Eid-ul-Adha, the second-largest Islamic festival, is celebrated by the sacrifice of animals in honor of Prophet Ibrahim’s devotion to Allah. In Bangladesh, religious observance also impacts economic activities, especially in the leather sector. Every year, over 10 million animals are sacrificed, producing an estimated 200–220 million square feet of raw hides, a vital input for Bangladesh’s leather industry. Leather is one of the oldest industries in Bangladesh. Exporting 10 percent of the global demand for leather, Bangladesh’s leather industry has become the country’s second-largest source of foreign exchange after RMG.

Having a favorable environment for raising and nurturing animals, Bangladesh has 2 percent of the total livestock population in the world. Bangladesh’s Leather is internationally popular for its high-quality fine-grain leather, uniform fiber structure, smooth feel, and natural texture. Currently, Bangladesh’s leather industry is gaining the capacity to produce processed raw leather and leather products in sustainable ways. However, this sector is often marred by syndicates, price manipulation, and logistical inefficiencies.

1. Historical Significance of Qurbani Hides in Bangladesh

Traditionally, Qurbani hides have been an essential source of revenue for religious and nonprofit institutions. Before the formal development of the leather industry, hides were manually processed and sold in local markets. After independence in 1971, Bangladesh began to enter into the commercial potential of leather. By the 1980s and 1990s, the country saw a leather export growth. The industry developed rapidly, turning raw Qurbani hides into polished products such as shoes, jackets, bags that made their way to Europe, the US, and beyond.

2. Leather Industry Overview:

Bangladesh’s leather industry isn’t just about fashion or footwear it’s an intricate ecosystem built on tradition, craftsmanship, and economic significance. Eid-ul-Adha, which generates an annual windfall of animal hides, is the biggest turning point in this sector’s calendar. But the journey from sacrificial hide to finished product is complex and layered.

2.1 Tanneries: The Starting Point of the Leather Chain

The first stop in the leather supply chain is the tannery where raw hides are chemically treated and processed. Traditionally based in Hazaribagh, Dhaka, the tanneries were relocated to Savar Tannery Industrial Estate to reduce environmental pollution and comply with global standards.

As of 2024, there are:

- 130+ active tanneries in Savar, many of which are still in the process of upgrading their effluent treatment systems.

- A handful of smaller tanneries in Chattogram, mainly serving the southeastern leather trade and some export markets.

- Challenges remain, such as delays in Central Effluent Treatment Plant (CETP) functionality and wastewater management, which impact export certifications like LWG (Leather Working Group) standards.

Despite these challenges, tanneries produce wet blue, crust, and finished leather, which serve as base materials for both local manufacturers and international buyers.

2.2 Manufacturing: Adding Value to Raw Leather

Once leather is processed, it is sent to manufacturing hubs, where artisans and workers convert it into finished goods like:

- Shoes

- Bags and wallets

- Belts and jackets

- Work and safety gear

This segment is vibrant and growing. Key manufacturing areas include Dhaka, Narayanganj, Chattogram, and emerging clusters in Rajshahi and Khulna. While large factories handle bulk international orders, thousands of SMEs and cottage industries create products for local markets and regional exports.

In 2024:

- Over 3,000 SMEs were actively involved in hide trading and leather goods production.

- Local brands like Bay, Apex, and Jennys continue to expand their footprint, both at home and abroad.

However, many manufacturers face constraints in machinery modernization, export compliance, and access to affordable financing.

2.3. Exporting: Bangladesh on the Global Leather Map

The export side of the leather sector is a vital foreign exchange earner for the country. Bangladeshi leather and leather products are shipped to:

- Italy, Spain, Germany, and France (Europe)

- China, Japan, South Korea (Asia)

- USA and Canada (North America)

- UAE, Saudi Arabia (Middle East)

The sector exports three major categories:

- Raw hides (salted)

- Wet blue leather (semi-processed)

- Finished leather goods

While wet blue exports still dominate, there is a government push to encourage value-added finished goods, which offer better prices and branding potential.

In 2023–24:

- Leather and leather product exports earned over $1.1 billion, though still below the sector’s full potential.

- Bangladesh ranks among the top 10 leather exporters globally in terms of raw materials.

2.4. Employment and Livelihoods

Perhaps the most human part of the industry is the people behind it. From seasonal hide collectors during Eid to permanent tannery workers, the sector provides income for a vast number of individuals.

- An estimated 100,000+ people are directly or indirectly employed.

- Employment includes:Tannery workers (often from marginalized communities), Logistics staff (truck drivers, warehouse workers),Artisans and factory workers, Informal agents and seasonal traders

- Many workers still operate without formal contracts, exposing them to health and wage risks.

3. Supply Chain of Qurbani Hides

The value chain of Qurbani hides is a complex journey that transforms sacrificial animal skins into valuable raw materials and finished leather goods. Each step is crucial in maintaining quality and maximizing economic benefits.

3.1 Collection

Immediately after the Qurbani sacrifice, hides begin their journey through multiple channels:

- Individual households often sell or hand over hides to local collectors.

- Street collectors play a vital role, visiting neighborhoods to gather hides door-to-door.

- Various NGOs, madrasas, and orphanages actively participate by collecting hides as donations, which they later sell to fund their activities, intertwining social welfare with the hide economy.

This diverse collection network ensures hides reach the next stage quickly but also creates challenges in standardizing quality and pricing.

3.2 Preservation

Preserving the hides is essential to prevent spoilage:

- Hides are salted immediately after collection to draw out moisture and slow decomposition.

- Unfortunately, many rural collectors and households lack adequate salt supplies or proper knowledge, leading to improper preservation.

- Poor storage conditions such as exposure to heat and humidity accelerate decay, reducing the commercial value of the hides.

Effective preservation is key to maintaining the economic worth of hides, especially when delays in collection and transportation occur.

3.3 Transportation

Once collected and preserved, hides move through a tiered transportation system:

- From villages and towns, hides are transported to regional warehouses that act as aggregation points.

- From these warehouses, hides are sent to major tannery hubs, primarily in Savar (near Dhaka) and Chattogram.

- Transportation infrastructure, especially in remote or rural areas, often faces challenges like poor roads, congestion during Eid season, and logistical bottlenecks.

- These delays cause quality deterioration due to extended exposure to heat and pests.

Streamlining transportation is critical to reduce losses and ensure hides reach tanneries in optimal condition.

3.4 Processing and Export

The final stage involves transforming raw hides into valuable leather:

- Tanneries in Savar and Chattogram chemically treat hides to produce finished leather used in various industries.

- Some hides are exported as raw or semi-processed wet blue leather, catering to global markets.

- Others are used by domestic manufacturers to produce footwear, bags, belts, and other leather goods, contributing significantly to local industry and employment.

This step adds the most value, but requires stringent quality control and investment in modern technology to compete internationally.

4. Economic Importance

The Qurbani hide sector is a cornerstone of Bangladesh’s economy, deeply intertwined with the country’s export earnings, employment landscape, and socio-economic welfare.

4.1. Exports and Foreign Exchange Earnings

Leather and leather-related products, including raw hides, wet blue leather, and finished goods like shoes and bags, contribute over $1 billion in export revenue annually. This places the leather sector among the most significant non-traditional export earners for Bangladesh. Ranked as the 5th-largest foreign exchange earner, it follows behind Bangladesh’s powerhouse industries: ready-made garments, remittances from overseas workers, agriculture, and jute. The continuous demand for leather goods globally—especially from Europe, the United States, and Asian markets—ensures a steady stream of income, which is vital for the country’s balance of payments and overall economic stability.

4.2. Employment Generation

The leather industry is a major source of employment, providing jobs to over 85,000 people directly and indirectly. The workforce largely consists of low-skilled and semi-skilled laborers who often belong to economically disadvantaged groups. This includes tannery workers, hide traders, transporters, craftsmen, and factory workers involved in the manufacturing of finished leather products. In rural areas, hide collection and preservation during the Eid-ul-Adha season provide seasonal employment opportunities that are crucial for many households. The industry thus plays a key role in poverty alleviation and livelihood generation in both urban and rural communities.

4.3. Charitable Contributions

A unique and socially significant aspect of the Qurbani hide market is the charitable dimension. Approximately 25% of all Qurbani hides collected during Eid-ul-Adha are donated by individuals, religious organizations, NGOs, madrasas, and orphanages. These donated hides are sold to generate funds that support a wide array of social welfare programs, including poverty relief, education, healthcare, and disaster response initiatives. This practice not only strengthens the link between religious observance and community support but also contributes to the redistribution of wealth within society.

4.4. Economic Linkages and Local Business Ecosystem

Beyond direct employment and export revenues, the Qurbani hide sector stimulates a complex supply chain involving thousands of small and medium-sized enterprises (SMEs). These include salt suppliers for hide preservation, transport companies, wholesale and retail traders, and leather goods manufacturers. The sector’s health directly affects ancillary industries such as chemicals for tanning, packaging, and logistics. Consequently, improvements in the Qurbani hide market’s efficiency and transparency can have far-reaching positive impacts on Bangladesh’s broader economic ecosystem.

5. Market Dynamics: 2024 Performance

5.1 Sacrificial Animal Count

Eid-ul-Adha 2024 once again underscored the deep religious and cultural significance of Qurbani in Bangladesh. According to Ministry of Fisheries and Livestock data and industry estimates, approximately 11.2 million animals were sacrificed nationwide:

- Cows and Buffaloes: Around 4.5 million, primarily in urban and semi-urban households.

- Goats and Sheep: Roughly 6.7 million, more prevalent in rural and lower-income areas due to affordability.

This immense volume of sacrificed animals generated one of the world’s largest seasonal surges in rawhide supply within just 48 to 72 hours—a phenomenon few other industries face globally. The magnitude of this annual event, if efficiently managed, could make Bangladesh a leather superpower.

5.2 Raw Hide Production and Losses

The Qurbani season in 2024 produced over 210 million square feet of raw hides. However, poor post-slaughter management led to alarming levels of waste:

- Almost 15% (31–35 million sq. ft.) of collected hides were damaged beyond usable condition.

- Heavy monsoon rainfall, especially in northern and central districts during Eid, soaked and spoiled thousands of hides due to inadequate tarpaulin coverage and lack of elevated storage.

- In many rural areas, access to salt was limited, leading to early bacterial decay.

- Shortage of cold storage facilities and trained personnel for hide handling exacerbated the spoilage rate.

These inefficiencies not only reduced overall export quality but also represented a multi-crore taka loss to the economy, particularly affecting NGOs and religious institutions relying on hide donations.

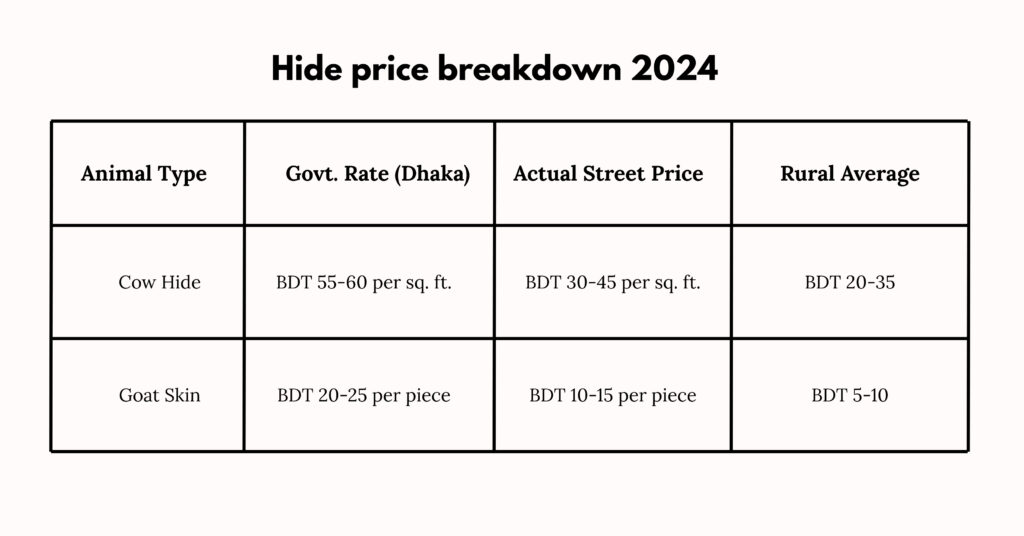

5.3 Price Breakdown (2024)

While the government declared minimum prices through the Commerce Ministry, actual transactions told a different story. In Dhaka and other metropolitan centers, there was some adherence to official rates—but in rural markets, prices dropped dramatically.

Middlemen exploited the urgency of the sellers—often madrasas, orphanages, and individuals with no storage or bargaining power. In some cases, they bought hides at a fraction of the declared rate, hoarded them, and later sold at higher profits when market demand peaked.

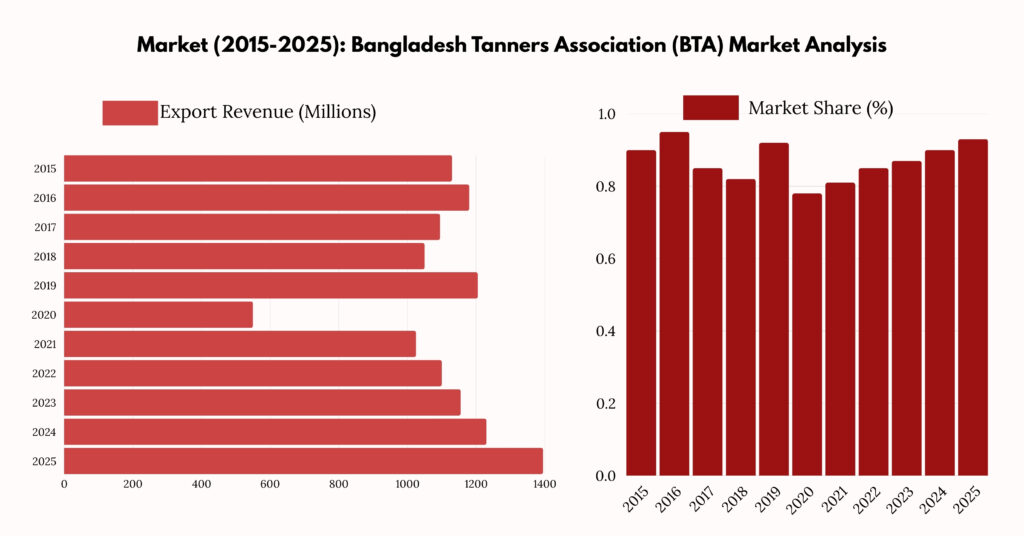

6. Export Performance of Leather and Leather Goods

While Bangladesh’s Qurbani season generates the world’s second-largest surge of hides after China, the country still struggles to capitalize fully on this raw material wealth in international markets.

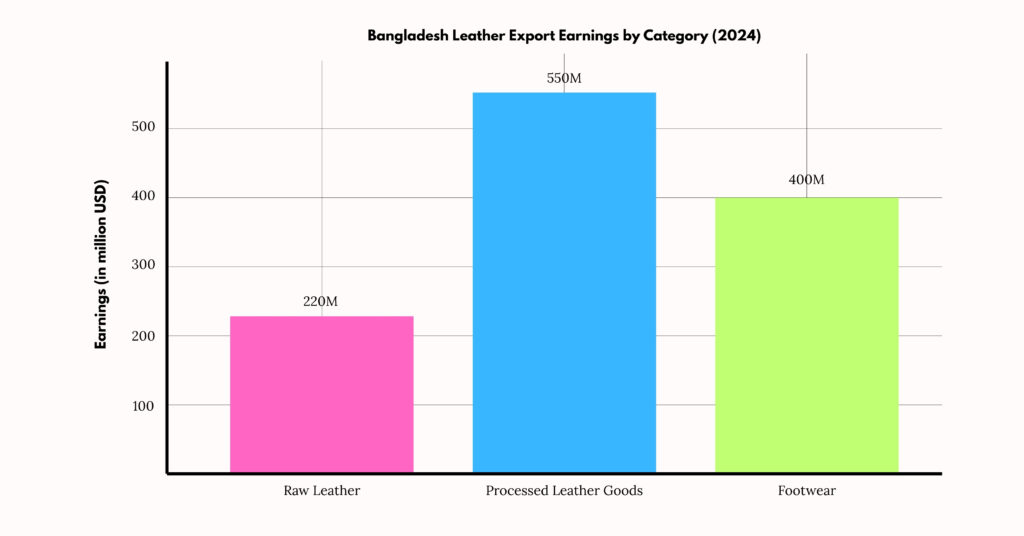

6.1. 2024 Leather Export Earnings:

- Raw Leather: $220 million – primarily to China and Korea.

- Processed Leather Goods: $550 million – bags, wallets, belts, etc.

- Footwear: $400 million – includes OEM and branded shoes for export.

- Total Export: ~$1.17 billion

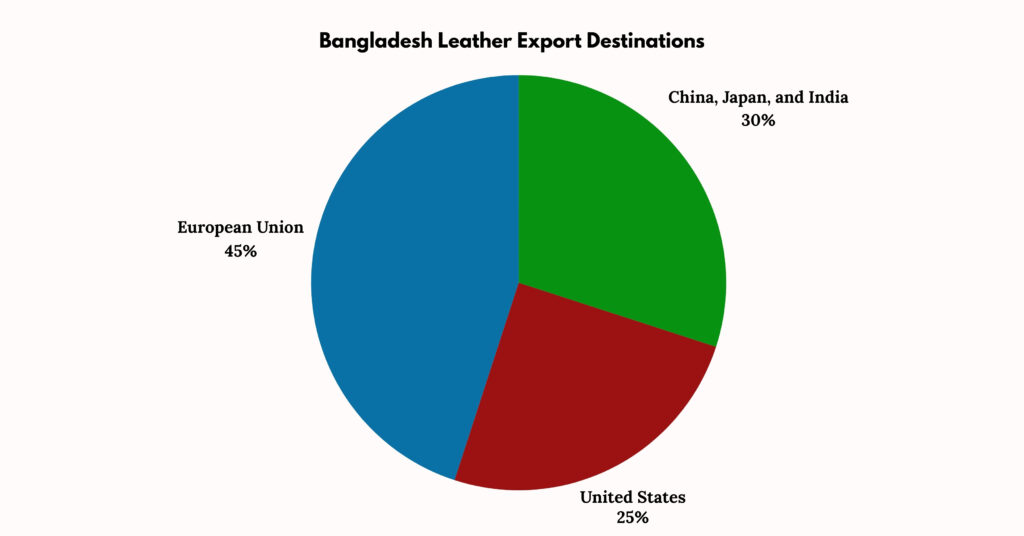

6.2. Key Export Destinations:

- European Union: 45% – mostly Italy, Germany, and Spain.

- United States: 25% – for both fashion and utility leather goods.

- China, Japan, India: 30% – predominantly raw and semi-processed hides.

6.3. Challenges Limiting Export Growth:

Environmental Compliance & CETP Dysfunction: The long-delayed Central Effluent Treatment Plant (CETP) in Savar remains plagued by inefficiencies. Incomplete waste treatment results in non-compliance with EU environmental norms, limiting access to high-value markets.

- Weak Global Branding: Bangladeshi leather is often sold under foreign brands or as unbranded OEM products. This keeps profit margins low and prevents local identity from forming in the global marketplace.

- Technological and Skill Gaps: A large portion of the workforce still relies on manual, outdated techniques. Investment in automated processing, eco-leather innovations, and designer-level finishing remains minimal.

- Export Dependency on Low-Margin Goods: While Bangladesh exports a large volume of leather, the bulk is low-margin wet blue leather or basic products. Higher value segments—luxury handbags, designer shoes, smart leather tech—remain untapped.

7. Price Trends and Syndicate Influence

One of the most controversial and damaging aspects of Bangladesh’s Qurbani hide market is the manipulation of prices by informal syndicates. These powerful groups emerge almost every year during Eid-ul-Adha, exploiting supply gluts and the lack of market regulation to artificially deflate prices. In 2024, this malpractice was especially evident:

- Hide donors—especially in rural areas—received less than 60% of the official government-fixed price. For example, while the government set cowhide rates in Dhaka at BDT 55–60 per square foot, many sellers were forced to accept BDT 30–45 in urban areas, and as low as BDT 20–35 in rural regions. Goat skins saw even worse devaluation, often selling for a fraction of their assessed worth.

- Syndicates strategically delayed bulk purchases, hoarding raw hides in temporary warehouses. They waited for supply to drop post-Eid and then resold hides at significantly higher prices, often to the same tanneries or exporters, pocketing huge profits while producers and donors suffered losses.

- Charitable organizations, madrasas, and orphanages—who rely on donated hides for funding—faced enormous revenue losses. Many reported a drop of over 50% in expected earnings, threatening their operational budgets for the coming year.

This price manipulation not only hurts sellers but also has a domino effect on the entire value chain—from collection agents to tanners. The lack of price transparency, inadequate monitoring, and absence of a fair pricing mechanism have turned what could be a national economic boost into a chaotic and exploitative market.

Read more: Leadership Crisis or National Duty? Dr. Muhammad Yunus Refuses to Resign Amid Political Unrest

8. 2025 Market Forecast and Industry Outlook

As Bangladesh prepares for another Qurbani season, the leather industry faces both challenges and opportunities. A mix of economic trends, regulatory efforts, and global demand will shape the performance of the sector in 2025.

8.1 Animal Slaughter Projections

For Eid-ul-Azha 2025, an estimated 11.5 to 12 million animals are expected to be sacrificed nationwide. This figure is consistent with recent trends, reflecting both population growth and increased income among rural and urban middle-class households. However, the volume of hides generated during this short window can overwhelm the country’s limited collection and processing capacity if not managed efficiently—particularly in the absence of strong logistics and preservation infrastructure.

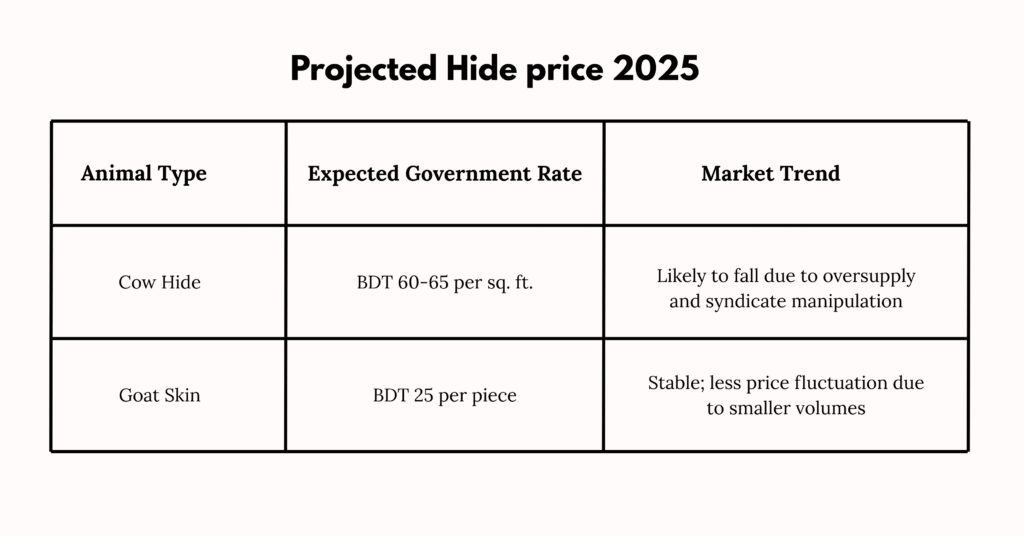

8.2 Projected Hide Prices

Analysis:

While the government aims to increase base rates slightly to encourage fair trade, actual market prices may again fall short due to syndicate influence, weak enforcement, and logistical constraints. Oversupply during Eid, especially in rural markets without cold storage or timely collection, could lead to significant price drops, hurting both donors and collectors.

8.3 Export Outlook

The government has set an ambitious export revenue target of $1.25–1.3 billion from leather and leather goods in FY2025, banking on several strategic shifts:

- Focus on finished and processed leather goods, rather than raw or semi-processed hides.

- Expanding access to Western markets through improved compliance with environmental and labor standards.

- Branding based on ethical sourcing and eco-friendly production, as global buyers increasingly prioritize sustainability.

With the EU and US markets gradually reopening and demand recovering post-pandemic, Bangladesh has a chance to regain momentum—if it can address compliance gaps and production inefficiencies.

8.4 Investment Trends

2025 is expected to witness renewed investment across the leather value chain:

- Tanneries are prioritizing waste treatment and environmental compliance to meet both local regulations and international standards, especially after continued pressure from watchdog organizations and export partners.

- Public-private partnerships (PPPs) are emerging to solve longstanding issues in rawhide collection and transportation logistics. Efforts include mobile app-based coordination, community-level cold storage setups, and financial support for small-scale collectors.

- Technological upgrades are being considered, including traceability systems, barcode tagging of hides, and blockchain integration for export tracking—creating more transparency in the supply chain.

9. Current Trends

9.1. Environment Pollution Issue

The Government of Bangladesh is working hard to prevent environmental pollution caused by waste from the leather industry. In 2003, the government established BSCIC Tannery Industrial Estate on 200 acres of land at Hemayetpur in Savar to prevent pollution of the Buriganga river and develop compliance in the industry, and all tanneries were shifted from Hazaribagh to Hemayetpur. But this facility can hold about 25 thousand cubic meters of liquid waste per day, in contrast to which about 40 thousand cubic meters of liquid waste is discharged from the tanneries every day.

In addition, proper solid waste management has not yet been established in the area. According to The Daily Star, the government is planning to close this tannery complex of Savar. Besides, the Bangladesh government is planning to set up a leather industrial park next to BSCIC Tannery Industrial Estate. A full-fledged ‘leather industrial city’ of 400 acres will have a tannery, forward and backward linkage industry, and a proper waste management system. According to Bangladesh Small & Cottage Industries Corporation or BSCIC, the government has decided to set up two more tannery villages in Bangladesh besides the Savar Tannery Zone. One of which is in Rajshahi and the other in the Mirsarai area of Chittagong.

9.2. Eco-friendly Leather Culture

All animal rights organizations around the world are working hard to stop the use of wild animal skins, such as snakes and crocodiles. As a result, world-renowned brands have also stopped using these wild animal skins in their products. The brands want to use the skin of domestic animals because the skin is a residue of meat consumption. Several companies in Bangladesh are working on making exotic skins that look like snake and crocodile skins by using domestic animal skins. The companies are conducting the entire designing and tanning process of this leather in an eco-friendly way as well as ensuring compliance for the foreign market.

10. Challenges of the Leather Industry

10.1. Imported Machinery & Chemicals

Machinery used in leather processing and production is modernizing mainly imported from abroad. Besides, chemicals required for production also have to be imported from abroad at high prices. As a result, the overall cost of leather preparation is much higher.

10.2. Inefficiency in Raw Material Procurement

According to a BTTC source, the total supply of raw skin in Bangladesh at present is 20 million units, of which 50 percent comes during Eid-ul-Azha. The processing work has to be done quite fast to finance and to maintain the quality of the raw leather procurement collected at this time. But the procurement, preservation, and processing systems of these skins are much more outdated, insufficient, and slow in Bangladesh. Due to this, in addition to declining skin quality, the skin is often permanently damaged.

10.3. Lack of Skilled Workforce

To add higher value to any product, it is important to meet the various needs and export targets of the value chain. And this requires a sufficient and efficient workforce. But there is a lack of an adequate skilled workforce in Bangladesh’s leather industry. Which is a big challenge for this industry.

10.4. Lack of Funding

One of the most significant challenges facing the leather industry is the lack of funding. In particular, the lack of funding for small and medium-sized tanneries is a major problem. A stable fund stream is much required to adopt advanced technology and create a skilled workforce. However, due to the high rate of loan default in the leather sector, it becomes very difficult for the tanneries to get funds. According to Business Standard, published in July 2020, more than BDT 40 billion has been invested in the country’s leather sector, of which BDT 32.5 billion is still in default, most of which is in long-term debt. As exports declined and processing became more expensive tanneries became loan defaulters.

10.5. Heavily Reliant on Brokers

The leather market in Bangladesh is dominated by some large tanneries which directly collect leather from small and medium tanneries. This has made most of the small tanneries in the market dependent on brokers for their leather sales. As a result of such a market structure, tanneries fail to reach foreign markets like conglomerates.

10.6. Work Environment

The tannery environment is very dirty due to poor management of waste. Tannery workers also gradually fall ill in such a dirty work environment. Most tanneries do not follow the Basic Health Compliance Guidelines, which is a major problem for the health and safety of the workers involved in production.

11. Conclusion

Qurbani animal hides remain a vital seasonal economic driver for Bangladesh. However, the full potential of this sector remains untapped due to inefficiencies, corruption, and poor regulation. The 2024 market highlighted critical vulnerabilities but also opened avenues for reform. With proper policy support, digital innovation, and ethical practices, the Qurbani hide industry can contribute significantly to exports, employment, and community development by 2025 and beyond.

References:

Share via: