Bangladesh is a rapidly developing country and is steadily emerging as one of the powerful nations in the world. Several factors contribute to this rise, including its resilient economy, progressive education system, and dynamic industries. Bangladesh’s pharmaceutical sector is not just about business, it is about making healthcare a right, not a privilege.

Among all sectors, the pharmaceutical industry holds a particularly significant position in Bangladesh’s economic landscape. It stands as one of the largest and most influential industries in the country, contributing immensely to national growth and international recognition.

Under visionary leadership and strategic planning, Bangladesh is achieving remarkable success in 2025, marking the beginning of a new era for the nation. This transformation symbolizes the birth of a new Bangladesh, poised for even greater achievements on the global stage. Discover the pharmaceutical industry role in advancing healthcare, driving drug innovation, shaping global markets, and improving patient outcomes worldwide.

A few quick highlights:

-

Bangladesh meets 98% of its domestic pharmaceutical needs with locally manufactured medicines.

-

It exports medicines to more than 150 countries, including the USA, UK, Australia, and several EU nations.

-

The industry size crossed $3 billion in 2024 and continues to grow.

A Chapter in Bangladesh’s Growth Story

In a world where access to affordable healthcare is a growing challenge, Bangladesh’s pharmaceutical industry is quietly scripting a success story that few saw coming.

From a country once heavily reliant on imported medicines, Bangladesh has transformed into a self-sufficient pharmaceutical hub, meeting 98% of its domestic needs and reaching patients in more than 150 countries worldwide.

The journey wasn’t easy. It took decades of reform, bold entrepreneurship and relentless commitment to quality. Today, Bangladesh’s pharmaceutical sector is not just one of its fastest growing industries it is a beacon of what focused ambition can achieve.

Introduction to Bangladesh’s Medicine Market

The pharmaceutical industry of Bangladesh is a true national success story. It started growing significantly after the 1982 Drug Control Ordinance. Which aimed to promote local production and reduce dependency on imports. Todays Bangladesh’s pharma industry:

-

Supplies 98% of domestic medicine needs.

-

Manufactures essential medicines, advanced oncology drugs, insulin, biotech products, and vaccines.

-

Is expected to become a $6 billion market by 2030, according to projections.

The industry serves over 170 million people domestically and is expanding into global markets specially in Asia, Africa and even parts of Europe and North America.

Why is the Bangladesh Pharmaceutical Industry Strong?

-

TRIPS Waiver Advantage:

Bangladesh, being a Least Developed Country (LDC), enjoys a waiver from WTO’s TRIPS agreement (Trade-Related Aspects of Intellectual Property Rights) until 2033.

That means Bangladeshi companies can legally produce generic versions of patented drugs without facing legal issues. -

Government Support:

The government has declared pharmaceuticals a thrust sector, offering tax breaks, policy support, and promoting “Made in Bangladesh” medicines globally. -

Growing Healthcare Demand:

Rising income levels, increased health awareness, and expanded health insurance systems have boosted medicine consumption inside Bangladesh. -

Strong Manufacturing Capabilities:

Companies like Square Pharmaceuticals, Beximco Pharma, Renata, Incepta, and ACI have world-class manufacturing plants. Some are even approved by the US FDA, UK MHRA, and Australia’s TGA.

Top Pharmaceutical Companies in Bangladesh

The Pharmaceutical industry is led by companies that specialize in producing high-quality medicines, meeting both local demand and expanding into global markets. With advanced manufacturing facilities, research and development initiatives, and a strong focus on affordability, these companies are transforming Bangladesh into a key player in the global pharmaceutical landscape.

-

Square Pharmaceuticals Ltd.- The undisputed market leader with consistent growth in both domestic and export markets.

-

Beximco Pharmaceuticals Ltd.- First Bangladeshi company to supply medicines to the USA and gain FDA approval.

-

Incepta Pharmaceuticals Ltd.- A pioneer in biotech, vaccines, and complex generics.

-

Renata Ltd.- Known for essential drugs and a strong export focus.

-

ACI Limited- Focused on a wide range of pharmaceutical products from generics to animal healthcare.

-

Eskayef Pharmaceuticals Ltd. (SK+F)- Recognized for high-end manufacturing standards.

-

Healthcare Pharmaceuticals Ltd.- Growing presence in both local and international markets.

-

Aristopharma Ltd., Opsonin Pharma Ltd., Popular Pharmaceuticals Ltd., Drug International Ltd. — All of whom contribute significantly to exports and employment.

Read More: The Alarming Reality: A Fragile Financial Sector Ravaged by Looting

Global Pharmaceutical Companies at a Glance

- Pfizer (USA)

-

Johnson & Johnson (USA)

-

Roche (Switzerland)

-

Novartis (Switzerland)

-

Merck & Co. (USA)

-

Sanofi (France)

-

AstraZeneca (UK-Sweden)

-

GlaxoSmithKline (GSK) (UK)

-

Bayer (Germany)

-

AbbVie (USA)

-

Eli Lilly and Co. (USA)

-

Bristol-Myers Squibb (USA)

-

Amgen (USA)

-

Teva Pharmaceuticals (Israel)

-

Boehringer Ingelheim (Germany)

These companies are major players in the global pharmaceutical market, specializing in a mix of innovative research, drug development, biotechnology, and patented medications.

Global Pharmaceutical Market Value

-

The global pharmaceutical market was valued at approximately $1.5 trillion USD in 2023.

-

It is expected to reach $2 trillion by 2030, according to industry reports (IQVIA, Statista).

-

The market is driven by:

-

Growing aging populations

-

Increase in chronic diseases

-

Demand for vaccines, biotech, and precision medicine

-

Top players by revenue (2024):

-

Pfizer

-

Roche

-

Novartis

-

Johnson & Johnson

-

Merck & Co.

Export Growth

-

Pharmaceutical exports have crossed $200 million in 2024.

-

Key export destinations: Myanmar, Sri Lanka, the Philippines, Kenya, Vietnam, and a growing presence in regulated markets like the US and EU.

-

Bangladesh is becoming known for high-quality generics, biologics, and biosimilar products globally.

-

Pharmaceutical exports have crossed $200 million in 2024.

-

Key export destinations: Myanmar, Sri Lanka, the Philippines, Kenya, Vietnam, and a growing presence in regulated markets like the US and EU.

-

Bangladesh is becoming known for high-quality generics, biologics, and bio-similar products globally.

Duties and Responsibilities of Bangladeshi Pharmaceutical Companies

Bangladeshi pharmaceutical companies have several major duties:

-

Ensuring Medicine Quality

Companies must follow Good Manufacturing Practices (GMP) as per WHO and local regulations, ensuring every tablet, capsule, and injection is safe and effective. -

Affordable Healthcare

One of their biggest missions is to keep medicines affordable for the mass population, especially life-saving drugs. -

Export Expansion

Companies are responsible for earning foreign currency through exports and establishing Bangladesh as a global generic hub. -

Research and Development (R&D)

Investing in new drug development, biotech innovations, vaccines, and complex generics is becoming a national priority. -

Self-Reliance

To minimize import dependency on Active Pharmaceutical Ingredients (APIs), companies are encouraged to set up their own API manufacturing. -

Compliance with International Standards

To enter the US, EU, and other regulated markets, companies must maintain stringent quality control, documentation, and certifications (like US FDA approval, EMA certification, UK MHRA compliance).

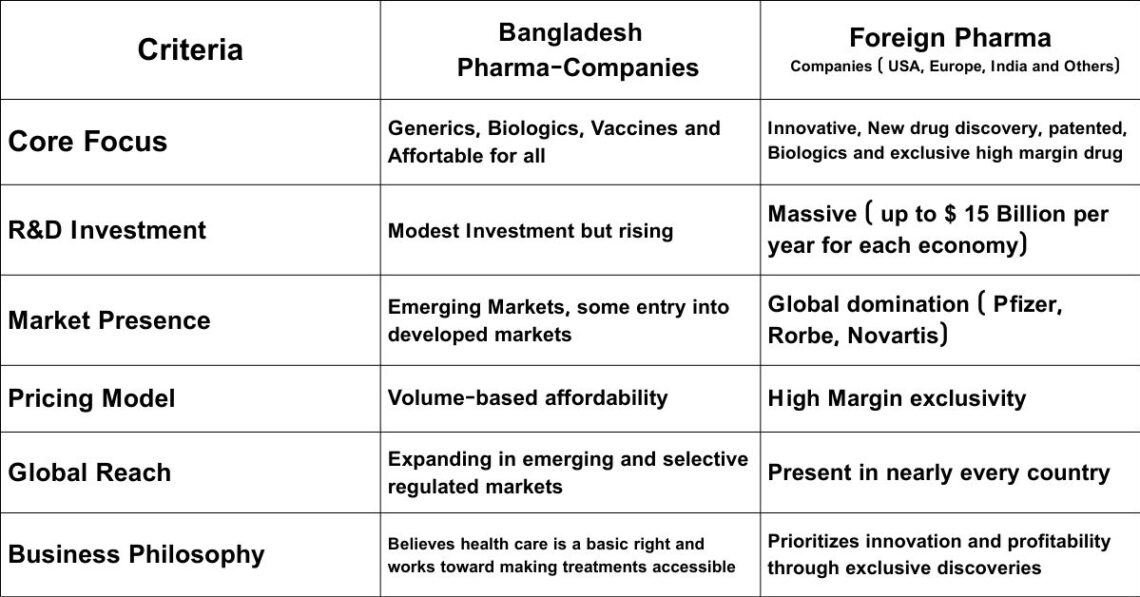

Bangladesh vs Foreign Pharma: A Comparison of Journeys

When compared to global pharmaceutical giants like Pfizer, Novartis, and Roche, the picture becomes even more inspiring.

While multinationals focus billions on discovering new molecules, Bangladeshi companies have built their reputation on affordable generics, biosimilars, and now slowly, specialty medicines.

In short:

-

Bangladeshi pharma focuses mostly on affordable generics and cost-efficient manufacturing.

-

Foreign giants like Pfizer, Roche, and Johnson & Johnson focus on innovation and blockbuster drugs.

However, Bangladesh is quickly catching up by expanding into biotech, biosimilars, and even original research specially companies like Beximco Pharma and Incepta.

Bangladesh’s Vision for the Pharmaceutical Future

There is a quiet confidence today in the corridors of Bangladesh’s top pharmaceutical companies. A belief that this is just the beginning. The journey of Bangladesh’s pharmaceutical industry is far from over.

In the coming years, we are likely to see:

-

Partnerships and acquisitions with international pharmaceutical players.

-

Deeper penetration into the US, EU, and Japanese markets.

-

Expansion into biotech and high-value biologics, like cancer and autoimmune drugs.

-

Full API independence, reducing reliance on imports and safeguarding supply chains.

-

$1 billion export target by 2030.

-

More public-private partnerships and joint ventures with global firms.

-

Sustainability initiatives, ensuring environment-friendly manufacturing practices.

Bangladesh may not be the largest, but it has something equally powerful. A will to rise, a hunger to serve, and the resilience to endure. From the bustling factories of Dhaka to pharmacies in Nairobi, Manila, or London, Bangladesh’s medicines are making a difference quietly, reliably, and with immense heart. And in that story, the real magic lies a nation’s commitment to healing one life, one medicine at a time.

Read More: 12 Years of Rana Plaza Tragedy in Bangladesh

The Silent Backbone: Active Pharmaceutical Ingredients (API)

To reduce dependency on imported raw materials, Bangladesh has initiated the construction of an API Industrial Park in Munshiganj. The park spans 200 acres and includes 42 plots, with 27 companies, including Square, Beximco, Incepta, and Acme, allocated plots.

This initiative aims to boost self-sufficiency in API production, lower production costs, and enhance export competitiveness.For Bangladesh, dependency on imported APIs from China and India was a major weakness.

To address this:

-

The API Industrial Park was launched in Gazaria, Munshiganj.

-

It aims to produce local APIs, boosting self-reliance.

-

It will reduce medicine production costs by up to 20–30%. And dependence on foreign suppliers

-

Lower production costs

-

Ensure a stable supply chain

-

It will strengthen Bangladesh’s export competitiveness by ensuring uninterrupted raw material supplies.

Once it completed, this park will help:

Self-sufficiency in APIs is a critical step towards securing Bangladesh’s healthcare sovereignty.

The Road Ahead: A Promising Future

The journey of Bangladesh’s pharmaceutical industry is far from over.

The future roadmap includes:

-

Deeper penetration into the US, EU, and Japanese markets.

-

Expansion into biotech and high-value biologics, like cancer and autoimmune drugs.

-

Full API independence, reducing reliance on imports and safeguarding supply chains.

-

$1 billion export target by 2030.

-

More public-private partnerships and joint ventures with global firms.

-

Sustainability initiatives, ensuring environment-friendly manufacturing practices.

Conclusion: Bangladesh’s Quiet Revolution in Medicine

While giants like Pfizer and Roche make headlines with billion-dollar drug discoveries, Bangladesh quietly saves millions of lives by making essential medicines affordable.

From the rural corners of Bangladesh to bustling cities in Africa and Asia, Bangladeshi medicines travel with a single message:

Healthcare is a right, not a privilege.

The pharmaceutical industry of Bangladesh is not just an economic powerhouse it is a humanitarian force.

And as Bangladesh continues to rise, its medicines will keep healing the world one life, one community, and one country at a time.

References

-

Centre for Policy Dialogue (CPD), Bangladesh

-

Report: “Accelerating the Growth of Bangladesh’s Pharmaceutical Industry”

-

Source link: cpd.org.bd

-

-

LightCastle Partners

-

Article: “Active Pharmaceutical Ingredient (API) Manufacturing: The Next Growth Driver of Bangladesh’s Pharmaceutical Industry”

-

Source link: lightcastlepartners.com

-

-

Business Inspection Bangladesh

-

Article: “Overview of the Pharmaceutical Industry of Bangladesh”

-

Source link: businessinspection.com.bd

-

-

Fact in BD

-

List: “Top 50 Pharmaceutical Companies in Bangladesh”

-

Source link: factinbd.com

-

-

Pharma Specialists

-

List: “Top 50 Pharmaceutical Companies in Bangladesh 2024”

-

Source link: pharmaspecialists.com

-

-

Statista

-

Global Pharmaceutical Market Value Data (2023 and 2030 projections)

-

Source link: statista.com

-

-

IQVIA Institute

-

Report: “The Global Use of Medicine in 2023: Outlook to 2027”

-

Source link: iqvia.com

-

-

WTO TRIPS Waiver Info

-

WTO Document on Bangladesh’s TRIPS Waiver until 2033

-

Source link: wto.org

-