Nagad has emerged as one of the leading mobile financial service (MFS) providers in Bangladesh. Suddenly that service was shaken and Nagad’s digital marketplace unexpectedly crashed.This crash raised many serious questions. How could a major platform collapse so suddenly? Was there enough technical support behind it? And most importantly—can people still trust digital services in Bangladesh?

1.Introduction

In recent years, Bangladesh’s financial landscape has been changing rapidly, with more people embracing digital solutions than ever before. Nagad is one of them which makes this digital transformation affordable. It is a digital financial service that operates under the Bangladesh Post Office. After its launch, Nagad quickly gained popularity by offering low-cost transactions, user-friendly interfaces, and innovative features such as digital Know Your Customer (e-KYC) registration.

With growing success, Nagad decided to expand. It introduced a digital marketplace, where people could shop online and pay directly from their Nagad wallets. For many users and small business owners, this felt like a golden opportunity. However, the vision quickly faced a serious challenge.

2.Background of Nagad

Nagad began with a simple, powerful question: “Why should millions of hardworking Bangladeshis remain excluded from the digital economy?”

2.1. Identifying the Gap

In the late 2010s, Bangladesh saw a rise in mobile financial services (MFS), yet millions of citizens especially in villages and remote areas remained uncategorized. Most services required smartphones, paperwork, or technical knowledge, which excluded a large section of rural people. The government recognized that a true financial revolution was still a distant dream for many and decided to act. The solution needed to be simple, affordable, and reachable—regardless of where a person lived or how digitally literate they were.

2.2.Government’s Vision

The Government of Bangladesh envisioned a future where every citizen could access digital financial services just as easily as visiting a post office. This aligned perfectly with the broader initiative of “Digital Bangladesh.” The aim was not just to compete with private MFS providers but to ensure no one was left behind. The concept was rooted in national progress—bringing the economy into the digital age while uplifting the lives of everyday people through secure, fast, and inclusive technology.

2.3. Reviving the Post Office

Instead of building something entirely new, policymakers looked at a familiar but underutilized institution—the Bangladesh Post Office. Present in nearly every corner of the country, it was deeply trusted by people from all walks of life. Transforming its outdated financial wing into a digital system made perfect sense. Thus, Nagad was launched as its mobile financial service arm—turning a century-old service into a future-facing solution.

2.4. Leadership of Tanvir A Mishuk

The driving force behind Nagad was its Managing Director, Tanvir A Mishuk. He wasn’t just a business leader—he was a dreamer with a mission. Mishuk believed that mobile financial services (MFS) shouldn’t be just for city people or tech experts. He wanted it to reach everyone, including farmers, small shopkeepers, and rural homemakers. He focused on making Nagad easy to use, simple to sign up for, and open to all. Under his leadership, Nagad moved fast, stayed focused on people’s needs, and always tried to include those who were left out. His mix of passion, empathy, and action truly shaped Nagad’s journey.

As of May 2025, Md. Shafayet Alam serves as the Chief Executive Officer (CEO) of Nagad Ltd. He has been an integral part of Nagad since before its commercial launch and has held several key leadership roles over the past seven years.

2.5. Formation and Early Operations

Nagad originated from a collaboration between Third Wave Technologies and the Bangladesh Postal Department. Established in 2016, Third Wave aimed to digitize the postal money order service using the infrastructure of over 10,000 post offices nationwide.

- In 2017, the groundwork for mobile banking under the Postal Department began.

- On March 26, 2019, Prime Minister Sheikh Hasina launched Nagad officially as a state-backed MFS.

- The service quickly gained traction, ending its first year with 7.8 million users, and jumping to 23.6 million in the second year. As of 2024, Nagad claimed 95 million customers and BDT 18 billion in daily transactions—claims that remain unverified.

2.6. Ownership Structure and Complications

From its launch, Nagad presented itself as a 51% government-owned service, with 49% held by Third Wave Technologies as the tech partner. However, Bangladesh Bank (BB) and the Ministry of Finance objected:

- While the Postal Department was authorized to provide money transfers, it had no legal authority to offer full MFS services without forming a subsidiary.

- The formation of such a subsidiary was not permitted under postal laws, creating a legal limitation..

- On March 15, 2020, BB provisionally allowed Nagad to operate for six months under seven conditions, which were never fully met. Despite repeated extensions, the company operated without a valid license for years.

2.7. Rise of Nagad’s E-Commerce

As digital spending grew in the country, Nagad wanted to capitalize on the flow by launching an e-commerce marketplace. Instead of providing fully as a financial tool, it wanted to be an ecosystem, similar to China’s Alipay-Taobao model. The marketplace was integrated directly into the Nagad mobile app and web portal. It featured:

- Listings of electronics, fashion, and household goods

- Flash sales and cashback offers

- Direct wallet payment with no middleman

- Merchant sign-up campaigns for local sellers

Initially, the model attracted both buyers and sellers. Thousands of vendors onboarded quickly. However, no logistics infrastructure, unverified merchants, and unrealistic pricing tactics soon undermined the user experience.

3.Nagad Revenue Overview (2019–2023)

Nagad has witnessed significant growth since its launch . The company’s revenue represents its expanding customer need, diversified services, and strategic moves.

3.1. Revenue Growth Journey

Since its inception, Nagad’s revenue has shown an impressive upward journey, driven primarily by the expansion of its digital wallet user base, diversified service offerings, and integration with various financial and non-financial products.

- In 2020, Nagad reported revenue contributions to the Bangladesh Postal Department at BDT 1.12 crore, marking the early stage of its commercial journey.

- By 2021, revenue sharing to the postal department rose to BDT 3.31 crore, more than tripling from the previous year, as the user base expanded amid increasing smartphone penetration and internet access.

- The year 2022 was a significant milestone with revenue contributions increasing to BDT 4.5 crore. Nagad’s total revenue reportedly reached BDT 517 crore, a remarkable 49% year-on-year growth, reflecting a strong uptake of its services. However, despite the revenue surge, Nagad faced operational challenges resulting in a net loss of BDT 262 crore.

- In 2023, Nagad’s revenue growth accelerated further with an 85% increase compared to 2022. This growth was fuelled by a 240% rise in digital payments transactions and a 90% increase in active wallets, reflecting the company’s success in deepening market penetration and broadening its service portfolio.

3.2. Financial Performance

- 2022: Nagad’s revenue increased by 49% year-on-year, reaching BDT 517 crore. However, the company reported a net loss of BDT 262 crore due to high operational costs and investments in infrastructure and marketing.

- 2023: The company experienced an 85% rise in revenue compared to the previous fiscal year, driven by a 240% increase in digital payments and a 90% year-on-year growth in active wallets.

3.3. Losses and Projections

Despite revenue growth, Nagad has faced financial challenges

- 2022: Accumulated losses reached BDT 625 crore.

- 2024: Projected to reduce losses to BDT 5 crore.

- 2025: Expected to achieve a net profit of BDT 28 crore.

Questionable Branding and Government Alignment

Nagad heavily utilized the Postal Department’s runner symbol to promote public trust. Yet behind the scenes:

- The Postal Department publicly denied assuming responsibility for any loans Nagad took.

- In October 2021, it was revealed that Third Wave Technologies had rebranded itself as Nagad Limited without informing the ministry.

- Then-Secretary Md. Afzal Hossain acknowledged the ministry had no knowledge of the rebranding, casting doubt on the supposed 51% government stake.

Promotional Spending and Financial Impact

In 2022, Nagad allocated Tk 157 crore to marketing and promotional activities, including cashback offers, bonuses, and advertising campaigns. This aggressive strategy aimed to expand its user base and enhance brand visibility. However, these expenditures contributed to an accumulated loss of Tk 625 crore by the end of the 2021-22 fiscal year .

To address its financial strain, Nagad secured approval from the Bangladesh Securities and Exchange Commission (BSEC) to issue a Tk 510 crore zero-coupon bond. Of this amount, Tk 400 crore was designated for loan repayment, while the remaining Tk 110 crore was allocated for working capital, including marketing and promotional activities .

Controversies and Data Privacy Concerns

Throughout its operation, Nagad faced numerous controversies:

- In 2019, BBC Bangla revealed that Robi and Airtel users were auto-enrolled as Nagad customers without consent, raising data privacy concerns.

- In 2021, Nagad froze 1,000+ accounts linked to shady e-commerce platforms. Social media speculated a scam, though the company claimed it acted under legal guidance.

- By September 15, Nagad had unfrozen 10,000+ accounts, but public confidence suffered.

Loan Scandal

In 2022, Nagad was accused of one of the most serious regulatory breaches in Bangladesh’s financial history:

- Third Wave Technologies borrowed BDT 5 billion from EXIM Bank using customer deposits as collateral, violating BB regulations.

- When it failed to repay, EXIM recovered BDT 3.17 billion from Nagad-held customer funds.

- This created a shortfall in deposits while users’ app balances remained unchanged—essentially creating unbacked digital money.

- While Nagad claimed to have replenished the funds, BB Governor Ahsan H. Mansur later confirmed that Nagad created more e-money than real deposits, equating it to counterfeiting.

4.The Marketplace Crash

The downfall of Nagad Marketplace started quietly in late 2023, but the damage soon became visible to thousands of everyday users and small business owners. What began as a promising digital platform where people could shop easily with mobile payments ended in disappointment, financial losses, and frustration.

4.1. What Went Wrong for Customers?

By November 2023, many customers began complaining on Facebook and YouTube. Their stories were similar:

- “I paid for my product, but it never arrived.”

- “They promised cashback, but I never got it.”

- “I asked for a refund, but it’s been months.”

- “Their helpline doesn’t even work anymore.”

These weren’t just isolated issues. Thousands of people were losing their hard-earned money. People who had ordered mobile phones, kitchen items, clothing, or home decor either received nothing or got poor-quality items. Some had paid in advance and waited weeks without any response.

4.2. Vendors Faced a Bigger Shock

Simultaneously, vendors using the platform raised alarms. Many claimed that despite shipping items and confirming delivery, Nagad failed to release their payments. Facebook groups like Nagad Seller Support BD saw testimonies from small business owners, many of whom were owed between ৳50,000 to ৳3,00,000.

One such vendor, “Rayhan Electronics,” posted:

“We completed over 300 orders through Nagad Marketplace in November. As of February, we haven’t received a single payment. Our capital is locked, and our shop is now closed.”

Some businesses even collapsed, unable to restock inventory or pay employees due to frozen funds.

4.3. Platform Malfunctions and Sudden Shutdown

In January 2024, the Nagad app started acting weird. Users couldn’t see their past orders, some product pages vanished, and new sellers were unable to register. Suddenly, the platform looked broken. In February 2024, Nagad officially shut down its marketplace, saying it was for “technical upgrades.” But most people didn’t believe that.

4.4. What Was Really Happening Behind the Scenes

Later, news reports and leaked information from insiders told a deeper story. Some of the serious problems included:

- No proper checking of sellers (anyone could join).

- No inventory control (they sold items that weren’t even in stock).

- Their technology system couldn’t handle large orders.

- They spent too much money giving cashback and discounts, which created a cash shortage.

- Basically, they were offering more than they could handle—like a house built on sand.

4.5. Just Like Evaly All Over Again

People quickly started comparing Nagad’s collapse with the earlier scandal of Evaly, an online marketplace that crashed in 2021. Evaly also gave huge cashback offers, took advance payments, didn’t deliver products, and ended up owing people hundreds of crores of taka. Evaly’s CEO was even arrested.

But Evaly was a private company. Nagad, on the other hand, was linked to the government—it was approved by the Bangladesh Post Office. That made people even angrier. Many said:

“If we can’t trust a government-supported platform, who can we trust?”

This incident damaged public trust in digital financial systems. Many became scared to use mobile wallets or buy from online marketplaces again. It didn’t just hurt users and sellers—it also affected Bangladesh’s digital future.

5. Reasons Behind the Crash

The sudden collapse of the Nagad Marketplace wasn’t just due to one mistake — it was a combination of technical failures, poor planning, and internal mismanagement. Each part of the system was broken in some way, and together, they caused the platform to fail. Let’s take a closer look at what went wrong.

5.1. Loan Taken Against Customer Funds

Nagad is officially linked to the Bangladesh Post Office and is seen as a government-backed mobile financial service. However, its technology partner, Third Wave Technologies, took a Tk317 crore overdue loan using customer funds—known as the “trust fund”, which is against the rules. This caused a big shortage of real money backing Nagad’s electronic balance. The Bangladesh Bank has asked the Post Office to cover this shortfall by September. Despite rapid growth, Nagad is now struggling with financial and regulatory problems, and the Post Office is hesitant to take full responsibility. This situation has seriously affected Nagad’s stability and contributed to the marketplace crash.

5.2. Technical Weakness

Another reason behind the crash of Nagad Marketplace was its weak technical foundation. The platform was launched without preparing a strong system that could handle thousands of users at the same time. Whenever a flash sale or festival offer came, the app would freeze, payments would fail, or users couldn’t track their orders. This frustrated both buyers and sellers. For instance, a student from Cumilla named Faridul paid for a smartwatch during a sale, but his order never showed up in the app—even though the money was deducted. Problems like these were very common, showing that the backend system wasn’t ready for such a large-scale marketplace.

5.3. Vendor Mismanagement

Nagad welcomed sellers too quickly, without checking if they were real businesses or had proper stock. Anyone could sign up and start selling, even if they didn’t have a warehouse or reliable supply. As a result, fake product listings appeared, and some dishonest sellers took money from customers but never delivered anything. There were also many delivery delays because sellers couldn’t keep up with orders. One small seller, Rasel Uddin, posted on Facebook that he listed products through an unreliable supplier. When that supplier failed to deliver, Rasel couldn’t fulfill customer orders, and Nagad held him responsible. These issues show that Nagad didn’t properly manage or verify its vendors before letting them sell.

5.4. Overuse of Promotions

To quickly attract users, Nagad started offering large cashback deals and discounts. People got up to 30% cashback, free delivery in many areas, and unlimited discounts during sales. These offers seemed exciting, but they cost Nagad a huge amount of money. For every ৳1,000 order, they might give ৳300 back and still pay for delivery costs. Thousands of people used these offers at once, which led to a financial shortfall. Just like Evaly, Nagad’s cashback promises grew larger than the money they actually had. This made it hard for them to pay sellers or give refunds to customers. In the end, these promotions became too expensive to continue.

5.5. Lack of Delivery Infrastructure

Nagad did not build its own delivery network, nor did it make strong partnerships with existing courier services. This became a serious problem when thousands of orders started piling up. Many customers never received their packages, and sellers blamed Nagad for not handling delivery properly. For example, Kawsar Mia from Rangpur ordered baby clothes but didn’t get them even after waiting for 22 days. No one from Nagad contacted him, and he had to keep calling to get an update. This kind of experience made customers lose trust in the platform and stopped them from ordering again.

5.6. Absence of Regulatory Supervision

After Evaly’s crash, the Bangladesh Bank and e-Commerce Association of Bangladesh (e-CAB) warned companies not to launch e-commerce platforms without proper licenses and rules. However, because Nagad was linked to the Bangladesh Post Office, it moved forward without following all the regulations. This gave them a false sense of security, and they launched the marketplace too quickly. Regulatory bodies didn’t take action fast enough, thinking Nagad was safer due to government involvement. But by the time they started asking questions, it was too late—the damage had already been done, and thousands of customers and sellers were affected.

5.7. Internal Conflict

Lastly, Nagad’s internal teams were not working well together. According to news reports and insiders, there was a lack of communication between the tech team and the marketplace operations team. Some senior employees resigned due to disagreements and delays. Features that were supposed to improve the platform were postponed again and again. One former employee said that the tech team warned about problems, but the marketing team kept pushing big promotions anyway. Because of these internal conflicts, important decisions were delayed, bugs remain unfixed, and the crisis kept growing until the platform completely failed.

6.Market Impact and Stakeholder Reactions

When Nagad’s marketplace collapsed, it didn’t just break a platform—it broke people’s trust. Customers were heartbroken over lost money, and small business owners were left in panic, waiting for payments that never came. The shock pushed regulators and the public to question how such a failure was allowed to happen.

6.1. Customers Lost Money and Trust

After the crash, thousands of customers across Bangladesh felt cheated. Many had paid for products they never received. Some people were waiting for refunds for months, and in many cases, they didn’t get the money back at all. For example, Tanjina Akter, a university student from Mymensingh, ordered a Bluetooth speaker during a Nagad flash sale. She paid ৳1,200, but the product never arrived. When she tried to call customer service, no one picked up. After weeks of frustration, she gave up. Stories like hers spread on Facebook, Twitter, and YouTube, where angry users warned others not to use Nagad’s marketplace again. The trust people had in Nagad started breaking down rapidly.

6.2. Small Sellers Faced Big Losses

Many small and home-based businesses used Nagad’s marketplace to sell products like clothing, electronics, cosmetics, or handmade goods. But when the platform crashed, they were hit hard. Even after shipping items to customers, these sellers didn’t receive payments from Nagad. Some vendors reported that Nagad owed them between ৳50,000 to ৳3,00,000. Take the case of Mahfuzur Rahman, who ran a mobile accessory shop in Rajshahi. He fulfilled over 150 orders but didn’t get his payments for two months. Eventually, he had to take a loan just to pay his delivery staff and rent. For small sellers like him, this crash meant not only financial loss but emotional stress and a blow to their dreams.

6.3. Public Confidence in Digital Platforms Declined

The Nagad marketplace collapse didn’t just affect individual customers or sellers—it also created fear about all digital platforms. People started questioning whether they could trust online services at all, especially when the platform is linked to the government. This was more serious than the Evaly crash because Nagad had the government’s backing through the Bangladesh Post Office. When a trusted name like Nagad failed to deliver, many people became scared to shop online. Elderly people, parents, and rural customers who had just started using mobile apps went back to offline shopping. The crash slowed down the overall progress of e-commerce in Bangladesh.

6.4. Competitors Benefited But Also Got Cautious

Other online marketplaces like Daraz, Chaldal, and AjkerDeal suddenly saw an increase in new users. People who left Nagad’s platform shifted to these alternatives. However, even these companies became more cautious. They began double-checking their cashback campaigns, vendor approval processes, and refund systems. One insider from Daraz said, “We had to pause a few offers because we didn’t want to make the same mistake Nagad did.” So, while competitors gained new customers, they also learned a lesson: building trust is more important than offering flashy discounts.

6.5. Government and Regulators Faced Criticism

Because Nagad is partially connected to the government, the public expected better regulation and safety. But when the marketplace failed, many people blamed not only Nagad but also the authorities. Why didn’t the Bangladesh Bank or the Ministry of Posts and Telecommunications stop this earlier? Why wasn’t there a rule in place to protect users and sellers? These questions started appearing in newspapers, talk shows, and social media posts. Eventually, Bangladesh Bank and e-CAB began investigations, but for many victims, it was already too late. The crash exposed the gap between digital innovation and proper regulation.

6.6. Nagad’s Reputation Was Damaged

Perhaps the biggest loss was to Nagad itself. Before the crash, it was known as a trusted mobile financial service (MFS) provider competing with giants like bKash and Rocket. But after the marketplace failure, its image took a serious hit. Even customers who used Nagad just for money transfers or mobile recharges began to hesitate. Some uninstalled the app entirely. The company tried to downplay the issue by calling it a “technical upgrade,” but people knew the truth from media reports and online whistleblowers. Rebuilding that lost trust won’t be easy, and it may take years.

7.Nagad Strategic Moves During the Crash

Nagad, as a prominent mobile financial service (MFS) provider in Bangladesh, has employed several strategic moves to gain market share and navigate competitive landscapes. During the Nagad leadership crisis, strategic moves included court challenges to the central bank’s appointment of an administrator and board. These moves can be broadly categorized into aggressive expansion, technology innovations, and government engagement.

7.1.Aggressive Expansion

The mounting pressure, Nagad didn’t back down, it adopted a range of strategic tactics to maintain its position and manage the crisis. This MFS mainly focused on quickly expanding its customer base. It adopted an aggressive market expansion strategy to rapidly increase its footprint across Bangladesh. Firstly they identified all gapes infinancial especially in rural and semi-rural areas. Through leveraging the Bangladesh Post Office’s infrastructure, it kept reaching new users, maintaining momentum even during regulatory tensions.

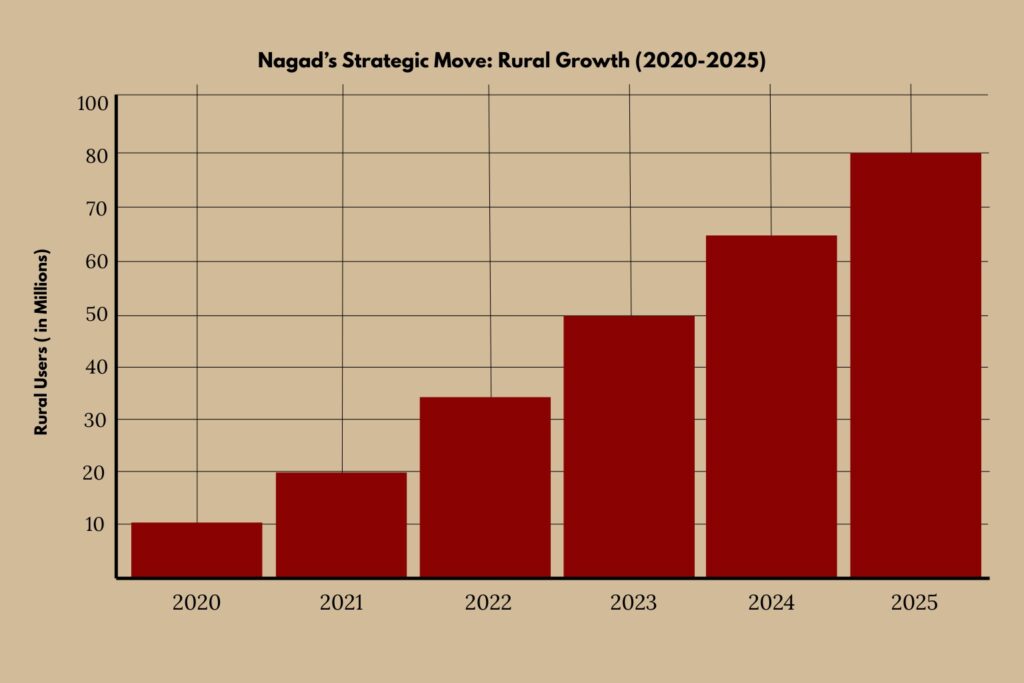

If we see the growth of last 6 years, we can understand how fast it grow. In 2020 the number was 1o Million. Next year 2021 the number increase 10 Million and it was 20 Million. In 2022 the number increase 15 Million and it was 35 Million. So, it already proves how fast it growth. After the year, 2023 the number cross all those previous years and it goes 50 Million. Next year 2024, the number increase 15 million and it was 65 Million. In 2025 the number cross all previous yeas and it was 80 Million.

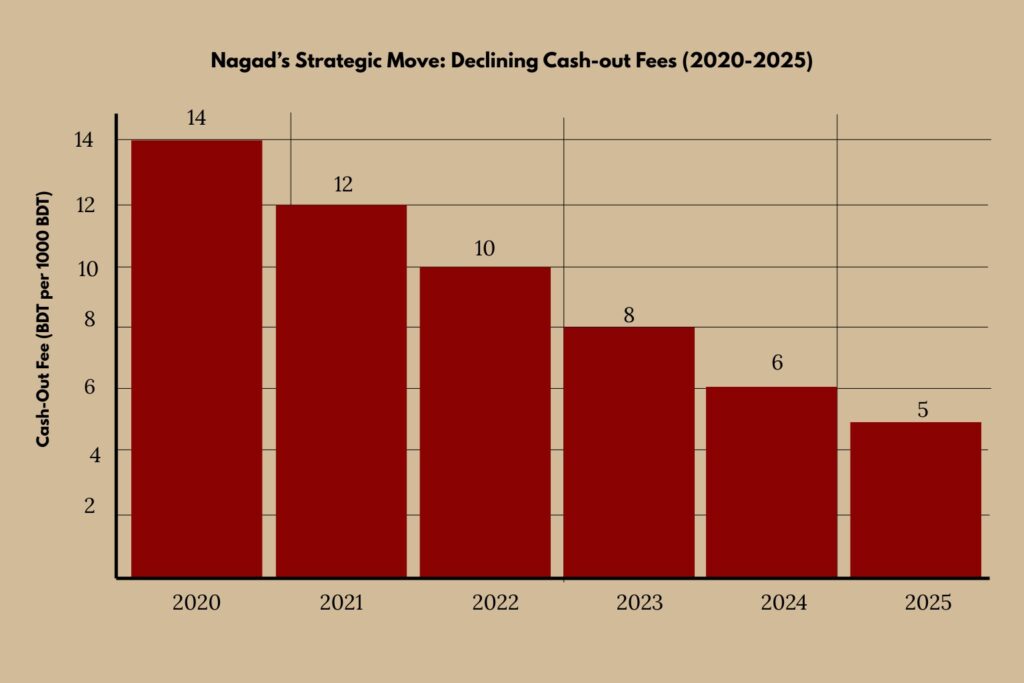

As Nagad’s target was rural and semi-rural area, so they think about the strategy and because of the crash they declining their cash-out fee. If we see the previous years cash-out fees we can understand how they decline the number from 14 taka to 5 taka.

7.2.Technology Innovations

Nagad is a leading provider of mobile financial services in Bangladesh. It positioned itself as a digital-first disruptor by introducing tech-driven solutions such as developing and implementing digital financial solutions, expanding access to financial services, and collaborating with strategic partners to enhance the customer experience.

- Digital KYC and AI: Nagad was the first MFS to introduce digital KYC, leveraging OCR (Optical Character Recognition) and AI for quick and efficient customer registration.

- Feature Phone Accessibility: The ability to open accounts and conduct transactions through USSD (*167#) on feature phones is a significant technological innovation that addresses the digital divide in Bangladesh.

- Digital Bank Vision: Nagad is actively working towards establishing a full-fledged digital bank such as financial services, including collateral-free, single-digit interest loans for small businesses and farmers, and micro-savings schemes, all accessible via mobile phones.

- Strategic Partnerships: Nagad collaborates with various stakeholders, including government agencies, financial institutions, and technology providers, to enhance its reach and provide a wider array of services.

7.3.Government Engagement

Nagad’s strategic engagement with the Bangladesh government involves several key areas, including collaborations with government institutions, training programs for users, and user incentives to encourage digital payments.

- Postal Division Leverage: Under the Bangladesh Post Office, Nagad enjoyed a unique position. This works with the postal division for its own benefits.

- Public-Private Alignment: Nagad often positions itself as a key enabler of the government’s “Digital Bangladesh” vision, aiming to bring more people under financial inclusion and facilitate a cashless economy.

- Lobbying for Licensing Clarity: Nagad also participated in many policy discussions and they also reported the lobbying’s because of a streamlined licensing.

8.Comparison with others MFS (Nagad vs. bKash, Rocket, Upay )

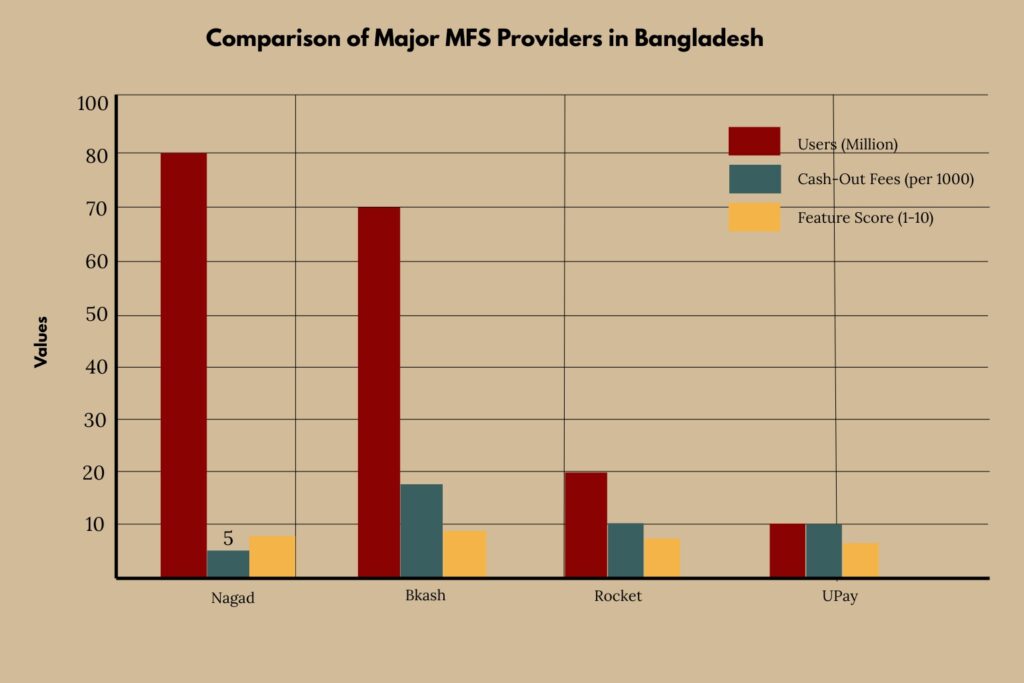

Nagad is a mobile financial service(MFS). If we compare this with other MFS we can understand the difference and how fast it grow than others.

•Bkash vs Nagad: If we compare with bkash we can see that it launched in 2011 and Nagad launched in 2019. Bkash’s operator is BRAC Bank subsidiary and Nagad’s operator is Bangladesh Post Office (Public-Private Partnership). Bkash is Market Leader (Largest user base & transactions) and Nagad is Rapidly grown to 2nd largest, Unicorn status achieved quickly. Bkash’s User Based is ~75 Million+ (as of March 2024) and Nagad’s ~5.5 Crore (55 Million) active customers (as of late 2024).Bkash’s Cash-Out Fee (per Tk. 1,000 from Agent) is Tk. 18.50 (general), Tk. 14.90 (for 2 ‘Priyo Agent’ numbers up to Tk. 50,000/month) and Nagad’s Cash-Out Fee (per Tk. 1,000 from Agent) is Tk. 12.50 (Regular App), Tk. 15.00 (Islamic App & USSD).

•Rocket vs. Nagad: If we compare with Rocket we can see that it launched in 2011(Pioneer) and Nagad launched in 2019. Rocket’s operator is Dutch-Bangla Bank (DBBL) and Nagad’s operator is Bangladesh Post Office (Public-Private Partnership). Rocket is 3rd largest, retains a significant loyal user base and Nagad is Rapidly grown to 2nd largest, Unicorn status achieved quickly. Rocket’s User Based is Significant (specific recent numbers are less publicly available) and Nagad’s ~5.5 Crore (55 Million) active customers (as of late 2024).Rocket’s Cash-Out Fee (per Tk. 1,000 from Agent) is Tk. 16.70 – Tk. 18.00 (General Agent) and Nagad’s Cash-Out Fee (per Tk. 1,000 from Agent) is Tk. 12.50 (Regular App), Tk. 15.00 (Islamic App & USSD).

•Upay vs. Nagad:If we compare with Upay we can see that it launched in 2021 and Nagad launched in 2019. Upay’s operator is United Commercial Bank (UCB) subsidiary and Nagad’s operator is Bangladesh Post Office (Public-Private Partnership). Upay is Newer entrant, gaining traction with competitive pricing and Nagad is Rapidly grown to 2nd largest, Unicorn status achieved quickly. Upay’s User Based is Growing, but smaller compared to bKash and Nagad, and Nagad’s ~5.5 Crore (55 Million) active customers (as of late 2024). Upay’s Cash-Out Fee (per Tk. 1,000 from Agent) is Tk. 14.00 (Agent), Tk. 8.00 (UCB ATMs) and Nagad’s Cash-Out Fee (per Tk. 1,000 from Agent) is Tk. 12.50 (Regular App), Tk. 15.00 (Islamic App & USSD).

Read More: Adidas and Puma: How a Sibling Rivalry Gave Rise Two Giants of the Sports World

9.Impact on Digital Economy

In recent years, the digital financial ecosystem in Bangladesh has experienced rapid transformation and it plays a vital role in day to day life. The launch of Nagad in 2019, and the subsequent intense competition with established players like bKash and Rocket, has had a profound and overwhelmingly positive impact on Bangladesh’s digital economy.

9.1. Before the Crash

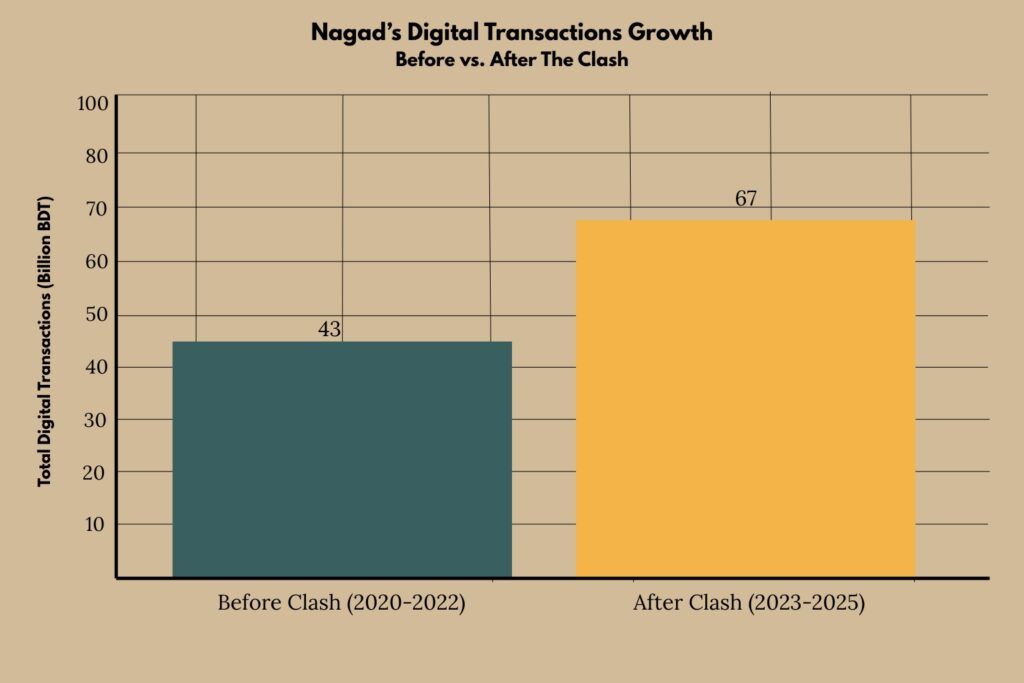

Before the crash, Bangladesh witnessed a steady rise in digital transaction volume. There have several factors such as increased smartphone adoption, mobile internet penetration, and pandemic-driven digital behavior boosted transaction volumes. As we know there have many MFS operators and Nagad, bKash, and Rocket all contributed to this trend through marketing, incentives, and financial inclusion drives.

9.2. During and After the Crash

The MFS clash, centered around Nagad’s legitimacy and licensing issues, triggered public confusion. Because of that, its consumer trust dipped, with users temporarily hesitant to transact via mobile platforms. Merchants and small businesses also slowed down MFS adoption, fearing regulatory backlash or instability. As a result, a notable dip in transaction volume in 2024 (down to 2300 billion BDT).

9.3. Effect During Crash

Because of this crash, user Confidence the number declined due to trust issues. Merchant transactions become slow as businesses waited. Innovation and Investment, temporarily paused or slowed. Regulatory Scrutiny are increased sharply. As they faces market Competition heightened tensions.

9.4.Post-Clash Recovery

After the crash, user Confidence gradually improved with clarification. Merchant transactions rebounded with policy assurances. Innovation and investment renewed with a focus on compliance. Regulatory scrutiny led to clearer policies and accountability. Market competition encouraged differentiation and reform.

10.Government and Regulatory Response

The rapid rise of Nagad in Bangladesh’s mobile financial services (MFS) sector stirred significant regulatory attention. A dynamic and often contentious interplay between government bodies, the Bangladesh Bank, and the MFS operators. Because of the crash period when questions were raised regarding its licensing, operational model, and competitive behavior. This sector outlines how the government and regulators authorities responded Nagad’s crash.

10.1.Initial Regulatory Ambiguity

Nagad’s rapid growth is the main cause of its crash. Its position operating under the Bangladesh Post Office (BPO) instead of directly under a full Bangladesh Bank (BB) license like bKash or Rocket. Bangladesh Bank’s reservations about how Nagad was operating without a full-fledged MFS license, despite having millions of users and processing large volumes of transactions. Nagad functioned under a temporary framework backed by the Ministry of Posts and Telecommunications, bypassing the traditional regulatory gatekeeping of Bangladesh Bank. Because all of this regulatory loophole was a major point of contention, contributing to the market crash and prompting a wave of policy discussions.

10.2.Ministry of Finance and Bangladesh Bank Actions

Bangladesh Bank began an intensive review process of Nagad’s license application under the Mobile Financial Services Guidelines. There was a push for Nagad to convert into a fully licensed Payment Service Provider (PSP), independent of its postal affiliation. All MFS providers were asked to increase reporting transparency, especially regarding KYC (Know Your Customer) compliance and fund safety. Nagad, in particular, was asked to provide detailed reports on its user base, transaction records, and agent activities. Authorities discussed drafting updated guidelines for non-banking financial digital platforms, ensuring uniform compliance and leveling the playing field.

10.3.Political and Public Engagement

Several government spokespersons highlighted that Nagad’s services would not be interrupted during regulatory adjustments, helping to maintain user trust. The government reiterated its support for innovation but stressed the importance of safeguarding consumer rights, data protection, and legal compliance.

11.Future Outlook

Nagad, is characterized by continued rapid growth, increasing regulatory scrutiny, a push for greater interoperability, and the advent of digital banking. Bangladesh’s mobile financial services (MFS) industry remains promising with major structural, technological, and regulatory transformations expected over the next few years.

11.1.Nagad’s Road Ahead: From Clash to Consolidation

As they faces a big crush now they have to focus in several parts as secure a full Payment Service Provider (PSP) license. Expand further into rural areas by leveraging its low-fee model. Introduce new financial services, including microcredit, savings products, and bill-pay innovations. Invest in data security, AI-powered risk management, and user experience enhancement to regain full public trust.

11.2.More Competition, Better Services

With rising competition, all MFS providers are expected to improve or introduce features such as,aggressive pricing strategy will pressure others to cut transaction and cash-out costs. Dynamic pricing models and “loyalty discounts” may emerge. Simplified apps with multilingual support, offline accessibility, and voice-guided interfaces. Focus on UI/UX to reach non-tech-savvy users, especially in rural areas. Personalized dashboards with spending analysis, credit scoring, and goal tracking. QR-based merchant payments integrated with reward systems. Micro-loans, nano-savings, and educational finance products tailored for small vendors, farmers, and students. Better KYC systems to onboard more users from underserved areas.

11.3.Tighter Regulations, More Stability

The Bangladesh Bank and Ministry of Finance are expected to adopt a “tech-enabling but risk-aware” approach to governance, which may attract foreign investors and increase consumer confidence. Revised MFS guidelines to cover grey areas (e.g., PSP vs. MFS licenses).Stricter KYC, AML, and cybersecurity compliance. Centralized oversight using real-time transaction monitoring systems.

11.4.Technology as the Differentiator

Tech will not only differentiate MFS providers, it will define the winners of the next digital finance era in Bangladesh. Blockchain for secure and traceable transactions, AI and Machine Learning for fraud detection and personalized financial products, Biometric KYC and facial recognition for onboarding and security, Integration with e-commerce, healthtech, and education platforms.

11.5.Impact on Digital Economy and Financial Inclusion

Bangladesh’s ambition for a “Smart Economy” by 2041 is heavily reliant on a stable, inclusive, and competitive MFS sector and this clash may end up accelerating progress in that direction. Deeper financial inclusion, especially in rural and semi-urban areas, Growth in digital micro-enterprises that rely on MFS for payments and logistics, a more resilient and diversified digital financial ecosystem.

12. Conclusion

The journey of Mobile Financial Services (MFS) in Bangladesh has been nothing short of a digital revolution. Nagad’s aggressive entry in 2019 challenged the dominance of bKash, catalyzing an era of unprecedented growth, innovation, and broader financial inclusion. What started as an aggressive expansion strategy by Nagad quickly evolved into a nationwide conversation about fairness, regulation, innovation, and consumer rights. Nagad’s strategic moves from its innovative digital KYC and aggressive pricing to its pivotal role in government disbursements.

The impact is clear that Bangladesh has witnessed an explosive surge in MFS accounts and transaction volumes, moving billions of Taka daily through digital channels. While challenges remain, including the need for greater digital literacy and robust cybersecurity, the MFS sector is undoubtedly a cornerstone of the “Smart Bangladesh” vision. The government’s response, though cautious, marked a turning point toward better oversight and long-term stability. This clash paved the way for a more inclusive, competitive, and technology-driven financial future in Bangladesh. The Nagad clash, once seen as a controversy, may very well become the catalyst that transformed Bangladesh’s digital economy for good.

Reference

The Financial Express

Daily Observer

Business Inspection BD

Bangladesh Bank

Dhaka Tribune

The Daily Star