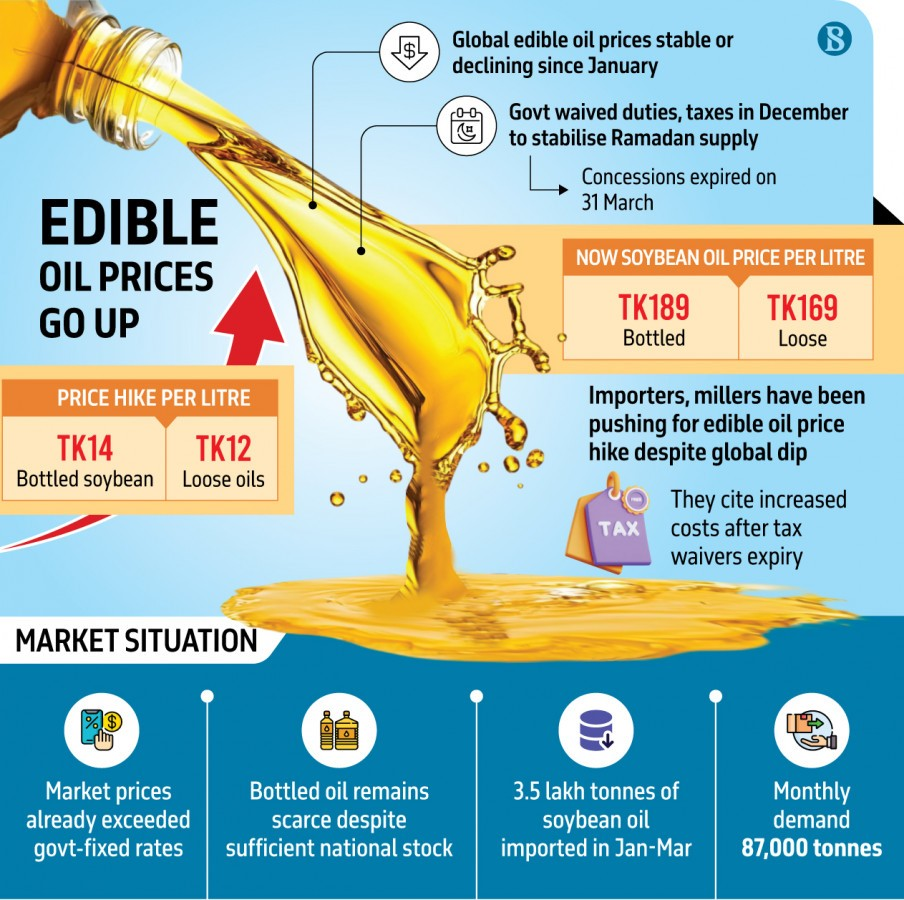

The price of soybean oil has gone up again. The price for bottled soybean oil and bulk oil has been increased by the authorities. The price of a five-litre bottle of soybean oil is now 922 BDT, up from the previous price of 852 BDT. The price of bottled soybean oil has also risen by 14 BDT per litre, reaching 189 BDT. Similarly, the price of bulk soybean and palm oil has increased to 169 BDT per litre, up from 157 BDT previously.

The Bangladesh Vegetable Oil Refiners and Vanaspati Manufacturers Association announced the price hike in a news statement. They confirmed that the increased prices will become effective immediately.

Reasons for the price increase include the withdrawal of tax and duty exemptions

At the end of March, the government eliminated all tax and tariff exemptions on edible oils, causing oil prices to skyrocket. Importers and mill owners had requested price increases owing to rising costs.

Earlier, in December, the government had removed taxes and duties on edible oils to keep prices stable during Ramadan. This led to a reduction in taxes, and the customs duties on crude soybean oil were cut from 17-18 BDT per kilogram to only 7 BDT. However, this relief ended on March 31st.

Even though the VAT on consumer sales was reduced to 5%, now oil sellers are facing a 15-21% VAT, which has pushed prices higher.

Read More: Culture as Our Strength: Dr. Muhammad Yunus’ Vision for a New Bangladesh

Proposals for Price Increases Were Made Earlier

The mill owners’ association had written to the Bangladesh Trade and Tariff Commission (BTTTC) on March 27, requesting an increase of 18 BDT per litre for bottled soybean oil and 13 BDT per liter for bulk soybean and palm oil. However, after multiple rounds of meetings, a final resolution was not reached.

Following Ramadan, the market experienced a shortage of bottled oil, prompting the mill owners to adopt the new prices.

Global market prices remain stable, but domestic prices are increasing

According to the World Bank’s commodity price data, worldwide edible oil prices have been relatively steady in recent months, with some even declining.

For example:

- In January, the price of crude soybean oil was 1,048 USD per ton,

- In February, it increased to 1,069 USD,

- By March, it decreased to 1,005 USD per ton.

Similarly, the price of crude palm oil was 1,070 USD per ton in January, 1,067 USD in February, and 1,069 USD in March. Despite this stability in global prices, the domestic market in Bangladesh has seen price increases.

Despite increases in oil imports, scarcity persists

According to the Chittagong Customs House, 560,176 tonnes of palm and soybean oil were imported through the Chittagong port in 2024, up from 478,673 tonnes in 2023. This is an increase of 81,503 tonnes in imports for 2024.

Despite the rise in imports, the market experienced a bottled oil shortage after Eid. Traders have reduced supply in the market, expecting further price increases.

Market Situation: Reduced Supply and Increased Prices

Syed Hakk, a local businessman in Chittagong’s Riyazuddin Bazaar, claimed, “The market has not picked up since Eid, and the supply of oil has decreased. I’ve heard that prices may rise, which is why supply is low.

In the wholesale market, the price of bulk soybean oil is being sold at 173 BDT per litre, and it is 180 BDT in retail. Meanwhile, palm oil is being sold at 158 BDT per litre in bulk and 168 BDT in retail.

Read More: China’s Grand Gift Marks 50 Years of Bond with Bangladesh

Importers’ Stock Information Taken by Government, Price Increase Suggested

City Group, one of the leading importers of soybean oil, confirmed that the government took stock information from them in early April. World’s 15% VAT is now being applied to the oil they import. As the government has ended the tax exemption relief, the price of oil has gone up.

Another major importer, TK Group, mentioned that since the beginning of April, the oil they supply has been subject to VAT of around 20-21 BDT per litre. Despite the lower demand post-Eid, they confirmed that supply was still in line with normal requirements.

Conclusion: Need for Better Market Regulation and Long-Term Planning

Experts suggest that although the mill owners’ argument about increased costs is valid, the market’s reaction doesn’t match the global trend of stable oil prices. This suggests a lack of effective market control and government oversight.

If the government fails to enact long-term policies on subsidies and taxes, rising prices will continue to hurt consumers. It is critical that market monitoring be strengthened, and a clear strategy be implemented to ensure fair pricing for all consumers in the future.

Source: TBS