The government is planning to remove tax exemptions from many important industries in the upcoming national budget. This will be a major shift in tax policy and could increase the cost of doing business in sectors like manufacturing, construction, and e-commerce.

Big Tax Changes Coming in New Budget

According to sources from the Finance Ministry and the National Board of Revenue (NBR), the government plans to:

- Remove tax benefits from key local industries.

- Increase VAT (Value Added Tax) on several products.

- Reduce import duty exemptions on raw materials for at least 14 industries.

These changes are expected to increase production costs and place pressure on businesses and consumers alike.

Industries That May Face Higher Taxes

Many industries might be affected by higher taxes. These include:

- Mobile phone manufacturing

- Electronics and home appliances

- Toiletries

- LPG cylinders

- Elevators and compressors

- Refrigerators and air conditioners

- Cotton and synthetic yarn production

- Construction materials (like rods and coated paper)

Read More: From Nagad to Global RegTech: Mishuk’s Next Big Move

Construction Industry Also at Risk

The construction sector, which plays a vital role in the economy, may also see higher taxes. Proposed changes include:

- VAT on duplex boards and cement sheets

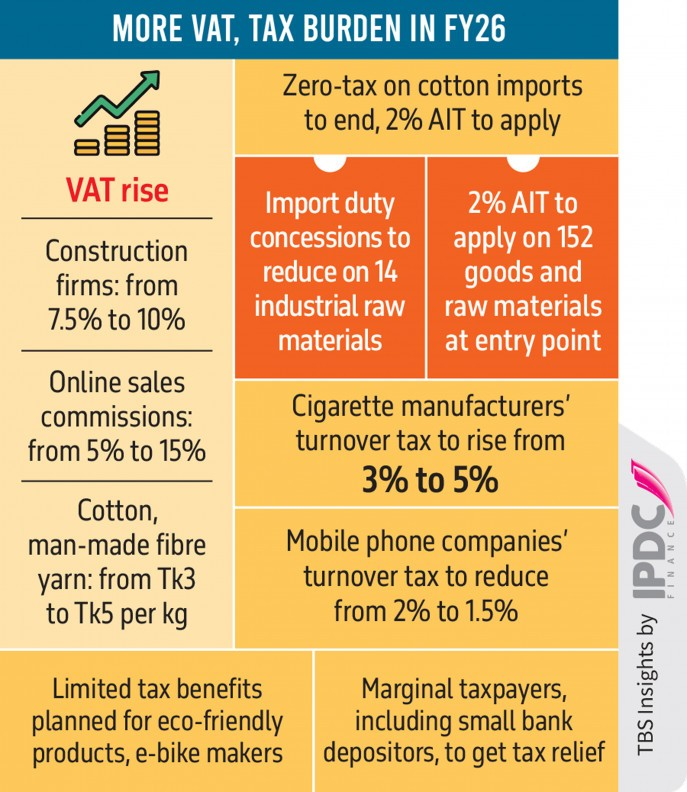

- Increasing VAT for construction companies from 7.5% to 10%

The government expects to collect an extra Tk 4,000 crore (40 billion) in revenue from these changes.

Digital Economy and E-Commerce May Be Affected

There’s also a plan to raise VAT on commissions earned through online product sales:

- VAT may go up from 5% to 15%

- E-commerce platforms and sellers will likely face increased costs

Cutting Import Duty Exemptions

Currently, many industries enjoy lower import duties on raw materials. This benefit may be removed.

- Higher duties will increase costs at the time of import

- 152 types of products and raw materials may face a 2% Advance Income Tax (AIT)

Limited Tax Relief May Remain for Some Sectors

Despite the cuts, some tax benefits may stay, such as:

- Eco-friendly product makers

- Electric bike manufacturers

- Certain dairy and healthcare-related products

Tax Burden Will Be Passed to Consumers

Professor Mustafizur Rahman of the Centre for Policy Dialogue (CPD) warned:

“Increased VAT and taxes will hurt industries and consumers. The cost of goods will rise.”

He suggested improving logistics and reducing business costs to reduce negative effects.

Budget Goals and Revenue Target

The government is aiming to:

- Collect an extra Tk 40,000 crore (400 billion) in taxes

- Reach a total revenue target of nearly Tk 5 lakh crore (5 trillion)

The national budget will be presented on June 2 and may be passed the same day.

Textile Industry to Face the Most Pressure

The textile sector may suffer the most:

- VAT on yarn production may increase from Tk 3 to Tk 5 per kg

- 2% Advance Income Tax may be added to cotton imports

Corporate tax for textile companies may rise from 22.5% to 27.5%

Industry Leader Speaks Out:

Khorshed Alam, Chairman of Little Star Spinning Mills, said:

“Due to gas shortage, we’re already running at only 30% capacity. If VAT increases, we may have to shut down.”

He added that small-scale weavers who make affordable clothes for poor people will suffer the most.

Hardware and Electronics May Also See Tax Hikes

- VAT for hardware like screws, bolts, and electrical parts may increase from 5% to 7.5%

- Mobile phone VAT rates may go up (2%, 5%, and 7.5%) to 4%, 7.5%, and 10%

- Washing machines, microwaves, ovens, and LPG cylinders may face higher VAT

- However, small electronics like blenders, rice cookers, and kettles may continue to enjoy 5% VAT until 2030

Other Product-Based Changes

- Soap and shampoo raw materials might keep a 5% VAT benefit next year

- Cigarette turnover tax may rise from 3% to 5%

- Import duty on cigarette paper may rise from 150% to 300%

- OTT and online streaming platforms may face a 10% supplementary duty

- Electric bike producers may lose their tax exemption and pay 15% VAT

Some Relief for Specific Sectors and Individuals

To provide some balance, the government may:

- Raise the tax-free bank deposit limit for low-income taxpayers from Tk 1 lakh to Tk 3 lakh

- Continue VAT exemption on LNG at the import level

- Offer tax relief for biodegradable product makers and eco-friendly industries

- Reduce duties for items like sanitary napkins, liquid milk, ball pens, and air travel insurance

- Cut supplementary duty on ice cream from 10% to 5%

Changes in Source Tax and Corporate Tax

Higher Source Tax (AIT) Proposed For:

- Over 150 products, including textiles

- Cigarette companies: from 3% to 5%

- Turnover tax: from 0.6% to 1%

Source Tax May Be Reduced For:

- Mobile phone companies

- Contractors: from 7% to 5%

- Farmers: from 1% to 0.5% for rice, wheat, potato, etc.

Other Tax Adjustments Being Considered

- Land registration tax may go down to 3%, 4%, and 6% (from 4%, 6%, and 8%)

- Recyclable industries may see tax cut from 3% to 1.5%

- Gas companies: from 2% to 0.6%

- Oil refining: from 2% to 1.5%

- Internet services: from 10% to 5%

- Electricity bills: from 6% to 4%

- Mobile operators: from 2% to 1.5%

Why This Tax Restructuring?

An NBR official explained:

“Some companies are paying more in source tax than their actual profits, leading to high refund demands. We are adjusting tax rates based on average sector profits.”

This new system is aimed at making taxation fairer and more efficient.

Source: TBS

Share via: