Bangladesh has witnessed a significant surge in remittance inflow during the first 18 days of June 2025, with expatriates sending $1.86 billion through official banking channels. This sharp rise is being viewed as a major boost for the national economy ahead of Eid-ul-Azha, a time when remittance flows typically climb.

According to the latest data released by Bangladesh Bank, the country received an average of $103.3 million per day during this period. At an exchange rate of Tk 122 per US dollar, the total amount received is equivalent to approximately Tk 22,700 crore.

This influx comes at a time when Bangladesh has already recorded a strong performance in remittance for the current fiscal year. From July 2024 to 18 June 2025, total remittances stand at $29.36 billion, showing a remarkable 27.3% increase compared to the same period in the previous fiscal year. At that time, the country received $23.06 billion in remittance.

These figures highlight the growing reliance on formal remittance channels and the increasing engagement of overseas Bangladeshis in supporting their families and the national economy.

Recent Months Reflect Continued Growth

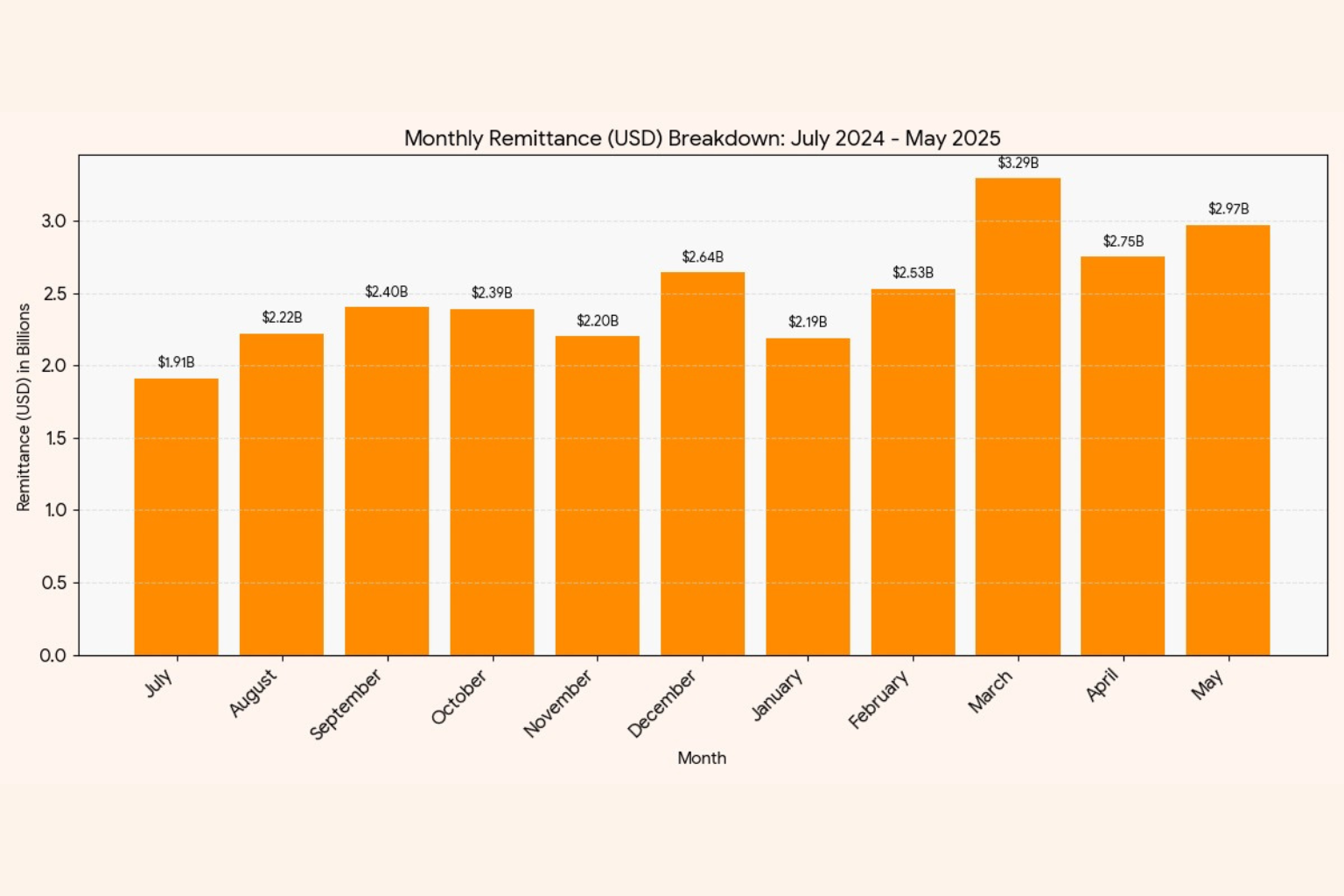

Remittance inflows have shown a steady upward trend over the past year, with several months posting impressive numbers:

-

March 2025: $3.29 billion (all-time highest)

-

May 2025: $2.97 billion (second-highest ever)

-

April 2025: $2.75 billion

-

February 2025: $2.53 billion

-

December 2024: $2.64 billion

Each of these figures underlines the consistent and positive momentum in remittance growth, especially in months linked to major religious festivals or family-related expenditures.

Monthly Breakdown: July 2024 to May 2025

Driving Factors Behind the Surge

Experts attribute this surge in remittance to several key factors:

-

Government Incentives: The 2.5% cash incentive on remittance through official channels continues to encourage migrant workers to avoid informal systems.

-

Eid-ul-Azha Effect: Religious holidays typically see a rise in remittance as families back home require more funds for festivities and sacrifices.

-

Crackdown on Illegal Channels: Authorities have strengthened measures against informal money transfer methods (such as hundi), making bank transfers a safer and more preferred choice.

-

Improved Digital Access: Online and mobile-based banking services have simplified the process of sending money, even from remote regions.

Read More: Remittance Dollar Rate Drops Unexpectedly Despite Market Reform – What’s Behind It?

Economic Implications: Boosting Stability Amid Challenges

This high volume of remittance is proving to be a timely relief for Bangladesh’s macroeconomic stability. It is easing pressure on foreign currency reserves, supporting the value of the taka, and helping banks manage liquidity more efficiently.

Given the global economic uncertainties and internal challenges including trade imbalances, inflation, and dollar shortages, a healthy inflow of remittance is critical to maintaining balance in the external sector.

If the current pace continues, June could end with over $3 billion in remittance inflows, possibly rivaling March’s record. This would significantly enhance the country’s foreign exchange reserves at a crucial time.

However, sustaining this momentum will depend on continuous policy support, technological enhancements in banking infrastructure, and consistent efforts to discourage the use of informal money channels.

Bangladesh’s robust remittance performance in June 2025 is more than just a number. It reflects the trust of millions of expatriates in the country’s financial system and their unwavering support for families and the broader economy. As the nation approaches Eid, this record-breaking inflow not only spreads joy among loved ones but also injects much-needed strength into the country’s economic framework.

Source: Jugantor