As Bangladesh gears up for the unveiling of the National Budget 2025–26, anticipation is growing across households and industries alike. Early indicators suggest a widespread increase in prices of various essential and luxury items, stemming from planned adjustments in taxes and duties.

Earlier, in the afternoon, the Advisory Council of the Interim Government led by Dr. Muhammad Yunus approved the proposed budget for the fiscal year 2025-26. This approval was given in a meeting of the Advisory Council chaired by the Chief Adviser.

While this move is driven by the government’s intent to increase revenue and stabilize fiscal pressures, it could have ripple effects across different layers of the economy. Based on initial indications, a mix of relief and increased costs could be on the horizon.

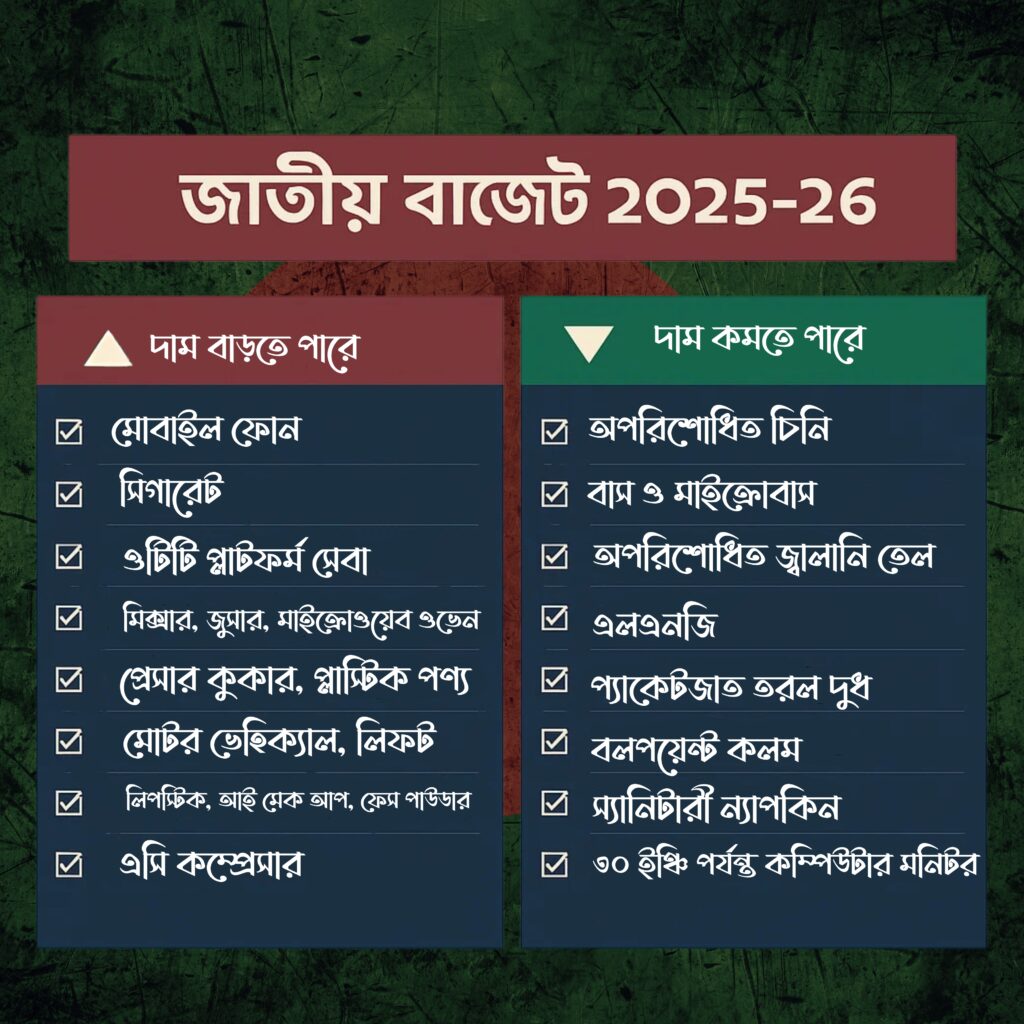

Potential Price Increases:

-

Mobile Phones

Customs duty and VAT adjustments may raise the prices of both imported and locally assembled smartphones. -

Cigarettes

Continuing its public health campaign, the government is likely to raise taxes on tobacco products, pushing cigarette prices higher. -

OTT Platforms

Digital entertainment platforms like Netflix, Amazon Prime, and local OTT services may face increased taxation under digital service brackets. -

Makeup and Personal Care Items

Products like mascara, eyeliner, foundation, and other beauty essentials may be subject to higher duties, impacting middle-class consumers especially. -

Plastic and Kitchen Items

Items such as pressure cookers and other plastic kitchenware may see a rise in price due to increased import duties or VAT revisions. -

Motor Vehicle Lubricants and Lifts

The auto industry may also feel the pressure, as prices of lubricants and mechanical lift systems are expected to climb. -

Household Appliances

Washing machines, refrigerators, and toilet accessories are likely to become costlier if the proposed tax hikes are approved. -

Air Conditioners

With rising temperatures, the anticipated hike in air conditioner prices could hit households and businesses hard. -

Electronics and Cosmetic Devices

Products like lipsticks, high-end makeup, and face powder are expected to see a spike in cost due to increased tariffs.

There are other list of items excluding upper items is:

-

Washing machines (both locally made and imported)

-

Online shopping (increased tax on digital services)

-

Blender, juicer, mixer, grinder (locally made)

-

Plastic goods and household plastic items

-

LPG cylinders (both locally made and imported)

-

Rods

-

Soap and shampoo

-

Foreign chocolates

-

Lipsticks and blades

-

Other household appliances such as microwave ovens, electric ovens, electric kettles, irons, rice cookers, pressure cookers

-

Ballpoint pens

-

Helicopter services

-

Locally made lifts

-

Locally made four-stroke three-wheelers

-

Commercial buildings (commercial space)

-

Self-copy paper, duplex board, coated paper

-

Threads, man-made fibers

-

Screws, nuts, bolts

-

Surgical kits

-

Ship scrap goods

-

Cement sheets

-

Credit rating services

-

Three-wheeler batteries

-

Set-top boxes

If prices of these items are increased, it is expected that the government’s revenue will increase and local industry development will be supported according to the budget objectives.

The potential hikes are part of a broader strategy by the government to increase revenue collection while also managing inflationary pressures and subsidies in critical sectors like energy and food. Economists are calling for a balanced approach that protects low- and middle-income households from further economic strain.

Read More: Big Boost for Women Entrepreneurs: 125 Crore Taka in Budget

Potential Price Decreases:

- Refined Sugar

The government is likely to reduce duties on raw sugar imports, aiming to stabilize the price of refined sugar for everyday consumers. - Bus and Minibus

To support public transport and ease vehicle procurement for operators, tax relief is expected on buses and minibuses. - Crude Fuel Oil

A cut in duties on unrefined fuel oil could help reduce transport and power generation costs. - LNG (Liquefied Natural Gas)

Lower import costs for LNG may translate into slightly reduced utility bills and operational expenses in industries. - Packaged Liquid Milk

In a move to support nutrition and affordability, VAT and duty reductions on packaged milk are on the cards. - Ballpoint Pens

Education support continues with proposed reductions in tax on pens, benefiting students and institutions. - Sanitary Napkins

A crucial step for menstrual health, sanitary napkins may finally become cheaper due to VAT and duty exemptions. - Computer Monitors (Up to 30 inches)

To push digital literacy and freelancing opportunities, prices for monitors up to 30 inches are likely to come down.

Source : Jamuna TV

Budget Deficit Set at Tk 2.26 Lakh Crore

In the FY 2025–26 budget, the government has set the deficit at Tk 2.26 lakh crore, with Tk 1.25 lakh crore to be financed from domestic sources and Tk 1.01 lakh crore from foreign sources.

Despite increased foreign loan payments due to taka depreciation, the adviser said the deficit remains “at a tolerable level.” Interest payments are projected at Tk 1.22 lakh crore, including Tk 1 lakh crore for domestic and Tk 22,000 crore for foreign loans. [Source: Somoy News]

Economic Impacts of the Budget Adjustments

The expected price hikes across multiple sectors will have mixed economic consequences, both positive and negative:

- Potential Negatives

Consumer Strain:

Middle- and lower-income groups may struggle with higher costs of daily items and services. - Reduced Purchasing Power:

Price hikes in electronics, beauty products, and appliances could reduce retail sales. - Increased Informal Trade:

Items like cigarettes and electronics may see growth in smuggling and gray-market sales. - Potential Positives

Higher Tax Revenue:

The government could close the fiscal gap and fund infrastructure, health, and education projects. - Encouragement for Local Industry:

Higher import taxes may incentivize local manufacturing, particularly in electronics and household appliances. - Tobacco Control Benefits:

If managed effectively, higher cigarette prices can discourage smoking, saving healthcare costs long-term.

Opportunities in Key Sectors

Despite the concern over rising costs, the budget also reveals potential areas for economic growth:

- Plastic Industry:

If incentives are included for local plastic goods manufacturing, this could reduce import dependency and create jobs. - OTT Services and Digital Economy:

New taxation on digital platforms could encourage homegrown OTT content production and local investment. - Consumer Electronics Assembly:

Price hikes on imported ACs, phones, and refrigerators may boost local assembly plants under “Made in Bangladesh” initiatives.