Bitcoin, introduced in 2008 by Satoshi Nakamoto, invented a new way to think about money. Its decentralized structure, based on blockchain technology, facilitates peer-to-peer transactions without the intermediaries of banks or other government institutions. Bitcoin has a hard cap of 21 million coins, contributing to scarcity and its status as a valuable digital asset. Bitcoin, the largest cryptocurrency by market capitalization at approximately $500 billion as of 2025 stated at CoinMarketCap

- The trading history of Bitcoin since its introduction has been volatile and revolutionary

- Bitcoin was created to be used as a currency for everyday use.

- And even though Bitcoin is a cryptocurrency, investors have also used it as a store of value and an inflation and market uncertainty hedge.

- The price of Bitcoin is shaped by supply, demand, and market sentiment

The Attraction of Bitcoin as an Investment Asset

Some of Bitcoin’s value as an investment asset comes from its substantial returns. The last decade saw Bitcoin grow exponentially.

Exponential Growth: In 2011, Bitcoin’s price was less than $1 per coin. In late 2021, it again achieved an all-time high of almost $69K (source: CoinDesk). This steep price hike caught the attention of retail and institutional investors.

Institutional Interest: In 2021 , Bitcoin’s market cap increased by more than $1 trillion, as major corporates such as Tesla and MicroStrategy held Bitcoin on their balance sheets. Note that MicroStrategy, a business intelligence company, currently has 120k+ Bitcoins worth ~$5 Billion, per MicroStrategy Quarterly Reports. This institutional interest is another evidence of the realization that Bitcoin can serve as a digital gold.

Volatility: But Bitcoin’s volatility carries risks as well. It peaked in late 2021, then plummeted sharply throughout 2022, dropping to approximately $16,000. This exemplifies how vulnerable Bitcoin is to the whims of the market and regulatory news.

Impact of Bitcoin in Global Economy, Currency and Financial System

Bitcoin’s ability to hedge against inflation is increasing and can be seen during some economically declining periods. Bitcoin experienced gradual growth as governments worldwide implemented loose monetary policies to combat the COVID-19 pandemic, including low interest rates and stimulus spending. Bitcoin’s price skyrocketed over 300% in 2020 as traditional assets, such as stocks and bonds, provided lower yields in the low-interest-rate environment.

From the lens of its effect on world monetary systems, Bitcoin represents chances and challenges. According to Gold. org, Bitcoin has a $500 billion market cap as of 2025, it is still small (10x) compared to the $10 trillion gold market. Weighing on Bitcoin’s mainstream adoption is regulatory uncertainty, but it’s toppling of traditional financial systems is clear.

Continious Increase:

The number of blockchain wallet users has shown continuous growth from Q1 2016 to Q1 2019 without any declines.If we notice the curve, it seems to speed-growth after 2017, which could be a sign of growing interest and adoption of blockchain technology.A steep increase is noticeable during 2018 and can imply increasing curiosity influenced by the cryptocurrency gatherings.

Effects on Future:

If this trend continues, the adoption of the blockchain may increase further along with the bulk of its implementing user base in years to come.

Regulatory Barriers and Trump Bitcoin Regulations

The regulatory landscape is still an essential challenge to Bitcoin as a global phenomenon. Over 60 countries have already enacted or are considering cryptocurrency regulations in 2023. These regulations can go from outright bans — in China and India, for instance — to more friendly frameworks; in El Salvador, for example, the legal tender was adopted as Bitcoin in 2021. Bangladesh Bank has warned against using Bitcoin for payment and making investment with it because its value is not fixed and it may be used for illegal activity, but its formal stand on Bitcoin is not defined.

Regulatory uncertainty has been one of the main reasons behind the reluctance of institutional investors to invest in Bitcoin. The laws on Bitcoin and other virtual assets are gradually unfolding, with major financial centers such as the U.S. and Europe striving to construct clear legal frameworks for Bitcoin and other virtual assets.In the states, we have the SEC working on regulations surrounding exchanges and ICOs, which will likely lead to helping institutional capital flow more freely.

Bitcoin Mining — The Environmental Impact

Bitcoin energy consumption is one of the most contentious aspects of its nature. There is a Cambridge University study (2021) indicating that Bitcoin mining uses some 127 TWh (terawatt-hours) of electricity per year, which is more than the whole country of Argentina according to Cambridge Centre for Alternative Finance! This has raised a serious outcry over Bitcoin’s environmental footprint, as more mining -series get powered by non-renewable energy sources.

The environmental impact of Bitcoin mining has raised questions about its sustainability. In 2021, Tesla’s CEO, Elon Musk, famously suspended accepting Bitcoin for Tesla products, citing environmental issues. As a result, a good number of BTC miners are now seeking out renewable energy. Greenidge Generation is a U.S. Bitcoin miner that has a facility powered entirely on natural gas, but more renewable energy investments are coming to the fore, such as Hut 8 Mining stated at Bitcoin Magazine.

Read More: Impacts of the RMG sector on Bangladesh’s Economy

Bitcoin’s Potential as Digital Gold

Because of their similarities with the precious metal, Bitcoin is frequently called “digital gold.” Bitcoin, like gold, is scarce and durable, which makes both suitable as a store of value. In 2025 Bitcoin gets a $500 billion market cap (CoinMarketCap) compared to $10 trillion in gold market cap (Gold. org). Still, some observers view Bitcoin as an ever-better gold alternative, particularly given its track record amid global economic uncertainty.

In 2020, gold was up about 25% whereas Bitcoin was up over 300% (Yahoo Finance). This performance gap has attracted many investors to Bitcoin as an effective hedge against inflation. Indeed, institutions such as Paul Tudor Jones let their mouths run that Bitcoin may displace gold as the store of value of choice.

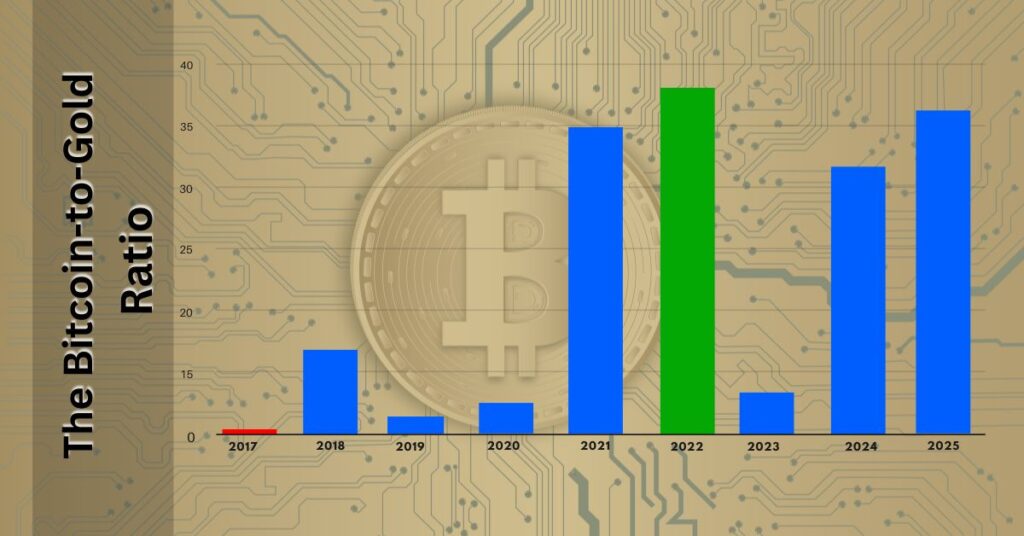

The primary visual seen though is a line chart from 2017 to 2024 showing all the variance of the ratio. The graph highlights some key points, such as:

- A low of 2.6 in 2019

- A high of 37.0 in 2022

- According to the last value as of November 11, 2025 is 35.2

- Moreover, an image of a scale, weighing Bitcoin against gold, symbolizes this asset comparison. Next to the scale is a confused-looking character assuring investors may be in doubt about the relative value of these assets.

Bitcoin and Cryptocurrency:Market Dynamics and Technological Innovation

It will be the technological innovation and the market forces that will decide the future of Bitcoin and the entire cryptocurrency market. One of the hottest topics in the cryptocurrency landscape is Decentralized Finance (DeFi), enabling traditional financial services such as lending, borrowing and trading on a blockchain. As of 2025, more than $100 billion was locked in DeFi protocols (DefiLlama), reflecting greater market interest in decentralized financial mechanisms versus established systems.

Bitcoin maintains an important role in this landscape. Bitcoin will still hold around 40-50% of the total market cap as late as 2025, according to data from CoinMarketCap. But the king is facing competition as alternative blockchain platforms such as Ethereum, which enables the execution of smart contracts and decentralized applications (dApps), continue to gain ground. Bitcoin Layer 2 solutions such as the Lightning Network can facilitate up to 1 million transactions per second, enabling Bitcoin to process more transactions than Ethereum, and making it relevant in the DeFi ecosystem.

The Current Status Of Bitcoin In Bangladesh

The central bank of Bangladesh has continuously raised concern about Bitcoin transactions in the country, due to the risks of money laundering and terrorist financing, as well as the absence of appropriate legal frameworks. In other words, Bitcoin trading and transactions are currently illegal in Bangladesh. Nonetheless, there’s an underground trade in cryptocurrency, suggesting an appetite for digital assets.

Legal and Regulatory Barriers

- Crypto Ban: The Bangladeshi government has a very strict position when it comes to cryptocurrencies and penalties for using Bitcoin.

- Finance Laws: Existing finance laws do not define Bitcoin as legal tender.

- Security Measures: There are stringent policies in place due to the fear that Bitcoin could be used for illegal activities.

Economic Implications of Bitcoin Adoption in Bangladesh

Despite the restrictions, showing there is demand for digital assets. Bitcoin faces regulatory headwinds, yet offers a prospect of diminishing economic opportunities:

- Financial Inclusion: Bangladesh is home to a sizable unbanked population. Bitcoin can offer financial services to the unbanked.

- Remittances and Cross-Border Payment Transactions: Remittances from expatriates are a lifeline for Bangladesh. It allows for lower payment costs and provides faster money transfers compared to traditional banking channels.

- Investment Opportunities: Bitcoin has emerged as a digital asset in the realm of safe investment. If well regulated, it could offer fresh opportunities for Bangladeshi investors and tech entrepreneurs.

Technological and Security Challenges

Several technology and security challenges hinder Bitcoin adoption in Bangladesh:

- Cybersecurity Risks: Bitcoin transactions can be hacked and fraudulent, a risk for investors and also users.

- Lack of Infrastructure: Currently, Bangladesh does not have the necessary facilities and so this can hinder effective implementation of Blockchain technology.

- Energy Consumption: Bitcoin mining is energy-intensive and worrisome in Bangladesh because of the existing energy crisis in the country, which could make it unsustainable.

Stakeholder Awareness and Social Attitudes

Bitcoin which is relatively a new currency has a mixed impression in the minds of the general people in Bangladesh. However, most may not be familiar with how it works or its possible advantages. Similar skepticism also exists because of negative media perceptions that link cryptocurrencies to scams and illicit activities. Public education around actual use cases for Bitcoin is critical to driving its wider adoption.

Strategies for Scaling Bitcoin as Payment

If Bangladesh subsequently seeks to embrace Bitcoin, it would have to do so judiciously and with proper regulatory oversight. Key recommendations include:

- Regulatory Framework: Create policies that guide the nature and field of Bitcoin transactions preventing illegal operations.

- Public Awareness Campaigns: Educate citizens about both the benefits and risks of Bitcoin through financial literacy.

- Strategic Partnership with Banking Institutions: Engage with banks and fintech to discuss viable ways to secure cryptocurrencies as a safer option.

Conclusion: The Future of Bitcoin in Finance

The rise of bitcoin from a niche digital currency to a global investment asset has been marked by volatility, regulatory scrutiny, and soaring institutional adoption. Bitcoin has come a long way since that first miner, and according to experts and analysts, will take even bigger steps in the coming decade, including increased adoption, new offerings in the ecosystem, and competition for gold and the stock market. That may turn it into a more mainstream asset, as clarity on regulations improves, and technical innovations like the Lightning Network enhance Bitcoin’s scalability.

However, its environmental impact, volatility, and regulatory uncertainty in major markets such as Bangladesh pose serious challenges that may determine its long-term adoption. Although Bitcoin’s future in the global financial system remains uncertain, its potential for addressing and disrupting the established ones is clear.

References

Share via: