1. Introduction

Amazon is a global technology and retail giant that started as an online bookstore and grew into a company which is founded by Jeff Bezos in Bellevue, Washington, near Seattle on July 5, 1994. From a small online bookstore to a familiar band in the world, has come a long way since it’s beginnings. The story shows how Amazon rise from a small startup into a global e-commerce giant, also it will inspire all businessmen who are thinking how they will grow their small business from a small business. Jeff Bezos chose the name “Amazon” to reflect his vision for a massive online selection, much like the world’s largest river.

Amazon has slowly expanded its reach and today, it is far more than just an online retailer. It is a multinational technology and retail giant operating across e-commerce, cloud computing, entertainment, digital devices, and logistics. Millions of customers around the world rely on Amazon to shop, stream movies, read books, listen to music, or run their businesses on Amazon Web Services (AWS).

Amazon’s significance lies not only in its size but also in how it has reshaped industries. It has changed how people buy goods, break traditional retail, set new standards in customer service, and created the world’s leading cloud infrastructure. With over 1.5 million employees globally and a market value in the trillions, Amazon is now one of the largest and most influential companies in the world.

2. History & Growth Journey[1]

Amazon was founded on July 5, 1994, by Jeff Bezos after he moved from New York City to Bellevue, Washington, near Seattle. He chose this location because it had skilled workers from Microsoft and the University of Washington, a smaller population that made sales taxes lower, and it was close to a big book distribution warehouse in Roseburg, Oregon. Other cities he thought about were Portland, and Boulder, Colorado.

Originally called Cadabra, the company started in Bezos’s garage and was renamed Amazon in November 1994. The Amazon website launched on July 16, 1995, selling books directly from wholesalers and publishers. Interestingly, Bezos also bought the URL www.relentless.com, which still redirects to Amazon’s homepage.

2.1. Jeff Bezos & Andy Jassy [2]

-

Jeff Bezos founded Amazon and was CEO for many years. In 2021, he stepped down as CEO. Now, he is Executive Chairman, focusing on long-term strategies and new big ideas.

-

Andy Jassy is the current President and CEO. He worked at Amazon for many years and built Amazon Web Services (AWS) from the ground up. His leadership keeps Amazon’s “Day 1” philosophy alive, meaning the company acts like a startup: fast, creative, and always improving, also focuses more on efficiency and profit.

2.2. Going Public and Expanding Globally (1997–1999)[32]

Amazon’s Initial Public Offering (IPO) in May 1997 was a crucial step that provided the company with the capital it needed to grow rapidly. The following year, in 1998, Amazon began its international expansion by acquiring online booksellers in the United Kingdom and Germany, marking its first move beyond the US market.

In 1999, Amazon diversified its offerings to include music, video games, consumer electronics, home improvement items, software, and toys, marking its transformation from an online bookstore to a full-fledged e-commerce platform, for that it became known as the “everything store.”

2.3. Amazon Web Services and Seller Programs (2002–2008)

Amazon launched Amazon Web Services (AWS) in 2006, initially providing APIs (Application Programming Interface) for developers to build web applications on its e-commerce platform. AWS shifted to enterprise services with S3 in 2006 and EC2 in 2008, allowing companies to rent storage and computing power. In 2006, Amazon also introduced Fulfillment by Amazon (FBA), enabling small businesses and individual sellers to use Amazon’s warehouses and delivery infrastructure.[24]

2.4. Retail Leadership and Strategic Acquisitions (2010–2017)

Amazon purchased Whole Foods Market in 2017, entering the grocery sector. By this time, it had become the leading e-retailer in the US, with approximately $178 billion in net sales and over 310 million active customer accounts globally.[27]

During the COVID-19 pandemic, Amazon hired more than 100,000 workers in the US and Canada to meet growing demand. However, some employees protested its decision to continue normal shifts due to health risks, leading to legal complaints in Spain and letters from US Senators expressing workplace safety concerns.[2]

2.5. Leadership Transition and Share Sales (2021–2023)

On February 2, 2021, Jeff Bezos announced he would step down as CEO to become Executive Chair of Amazon’s board, with Andy Jassy, former CEO of AWS, taking over on July 5, 2021.[2]

In January 2023, Amazon cut over 18,000 jobs, mainly in retail and human resources, as part of cost-cutting efforts. Later, on November 8, 2023, Bezos announced plans to sell 50 million shares over the next year, starting with 12 million shares sold for $2 billion.[2]

2.6. Recent Developments (2024–2025)

On February 26, 2024, Amazon became a component of the Dow Jones Industrial Average. After that on December 19, 2024, Amazon workers, led by the International Brotherhood of Teamsters labor union, went on strike against Amazon in at least four US states, with workers in other facilities in the United States being welcomed to join the strike as well. [26]

On April 2, 2025, it was reported by various media outlets that Amazon had made a bid to buy the social media platform TikTok in order to save the platform from facing a US ban set to take effect on Saturday, April 5, 2025. The cost of the bid has yet to be announced.[34]

3. Company Overview

Amazon is a multinational technology and retail company that has grown far beyond its origins as an online bookseller. Today, it is one of the world’s most valuable and influential corporations, with a business model that operates across several key, high-growth sectors. Amazon reports its operations across three main segments-

- North America

- International

- Amazon Web Services (AWS)

3.1. Mission, Vision, and Values

Amazon is a global giant that is more than just an online store. This company has built a powerful and complex business that makes money in several different ways.

•Mission: Amazon’s mission is to be “Earth’s most customer-focused company,” which means making shopping easy, fast, and convenient for everyone. They want to be the one-stop-shop where you can find, discover, and buy anything you want.[2]

•Vision: Amazon’s vision has grown to becoming ‘Earth’s best employer’ and ‘Earth’s safest place to work.’ This shows the company’s recent focus on taking better care of its employees and ensuring a safe workplace as it has become larger and more influential.[2]

•Core Values: Amazon’s values are built around 16 “Leadership Principles”, which guide how employees work and make decisions. These principles are the foundation of Amazon’s unique culture. They always start with the customer and work backward. Earning and keeping customer trust matters more than worrying about competitors. Employees are encouraged to think like owners and they focus on long-term success instead of short-term results which make them more unique than others.[2]

Amazon pushes its people to be creative and to find simpler solutions for complex problems. They think small goals create small results and leaders are encouraged to set bold visions that inspire progress. They believe achieve more with fewer resources and this principle encourages efficiency and resourcefulness. Also they believe speed is important in business. Amazon values quick, thoughtful decision-making and smart risk-taking.

3.2. How Amazon Makes Money

Amazon has many different ways of earning money,[7]

•Online Shopping: This is the most well-known part. Amazon sells products directly to customers through its website and app. They buy products in bulk and resell them, making a profit on each sale.

•Third-Party Sellers: Amazon also earns money by letting other businesses sell their products on its website. It charges them a fee for each sale and offers services like Fulfillment by Amazon (FBA), where Amazon stores, packs, and ships the products for the seller, for an extra fee. This is a highly profitable part of the business.

•Cloud Computing (AWS): Amazon built a powerful computer network for its online store, then realized it could rent that system to others. Amazon Web Services (AWS) now provides cloud services to businesses and governments worldwide. It is Amazon’s biggest money-maker and funds much of the company.

•Subscriptions: Amazon makes a lot of money from its Amazon Prime membership. Customers pay a yearly or monthly fee for benefits like fast, free shipping, access to movies and TV shows on Prime Video, and exclusive deals. This makes customers very loyal.

•Advertising: When you search for something on Amazon, you often see “sponsored” products at the top. Brands pay Amazon to have their products shown more prominently. This has become a very profitable and fast-growing part of Amazon’s business.

3.3. Major Products and Services

Amazon has a several list of products and services, but some of the most important are,[24] [10]

•Amazon.com: The core online store where you can buy almost anything which launched on July 16, 1995, as an online bookstore. The company was founded a year earlier in 1994 by Jeff Bezos out of his garage in Bellevue, Washington.

•Amazon Prime: A membership service that includes fast shipping and a wide range of digital content, launched in 2005.

•Amazon Web Services (AWS): The world’s leading platform for cloud computing, founded in 2002 but the formal launch of its cloud computing platform with services like Simple Storage Service (S3) and Elastic Compute Cloud (EC2), which created the modern cloud industry, occurred in 2006.

•Amazon Devices: A family of popular electronics like the Kindle e-reader, launched in 2007, which helped to revolutionize the e-book market. They introduced the Echo and Alexa devices in late 2014, marking its significant entry into AI and smart home technology. Amazon’s first tablet, the Kindle Fire, was launched on September 28, 2011. It was officially released for sale on November 15, 2011, in the U.S.

•Prime Video: A streaming service that offers a large library of movies, TV shows, and original content, included with a Prime membership which launched its first original content on Prime Video starting in 2013.

•Audible: A subscription service for audiobooks. Amazon earned Audible in 2008 for roughly $300 million, a move that compact the world’s largest online retailer with the world’s largest audiobook provider.

•Whole Foods Market: A physical grocery store chain that Amazon acquired to enter the grocery market (2017).

•Twitch: Amazon earned Twitch on August 25, 2014, for approximately $970 million. The acquisition allowed Amazon to enter the rapidly growing live-streaming and gaming industries.

4. Market & Industry Position

Amazon is a global giant that leads in many industries. Its success comes not from just one business, but from a smart mix of different services that all connect and support each other.

4.1. E-commerce Dominance

Amazon is the clear leader in the U.S. e-commerce market, holding a commanding market share of about 37.6% which is roughly six times larger than its closest competitor, Walmart which holds around 6.4%. Amazon’s e-commerce dominance is built on three main pillars,[35][36]

- Large Selection: The company offers millions of products, from electronics to groceries, making it a true “everything store.”

- Benefit: Its logistics network, which includes fulfillment centers, delivery vans, and even drones, enables fast, reliable shipping, often in just one or two days.

- Customer Loyalty: The Amazon Prime subscription program provides free and fast shipping, as well as a range of other services, creating a loyal customer base that rarely shops elsewhere.

4.2. Cloud Computing Leadership(AWS)

Amazon Web Services (AWS) is the global leader in the cloud computing industry. It was the first to lead this industry and now controls a big share of the market, staying ahead of main rivals like Microsoft Azure and Google Cloud. This part of the business makes a lot of profit and helps pay for Amazon’s other projects, giving it a strong advantage.

4.3. Company’s Share in the Market

Amazon holds a dominant market share in its primary business areas:

- E-commerce: As of 2024, Amazon’s share of the U.S. e-commerce market is approximately 37.6%, making it the clear leader. Its closest competitor, Walmart, holds around 6.4%.

- Cloud Computing: Amazon Web Services (AWS) is the global leader in cloud infrastructure services. As of Q2 2025, it holds about 30% of the worldwide market, ahead of rivals like Microsoft Azure and Google Cloud.

- Digital Advertising: Amazon is a key player in digital advertising, along Google and Meta. Its ad services have become a major, high-profit revenue stream for the company.

4.4. Unique Selling Points (USPs)

Amazon’s strength comes from several special advantages that are hard for other companies to copy.[37]

•Customer Obsession: Amazon’s main rule is to always put the customer first. This means customers enjoy a huge variety of products, low prices, and a smooth shopping experience with helpful features like easy returns.

•The Prime Ecosystem: Amazon Prime is one of its biggest advantages. With a single subscription, customers get fast, free shipping along with digital services like Prime Video and Prime Music. This package makes customers loyal and keeps them connected to Amazon.

•Scale and Infrastructure: Amazon has built one of the largest delivery systems in the world, with warehouses, vans, and sorting centers everywhere. This powerful network lets Amazon deliver quickly and reliably, something most competitors cannot match.

•AWS Profitability: Amazon Web Services (AWS) earns huge profits, giving Amazon a special financial strength. This money allows the company to take risks and invest billions in new ideas, like better logistics and new devices, without worrying about making profit right away.

5. Financial Performance

Amazon’s financial story is about a company that sells a lot of things but makes most of its money from a few highly profitable businesses. The company’s revenue continues to grow, but its profit growth has become the main highlight.

5.1. Revenue, Profit, and Growth Trends

Amazon’s revenue has consistently grown, reaching $638 billion in 2024. While revenue growth has slowed down from its rapid pace during the pandemic, the big news is the significant jump in profit. The company’s net income for 2024 was $59.2 billion, which is nearly double its profit from the previous year. This large increase shows Amazon’s success in becoming more efficient and its focus on its most profitable businesses. [12]

5.2. Amazon’s Stock Market performance

Amazon’s stock story is one of massive long-term growth, mainly fueled by its leadership in e-commerce and the strong profits of Amazon Web Services (AWS). Like all stocks, however, it does face ups and downs in the short term.[12]

•The Big Picture: Long-Term Growth

Since its IPO in 1997, Amazon’s stock has given huge returns to long-term investors. One important reason is its stock splits, which made shares more affordable for everyday investors. For example, in 2022, Amazon did a 20-for-1 stock split, which lowered the price of a single share and attracted more buyers. Over the years, this steady growth has made Amazon one of the top-performing stocks in history.

•Recent Performance

-

Positive Signs: Amazon’s profits have been rising, and its earnings per share (EPS) have improved. This shows that the company is becoming more profitable. AWS, in particular, continues to bring in the biggest share of profits.

-

Volatility: The stock still moves up and down. For instance, news about its Project Kuiper satellite internet venture has boosted investor confidence, while worries about government rules or the global economy sometimes pull the stock down. In 2025, the stock has shown a mixed year-to-date performance.

- Key Metrics: As of early September 2025, the stock’s 52-week price has ranged from a low of about $161 to a high of $242. This shows a significant recovery from its 2022 lows and indicates continued investor interest, despite some short-term volatility.

| Year/Event | Stock Price / Notes |

|---|---|

| 1997 (IPO) | $18 per share at IPO (May 15, 1997). Adjusted for all four stock splits, this equals about $0.075 per share today. |

| 1999 [Peak (Dot-com Boom)] | Surged to around $113 (unadjusted). Split-adjusted, roughly $4.25; after 2022 split, a few dollars per share. |

| 2001 (Post-crash Low) | Dropped to ~$5.51 (unadjusted). Split-adjusted, less than $1 per share. |

| 2010 (Milestone) | Trading around $120 (unadjusted). Split-adjusted, about $6 per share. |

| 2015 (Growth Phase) | Trading around $500 (unadjusted). Split-adjusted, approximately $25 per share. |

| 2020 (Pandemic Boost) | Reached over $3,500 (unadjusted) before the 2022 split, fueled by the rise of e-commerce during the pandemic. |

| 2022 (20-for-1 Stock Split) | One share became 20; price immediately after split was ~$120 per share, making it more accessible to investors. |

| 2025 (Recent Range) | 52-week range: $161 – $242 as of September 2025, showing continued strong performance. |

Table: Amazon Stock Performance [Source: Investing.com]

6. Amazon’s Business Strategy

Amazon’s success comes from a few simple but powerful ideas that all work together. The main focus is always on the customer, not the competitors, which has helped Amazon become a leader in many industries.

6.1. Core Strategies

Amazon’s strategy is often called the “Flywheel Effect” or “Virtuous Cycle”, meaning every part of the business helps the others, creating a loop of growth.[24]

-

Customer-Centricity: Amazon starts every idea by asking, “What does the customer want?” and works backward. This mindset has created features like one-click ordering, easy returns, and Prime membership. By focusing on lower prices, fast delivery, and a huge product selection, Amazon ensures long-term success.

-

Cost Leadership: Amazon wants to be the lowest-cost provider. They invest in logistics and supply chains to make shipping and packaging more efficient. These savings are passed to customers as lower prices, attracting more shoppers and fueling the Flywheel.

-

Innovation: Amazon keeps a “Day 1” mentality, acting like a startup even as a huge company. It takes risks and is okay with “failing fast” on new ideas. This culture has led to Kindle, Alexa, and AWS, which are all major successes.

6.2. Expansion and Diversification

Amazon’s strategy includes growing into new markets and industries.[38]

•Diversification & Acquisitions: Amazon buys companies to enter new areas quickly. For example:

- Whole Foods (2017): Entered the grocery market.

- MGM Studios: Gained a huge library of movies and TV shows for Prime Video.

- Zoox: Invested in self-driving car technology.

•Prime Ecosystem: The Prime membership is a key strategy. Customers pay yearly for fast shipping, which encourages them to shop more. They also get Prime Video, Prime Music, and other services, making the membership valuable and hard to leave.

•Global Expansion: Amazon has local marketplaces in many countries like Amazon.in (India) and Amazon.de (Germany). It adapts to local needs, such as offering country-specific deals and accepting local payment methods.

6.3. Pricing and Marketing Approaches

Amazon uses data-driven methods for pricing and marketing.[39]

•Dynamic Pricing: Amazon changes prices in real-time, sometimes thousands of times a day, based on competitor prices, supply and demand, and product popularity. This ensures customers always get good value.

•Marketing Focus: Most marketing is on Amazon’s own platform. Targeted ads and sponsored product listings help sellers reach interested customers. Prime Day is the most important marketing event, attracting new members and boosting sales.

7. Innovations & Technology of Amazon

Amazon is not just an online store; it is also a technology leader. Over the years, the company has introduced many new products and systems that changed how people shop, read, and even run their businesses.

7.1. Kindle, Alexa, and AI-driven Solutions

Amazon has created many new technologies that changed the way people shop, read, and use digital devices. Two of its biggest inventions are the Kindle and Alexa.[2]

•Kindle

- Launched in 2007, the Kindle made it possible to carry thousands of books in one small device.

-

It changed how people read by making e-books simple and popular.

-

This invention turned Amazon from just an online bookstore into a digital publishing leader.

•Alexa

-

In 2014, Amazon launched the Echo smart speaker with Alexa, its voice assistant.

-

Alexa uses artificial intelligence (AI) and machine learning (ML) to understand voice commands.

-

It can play music, give weather updates, answer questions, and control smart home devices.

-

This made Amazon one of the top players in the smart home market.

•AI-driven Solutions

-

Amazon uses AI and ML across its entire business.

-

AI gives personalized product suggestions based on what customers search and buy.

-

It also predicts what products people will want and where they will need them (based on demand).

-

This helps Amazon deliver faster and manage its huge inventory better.

7.2. AWS (Amazon Web Services)

-

Launched in 2006, AWS is one of Amazon’s biggest and most successful innovations.

-

It lets businesses rent Amazon’s computer systems instead of building their own.

-

From small startups to big companies, many rely on AWS for websites, apps, storage, and data.

-

AWS makes huge profits, which Amazon uses to fund new projects and growth.[49]

7.3. Robotics, Drones, and Logistics

•Robotics: Amazon has invested heavily in robotics to transform its fulfillment centers (warehouses). The company bought Kiva Systems in 2012, which developed small, autonomous robots that move entire shelves of products. Instead of workers walking miles to find an item, the robots bring the shelves directly to them. This system, now under Amazon Robotics, has been scaled up to include millions of robots in warehouses around the world. These robots work alongside human employees to sort and move inventory, increasing efficiency and reducing the physical effort required from workers.[2]

•Drones: Amazon’s drone delivery service, Prime Air, is a long-term project to make package delivery even faster. These small flying drones are designed to deliver packages in under 30 minutes. The company is developing and testing small, electric drones that can autonomously fly to a customer’s home and deliver a package weighing up to five pounds in under an hour. While it’s still being tested in a few select locations, the goal is to revolutionize “last-mile” delivery, especially for smaller items. The drones use advanced sensors and AI to navigate and safely land in a designated delivery area.[2]

8. Organizational Structure & Leadership

Amazon’s organizational structure is a hybrid that uses, a top-down hierarchy (big decisions come from the top leaders (like CEO, executives, or managers) and then move down to the rest of the company) for big decisions and another is small, independent teams for daily work. This design helps Amazon stay huge in size but still fast in decision-making.

8.1. Management Style & Culture [2]

Amazon’s management style is demanding and data-driven, following 16 Leadership Principles such as “Customer Obsession” and “Bias for Action.”

One famous rule is the “Two-Pizza Team”: a team should be small enough that two pizzas can feed everyone. This keeps teams small, flexible, and quick at making decisions without too much paperwork or bureaucracy.

8.2. Workforce Policies & Employee Size [40]

Amazon is one of the biggest employers in the world, with over 1.5 million employees by late 2024. These include corporate staff, tech workers, warehouse staff, and delivery drivers.

The company is known for its fast-paced work culture, especially in warehouses. After criticism about working conditions, Amazon promised to become “Earth’s Best Employer” and “Earth’s Safest Place to Work.” It has invested in safety technology and training to improve employee well-being.

9. Amazon’s Customer Strategy

Amazon’s success is deeply tied to its customer-first mindset, often called “customer obsession.” The company’s main mission is to be the most customer-focused company on Earth. To achieve this, Amazon focuses on three main areas- building loyalty through Prime membership, expanding worldwide, and always working to improve customer satisfaction.

9.1. Prime Members: The Loyal Core

Amazon Prime is the heart of its customer strategy. By 2024, Amazon had over 200 million Prime members, including about 180 million in the U.S. alone. These members are extremely valuable because,[35]

-

They spend more: A Prime member spends about twice as much per year as a non-Prime customer.

-

They shop more often: With benefits like fast, free delivery, Prime members naturally turn to Amazon first for most of their shopping.

-

They are more engaged: Beyond shopping, Prime members also enjoy services like Prime Video, Prime Music, and Prime Reading, making them more connected to Amazon and less likely to switch to competitors.

9.2. Expanding Global Reach

Amazon is not just a U.S. company it operates in 25+ countries. While the U.S. is still its biggest market, Amazon has strong customer bases in countries like Germany, Japan, and the UK, and it is quickly growing in India and Brazil. This global presence means Amazon can serve a wide variety of customers and adjust its services to local cultures and needs.[58]

9.3. Ensuring Customer Satisfaction

Amazon invests heavily to keep customers happy and loyal. Some of its key strategies include,[16]

-

Fast and reliable delivery: Billions of dollars are spent on warehouses, trucks, and planes so that customers can often get packages the same day or the next day.

-

Easy returns: Customers can return items with almost no hassle. This “no-questions-asked” policy builds trust and makes people more willing to try new products.

-

Personalized shopping: Amazon uses artificial intelligence (AI) to recommend products based on past purchases, making shopping more enjoyable and personal.

-

Customer reviews: Amazon’s review system lets buyers share honest feedback, helping others make decisions and creating a strong sense of trust in the marketplace.

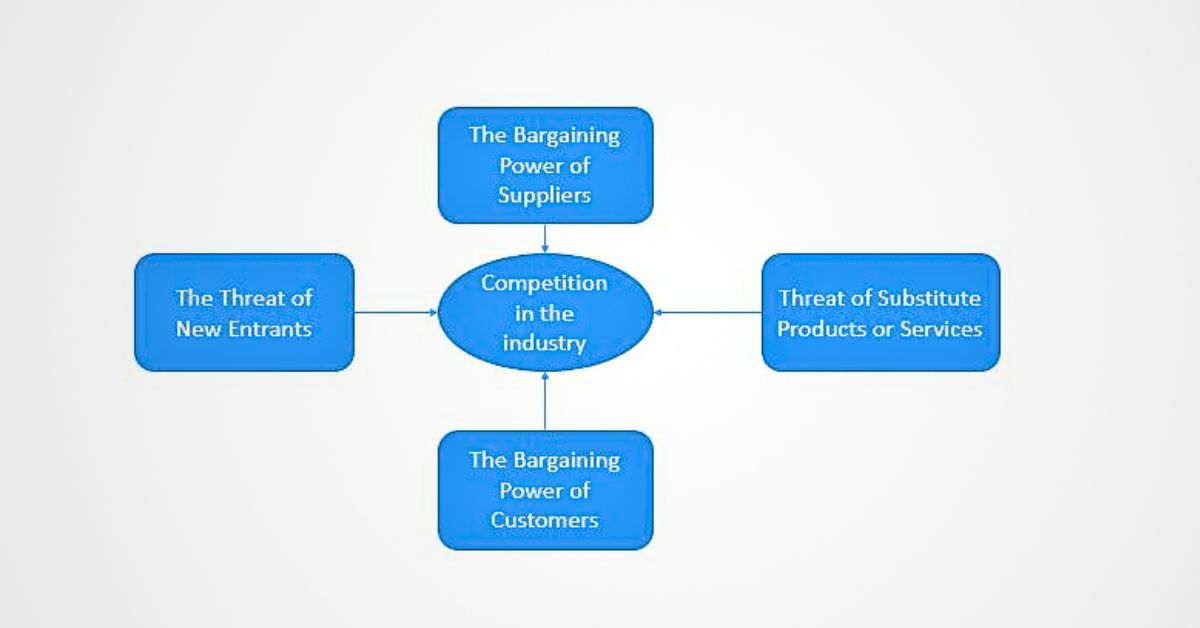

10. Amazon’s Competitive Advantage (Porter’s Five Forces) [21]

Amazon’s competitive advantage can be understood by looking at how it handles the five competitive forces in its markets, a model created by business expert Michael Porter. In simple way, Amazon has built a castle that is very hard for competitors to attack.

Along with Amazon’s analysis through Porter’s Five Forces, the company has also relied on some key strategies that have played a major role in its overall success, include cost leadership, differentiation, and focus. The five forces have helped Amazon predict shifts in competition, understand how the industry structure evolves, and find a strategic position in the e-commerce industry.

Amazon’s Porter’s Five Forces Process

10.1. Competition in the Industry (Strong Force)[21]

Amazon’s competitor analysis shows that competition in the e-commerce industry is getting tougher every year. Many new companies are entering the market, and existing retailers are becoming more aggressive. This growing rivalry is making it harder for Amazon to maintain its leading position, profit margins, and market share.

- Rate of Growth of the Industry: In recent years, many new competitors have entered the market. Some physical retailers, like Walmart, have also started selling online. Because these retail businesses are very aggressive, they create a strong challenge for Amazon, making it harder for the company to keep growing its profit margins and market share.

- Diversity of competitors: In the e-commerce retail industry, companies use different strategies to compete. Some, like Walmart, run both physical stores and online shops, while others, like Amazon, focus on offering a huge variety of products and services. These different approaches make the competition even tougher.

10.2. The Threats of the New Entrants (Weak Force)[21]

Amazon is a very large company that makes huge profits every year. This success has attracted new businesses to enter the market, which affects the way competition works in the industry. The risk from these new companies depends on a few key factors:

- Economies of Scale: Because Amazon makes large profits and has a big share of the e-commerce market, it benefits from economies of scale, it can operate more efficiently and at lower cost than most competitors. New companies can try to copy Amazon’s business model, but they cannot achieve the same scale and efficiency. This makes it hard for them to compete.

- Capital Requirements: Amazon is a well-known and trusted brand. It has spent a lot of money on marketing, warehouses, logistics, customer service, and delivery systems. For new companies, matching this level of investment is very expensive, making it hard for them to compete with Amazon.

10.3. The Bargaining Power of Suppliers (Moderate Force)[21]

In Amazon’s Porter’s Five Forces analysis, suppliers have a moderate level of power. This means they can somewhat influence prices and profits, but not completely. Several factors affect how much power suppliers have,

- Differentiation of Products Provided by Suppliers: Some suppliers offer unique products or services, which gives them some control in the market. However, this only has a moderate effect on Amazon, because the company already has a large share of the e-commerce market and strong buying power.

- Importance of Volume to Supplier: Suppliers want to sell their products in large quantities, and Amazon buys very large volumes from them. Because no supplier wants to lose such a big customer, their bargaining power over Amazon is only moderate.

10.4. The Bargaining Power of Customers (Strong Force)[21]

The power of customers shows how much they can influence prices and the quality of products and services. For Amazon, a few key factors decide how strong the customers’ bargaining power is,

- Information About Products and Services: Customers can easily get information about products from different online stores. This makes it simple for them to compare options and find alternatives to what Amazon offers.

- Customer’s Price Sensitivity: Customers who know about prices are very sensitive to cost. If a new company offers the same products for less, many customers may choose to buy from that company instead of Amazon.

10.5. The Threat of Substitute Products or Services (Strong Force)[21]

Amazon’s focus on excellent customer service helps keep customers loyal and protects its market share. However, the company still faces the threat of substitute products or services, as customers can switch to alternatives if they find better options.

- Perceived Level of Product Differentiation: Some suppliers make unique products that stand out from others. If these suppliers do not sell through Amazon, customers may buy those products from other retailers instead.

- Existence of close Substitutes: Even though Amazon is a huge retailer, it sells many of the same products as other stores. This makes it easy for customers to switch to other online or physical retailers if they want.

10.6. Strategies of Success[21]

Besides the insights from Amazon’s Porter’s Five Forces analysis, the company’s success also comes from other key strategies, which are explained below,

- Cost Leadership: Amazon uses a Cost Leadership strategy by offering a large variety of products at low prices with fast, convenient delivery. Even though the profit on each sale may be small, this approach helps Amazon attract more customers, grow its market share, and stay ahead of competitors.

- Differentiation: Differentiation means standing out from competitors by offering unique products or services. For Amazon, this comes from smart marketing, creativity, new technologies, and constant innovation. These factors help Amazon stay different and strong in the highly competitive e-commerce industry.

- Focus: Focus Strategy means carefully studying the industry, competitors, suppliers, and customers to choose one specific market segment. By focusing on that segment, Amazon can serve it better and gain an advantage over others.

11. Amazon Competitors Around the World [20]

Over the years, Amazon has grown from a small online bookstore to a trillion-dollar company. Today, it is one of the most recognized e-Commerce brands worldwide. But as it expanded into many industries such as e-Commerce, cloud services, and digital streaming, Amazon has faced strong competition from many companies. Below are some of its main competitors across the globe:

11.1. eBay[20]

Launched in 1995, just months after Jeff Bezos renamed his company “Amazon,” eBay became famous as an online auction site. Today, it connects buyers and sellers worldwide and is still one of Amazon’s biggest rivals.

-

eBay has over 135 million users, with 18 million active sellers.

-

An average seller earns around $44,000 a year.

-

It is popular for its quick account setup, though some sellers complain about high and inconsistent fees.

11.2. Walmart[20]

Founded in 1962 by Sam Walton, Walmart is the world’s largest physical retailer with 10,600+ stores in 24 countries.

-

Walmart dominates offline retail, while Amazon leads online.

-

In 2016, Walmart bought Jet.com to strengthen its online presence.

-

Amazon has responded by opening its own physical stores.

Read more: Walmart Revolutionary Story from Beginning to Global Retail Giant

11.3. Best Buy[20]

Best Buy started as an audio specialty store in 1966 and is now one of the largest electronics retailers in the U.S.

-

Competes with Amazon in electronics and media.

-

Earns most of its revenue from the U.S. market.

-

Reported $43.5 billion in revenue globally.

11.4. Target [20]

Target is a U.S. discount retailer selling a wide range of products like food, household items, clothing, and toys.

-

Operates 50+ stores in the U.S.

-

In 2023, sales dropped by 1.7%, but still remained high compared to previous years.

-

Target.com is one of the top online stores in categories like baby products, furniture, and electronics.

11.5. Alibaba [20]

Alibaba is one of Amazon’s strongest rivals, but their focus is different:

-

Amazon serves consumers directly (B2C).

-

Alibaba mainly connects businesses (B2B).

-

Alibaba dominates in China, though in 2023 its revenue fell 6% to $130 billion, while Amazon made $575 billion.

11.6. AliExpress [20]

Owned by Alibaba, AliExpress started in 2010 as a B2C platform.

-

Attracted over 1 billion visitors in June 2024.

-

Popular among global drop shippers.

-

Needs to improve product quality and shipping speed to truly challenge Amazon.

11.7. Taobao [20]

Also owned by Alibaba, Taobao is one of China’s largest retail platforms.

-

Has over 920 million monthly active users.

-

Similar to eBay, it allows sellers to run virtual stores and sell at fixed prices or through auctions.

-

Amazon struggled in China and even closed its local marketplace in 2019 because of competitors like Taobao.

11.8. Rakuten[20]

Founded in 1997, Rakuten is the biggest competitor of Amazon in Japan.

-

Used by 80% of Japan’s population.

-

Offers a wide variety of consumer products.

-

Famous for its loyalty point programs.

-

Had 520 million+ visitors by June 2024.

11.9. Flipkart [20]

Flipkart, now owned by Walmart, is Amazon’s top competitor in India.

-

Holds 65% market share in categories like electronics, homeware, and fitness.

-

Earned $6.6 billion in revenue in 2023.

11.10. JD.com[20]

JD.com is China’s largest online and offline retailer.

-

Offers products like food, clothes, electronics, and cosmetics.

-

Known for fast delivery services (same-day and next-day).

-

Strong policy against fake products, similar to Amazon.

-

Reported $152.8 billion in revenue and 580 million active customers.

12. Amazon’s Strengths & Weaknesses (SWOT Analysis)

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is a tool that helps us understand Amazon’s position by looking at its Strengths, Weaknesses, Opportunities, and Threats.

12.1. Strengths

Amazon’s strengths are the areas where it outperforms most of its competitors and creates a lasting side in the global market.

•Powerful Brand & Customer Loyalty [19]

Amazon has built one of the strongest brands in the world. Customers across the globe trust the Amazon name because it offers a wide variety of products, competitive prices, and unmatched convenience. The Amazon Prime subscription program plays a big role in customer loyalty members not only shop more frequently but also spend more money compared to non-members, making it a powerful driver of repeat business.

•Leading Technology [35] [2]

Technology is at the heart of Amazon’s success. Its cloud computing division, Amazon Web Services (AWS), is not only a leading global provider of cloud solutions but also one of the company’s biggest profit generators. The revenue from AWS gives Amazon the financial strength to invest in innovation and expand into new industries. Beyond cloud computing, Amazon uses artificial intelligence in services like Alexa and in its e-commerce platform to deliver personalized recommendations and improve the overall shopping experience.

•Unrivaled Logistics [42]

Amazon’s logistics system is one of the most advanced in the world. With a vast network of warehouses, fulfillment centers, and delivery services, Amazon can provide fast, reliable, and often same-day or next-day shipping to millions of customers. This efficient supply chain is extremely difficult for competitors to replicate and is a major reason why customers remain loyal to Amazon, it consistently delivers on speed and reliability.

12.2.Weaknesses

These are the internal challenges Amazon faces and areas where it struggles compared to its strengths.

•Thin Retail Profits [28]

While Amazon’s online retail platform brings in massive sales, the profit margins are very slim. This is largely because the company spends heavily on services like free and fast shipping, which customers expect but are expensive to maintain. Although this strategy helps keep shoppers loyal, it reduces profitability in retail. In contrast, Amazon’s cloud computing division, AWS, is much more profitable and often carries the weight of the company’s earnings.

•Employee Criticism [31][30]

Amazon has repeatedly faced negative publicity regarding working conditions in its warehouses. Reports of long hours, strict monitoring, and physical strain have led to criticism from employees and labor rights groups. Such issues not only risk labor disputes and strikes but also damage Amazon’s public image, making it appear as a company that values efficiency over worker well-being.

12.3. Opportunities

These are external factors in the market that Amazon can take advantage of to grow further.

•Artificial Intelligence (AI) [24]

The global AI industry is expanding rapidly, and Amazon is well-positioned to benefit. Through AWS, the company can sell more AI-powered services to businesses worldwide. Additionally, Amazon can integrate AI into its own operations from personalizing shopping recommendations to improving logistics efficiency making the customer experience even smoother while cutting costs.

Read more: Discovering PetParty’s Handmade World: Your Pet, Your Style

•Healthcare [24]

Amazon is steadily moving into the healthcare market with initiatives such as Amazon Pharmacy and One Medical. This industry is massive, with opportunities ranging from online prescription services to digital health solutions. By leveraging its strong logistics and technology, Amazon has the potential to disrupt healthcare in the same way it transformed retail.

•Sustainability [2]

As people and governments care more about the environment, being sustainable has become a big business opportunity. Amazon can lead the way by using renewable energy, switching to electric delivery vehicles, and lowering its carbon emissions. Doing this will improve its reputation and satisfy customers who want eco-friendly companies.

12.4. Threats

These are external challenges that could harm Amazon’s business and limit its growth.

•Government Regulations and Antitrust [18]

Because Amazon is very big and powerful, governments are always watching it closely. It’s size and dominance have placed it under constant scrutiny by regulators around the world. Governments are increasingly concerned about monopolistic practices, data privacy, and fair competition. New regulations, antitrust lawsuits, or forced changes in operations could disrupt Amazon’s business model and make it harder to operate as freely as before.

•Global Competition [17]

Amazon faces tough competition in all its major sectors. In e-commerce, strong rivals like Walmart and Alibaba are constantly pushing for greater market share. In cloud computing, Microsoft and Google are serious challengers to AWS. If these competitors continue to grow stronger or innovate faster, Amazon risks losing market dominance and future profits.

13. Challenges and Criticisms Amazon Faces

Amazon has grown very fast and become a powerful company, but this success has also brought many problems and criticisms. Most of these issues come from its strong focus on efficiency and customer satisfaction, which some say harms its employees, competitors, and even the public.

13.1. Labor Practices and Working Conditions [30]

Amazon often faces criticism for how it treats its warehouse and delivery workers.

-

Work environments are high-pressure, with strict performance rules.

-

Injury rates in fulfillment centers are reported to be high.

-

The company uses technology to closely monitor workers’ every move, which many say feels dehumanizing.

-

These issues have encouraged workers in some places to try to form unions, but Amazon has usually resisted unionization.

13.2. Antitrust and Regulatory Scrutiny [18]

Because of its huge size and influence, Amazon is closely watched by regulators and governments worldwide.

-

Platform Power: Regulators like the U.S. FTC claim Amazon favors its own products over those of third-party sellers on its marketplace.

-

Price Parity: Amazon has been accused of forcing third-party sellers not to sell cheaper on other websites, which keeps prices high.

-

Data Use: Critics say Amazon uses data from third-party sellers to create its own competing products, giving it an unfair edge.

These legal challenges are serious because they could force Amazon to change how it does business.

13.3. Environmental Impact and Sustainability [2]

Amazon has promised to become more eco-friendly, but critics say it still leaves a big environmental footprint.

-

Its fast shipping and global logistics network create large carbon emissions.

-

Excess packaging waste and the destruction of unsold or returned goods are also major concerns.

13.4. Data Privacy [6]

Amazon collects a lot of data from customers, which has led to worries about how it is used and protected.

-

Devices like Alexa raise concerns about what Amazon does with the data.

-

Some people worry that customer information may not be fully safe.

-

Amazon’s facial recognition tool (Rekognition) and partnerships with law enforcement have drawn criticism, with concerns about privacy and surveillance.

14. Amazon’s Global Strategy

Amazon’s worldwide strategy is built on its main idea, putting customers first. But instead of using the exact same method everywhere, Amazon adapts to local needs while keeping its main principles of low prices, fast delivery, and convenience.

14.1. How Amazon Expands [29][3][4][5]

Amazon grows into new countries step by step:

-

First, developed markets: It entered countries like the UK and Germany, where online shopping was already common.

-

Then, growing markets: Later, it expanded to countries like India and Brazil, which have bigger challenges but also big growth opportunities.

To succeed, Amazon focuses on localization, meaning it adjusts to each country:

-

Adapting the Shopping Experience: In India, many people don’t use credit cards, so Amazon introduced Cash on Delivery.

-

Tailoring Products: It sells items popular in specific regions, like local foods or clothing, and aligns marketing with local holidays.

-

Building Infrastructure: Amazon builds local warehouses and works with local delivery companies to ensure quick service, investing billions.

-

Local Platform: Its website and apps are translated into local languages, show prices in local currencies, and follow local shopping festivals.

14.2. Partnerships [24]

Amazon forms partnerships to grow stronger worldwide:

-

It works with law enforcement and brands to fight counterfeit goods.

-

In cloud services (AWS), Amazon partners with thousands of companies to give better services and support.

-

These partnerships build trust and reach, making Amazon’s ecosystem stronger globally.

14.3. Key Principles Behind the Strategy [8]

No matter the country, Amazon follows the same guiding principles:

-

Customer-Centric: Always focus on the best customer experience.

-

Frugality: Keep costs low and pass on savings.

-

Long-Term Thinking: Willing to invest for years before making a profit.

-

Innovation: Continuously testing new ideas, like drone delivery or AI tools.

14.4. Expansion Case Studies [23] [15]

•India-A Success Story

Amazon entered India in 2013 and became very successful because it adapted well:

-

Languages: Created a multilingual app in Hindi, Tamil, Bengali, and more.

-

Payments: Introduced “Cash on Delivery.”

-

Logistics: Partnered with small shops through the “I Have Space” program for deliveries in rural areas.

-

Regulations: Designed its business model to match India’s foreign investment rules.

•China-A Failure Story

Amazon closed its Chinese marketplace in 2019 because it couldn’t compete:

-

Local Rivals: Alibaba and JD.com already dominated and knew Chinese consumers better.

-

Poor Localization: Amazon kept a Western-style site, while Chinese shoppers preferred social-media-integrated platforms.

-

Weak Logistics: Delivery speed and efficiency couldn’t match local competitors.

-

Cultural Gap: Amazon’s approach didn’t fit local consumer habits or culture.

15. Amazon’s Key Business Risks

Amazon is one of the biggest companies in the world, but its size and wide range of businesses also bring serious risks. These challenges come from governments, hackers, workers, and even the limits of its own growth.

15.1. Regulatory and Legal Risks

Because Amazon is so large and powerful, it is always under the watch of governments and regulators: [25]

-

Antitrust Lawsuits: In the U.S. and Europe, regulators argue that Amazon uses its power unfairly, such as promoting its own products over those of smaller sellers.

-

Possible Outcomes: These cases could lead to very large fines or force Amazon to change its business model. In extreme cases, regulators could even try to break parts of the company apart.

This is one of the biggest threats to Amazon’s future.

15.2. Operational and Financial Risks

Amazon’s main online store runs on very thin profits because it spends a lot on things like fast and free shipping. [14]

-

High Costs: To stay competitive, Amazon invests billions in its warehouses and delivery network.

-

AWS Dependence: Amazon Web Services (AWS) earns big profits and supports the company financially. But if AWS growth slows down, Amazon’s overall financial health could weaken.

-

Global Supply Chain Risks: Events like trade disputes, natural disasters, or political conflicts can disrupt Amazon’s ability to move goods worldwide.

15.3. Human Capital and Reputation Risks

Amazon’s treatment of workers often draws criticism: [30]

-

Warehouse Issues: Reports highlight strict monitoring, high injury rates, and tough performance demands.

-

Unionization & Strikes: Workers have tried to unionize, which Amazon has resisted. This can lead to labor disputes and negative publicity.

-

Reputation Damage: These issues can harm Amazon’s public image and may push governments to enforce stricter labor rules.

15.4. Cybersecurity and Data Privacy Risks

Amazon handles an enormous amount of personal and financial data, making it a major target for hackers: [24]

-

Cyberattacks: A big data breach could cost the company billions and make customers lose trust.

-

Privacy Concerns: Devices like Alexa collect customer data, which raises questions about how Amazon uses and protects that information.

-

Legal Challenges: Governments may introduce stricter rules on data privacy, limiting how Amazon can use customer data.

15.5. Market Saturation Risks

Amazon has grown very fast for many years, but now: [13]

-

Slowing Growth in Big Markets: In the U.S. and Europe, most people who want to shop online already use Amazon. There are fewer new customers to gain.

-

Need for New Growth Areas: To keep growing, Amazon is turning to new businesses like healthcare, advertising, and other services.

-

Shift in Focus: Instead of just chasing growth, Amazon may now need to focus more on profitability.

16.What Does the Future Hold for Amazon?

Amazon’s future will look different from its past. Instead of focusing only on rapid growth in online shopping, the company is now turning more toward profitability and innovation. Its biggest profits will come from businesses beyond retail.

16.1. The Rise of Profitability Engines [22]

Amazon’s online store still brings in a lot of money, but the profit margins are very small. That’s why the company relies on other businesses that make much bigger profits:

-

Amazon Web Services (AWS): This is Amazon’s cloud computing division. It’s the most profitable part of the company and keeps growing fast as more businesses and governments move their work to the cloud. With the rise of artificial intelligence (AI), AWS will become even more important.

-

Advertising: Amazon’s ads are becoming a huge money-maker. Since Amazon has so much customer data, it can give brands very targeted ads that work well. This part of the business is growing fast and could one day become as big as AWS.

16.2. New Growth Frontiers [2]

Amazon is investing heavily in long-term projects that could open up new markets in the future:

-

Artificial Intelligence (AI): AI powers nearly everything Amazon does from faster deliveries to Alexa to personalized shopping. The company is also working on new generative AI models to stay ahead in technology.

-

Project Kuiper (Satellite Internet): This is Amazon’s bold plan to launch satellites and provide high-speed internet worldwide, especially in areas that don’t have reliable internet. It could bring in millions of new customers and also connect with AWS’s cloud services.

-

Robotics: Amazon is using robots to make its warehouses and deliveries faster and cheaper. It already has millions of robots and is building even more advanced ones to improve efficiency.

-

Healthcare: With Amazon Pharmacy and One Medical, the company is entering the healthcare industry. Using its technology and logistics, Amazon wants to make healthcare more convenient and accessible.

17. Conclusion

Amazon has grown from an online bookstore into one of the world’s most powerful companies. Its success comes from always focusing on customers, building strong technology, and constantly trying new ideas. While its retail business still makes the brand famous, the real future of Amazon lies in cloud computing, advertising, artificial intelligence, satellites, robotics, and healthcare.

Amazon’s story is one of constant growth, innovation, and adaptation and the road has not been without challenges. The company continues to face serious issues such as regulatory pressures, criticism over working conditions, environmental impact, and increasing global competition. These risks remind us that even the largest companies must constantly evolve to survive.

Yet, Amazon’s future looks strong because it is not only focusing on selling products but also investing in high-growth, high-profit areas. Businesses like AWS and advertising are already major profit engines, while new projects in AI, satellite internet, and healthcare open doors to entirely new opportunities. By combining its core values of customer obsession, innovation, and long-term thinking, Amazon is building a future where it will remain one of the most influential companies worldwide.

However, Amazon is more than just a retailer, it is a global innovator that keeps reshaping industries, pushing boundaries, and defining how the world shops, works, and connects.

Reference

1.Wikipedia

2.Amazon

3.Accelingo

4.ColemanWick

5.eStore Factory

6.The Wall Street Journal

7.Investopedia

8.UPGRAD

9.Bueiness of Apps

10.Nasdaq

11.Investing.com

12.Macrotrends

13.Quartz

14.tastylive

15.Scribd

16.esols

17.Seller Snap

18.COURTHOUSE News Service

19.Business Dasher

20.Doit Software

21.EdrawMax

22.Marketplace Pulse

23.Research gate

24.Aws

25.Al Jazeera

26.S&P Global

27.Harvard Business School

28.highradius

29.MultiLipi

30.The Guardian

31.oxfam

32.Casecade

33.S&P Global

34.Fox Business

35.Statista

36.Visual Capitalist

37.Red Stag Fulfillment

38.Forex.com

39.Webretailer

40.Doofinder

41.Netpeak Journal

42.Supply Chain Dive

Share via: