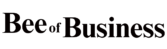

Bangladesh Bank Governor Dr. Ahsan H. Mansur has said that cash transactions encourage corruption and make tax evasion easier. Speaking at a seminar on development strategy, he emphasized the need to shift towards a cashless society. He also highlighted challenges in restoring discipline in the financial sector and shared how mobile financial services like “nano loans” are becoming popular.

Cash Transactions Linked to Corruption and Tax Evasion

At the seminar, Dr. Ahsan H. Mansur pointed out that cash transactions are a major reason behind corruption and tax evasion.

He said:

“নগদ লেনদেন দুর্নীতিকে উৎসাহিত করে, এর মাধ্যমে কর ফাঁকি দেয়াও সহজ।”

Translation: “Cash transactions encourage corruption, and through it, tax evasion also becomes easier.”

Read More: Deadly Bus Accident in Afghanistan Kills 71 Deportees from Iran

Move Towards a Cashless Society

The Governor stressed that Bangladesh must stop this trend and strengthen its foundation for a cashless society.

He added:

“এখন থেকে এই প্রবণতা বন্ধ করতে হবে। বাংলাদেশের ক্যাশলেস সোসাইটির ভিত্তি শক্তিশালী হচ্ছে। আগামী ৭-৮ বছরে বাংলাদেশ ক্যাশলেস ইকোনমির একটি বড় কেন্দ্র হবে।”

Translation: “From now, this trend must stop. The foundation of Bangladesh’s cashless society is getting stronger. In the next 7–8 years, Bangladesh will become a major hub of a cashless economy.”

Restoring Discipline in the Financial Sector

According to him, the biggest challenge is to bring back discipline in the financial sector. A strong financial system will also ensure a strong macroeconomy.

He explained:

“আর্থিক খাতে শৃঙ্খলা ফেরানোই হবে সবচেয়ে বড় চ্যালেঞ্জ। তাহলে সামষ্টিক অর্থনীতি শক্তিশালী হবে। একই সাথে আর্থিক খাতে লেনদেনে নতুনত্ব আনা প্রয়োজন, যাতে সবাইকে অন্তর্ভুক্ত করা যায়।”

Translation: “Restoring discipline in the financial sector will be the biggest challenge. Then the macroeconomy will become stronger. At the same time, innovation in financial transactions is needed so that everyone can be included.”

Rising Popularity of Nano Loans

The Governor also mentioned that mobile financial services are introducing new opportunities like “nano loans,” which are growing popular among people.

He informed:

“মোবাইল ফাইন্যান্সিয়াল সার্ভিসের ‘ন্যানো লোন’ ধারণা জনপ্রিয় হচ্ছে। প্রতিদিন গড়ে ৪ হাজার মানুষ পাচ্ছে এ ধরণের ঋণ সেবা। ৭ হাজার কোটি টাকা এভাবে ঋণ দেয়া হয়েছে।”

Translation: “The idea of ‘nano loans’ in mobile financial services is becoming popular. On average, 4,000 people are receiving such loan services every day. Around 7,000 crore taka has already been provided this way.”

Source: Jamuna Tv