The Dhaka Stock Exchange (DSE) encountered one of the most turbulent periods in its history during 2024 and 2025. This decline was not caused by a single event but by a combination of macroeconomic stress, political turmoil, regulatory missteps, and structural weaknesses. Investor confidence hit rock bottom, daily trading volume dropped drastically, and many retail investors exited the market after incurring significant losses. This article focuses on the multifaceted causes behind the downturn, including macroeconomic instability, political upheaval, regulatory interventions, and structural weaknesses within the capital market. Drawing upon recent data and expert analyses, it aims to provide a comprehensive understanding of the challenges facing the DSE and offers recommendations for restoring stability and investor trust.

Introduction

The Dhaka Stock Exchange (DSE) is the principal stock exchange of Bangladesh and serves as a crucial engine for the country’s economic growth. It facilitates the mobilization of capital, investment in businesses, and the democratization of wealth creation.However, in 2024 and 2025, the DSE faced a series of challenges that led to a significant decline in its performance. The period saw considerable volatility, with major indices such as the DSEX and DS30 experiencing notable declines.

Key factors contributing to this downturn included escalating energy prices, political uncertainty, and ongoing negotiations with international financial bodies like the International Monetary Fund (IMF). These developments, coupled with sectoral weaknesses and declining investor confidence, set the stage for a prolonged bearish market trend. This paper examines the factors behind the recent downturn in the DSE, focusing on the implications for investor confidence, economic pressures, and regulatory challenges in Bangladesh’s capital markets.

Market Decline: A Closer Look at Recent Developments

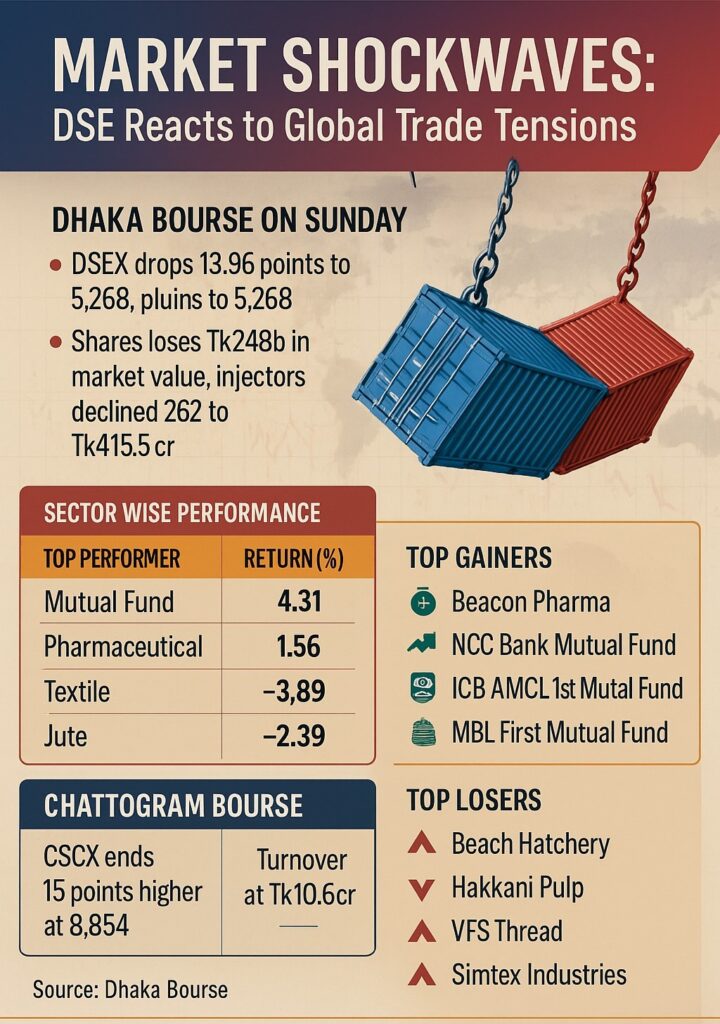

On one notable trading day during this period, the DSEX dropped by 23 points to close at 5,074, while the DS30 index, tracking blue-chip stocks, fell by 3 points to 1,872. Analysts, including those from EBL Securities, linked this specific decline to panic selling triggered by a sudden hike in gas prices, which led investors to anticipate a rise in industrial production costs. This prompted a widespread reassessment of risk and a withdrawal of investments, especially from sectors highly dependent on energy inputs. Concerns also escalated around the government’s ongoing negotiations with the International Monetary Fund (IMF), with fears that the financial assistance would be accompanied by stringent fiscal conditions.

Increase in Turnover Despite Bearish Sentiment

Despite the overall bearish sentiment, turnover on the DSE increased by 3.5% on that day, reaching Tk351 crore, up from Tk339 crore in the previous session. This was attributed to selective investments in undervalued or blue-chip stocks by a segment of long-term investors attempting to capitalize on low valuations. However, institutional investors remained largely passive, and retail investors showed growing reluctance to engage amid increasing uncertainty.

Sectoral Performance and Investor Sentiment

According to EBL Securities, the prolonged bearish trend continued to feed investor pessimism and uncertainty. Out of 396 issues traded, 101 advanced, 243 declined, and 52 remained unchanged. Sectoral analysis revealed that pharmaceuticals led turnover with an 18.8% share, followed by banks at 11.2% and general insurance at 10.6%. In contrast, the cement, travel, and mutual fund sectors saw the sharpest corrections, while the general insurance sector gained 1.3% and telecom edged up by 0.1%.

Impact of April 2025 Gas Price Hike

More recently, the April 2025 gas price hike of over 33% added another layer of pressure on the market. On April 15, the DSEX plunged by 37 points to 5,132 — its lowest in more than two months. The DS30 index also dropped by 18 points to 1,893. Analysts pointed to the rising cost of doing business, particularly for gas-dependent industries such as textiles, cement, and ceramics. The hike sparked fears of eroded profit margins and a renewed inflationary cycle. According to business leaders and economists, these higher costs threaten industrial competitiveness and could deter both domestic and foreign investment.

Concerns from Industry Bodies

The Foreign Investors’ Chamber of Commerce and Industry (FICCI) and the European Union Chamber of Commerce in Bangladesh (EuroCham) expressed concern that the tariff hike may create unintended barriers for industrial expansion. In response, policy think tank Business Initiative Leading Development (BUILD) urged the government to consider energy subsidies or alternative sources to mitigate the shock.

Bangladesh stock market weathers trump’s tariff storm, but uncertainty lingers

Despite global market instability caused by U.S. President Donald Trump’s aggressive tariff announcements, Bangladesh’s stock market showed surprising resilience following a nine-day Eid holiday in April 2025. Bangladesh’s market, having already seen prolonged bearish trends, didn’t overreact compared to more volatile global exchanges.

In April 2025, global stock markets were roiled by a sudden escalation in the U.S. tariff war under President Donald Trump. He announced a sharp increase in reciprocal tariffs, including a rise from 15% to 37% on goods imported from Bangladesh.Ashequr Rahman (MD, Midway Securities):

“Investors were initially rattled by Trump’s global tariff announcement, but confidence returned later in the day. The market has been bottomed out for years, which cushioned the impact.”

Key Factors Behind the Share Price Decline

Economic Challenges and Investor Confidence

Over the past eight years, more than 1.2 million investors have exited the stock market, leading to a significant drop in Beneficial Owner (BO) accounts from 2.92 million in 2016 to 1.67 million in 2024. This exodus is attributed to market volatility, losses from margin loans, and a general lack of trust in the market’s stability .

High Interest Rates and Alternative Investment Avenues

The banking sector’s attractive interest rates, with some deposits offering over 11%, have diverted funds away from the stock market. Additionally, the introduction of offshore banking options with tax-free profits has made fixed-income instruments more appealing to investors, further draining liquidity from the DSE .

Regulatory Actions and Market Interventions

The Bangladesh Securities and Exchange Commission (BSEC) has implemented measures like floor price impositions and circuit breaker limits to stabilize the market. However, these interventions, especially when executed without stakeholder consultations, have sometimes exacerbated market instability and eroded investor confidence .

Corporate Governance and Market Manipulation

Instances of market manipulation and lack of transparency have plagued the DSE. The 2011 stock market crash, for example, was attributed to manipulative practices by influential individuals, leading to significant investor losses . Such events have long-term repercussions on investor trust and market participation.

Macroeconomic Instabilities

External factors like the Russia-Ukraine war have impacted Bangladesh’s economy, leading to inflation rates above 9% for over 20 months. The devaluation of the taka by approximately 35% has increased import costs, affecting corporate earnings and, by extension, share prices .

Duration and Timeline of the Crisis

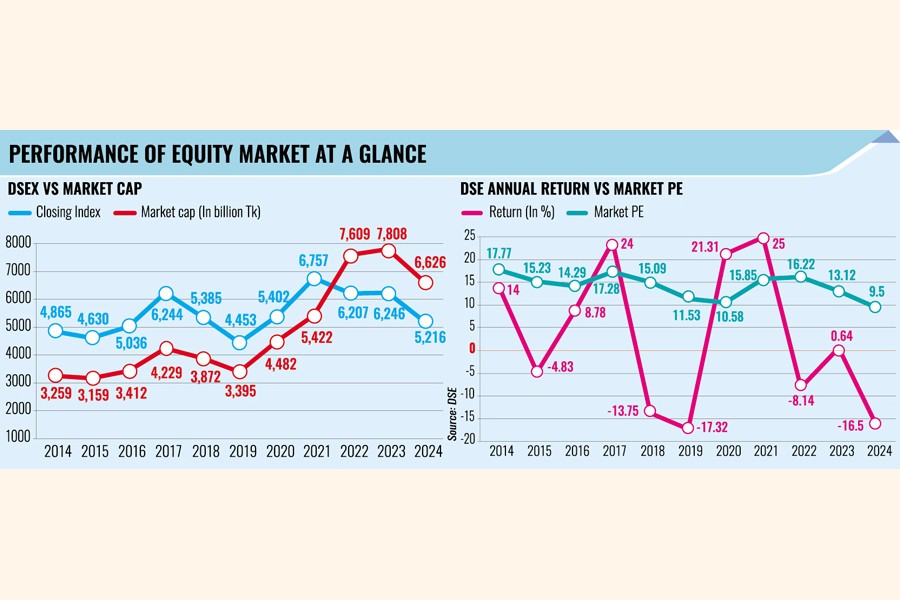

Understanding the historical context of the DSE’s instability helps illuminate the roots of current challenges:

2010–2011: The DSE experienced a significant crash due to rampant market manipulation and regulatory failure. This led to widespread investor losses and triggered mass protests.

2016–2024: A steady decline in investor confidence resulted in the closure of over 1.2 million Beneficiary Owner (BO) accounts. Market participation thinned, with only a small fraction of the population actively investing in equitie

2022: In response to global economic uncertainties and a rapid fall in stock prices, the Bangladesh Securities and Exchange Commission (BSEC) imposed a floor price mechanism to prevent further market decline.

2024: The DSEX index dropped by more than 1,000 points. Market capitalization declined by over Tk1 lakh crore. The crash was exacerbated by political instability, tax policy changes, and high inflation.

2025: The crisis deepened as gas prices rose by over 33% in April, impacting industrial production costs and sparking inflation fears. The DSEX continued its downward trajectory, hitting its lowest levels in over two months. Investor participation remained low, with institutional players largely passive and retail investors gripped by uncertainty.

Read More: UN Urges Nearly $1 Billion in Urgent Aid for Rohingya Refugees in Bangladesh

Why Was the Stock Market Missing at the Investment Summit?

The Bangladesh Investment Summit 2025, held earlier this year and organized by the Bangladesh Investment Development Authority (BIDA), was a high-profile event aimed at showcasing the country’s economic potential to local and foreign investors. While the summit attracted hundreds of foreign delegates and focused on key sectors with immediate investment opportunities, a glaring omission became the subject of significant debate — the complete absence of the capital market, particularly the Dhaka Stock Exchange (DSE), from the agenda.

BIDA’s Justification for Exclusion

BIDA officials explained that the summit was designed specifically for primary investors — those who invest directly in businesses, infrastructure, and development projects. They argued that secondary market investors (stock market participants) operate under different investment criteria and due diligence processes, and therefore, were not a focus this year. According to BIDA’s Executive Chairman Chowdhury Ashik Mahmud Bin Harun:

- The stock market’s market capitalization is relatively small compared to Bangladesh’s GDP.

- Mixing both primary and secondary investor focuses in a single summit would be “unproductive.”

- If needed, a separate program for capital market promotion would be more effective.

Reactions from Stock Market Stakeholders

Despite BIDA’s reasoning, capital market stakeholders voiced strong concerns over the exclusion: Minhaz Mannan Emon, Director of the Dhaka Stock Exchange (DSE), emphasized that excluding the stock market from such a major investment forum was a strategic misstep. He noted that:

- The stock market plays a crucial role in providing fundraising avenues for companies.

- It also allows entrepreneurs to exit by offloading shares to new investors.

- Even though the market has weaknesses, several listed companies are fundamentally strong and offer genuine investment opportunities.

Saiful Islam, President of the DSE Brokers Association (DBA), echoed these views, stating:

- The stock market is a vital part of the economy.

- Without a robust capital market, attracting sustainable foreign investment is difficult.

- The summit missed an opportunity to present the capital market as a viable platform for investment.

Implications for Economic Growth and Market Confidence

The exclusion of the stock market from a national investment promotion event has broader implications: It sends a message that the capital market is not in sync with Bangladesh’s economic development strategies.It raises concerns that policy makers are overlooking the importance of equity financing, in a country still heavily dependent on bank loans.The absence of a session dedicated to the stock market limits foreign investor awareness about its potential and ongoing reforms. Market experts argue that without an inclusive approach that integrates both primary and capital market investment channels, Bangladesh’s investment ecosystem remains incomplete.

Missed Opportunity for Reform Advocacy and Image Building

Previously, the Bangladesh Securities and Exchange Commission (BSEC) led roadshows abroad to promote the stock market. While some criticized these efforts, they did help raise awareness. Now that BIDA leads national investment promotion, stakeholders expected a more integrated approach — one that includes both infrastructure and capital markets.Emon pointed out that BIDA could have hosted a session to update investors on stock market reforms, valuation opportunities, and regulatory improvements.Instead, the summit’s entire focus on FDI and primary sectors once again highlighted the disconnect between market regulators and policymakers.

While BIDA defends the stock market’s exclusion on strategic grounds, many stakeholders believe this was a missed opportunity to promote a critical financial sector. In a developing economy like Bangladesh, the stock market should be seen as a partner in economic growth, not a separate or secondary concern. Integrating the equity market into future summits could enhance investor trust, support business expansion, and create a more balanced financing system — ultimately strengthening Bangladesh’s investment climate on both local and global fronts.

Real-Life Investor Experiences: The Human Cost of Market Decline

The economic landscape in 2025 has been challenging. High inflation rates, currency depreciation, and declining foreign reserves have created a precarious environment for investors. The DSE’s benchmark index, DSEX, experienced a significant drop, leading to substantial losses for many.

Altaf Hossain highlighted the dangers of margin loans:

“Many took out loans to invest, hoping for high returns. But as share prices plummeted, they became trapped in margin loans. As the value of shares, including those of medium- and low-quality companies, dropped, forced sales occurred, even for good shares, resulting in severe financial losses.”

Ashiqur Rahman Pinu, a retail investor, invested Tk 30 lakh in the stock market, half of which was borrowed from his sister residing abroad. Despite choosing comparatively sound companies and avoiding junk stocks, his investment value plummeted to Tk 16 lakh. The prolonged floor price mechanism prevented any returns for two years, straining family relations due to unmet financial expectations. Pinu expressed his frustration:

“Now, the stocks are falling. I am utterly disappointed. Once the stocks rise, I will sell them and leave the market. The investment in the stock market has already created a problem in my family.”

Tariq Mahmud, another investor, voiced his concerns: Investors are losing money daily. The primary reason people invest in the stock market is for financial gain. However, continuous losses have led to a lack of trust.These narratives underscore the profound personal and financial toll the market downturn has taken on individual investors.

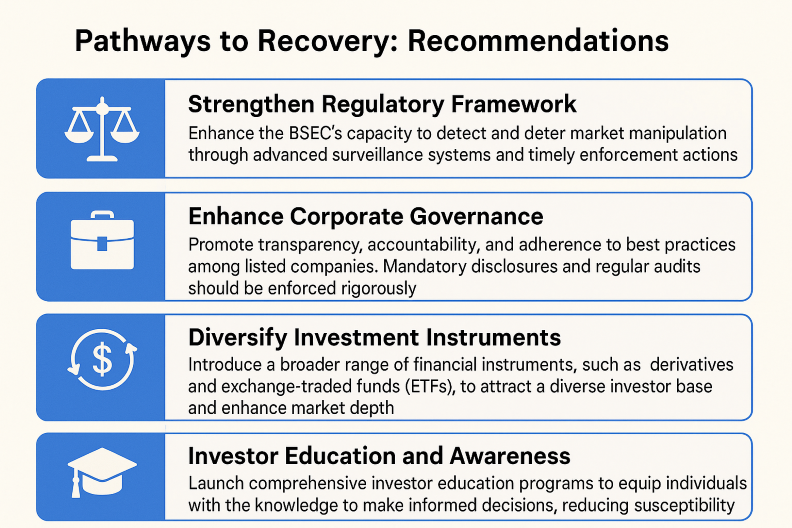

Pathways to Recovery: Recommendations

To rejuvenate the DSE and restore investor confidence, a multifaceted approach is essential:

Strengthen Regulatory Framework: Enhance the BSEC’s capacity to detect and deter market manipulation through advanced surveillance systems and timely enforcement actions.

Enhance Corporate Governance: Promote transparency, accountability, and adherence to best practices among listed companies. Mandatory disclosures and regular audits should be enforced rigorously.

Diversify Investment Instruments: Introduce a broader range of financial instruments, such as derivatives and exchange-traded funds (ETFs), to attract a diverse investor base and enhance market depth.

Investor Education and Awareness: Launch comprehensive investor education programs to equip individuals with the knowledge to make informed decisions, reducing susceptibility to market rumors and panic selling.

Macroeconomic Stabilization: Implement coordinated efforts to stabilize inflation, strengthen the currency, and rebuild foreign reserves. A stable macroeconomic environment will naturally bolster investor confidence in the capital market.

Regulatory Actions and Consequences in Bangladesh’s Stock Market (2010–2025)

A History of Policy Misfires: Over the past 15 years, the Bangladesh Securities and Exchange Commission (BSEC) introduced numerous rules and policy changes aimed at “protecting investors” and ensuring market stability. However, most of these moves have had unintended consequences, undermining investor confidence and damaging the capital market.

Questionable Leadership Extensions: Shibli Rubayat-ul Islam and M Khairul Hossain, two consecutive BSEC chairmen, received controversial tenure extensions. Despite poor market performance during their leadership, governance reforms were limited or poorly implemented.

Harmful Regulatory Decisions

1.Floor Price Imposition

- First implemented during the COVID-19 pandemic (2020), and again in 2022 during the Russia-Ukraine war.

- Critics argue this distorted price discovery and led to a liquidity crisis.

- Floor prices remain in place for six companies as of April 2025.

2.Mutual Fund Tenure Extensions

- In 2018, the Khairul-led commission extended the tenure of all closed-end mutual funds by 10 years without unitholder approval.

- This caused major backlash and legal challenges (e.g., by City of London Investment Management Company).

- Investors were denied timely returns, eroding trust in mutual funds.

3.IPO Approvals for Weak Companies

- Many poorly performing or non-transparent companies were allowed to go public.

- A large number of these IPOs resulted in long-term value erosion and downgrades.

4.Book-Building Restrictions: Overly strict valuation criteria discouraged company listings and mispriced offerings.

5.Circuit Breaker Adjustments: Frequent and inconsistent changes to price movement limits increased volatility and investor confusion.

Forced Sales and Institutional Investor Withdrawal

- The 2011–2012 attempts to stop forced sales under Khairul’s leadership led institutional investors to exit the market.

- Many institutions have since remained inactive, citing policy instability and previous losses.

Poor Pandemic Management

- The Dhaka Stock Exchange was closed for about two months during COVID-19 — longer than any major stock exchange globally.

- This abrupt closure disrupted capital flows and spooked foreign investors.

Mutual Fund Market Setbacks

Policy Missteps: Mandating AMCs to allocate 75% of assets to mutual funds — even during overvalued markets — led to significant losses. Allowing stock dividends as fund returns (rather than cash) was another controversial and globally rare move.

Result: Retail and institutional confidence in mutual funds collapsed. Investors began avoiding mutual fund products, impacting long-term capital formation.

Mohammad Emran Hasan, CEO of Investit Asset Management: “A regulator cannot set share prices… Floor prices dried up liquidity and harmed investor confidence.” Shekh Mohammad Rashedul Hasan, CEO of UCB Asset Management:“The BSEC must assure investors of policy consistency. Only then can confidence in mutual funds return.”

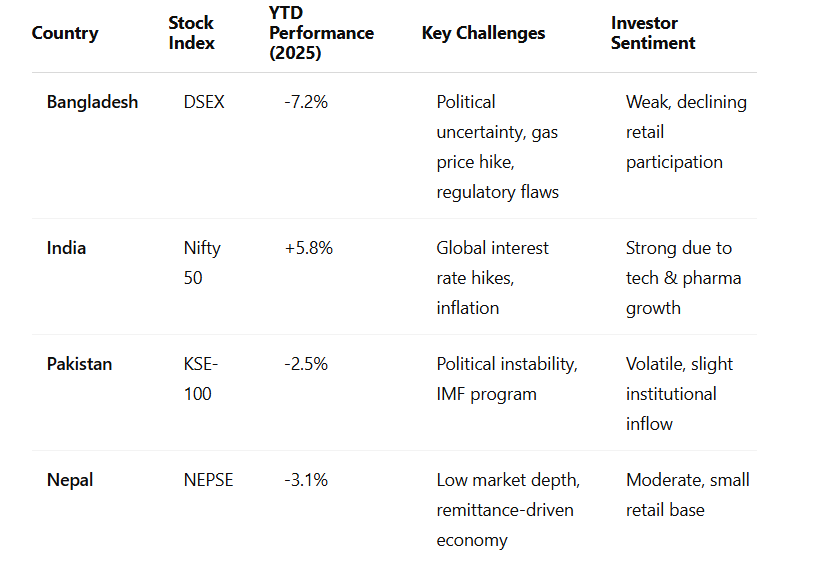

Comparative Analysis with Regional Markets

As seen, Bangladesh has the steepest decline among the listed markets, largely driven by internal policy challenges and low investor confidence. In contrast, India’s market has shown resilience due to a diversified economy and robust corporate earnings. Pakistan, while facing instability, has attracted some institutional capital due to currency adjustments and reform promises. Nepal remains relatively stable but limited in scale and liquidity.

Conclusion

The Dhaka Stock Exchange’s ongoing crisis reflects deep-rooted structural, regulatory, and economic challenges that have eroded investor confidence. From political instability and gas price hikes to policy missteps and poor market governance, multiple factors have converged to destabilize the capital market. Compared to regional counterparts, DSE lags significantly in resilience and reform. To restore faith, bold regulatory overhaul, enhanced investor education, and institutional participation are critical. Without swift and strategic intervention, the DSE risks prolonged stagnation in a rapidly evolving regional landscape.

References

Share via: