According to a new report by the Swiss National Bank (SNB), the amount of money held in Swiss banks under Bangladesh’s name increased drastically by the end of 2024. This information was published in their yearly banking statistics, which include data for all countries.

How Much Has It Increased?

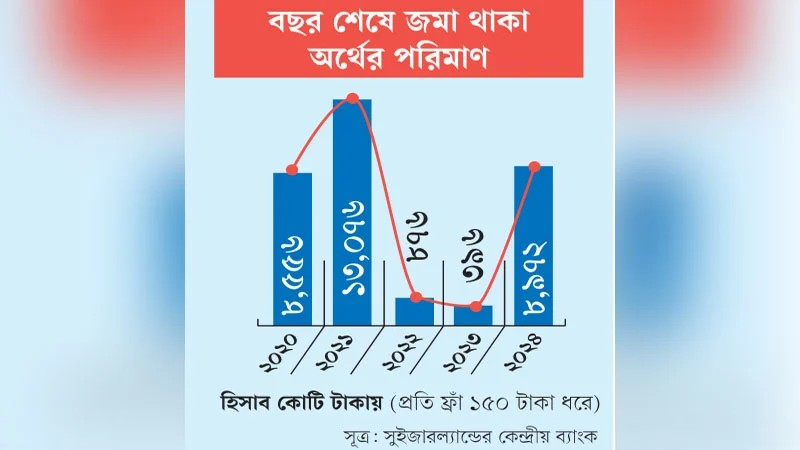

At the end of 2024, Swiss banks held 59.82 million Swiss Francs for Bangladesh. At an exchange rate of 150 taka per Franc, that equals around 8,972 crore Bangladeshi Taka. Just a year before, in 2023, this amount was only 2.64 million Francs (about 396 crore Taka). This means the total amount has grown almost 23 times in just one year.

What Does This Money Include?

The amount includes:

-

Funds owed to Bangladeshi banks (the largest portion, over 95%)

-

Deposits by Bangladeshi individuals or institutions

-

Investments made under Bangladesh’s name in Swiss stock markets

Bangladesh Bank has previously explained that most of this is business-related money.

Read More: Foundation Stone Laid for Modern Libraries in 44 Upazilas of 11 Districts

Details of the Bank Funds

-

Bank Claims: By the end of 2024, Bangladeshi banks were owed 57.66 million Francs (around 8,649 crore Taka), compared to just 0.35 million Francs (52 crore Taka) in 2023. This is a 165-fold increase.

-

Depositor Accounts: Personal and corporate deposits stood at 1.26 million Francs (about 190 crore Taka), slightly down from 1.4 million Francs in 2023.

Total Money in Swiss Banks

Combining both bank and depositor funds (excluding investments), the total comes to 58.95 million Francs or 8,843 crore Taka. The previous year’s total was only 1.77 million Francs—so this marks a 33-fold increase.

Investments in Swiss Capital Market

In 2024, investments by Bangladeshis in shares and other securities through asset managers were worth 0.86 million Francs (around 130 crore Taka), similar to the previous year. When this is included, the total money under Bangladesh’s name in Swiss banks becomes 59.81 million Francs, almost 23 times more than in 2023.

No Official Explanation Yet

Bangladesh Bank’s spokesperson, Arif Hossain Khan, said they are trying to gather information about the reasons behind this sharp rise. However, no official statement has been released yet.

Is This Money All Legal?

There is suspicion that some of the money may have been illegally transferred or laundered, but there is no solid proof. Swiss banking laws protect individual information, so we don’t know how much belongs to whom.

Past Efforts to Get Information

Over the years, Bangladesh’s Financial Intelligence Unit (BFIU) has contacted the Swiss counterpart for details, but Swiss authorities refused to share individual names unless proof of illegal activity is provided.

Expert Opinion

Dr. Zahid Hussain, former lead economist at the World Bank, said such a large jump in just one year is unusual and raises serious questions. He added that even if some of it is trade-related, there might be signs of money laundering or illegal transfers, especially given the political events in 2024, including the national election and a change in government.

Not All Assets Are Counted

If a Bangladeshi person deposits money using another nationality, or if they store valuable items like gold, artwork, or antiques in Swiss banks, these are not included in this report.

Historical Data

In 2021, Bangladesh’s deposits in Swiss banks were 87.11 million Francs, but this dropped to 5.84 million Francs in 2022 and remained low in 2023. The 2024 surge is the first sharp rise after two years of decline.

Former Minister’s View

In 2017, then Finance Minister AMA Muhith said in Parliament that most transactions with Swiss banks were trade-related and not considered money laundering, though some illegal transfers might happen.

Global Context

-

India: Money under India’s name rose to 350 million Francs in 2024 from 103 million in 2023.

-

Pakistan: Dropped slightly to 270 million Francs from 290 million.

-

Sri Lanka and Myanmar: Saw increases in deposits.

Bangladesh and Money Laundering

Washington-based Global Financial Integrity (GFI) has estimated that around 50,000 crore Taka is illegally transferred from Bangladesh every year, mostly through fake trade declarations.

Investigations like the Panama Papers, Paradise Papers, and ICIJ leaks have revealed names of many Bangladeshis with offshore companies and hidden wealth, showing how money is moved for tax evasion, hiding profits, or for luxury living abroad.

Source: Samakal