks like Lockheed Martin and Raytheon are now seen as crisis-proof due to booming government procurement and wartime spending.

5. Short-Term Government Bonds

-

U.S., German, and Japanese government bonds are seeing renewed demand as investors seek safety and predictable returns in volatile conditions.

6. Cash and Money Market Funds

-

Liquidity is king. Amid fast-moving headlines and market swings, many investors are holding cash or rotating into money markets to stay flexible.

- Risky Assets: Where Investors Are Pulling Back

The war has amplified existing vulnerabilities in certain markets and assets. These are sectors where uncertainty, volatility, or exposure to global shocks have driven capital flight.

1. Emerging Market Equities and Currencies

-

From India and Bangladesh to South Africa and Brazil, these markets are suffering as rising oil prices and capital outflows increase inflation and debt burdens.

2. Israeli Assets

-

The Tel Aviv Stock Exchange (TASE) has dropped over 25%. The shekel has weakened sharply. Warzone exposure has triggered investor exits.

3. Tech Stocks (Especially Growth & AI)

-

High-growth tech, especially early-stage and AI-heavy firms, are losing investor confidence. These assets are viewed as too volatile and dependent on long-term capital in a high-rate, high-risk world.

4. Airlines and Travel Stocks

-

Jet fuel surges and rerouted international flights are hammering the travel sector. Global airline equities are down significantly.

5. Manufacturing and Heavy Industry

-

Supply chain disruptions and rising input costs are squeezing margins. Investors are avoiding these stocks, particularly in Europe and Asia.

6. Cryptocurrencies

-

Once hailed as “digital gold,” crypto has struggled to act as a true safe haven. Volatility, regulatory risk, and low liquidity during conflict have made many investors wary.

This rebalancing will define how portfolios are constructed in the months ahead. Safe havens aren’t just shelters they’re strategies. And risky assets, while punished now, may become the next great buying opportunity when the dust settles.

The Tel Aviv Stock Exchange (TASE) plunged 25%, while the S&P 500 and European DAX fell amid global investor anxiety; Brent crude oil surged from $85 to $140 per barrel, gold jumped from $1950 to $2350 per ounce as a safe haven, and defense stocks like Lockheed Martin and Raytheon rose about 12%.

Opportunities Amid Crisis

While the Iran-Israel war has triggered sharp volatility and steep declines in key stock markets, it has also created unique investment opportunities for those with a strategic approach. Safe-haven assets like gold and defense stocks have shown strong gains, highlighting sectors that can provide stability and growth even in turbulent times.

The surge in oil prices, despite its inflationary pressures, also signals potential benefits for energy companies and related industries. Investors who can carefully navigate market fears and identify resilient sectors may capitalize on undervalued assets, positioning themselves for long-term gains once the geopolitical dust settles. In essence, crisis moments, though daunting, often reveal openings to build a more robust and diversified portfolio.

Strategic Investment Approaches in Uncertain Times

Diversification Tactics

In times of geopolitical turmoil and market uncertainty, diversification becomes crucial. Spreading investments across different asset classes, sectors, and geographies helps reduce overall portfolio risk. This strategy cushions against sharp declines in any one area—like equities in conflict-affected regions—while allowing exposure to assets that may outperform during crises.

Defensive Stocks vs Growth Stocks

Defensive stocks such as utilities, healthcare, and defense companies tend to be more resilient during downturns, providing steady dividends and relative stability. Growth stocks, often found in technology and consumer discretionary sectors, may experience higher volatility but offer long-term appreciation potential. A balanced mix of both allows investors to benefit from growth while managing risk.

Role of Commodities and Precious Metals

Commodities like oil and precious metals such as gold have historically acted as hedges during times of inflation and conflict. The recent surge in oil prices reflects supply concerns tied to geopolitical instability, while gold’s rally highlights its enduring role as a safe haven. Including these in a portfolio can provide a buffer against currency devaluation and market shocks.

Impact on Cryptocurrency and Digital Assets

Cryptocurrencies and digital assets have a complex role during geopolitical crises. On one hand, their decentralized nature can appeal as alternatives to traditional finance. On the other, their high volatility and regulatory uncertainties can amplify risks.

Long-Term Economic Implications of the Iran-Israel Conflict

The Iran-Israel conflict extends beyond immediate market shocks and poses significant long-term economic challenges and uncertainties for the global economy. One of the most pressing concerns is the sustained disruption of energy supplies, particularly oil, given the strategic location of the Middle East in global energy logistics. Prolonged instability could lead to persistent high oil prices, fueling inflation worldwide and slowing economic growth, especially in energy-dependent economies.

Regional trade and investment flows are also likely to suffer, as heightened tensions discourage foreign direct investment and complicate cross-border commerce. Countries within and near the conflict zone may face reduced economic cooperation, undermining prospects for regional development and integration.

Furthermore, global supply chains, already strained by recent events, could experience further interruptions as shipping routes and logistics are threatened by geopolitical risks. This could increase costs for manufacturers and consumers alike, intensifying inflationary pressures.

On the financial front, increased volatility and uncertainty may lead to more cautious investor behavior, impacting capital markets and funding availability for businesses. Governments might prioritize defense and security spending over productive investments, potentially slowing down innovation and infrastructure development.

However, the conflict could also accelerate shifts in energy policy and technology adoption. For instance, countries might intensify efforts to diversify energy sources, invest in renewables, and enhance energy security. In the long run, such shifts could reshape global economic patterns, fostering resilience but also requiring substantial investment and policy coordination.

In summary, while the Iran-Israel conflict poses immediate challenges, its long-term economic implications demand strategic planning from governments, businesses, and investors to mitigate risks and seize emerging opportunities.

What Retail Investors Should Keep in Mind

For retail investors navigating the turbulent aftermath of the Iran-Israel conflict, staying calm and informed is essential. Market volatility can be unsettling, but knee-jerk reactions often lead to costly mistakes. Instead, investors should focus on long-term goals and avoid making impulsive decisions based on short-term headlines.

Read More: Banking and Internet Services Collapse in Iran Amid Israeli Airstrikes and War

Diversification remains a key principle spreading investments across different sectors and asset classes can help manage risk and smooth out returns during uncertain times. It’s also wise to maintain an emergency fund and avoid over-leveraging, ensuring financial flexibility if markets take unexpected turns.

Retail investors should pay close attention to defensive sectors such as healthcare and consumer staples, which often show resilience during geopolitical crises. Keeping an eye on commodities like gold can provide additional portfolio stability.

Finally, it’s important to stay educated and seek trustworthy sources of information. Consulting with financial advisors can offer personalized guidance tailored to individual risk tolerance and financial goals. Patience and a well-thought-out strategy will serve retail investors best as markets adjust to the evolving geopolitical landscape.

Conclusion: Navigating the New Financial Landscape

The Iran-Israel conflict has sent ripples through the global economy, shaking markets, inflating energy prices, and unsettling investor confidence. Yet within this uncertainty lies a pivotal opportunity to rethink, rebalance, and reinforce our financial strategies for a more unpredictable world.

For governments and institutions, this moment demands long-term planning that prioritizes resilience is investing in energy security, diversifying trade partnerships, and building stronger financial safety nets.

For retail and institutional investors alike, it’s a time to move with caution, but not fear to embrace diversification, monitor geopolitical developments closely, and look for emerging trends that could shape the next decade.

Defense, energy, and safe-haven assets are already showing signs of strength. But more broadly, the post-conflict era could usher in a new wave of innovation, especially in renewable energy, digital finance, and cybersecurity are sectors that thrive on disruption.

Navigating this new financial landscape requires clarity, courage, and discipline. Whether you’re a policymaker, business leader, or everyday investor, the road ahead will be complex but it is navigable. With the right strategy, this crisis can be a turning point not just for markets, but for building a more stable, adaptable global economy.

References:

1.IMF

2.Reuters

3.CNBC

4.ISW

5.WTO

6.Globes

7.OPE monthly oil report

8.Bloomerg