Dollar Rate Goes Down Despite Market-Based System

After the Bangladesh Bank introduced a market-based exchange rate system on 14 May, many people expected the dollar rate to go up. But instead, the dollar rate for remittances has started to fall.

On Thursday, banks were offering Tk122.70–122.80 per dollar to buy remittance money. This is a drop of Tk0.5–0.7 from mid-May, when the rate was around Tk123.20–123.30, according to treasury officials.

Why Is the Rate Falling?

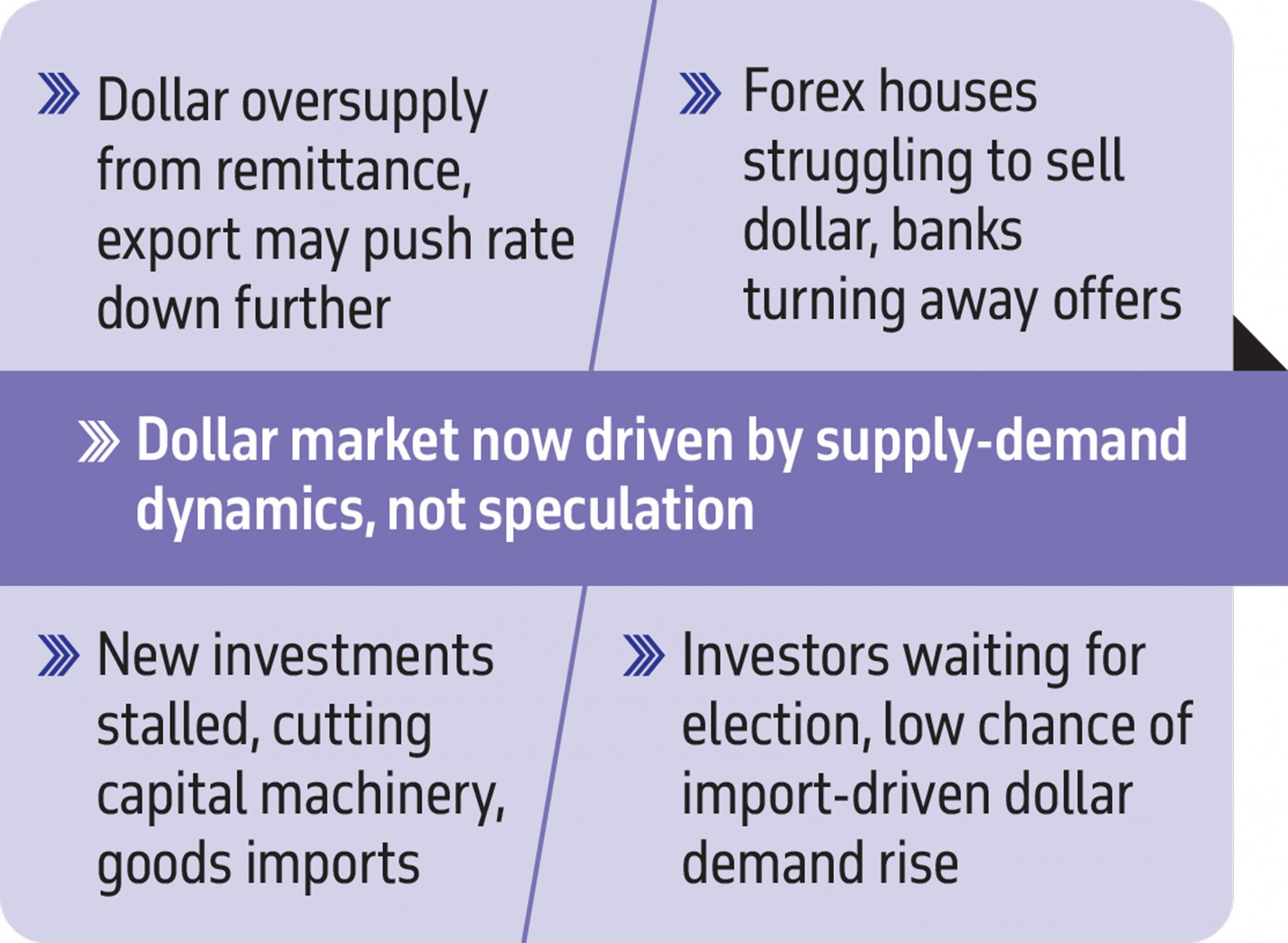

Several reasons are behind the falling rate:

-

Banks have better dollar liquidity now

-

Overdue import bills have mostly been paid

-

Export income is growing steadily

-

Demand for dollars in the interbank market is lower

Even though the market-based system allows rates to move freely, major bank treasury heads informally agreed to cap the remittance dollar rate at Tk123, which caused the rate to drop sharply right after the announcement.

Read More: Toyota Water-Powered Car; Is It Relevant for Bangladesh?

No Rush for Dollars Anymore

Syed Mahbubur Rahman, Managing Director of Mutual Trust Bank, said the dollar market depends on supply and demand.

“After the new system started, many thought the rate would increase. But the actual demand for dollars isn’t high now,” he said.

He also added:

-

New investments are on hold

-

Imports of machinery and raw materials are low

-

Most overdue import payments are already cleared

-

Export earnings are strong

-

Over- and under-invoicing in trade have reduced

All of this has improved the dollar availability in banks.

Strong Export and Remittance Numbers

According to Bangladesh Bank:

-

Export earnings from July to May (FY25) were $44.95 billion, which is 10.36% higher than the same time last year.

-

Import LCs opened reached $58.94 billion (July–April), up 2.98% year-on-year.

-

LC settlements totalled $58.82 billion, growing 6.08%.

-

Remittance inflow from July to 21 June was $29.5 billion, up 26.7% from $23.29 billion a year ago.

Analysts said the remittance inflow could have been even higher if banks were not closed for about 20 days during Eid.

Private Sector Reduces Dollar Borrowing

From February to April, short-term foreign debt in the private sector rose by $454 million, helped by:

- Favourable international interest rates

- Stable foreign exchange reserves

- Low market volatility

Still, demand for dollars remains low, especially in the private sector.

Investors Are Waiting for National Election

Bank officials believe the dollar demand will not increase much in the near future. This is because:

-

Most private investors are waiting for the national election

-

They are not starting new projects

-

Investment-related import demand remains low

On the other hand, remittance and export earnings are likely to keep growing, which means more dollars in the market and continued pressure on the exchange rate to fall.

Banks No Longer Chasing Dollars

A foreign exchange house representative said:

“Earlier, banks used to call us to buy dollars. Now we are calling them, and many don’t even want to buy. Some state-owned banks that were active buyers last month have now stopped.”

He also said the remittance dollar rate is now dropping daily by around Tk0.5 to Tk0.1.

Stable Reserves Support Currency Market

According to Bangladesh Bank, the country’s gross foreign exchange reserves stood at $20.77 billion as of 4 June. This is the fifth month in a row that reserves have stayed above $20 billion, helping keep the currency market stable.

Source: TBS