1. Introduction

RFL (Rangpur Foundry Limited) is a name that’s deeply connected to everyday life in Bangladesh. From plastic chairs and kitchen containers to water pumps and pipes—RFL products are used in homes, farms, schools, and shops across the country. What started as a small factory in Rangpur in 1981 has grown into one of Bangladesh’s biggest companies, trusted by millions. Today, RFL runs over 30 factories, employs more than 110,000 people, and brings useful products to every corner of the country—and even to other parts of the world.

PRAN‑RFL Group, a diversified powerhouse whose brands echo through every Bangladeshi household. Under RFL (Rangpur Foundry Ltd.), rivers of molten metal and polymers become water pumps, PVC pipes, furniture, kitchenware, and toys—durable symbols of Bangladeshi industry stamped “Made in Bangladesh.”

2. Background of RFL

RFL’s goal is simple: make daily life easier and better for everyone, using quality materials made right here in Bangladesh. With each product, RFL is not only supporting families and communities but also helping build a stronger, self-reliant nation.

2.1 Identifying the Gap

Back in the early 1980s, everyday life in rural Bangladesh was full of struggles. Farmers were working hard to grow crops, but they lacked basic tools like water pumps, pipes, or even strong buckets to carry water. In villages, many people still relied on traditional or imported items that were either too expensive or not built for their needs. At the same time, there were no local companies producing these essential products at a large scale. Bangladesh was importing even the simplest household and farming tools. That’s when the idea behind RFL took shape:

“What if we could make these tools ourselves—right here in Bangladesh—for our own people?”

2.2 The Founder’s Vision

This vision came from Major General Amjad Khan Chowdhury, a retired army officer with a strong desire to improve lives in rural areas. In 1981, he founded RFL (Rangpur Foundry Ltd.) with a clear purpose: To make durable, affordable tools—like tube wells, irrigation pumps, pipes, and buckets—that would help farmers and families across the country.

Alongside RFL, he also established PRAN to support farmers by turning surplus fruits and vegetables into food products. But RFL had a different mission: it focused on manufacturing essential goods that rural Bangladesh needed to grow, build, and live better. His dream was simple yet powerful: If we make our own products using our own people and materials, we won’t just save money—we’ll build a stronger, self-reliant Bangladesh where both villages and cities can thrive.

2.5. Formation and Early Operations

RFL (Rangpur Foundry Ltd.) began its journey from a small facility in Rangpur, initially focusing on producing manual tube wells and irrigation pumps to help farmers access clean water and support agriculture.

- In its first year, RFL earned a modest revenue of less than BDT 10 lakh (approximately USD 12,000). But even with this small beginning, it made a big impact. Their pumps were reliable, affordable, and locally made—something that rural families had never experienced before.

- Throughout the 1980s, RFL steadily expanded its product range to include pipes, buckets, and other cast iron tools, responding to growing demand in both rural and urban areas. The success of these basic tools encouraged the company to explore plastic product manufacturing in the 1990s.

- By the early 2000s, RFL had evolved into a household name, producing a wide range of items including plastic furniture, kitchenware, water tanks, and sanitary items. Its expansion was backed by increased factory capacity, local workforce development, and a growing rural-to-urban customer base.

- In just a few decades, what began as a small foundry became one of the largest industrial manufacturing brands in Bangladesh, operating over 30 factories and exporting to multiple countries.

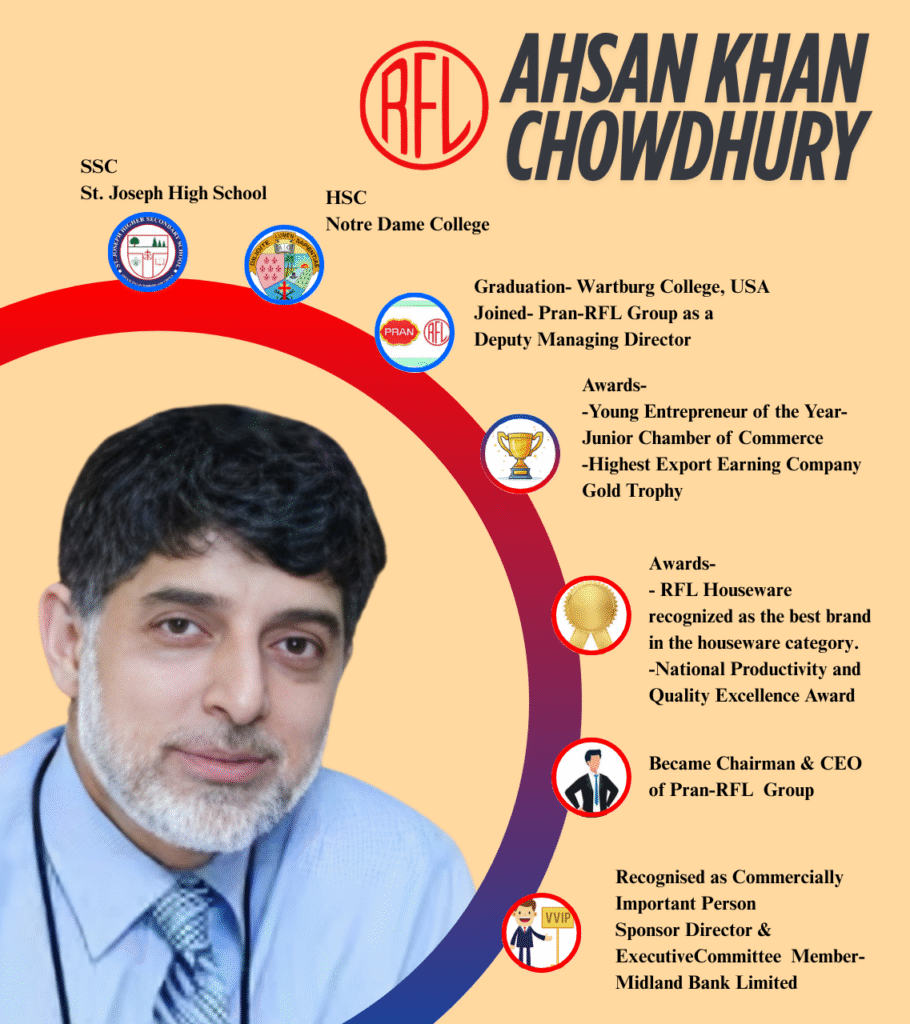

2.4. Ahsan Khan Chowdhury’s Leadership

After the passing of Major General Amjad Khan Chowdhury in 2015, the leadership of RFL (Rangpur Foundry Limited) was taken over by his son, Ahsan Khan Chowdhury, who is now the Chairman and CEO of PRAN-RFL Group.

While his father had laid the foundation in rural manufacturing, Ahsan focused on scaling up, diversifying the product line, and reaching global markets. He led RFL into new areas like:

- Plastic and PVC-based products

- Modern furniture manufacturing

- Industrial items like tools, tanks, pipes, and containers

- Home solutions like kitchenware, bathroom fittings, and water filters

Ahsan Khan Chowdhury also pushed for automation and innovation within RFL’s factories—bringing in better machines, improving worker training, and introducing eco-friendly practices. He expanded RFL’s factory network to over 30 production units and increased its workforce to more than 110,000 employees. With his leadership, RFL became:

- One of Bangladesh’s most trusted brands in plastic and household products

- A regular exporter to over 50 countries

- A company that balances business with social impact, supporting rural development and local employment

Ahsan once said, “My father believed in the power of the village. I believe in taking that power to the world.” And that’s exactly what RFL has done—grown from a foundry in Rangpur into a symbol of Bangladesh’s industrial future. As of 2025 RFL’S CEO Ahsan Khan Chowdhury , COO Afzlur Rahman, Managing Director Rathendra Nath Paul

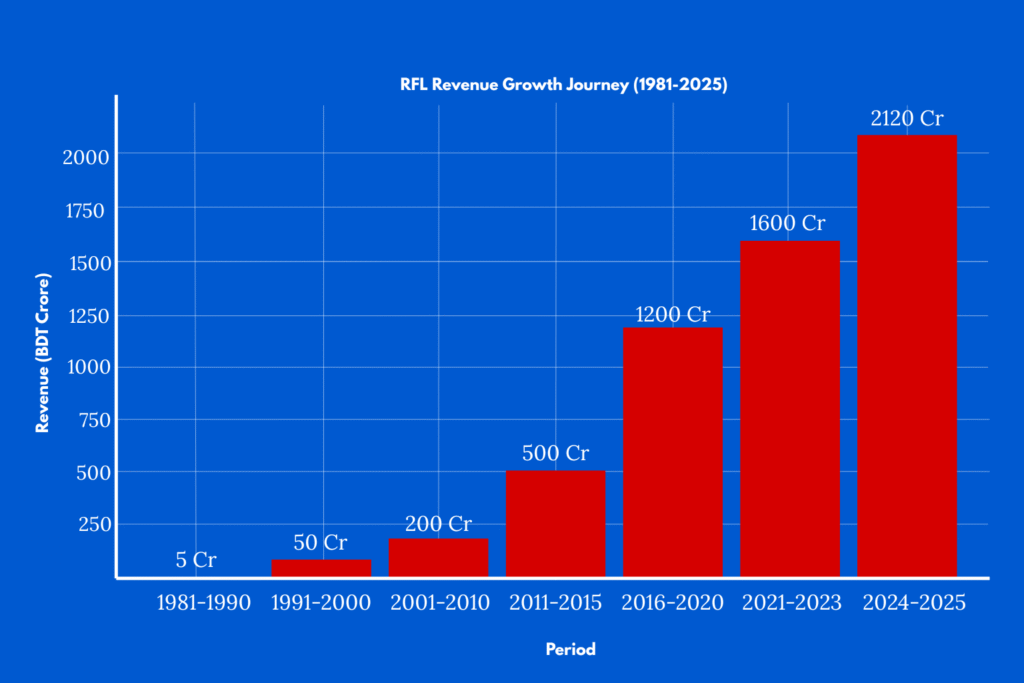

4. RFL Revenue Overview (1981–2025)

RFL, starting as a small foundry in Rangpur, has grown into a leading manufacturer of plastic, metal, and household products in Bangladesh. Its steady revenue growth reflects successful product diversification, rural empowerment, and expansion into export markets.

4.1. Revenue Growth Journey

RFL began operations in 1981 with limited production focused on cast iron tube wells and water pumps. Initial annual revenue was modest, estimated below BDT 5 crore, mainly serving rural farmers in northern Bangladesh.

- 1991–2000: Early Expansion

By the 1990s, RFL expanded into plastic products like pipes, buckets, and household containers. Revenue grew steadily, surpassing BDT 50 crore by 2000, as distribution widened to urban centers alongside rural markets. - 2001–2010: Product Diversification and Industrial Growth

RFL broadened its product line to include plastic furniture, kitchenware, water tanks, and sanitary items. Revenue crossed BDT 200 crore by 2010, driven by growing domestic demand and improvements in manufacturing capacity. - 2011–2015: Manufacturing Modernization and Export Entry

With investments in automation and technology upgrades, RFL began exporting products to neighboring countries and the Middle East. Domestic revenue climbed to approximately BDT 500 crore, with exports contributing 10–15% of sales by 2015. - 2016–2020: Scale and Global Reach

RFL grew its factory network to over 20 plants, producing over 800 product varieties. Exports expanded to more than 40 countries, including the USA and Europe. Annual revenue crossed BDT 1,200 crore by 2020, making RFL one of Bangladesh’s top industrial exporters. - 2021–2023: Pandemic Adaptation and E-commerce Growth

Despite global challenges, RFL adapted by strengthening its online presence and supply chain. New product launches, especially in consumer plastics and industrial segments, fueled revenue growth to an estimated BDT 1,600 crore by 2023. - 2024–2025: Innovation and Sustainability Focus

RFL introduced eco-friendly products and expanded digital marketing. Revenue is projected to reach BDT 2,000 crore in 2024 and BDT 2,250 crore by the end of 2025, led by higher demand for sustainable goods and export growth.

4.2. Financial Performance

- 2010: Revenue reached BDT 200 crore due to expanded product lines and rising domestic demand.

- 2015: Revenue crossed BDT 500 crore, boosted by entry into export markets.

- 2020: Revenue exceeded BDT 1,200 crore, supported by new factories and product diversification.

- 2023: Estimated revenue of BDT 1,600 crore, with growing online and export sales.

- 2025 (Projected): Revenue expected to hit BDT 2,250 crore, driven by innovation and sustainability trends.

4.3. Profitability and Projections

RFL has maintained healthy profit margins by leveraging economies of scale, efficient production, and export incentives.

- 2020: Operating profit margin around 12%, with estimated net profit of BDT 144 crore.

- 2023: Profit margins improved to about 14% due to automation and cost control; net profit estimated at BDT 224 crore.

- 2025 (Forecast): Net profit expected to reach BDT 300 crore, supported by premium product launches and export expansion.

Read more: Bangladesh start receiving 40 MW of hydroelectric power from Nepal

5. RFL Marketing and Revenue Impact

Between 2020 and 2025, RFL launched several key marketing campaigns that reinforced its brand presence, expanded customer reach, and significantly contributed to revenue growth. These campaigns focused on quality, innovation, sustainability, and connecting with both rural and urban consumers. সবচেয়ে শক্তপোক্ত চেয়ার” campaign for plastic chairs, Vision Electronics’ “সবাইয়ের জন্য প্রযুক্তি” promoting affordable gadgets, Best Buy TV commercials this type of marketing enhance their marketing and revenue.

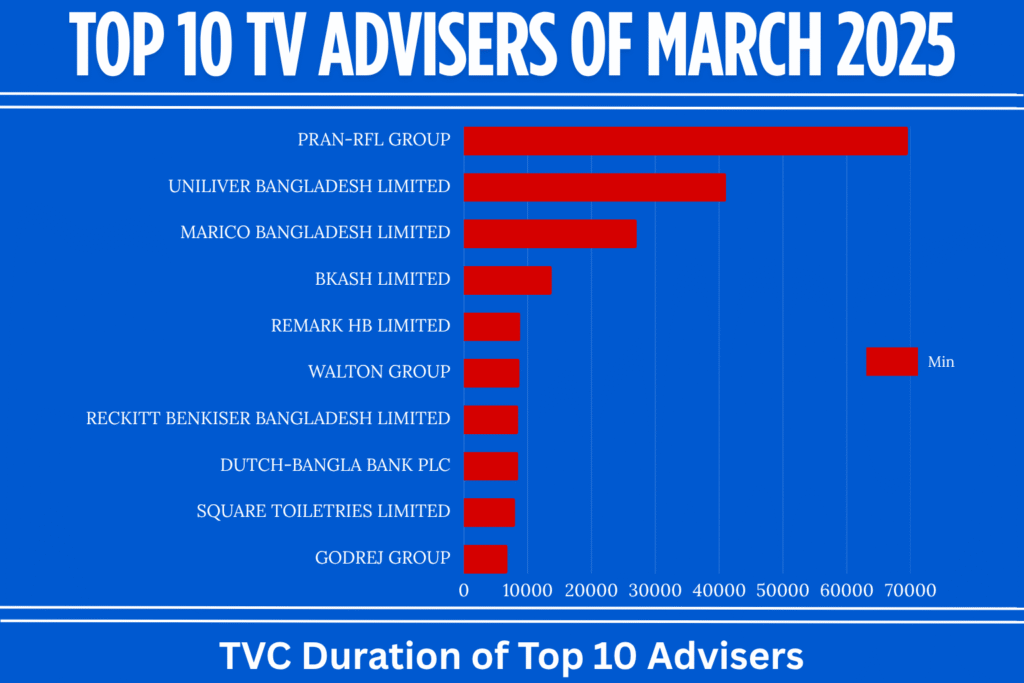

In March 2025, Pran RFL Group emerged as the top advertiser on Bangladeshi television, securing 69,583 minutes of total commercial airtime across 35 local TV channels. Unilever Bangladesh Limited followed with 41,093 minutes, while Marico Bangladesh Limited ranked third with 27,101 minutes.

The list also includes major players like bKash Limited (13,794 minutes), Remark HB Limited (8,854 minutes), Walton Group (8,749 minutes), and Reckitt Benckiser Bangladesh Limited (8,536 minutes). Dutch-Bangla Bank PLC and Square Toiletries Limited both recorded airtime slightly above 8,000 minutes, while Godrej Group rounded out the top ten with 6,868 minutes.

The data, gathered from 35 television channels, reflects the aggressive marketing strategies of top FMCG, tech, and financial service companies vying for consumer attention in Bangladesh’s competitive market.

“Built to Last” Campaign (2020–2021)

- Focus: Highlighted the durability and reliability of RFL’s plastic furniture, water tanks, and kitchenware.

- Channels: Television, radio, billboards, and social media ads.

- Impact: Increased consumer trust, boosting sales especially in rural and semi-urban markets. The campaign helped RFL increase revenue by an estimated 15% in 2020 compared to the previous year.

“Green Future” Sustainability Initiative (2021–2023)

- Focus: Promoted RFL’s eco-friendly product lines made from recyclable and biodegradable plastics.

- Channels: Digital marketing, influencer partnerships, community events, and CSR activities.

- Impact: Improved brand image among environmentally conscious consumers and institutions. Contributed to a 10% revenue growth annually in sustainable product categories.

“RFL Digital Bazaar” Launch (2022)

- Focus: Expansion into e-commerce with a dedicated online store and partnerships with major platforms like Daraz and AjkerDeal.

- Channels: Social media marketing, influencer campaigns, and online ads.

- Impact: Captured younger urban demographics and boosted direct sales. Online sales accounted for 12% of total revenue by 2023, contributing to overall growth.

“Empowering Village Entrepreneurs” Program (2023–2024)

- Focus: Engaged local shop owners and small businesses as brand ambassadors and distributors in rural areas.

- Channels: On-ground training, community workshops, and incentive programs.

- Impact: Expanded rural penetration, increasing market share in previously underserved regions. This initiative helped raise rural sales by 18% in 2024.

“RFL Export Excellence” Campaign (2024–2025)

- Focus: Showcased RFL’s product quality and certifications (ISO, HACCP) to global markets, targeting Middle East, Europe, and North America.

- Channels: Participation in international trade fairs (e.g., Gulfood), digital marketing, and B2B outreach.

- Impact: Export revenue grew by 25% in 2024 and contributed significantly to overall revenue growth projected for 2025.

“RFL Mother’s Day Campaign & Website Launch” (2025)

- Focus: Celebrated mothers across Bangladesh by highlighting how RFL products support daily household life, while launching a revamped e-commerce website to boost digital sales and customer engagement.

- Channels: Emotional video storytelling on TV and social media, user-generated content campaigns on Facebook, Instagram, and YouTube using hashtags like #ShantiMaaRFL, special discount bundles in retail stores and online, and the launch of RFL’s official website with integrated online shopping and customer support.

- Impact: Website traffic increased by 40% in the first month, online sales grew by 25% during the campaign, and social media engagement reached over 10,000 user posts and shares, strengthening RFL’s digital presence and customer loyalty.

6. RFL’s Diversification and Manufacturing

RFL’s evolution is characterized by aggressive diversification and vertical integration. It now comprises several distinct divisions:

6.1 Plastic Division

- Household items: buckets, bowls, baskets, tubs

- Furniture: chairs, tables, wardrobes

- Kitchenware: containers, trays, racks

- School and office supplies

6.2 Hardware and Tools

- Water pumps

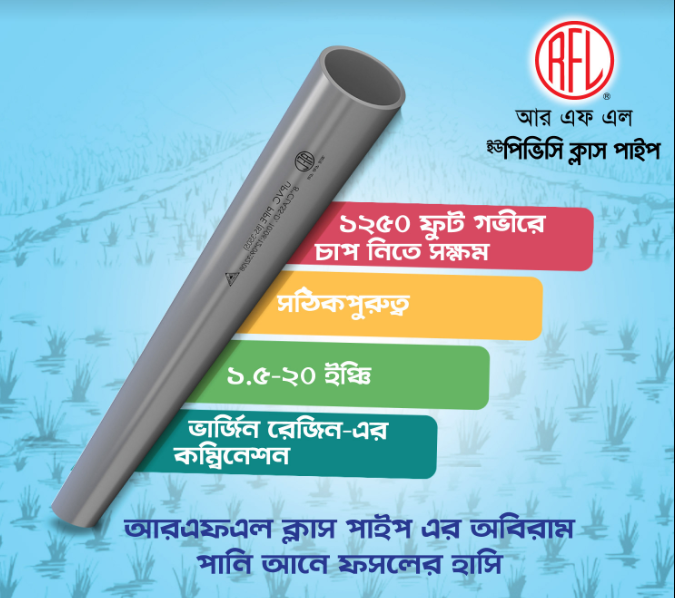

- PVC, CPVC, and UPVC pipe systems

- Bathroom fittings and sanitary wares

- Agricultural and irrigation tools

6.3 Electronics and Appliances

- Fans, lights, switches

- Blenders, rice cookers, irons

6.4 Construction and Infrastructure

- Doors, windows, panels

- Tanks, basins, and pipes for construction needs

6.5 Furniture

- Plastic, metal, and wooden furniture for home, office, and education institutions

6.6 Retail

RFL also launched several retail brands:

- Best Buy: One-stop home and lifestyle product retail outlet

- Vision Electronics: Affordable home appliances

- Eco+: Budget-friendly electronics brand

RFL operates numerous manufacturing plants across Bangladesh—Narsingdi, Habiganj, Rangpur, and Gazipur being major hubs. These plants are equipped with modern injection molding, blow molding, die casting, and extrusion machinery. The company employs over 40,000 workers, many of whom are semi-skilled or unskilled, thereby creating a strong employment generation impact. It has dedicated R&D and QC teams to monitor innovation and ensure product standards. To reduce reliance on imports and ensure steady supply, RFL sources plastic resin (like HDPE, LDPE, PP), metals, and pigments both locally and internationally. It has also established partnerships with petrochemical suppliers in the UAE, China, and India.

7. How RFL Overcome Big Challenges and Grow Stronger

RFL has weathered a wide spectrum of challenges. Its knack for turning problems into platforms for innovation has kept the brand resilient, relevant, and profitable.

7.1. Raw‑Material Price

Challenge: RFL’s core inputs—polymer resins and rolled steel—are tied to global oil and commodity markets. A single quarter of price turbulence can erode margins across thousands of SKUs.

Solution: RFL now secures long‑term supply contracts with GCC petrochemical producers, operates Bangladesh’s largest in‑house plastics‑recycling plant (20 kt/yr), and hedges resin costs through futures on the Dalian Commodity Exchange. Recycled resin already feeds 18 % of its consumer‑plastic lines, cushioning price shocks.

7.2. Environmental Pressure on Plastics

Challenge: Growing public concern over single‑use plastics and looming bans on certain items threaten RFL’s flagship categories.

Solution: Under its “Green Future” roadmap, RFL has:

- launched bio‑based tableware and oxo‑biodegradable shopping bags,

- installed take‑back bins at 500 Best Buy outlets, and

- earned ISO 14001 certification at six plants.

These moves pre‑empt regulation and reposition RFL as a sustainability leader rather than a polluter.

7.3. Logistics & Ports Jam

Challenge: Chattogram port delays and festival‑season traffic jams can cripple deliveries during peak demand.

Solution: RFL built satellite warehouses in Bogura, Cumilla, and Jashore, added rail freight from Kamalapur ICD, and adopted AI‑driven route optimisation (developed with a2i). Average lead‑time to retailers dropped from 72 h (2021) to 46 h (2024), even during Eid peaks.

7.4. Low‑Quality Imitations and Grey‑Market Imports

Challenge: Cheaper Chinese chairs and counterfeit “RFL” buckets erode trust and undercut pricing.

Solution: The company introduced laser‑etched authenticity codes and a scan‑to‑verify mobile app, while a dedicated brand‑protection team works with customs to seize fakes. Consumer‑side education (“Look for the Laser”) runs across TV and social media, reinforcing quality credentials.

7.5. Energy Shortages & Rising Utility Costs

Challenge: Load‑shedding and soaring electricity tariffs inflate manufacturing costs and disrupt shift schedules.

Solution: RFL has installed 20 MW of rooftop solar (target 50 MW by 2026) and converted its largest Narsingdi plant to trigeneration (power‑steam‑chilling). Combined, these cut grid dependence by 28 % and save ► BDT 120 crore annually.

7.6. Workforce Upskilling amid Automation

Challenge: Injection‑moulding robots and IoT quality controls demand new skills, risking job displacement and production errors.

Solution: A tripartite program with BUET and Skills for Employment Investment Program (SEIP) retrains operators as “polymer‑process technicians.” Over 4 000 workers have earned NVQ Level 3 certificates, keeping human capital aligned with the automation drive.

7.7. Market Saturation

Challenge: With brand penetration already above 85 % in Bangladesh, incremental domestic growth is costly.

Solution: RFL’s “Export Excellence” campaign (2024–25) shifts focus outward—spotlighting ISO, HACCP, and halal credentials at expos such as Gulfood and Ambiente. Coupled with custom‑mould services for overseas buyers, exports rose 25 % in 2024 and are on track to top BDT 450 crore in 2025.

RFL’s ability to pre‑empt risks, invest in technology, and embed social responsibility ensures that each hurdle becomes a launch‑pad for the next growth wave—cementing its status as Bangladesh’s industrial standard‑bearer.

8. Comparison with Other Leading Bangladeshi Brands( RFL vs Bengal, Partex, BSRM )

To understand RFL’s market position in Bangladesh’s plastic and light-engineering industry, it’s important to compare it with major local competitors like Bengal Group, Partex Group, and BSRM.

8.1 RFL vs Bengal Group

| Dimension | RFL (Rangpur Foundry Ltd.) | Bengal Group / Bengal Windsor Thermoplastics |

| Launch & Operator | 1981; founded by Maj‑Gen Amjad Khan Chowdhury; now steered by Ahsan Khan Chowdhury. | 1969; created by Morshed Alam; plastics arm listed as Bengal Windsor Thermoplastics PLC. |

| Market Position | No. 1 in household plastics, PVC pipes, pumps & furniture. | Strong in industrial & consumer plastics; narrower SKU count in household goods. |

| Customer Base | 500 + Best Buy showrooms, 100 k + rural retailers. | Strong urban presence; exports to 60 + countries. |

| Revenue FY 2024 | BDT 1.45 billion (listed entity, ttm) stockanalysis.com | BDT 0.80 billion (FY 2024) stockanalysis.com |

| Pricing & Positioning | Mass‑to‑mid premium, “Made‑in‑Bangladesh” pride. | Mid‑priced, emphasises moulding quality & design. |

8.2 RFL vs Partex Group

8.3 RFL vs BSRM (Hardware / Industrial Segment)

9. Impact on Economy

As one of the largest plastic and consumer goods manufacturers in Bangladesh, RFL has played a significant role in shaping the national economy, particularly through industrial employment, rural empowerment, and digital adoption. Its expansion and tech-driven transformation over the past five years have created ripple effects across manufacturing, logistics, e-commerce, and digital finance.

Employment and Skill Development

RFL operates more than 25 manufacturing plants across Bangladesh, creating direct employment for over 40,000 people and indirect jobs for over 100,000, including factory workers, delivery agents, retailers, and technicians. Through technical training programs and in-house skill development, RFL has contributed to upskilling the workforce, particularly in rural and semi-urban areas.

Boost to Rural Economy

With over 1,000 RFL Best Buy outlets and thousands of local retail points, RFL ensures that income and commerce are not Dhaka-centric. Its decentralized retail strategy pumps money into rural areas, supporting small shop owners, transport operators, and local raw material suppliers. This model has helped reduce regional economic inequality.

Contribution to Export Growth

RFL’s export operations—particularly in plastic furniture, pipes, and household items—have expanded significantly since 2020. It now exports to over 70 countries, including India, Nepal, UAE, and several African nations. Export earnings from RFL crossed USD 60 million in 2024, contributing to Bangladesh’s non-RMG (ready-made garment) export diversification.

E-Commerce and Digital Retail Expansion

RFL was among the first industrial brands to launch a fully integrated e-commerce platform (www.rflbestbuy.com) and also partnered with marketplaces like Daraz, Chaldal, Pickaboo, and Evaly (before its collapse). From 2021 to 2025, online sales grew by 210%, helping normalize the online purchase of household items, pipes, cookware, and tools.

Integration with Digital Payment Systems

RFL products are widely purchased via bKash, Nagad, Rocket, and mobile POS systems at retail shops. Its promotion of cashless transactions has helped grow transaction volumes for MFS (mobile financial services), especially in suburban and rural outlets, where RFL has a strong presence.

Digitization of Manufacturing and Inventory

Between 2022 and 2025, RFL invested in smart ERP systems, IoT-based production tracking, and automated warehousing to boost productivity. This digital transformation reduced lead times, improved stock visibility, and minimized resource wastage, indirectly encouraging digital transformation among its suppliers and SME partners.

Promotion of Sustainable Manufacturing

By shifting to eco-friendly plastics, solar-powered factories, and green packaging solutions, RFL has helped drive the green economy movement in Bangladesh. These sustainability efforts align with SDG goals and set an example for industrial manufacturers in the country.

The company’s ability to combine traditional manufacturing with modern tech, e-commerce, and sustainability strategies positions it as a cornerstone of Bangladesh’s inclusive economic development.

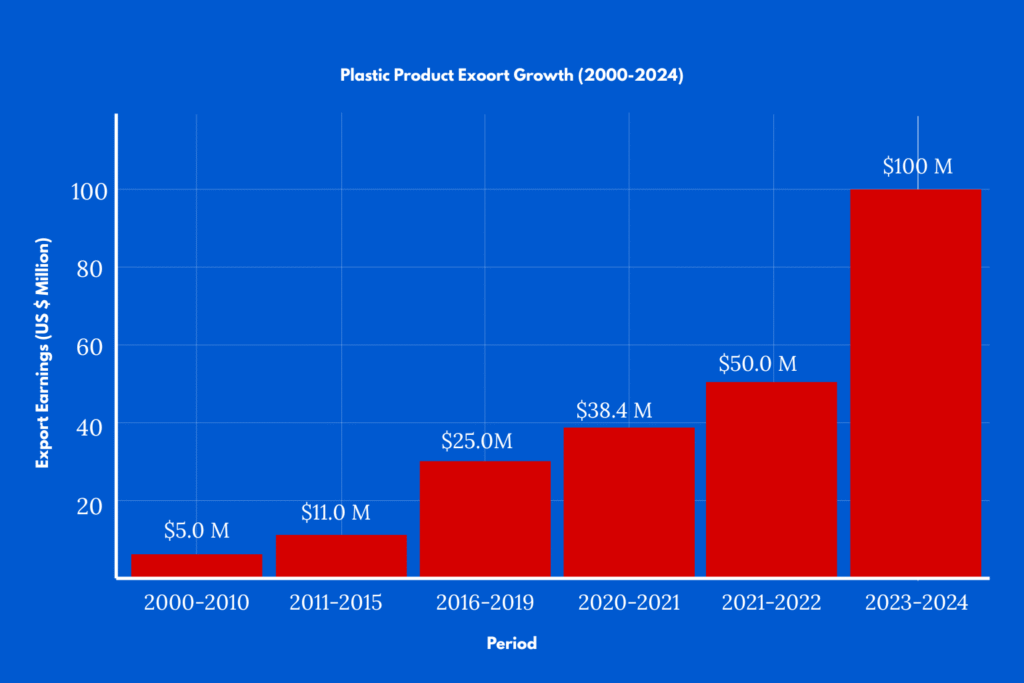

9. RFL Export Performance (2000–2025)

- 2000–2010: Modest Beginnings

During this period, RFL was establishing its export channels in neighboring countries. Export earnings remained modest, well below US $5 million annually, primarily from basic plastic items like buckets, furniture, and PVC pipes shipped to nearby countries. - 2011–2015: Early Momentum

RFL saw growing interest abroad, expanding into markets like the UAE, West Africa, and parts of Southeast Asia. Annual export revenues climbed steadily to between US $10–12 million, driven by value-added plastic furniture and sanitaryware. - 2016–2019: Broadening Reach

RFL’s export portfolio grew richer and its market presence strengthened. By 2019, annual exports had reached US $25 million, covering over 80 countries including India, EU nations, the US, Canada, and Australia. - 2020–2021 (Pandemic Surge)

Despite global supply chain challenges, demand for household goods lived on. Export revenue surged to US $38.4 million, thanks to rising needs for home storage, patio furniture, and clean-water solutions. - 2021–2022: Recognition and Ambition

RFL received national export trophies for plastic and light-engineering goods, marking 21 consecutive years of top export performance. The group set a bold target: US $1 billion total exports by 2025, scaling non-RMG categories including RFL’s portfolio. - 2023–2024: Peak Performance

With a Tk 200 crore (≈US $20 million) investment in a new export‑oriented plant in Gazipur, designed for up to Tk 450 crore (≈US $45 million) in exports, RFL boosted shipment volume. In FY 2023‑24, export revenue reached a record US $100 million, covering 500+ SKUs in 80 countries. - First Half FY 2024–25 (Jul–Dec 2024):

RFL earned a further US $36.1 million in export revenue during the first half of FY 2024–25 and is on track to achieve US $70 million for the full 2024‑25 year.

10. Future Outlook

RFL Group’s future trajectory looks highly promising and strategically vital for Bangladesh’s industrial growth, export diversification, and technological advancement. As global markets evolve, consumer demands shift, and sustainability becomes paramount, RFL is well-positioned to grow, innovate, and lead in multiple sectors:

- Diversification and Value-Added Product Expansion

Traditionally known for its plastic products, household appliances, and packaging solutions, RFL is progressively expanding into higher value-added and technologically sophisticated segments. This includes furniture, light engineering, consumer electronics, and agricultural machinery. By embracing innovation and modern manufacturing techniques, RFL aims to develop smart products that meet both local needs and international standards. - Aggressive Export Market Growth

Currently exporting to over 145 countries, RFL aims to double its export revenue to $2 billion by 2030. With an established presence in markets like the US, Europe, and the Middle East, the company plans to deepen market penetration and explore emerging regions in Africa and Southeast Asia. Strategic partnerships with global distributors and e-commerce platforms such as Amazon and Walmart will further enhance international visibility and sales. - Digital Transformation and Smart Manufacturing

RFL is actively investing in Industry 4.0 technologies, including automation, IoT-enabled manufacturing, and AI-driven supply chain management. This digital transformation aims to improve production efficiency, reduce waste, and enable real-time quality control. Additionally, predictive analytics will enhance demand forecasting and inventory management, aligning production closely with market trends. - Commitment to Sustainability and Circular Economy

Reflecting global environmental priorities, RFL is focused on sustainable manufacturing practices. This includes achieving 100% plastic recycling by 2030, reducing energy and water consumption, and increasing the use of renewable energy sources across its factories. RFL is also exploring biodegradable materials and eco-friendly packaging solutions, positioning itself as a leader in green industrial practices within Bangladesh. - Innovation in Consumer Solutions and Smart Products

As consumer lifestyles modernize, RFL is venturing into smart home appliances integrated with IoT technology. The group envisions launching connected kitchen and household devices controllable via mobile apps and voice assistants. This move will not only enhance customer convenience but also open new revenue streams in the burgeoning smart home market.

Lessons from RFL

RFL shows us that trying different kinds of products helps a business grow and stay strong. It’s important to think big and sell products worldwide but also understand what local customers want. Using new technology helps make better products faster and saves money. RFL cares about the environment by recycling and using less energy, which is good for the planet and the business. They also believe in training their workers and learning new things to keep improving. RFL teaches us to be flexible, responsible, and always ready to change for a better future.

Conclusion

RFL’s journey highlights how embracing change and innovation leads to growth. Their commitment to quality, sustainability, and people has helped them become a leader in many industries. By balancing local understanding with global reach, and using technology wisely, it sets a strong example for businesses everywhere. Their story reminds us that success comes from hard work, adaptability, and caring for both customers and the environment.

References

Share via: