Introduction: The Evolving Fintech Landscape

Imagine a world where Bangladeshis can send money abroad instantly, pay for services online like anyone else, and avoid high transfer fees. That’s exactly what RiverPay is trying to make happen. It’s a new financial technology (fintech) platform launched by a U.S.-based company called River.app, created by Bangladeshi-American entrepreneurs Ruhin Hossain, Mushrath, and Yasser.

In recent years, financial technology (fintech) is changing how we manage money. From mobile banking to digital wallets and cryptocurrency, the global fintech industry is growing faster than ever. But while people in countries like the U.S. or the U.K. enjoy easy digital payments, many developing countries are still catching up.

In Bangladesh, there are millions of freelancers, migrant workers, and entrepreneurs. Yet, global payment services are still not available there. Sending or receiving money across borders is often slow, expensive, or simply not possible. That’s where River.app steps in—with a mission to close this gap and give Bangladeshis equal access to global financial tools.

Their latest innovation is RiverPay, a powerful platform designed to support freelancers, migrant workers, and global travelers. With features like instant payments, multi-currency wallets, low-cost money transfers, and even global eSIMs,RiverPay is turning financial independence into a possibility for Bangladeshis everywhere.

What is River.app?

River.app is a U.S. based tech company founded by Ruhin Hossain, Mushrath, and Yasser—three Bangladeshi-Americans with a vision to build tools that truly serve the needs of the global Bangladeshi community. They didn’t want Bangladeshis to just use foreign technologies, they wanted them to help create the next generation of it.

River first made its name in telecommunications, offering affordable global eSIM services. With over 130,000 users, their service helped travelers, remote workers, and migrant laborers stay connected anywhere in the world without relying on local SIM cards.But the team saw a bigger opportunity. Beyond just connecting people by phone, they wanted to connect them financially. So the company is growing beyond telecom and diving into global finance with RiverPay.

The Power of Partnership: River + Wind

To make RiverPay truly revolutionary, River.app joined forces with another visionary—Hussain M Elius, the CEO and co-founder of Pathao, one of Bangladesh’s top tech startups. After Pathao, Elius turned his attention to blockchain and created Wind, a digital payment system that used blockchain software to transfer money quickly and safely over borders. Blockchain, best known for powering cryptocurrencies like Bitcoin, confirms instant transactions without the presence of a middleman. River.app acquired Wind, and Elius joined the River team as a Co-Founder and CTO. His fintech experience and blockchain expertise are now at the heart of RiverPay’s technology.

A three-part super app: Telco, payments, banking

Telecommunications: River’s eSIM service was launched in 2024 and reached $10 million ARR in under 12 months. Today, it serves 30,000+ recurring users and over 100,000 one-time buyers globally.

Payments: With the acquisition of Wind, users will now be able to send and receive stablecoin-powered transactions with up to 70% lower fees than legacy providers, hold multi currency wallets, and pay bills—no bank required.

Banking: River’s upcoming roadmap includes fully decentralized banking tools to unlock cross-border users’ income, credit, and savings access.

“This isn’t about hype,” said Chairman Nabeel Alamgir. “It’s about fast money, simple mobile, and earning trust where legacy systems failed.”

Introducing RiverPay: Features and Solutions

So what exactly does RiverPay offer? It’s not just a payment app. RiverPay is a global financial toolkit built with the real-life challenges of Bangladeshis in mind. Here are its core features:

Instant Payments with Stablecoins: RiverPay uses stablecoins , a type of cryptocurrency that’s equal to traditional money (like the U.S. dollar), to allow fast, secure, and borderless payments. Unlike normal crypto, stablecoins don’t suddenly lose value, making them safe for everyday use.

Multi-Currency Wallets: Users can hold and use different currencies—like USD, EUR, or BDT—in one app. This is perfect for freelancers who get paid in dollars but spend in taka.

Reduced Remittance Fees: Traditional remittance providers typically charge high fees. RiverPay wants to provide cheaper options so more of the sender’s money makes it to the recipients.

Global eSIM Connectivity: Expanding beyond the telecommunications roots from which it was founded, RiverPay offers international eSIM services so users can travel without having to swap out SIM cards.

Together, these features solve several problems like the absence of PayPal in Bangladesh, high remittance costs, and the lack of digital financial tools for freelancers and migrant workers.

Regulatory Compliance and Global Expansion

RiverPay has secured regulatory licenses in the European Union (EU) and the United Arab Emirates (UAE), where there are a lot of Bangladeshi Expatriates. These licenses are not just a testament to RiverPay’s dedication to regulation, but they also place the platform in a good standing for developing business in valuable markets. By following international regulatory practices, RiverPay guarantees the security and reliability of its service and to build trust among users as well as its partners.

A profitable, rapidly scaling platform

River has achieved profitability and rapid scale without outside investment. The company is currently valued between $100 million and $200 million and expects to grow its user base from six figures to several million by year-end.

Key growth drivers include:

- Enterprise partnerships, including a recent deal to onboard over one million migrant workers

- Licensing in key global markets, including the EU and UAE

- Strategic focus on diaspora populations, who sent over $800 billion in remittances last year

“We’re closing the loop,” said Ruhin Hossain, CEO of River. “We started by connecting people across borders. Now we’re helping them move money, build wealth, and live with dignity—on one seamless platform.”

Read More: Dubotech: Transforming Underwater Technology in Bangladesh

Impact on Bangladesh and the Global Bangladeshi Community

RiverPay’s launch has the potential to bring significant change to both Bangladesh and its global community.

Empowering Freelancers: Bangladesh also has an increasing number of freelancers, specially in technology, design and writing. RiverPay offers these freelancers with fast and trusted method of receiving payments from clients across the globe, therefore improving their efficiency and profit.

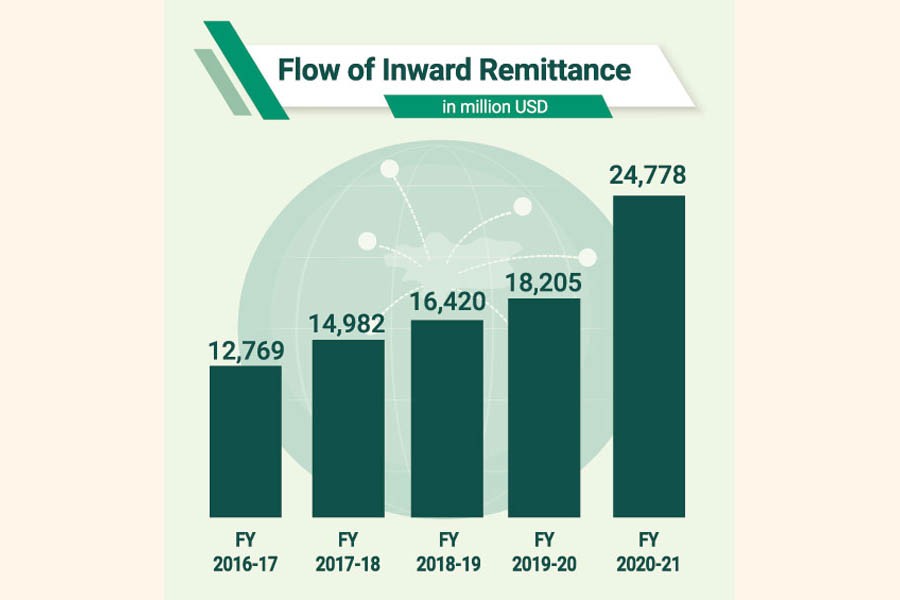

Supporting Migrant Workers: Many Bangladeshis work outside the country and send money home to support their families. RiverPay gives them an easy, low-cost way to provide financial support, making it easier for their loved ones to have a more stable financial life in their home countries.

Fostering Financial Inclusion: RiverPay makes financial services accessible to more people, especially those who might not have access to traditional banking. By offering digital financial tools, it helps more people join the global economy and manage their money easily.

Moreover, RiverPay is also the beginning of a new digital era for Bangladeshis: from users of foreign technology to creators. It presents the Bangladeshi community as a world-class people and nation in terms of talent and promise, capable of delivering strong solutions to global challenges.

Future Prospects and Challenges

While RiverPay’s prospects are promising, several challenges lie ahead:

- Challenges to adoption: Getting people to adopt digital over traditional finance requires efforts in the education and outreach department.

- Regulatory Dynamics: Adapting to the dynamic and varied regulatory framework of different countries requires agility and adherence.

- Technological Literacy: Ensuring that users, especially in rural areas, understand and can effectively use digital financial tools is crucial for widespread adoption.

Addressing these challenges will require a partnership with local institutions, ongoing user education, and more flexible technology.

Conclusion: A Step Towards Financial Empowerment

RiverPay represents a significant stride towards financial empowerment for Bangladeshis worldwide. By addressing specific challenges and offering tailored solutions, it paves the way for greater inclusion in the global financial ecosystem.

Through the combined efforts of visionary leaders like Ruhin Hossain and Hussain M Elius, RiverPay not only offers practical solutions but also inspires a broader movement of innovation and self-reliance within the Bangladeshi community.

References: