Introduction

While soft drinks have become synonymous with Eid hospitality, their rising consumption during the festival also sparks concerns over health risks, consumerism, and environmental impact raising questions about where cultural tradition ends and corporate influence begins.

Eid ul Adha is not only a religious milestone but also a key driver of economic momentum in Muslim-majority countries. From sacrificial rituals to family feasts, every corner of society becomes active. A less talked-about but economically significant product during this time is soft drinks. Soft drinks are everywhere, whether they are served at mealtime, offered to guests, or used to cool down in the summer heat. Their presence in homes, markets, and Eid festivities transforms them into cultural commodities, not just consumer goods.

This seasonal transformation is not merely anecdotal. Retailers, distributors, and beverage manufacturers witness a substantial uptick in demand leading up to Eid. Companies plan their inventory, production schedules, and marketing strategies months in advance to capitalize on the occasion. Special edition packaging, Eid-themed advertising campaigns, and promotional pricing strategies become common tools to capture consumer attention. In effect, soft drinks evolve from mere consumer goods into cultural commodities an essential part of the Eid experience.

The influence of Eid ul Adha on the soft drink industry also reveals important insights into the interplay between tradition and market behavior. Economic activity around the festival generates temporary spikes in employment, stimulates distribution networks, and fuels revenue across various sectors. Small businesses, local vendors, and delivery services benefit from increased customer flow and consumer spending. This pattern highlights the adaptive nature of commerce, where seasonal and religious events significantly impact consumer trends and business performance.

The Cultural Role of Soft Drinks During Eid

Soft drinks may not be religious symbols, but during Eid ul Adha, they evolve into cultural signifiers quietly yet powerfully embedded in the rituals of hospitality. In many Muslim households, offering a cold beverage to guests is a gesture of warmth, generosity, and celebration. Whether it’s a fruity soda or a fizzy cola, the soft drink transcends its role as a mere beverage and becomes a shared experience, social cue, and unwritten tradition.

In the days leading up to Eid, families prepare not only meat dishes and desserts but also stock up on bottled and canned beverages in bulk. The variety reflects both personal taste and the desire to cater to guests, often with multiple brands and flavors lined up in refrigerators. The sound of a bottle cap twisting open or the fizzing splash into a glass is part of the sensory experience of Eid just as integral as the aroma of biryani or the sizzle of grilled meat.

Children, in particular, associate soft drinks with festive joy. For many, it’s the one time of year when consumption is freely allowed and even encouraged. Elders, while more health-conscious, still partake as a way of honoring tradition and joining in the collective mood. From rural villages to urban high-rises, soft drinks are served in plastic cups, glass tumblers, or directly from the bottle creating moments of togetherness across class and geography.

Even outdoor Qurbani (sacrificial meat distribution) areas become informal social spaces where volunteers and workers share a bottle of soda under the sun. Whether inside the home or out in the community, the beverage functions as a small token of hospitality with a surprisingly large cultural weight.

This transformation from a commercial product to a cultural artifact illustrates how global brands and local customs can intersect, forming unique traditions that are deeply rooted in both memory and market behavior.

Why Eid ul Adha Boosts Soft Drink Sales

Soft drink sales experience a significant surge during Eid ul Adha, driven by a combination of cultural practices, climatic conditions, and economic behavior. Several key factors contribute to this seasonal spike:

-

Increased Social Gatherings: Eid is a time for communal prayers, family reunions, and social visits. With more people coming together for meals and celebrations, the demand for refreshments naturally rises. Soft drinks are often the beverage of choice due to their convenience, variety, and wide appeal.

-

Hot Climate: Eid ul Adha often coincides with peak summer in many Muslim-majority countries. The soaring temperatures amplify the craving for cold beverages, making soft drinks a quick and accessible way to cool down during outdoor and indoor festivities.

-

Cultural Tradition: Offering drinks to guests is deeply ingrained in the hospitality norms of Eid. Whether during visits to relatives, community events, or Qurbani meat distribution, soft drinks are a common token of goodwill and generosity.

-

Extended Holidays: The Eid break allows families more time at home, leading to increased domestic consumption. Meals become more elaborate, and beverage consumption rises correspondingly, especially with children and young adults home from school.

-

Outdoor Activities: In the days leading up to Eid, people spend considerable time in cattle markets, shopping centers, and open-air gatherings. On-the-go purchases of chilled soft drinks become a common choice for refreshment in the midst of these activities.

These combined factors create a favorable environment for beverage companies. In many markets, sales can spike by as much as 30% to 50% during the week of Eid compared to regular periods. For manufacturers and retailers, Eid ul Adha is not just a festive period—it is a vital window of commercial opportunity that requires targeted logistics, increased production, and strategic marketing.

Economic Flow: From Manufacturers to Small Retailers

The soft drink industry during Eid operates like a carefully timed machine. It begins with manufacturers increasing production weeks in advance. Warehouses, transporters, and distributors form a chain that ensures supply matches the spike in demand.

-

Large Manufacturers: Companies like Coca-Cola, PepsiCo, Akij Food & Beverage (Mojo, Clemon), Partex (RC Cola), and Pran-RFL ramp up production.

-

Distributors: These middlemen ensure that city stores and rural vendors are stocked.

-

Retailers: From mega super shops to roadside stalls, everyone prepares for higher foot traffic.

-

Hawkers and event caterers: Purchase large quantities for Eid-related gatherings.

This economic flow supports thousands of temporary jobs—delivery drivers, cold storage workers, shopkeepers, and festival vendors.

Popular Soft Drink brands in Bangladesh

The market includes both international brands and local producers catering to diverse tastes. These charts illustrates the consumption trends, brand preferences, and seasonal demand patterns for soft drinks in Bangladesh.

Popular Soft Drinks in Pakistan

A chart that highlights the most popular soft drinks in Pakistan. From global giants like Pepsi and Coca-Cola to beloved local favorites like Pakola, this chart gives us a clear picture of consumer preferences and market trends across the country.

Popular Soft Drinks in the Middle East & Africa

we’re taking a refreshing look at the popular soft drinks across the Middle East and Africa. From international giants like Coca-Cola and Pepsi to unique local favorites like Barbican in the Gulf and Maltina in West Africa, this chart reveals the diverse tastes and cultural preferences that shape beverage choices across these regions.

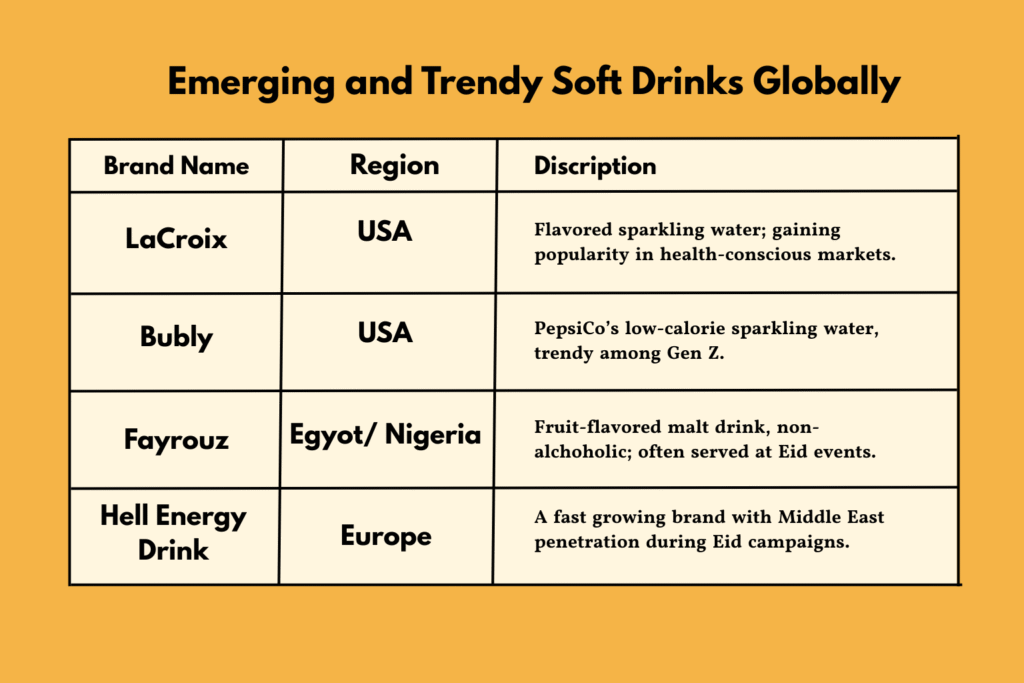

Emerging and Trendy Soft Drinks Globally

Around the world, consumer tastes are evolving people are moving beyond the classic colas and reaching for something fresher, healthier, or just a little more exciting. Whether it’s probiotic sodas in the U.S., sparkling herbal drinks in Europe, or fruit-based fusion beverages in Asia, new trends are bubbling up everywhere. This chart gives us a glimpse into what’s rising in popularity and shaping the next generation of soft drinks globally.

Hyped Soft Drinks Market Investment Trends

-

Local Expansion

-

Akij and Pran are increasing capacity to meet Eid demand with new bottling lines.

-

Pran exports soft drinks to 120+ countries, including high-Eid consumption zones.

-

-

Global Investment

-

Coca-Cola invested over $200 million in Bangladesh for production and distribution.

-

PepsiCo is expanding logistics and introducing festival-focused limited editions.

-

-

E-commerce Integration

-

Companies are partnering with delivery platforms (like Chaldal, PandaMart) to deliver chilled soft drinks during Eid.

-

Online-exclusive combo packs and cashback deals are growing.

-

-

Cold Chain Development

-

Investment in refrigerated vehicles and storage warehouses is rising due to Eid demand peaks.

-

Solar-powered cold boxes are being explored for rural coverage.

-

-

Marketing Spend

-

Eid promotions make up 25–30% of annual ad budgets.

-

Short-form video ads, influencer campaigns, and mobile wallet promotions dominate.

-

-

Sustainability Investment

-

Biodegradable bottles and return schemes are gaining traction.

-

Carbon emission audits are being implemented by major producers.

-

Hyped Soft Drinks Market Investment Trends

-

Local Expansion

-

Akij and Pran are increasing capacity to meet Eid demand with new bottling lines.

-

Pran exports soft drinks to 120+ countries, including high-Eid consumption zones.

-

-

Global Investment

-

Coca-Cola invested over $200 million in Bangladesh for production and distribution.

-

PepsiCo is expanding logistics and introducing festival-focused limited editions.

-

-

E-commerce Integration

-

Companies are partnering with delivery platforms (like Chaldal, PandaMart) to deliver chilled soft drinks during Eid.

-

Online-exclusive combo packs and cashback deals are growing.

-

-

Cold Chain Development

-

Investment in refrigerated vehicles and storage warehouses is rising due to Eid demand peaks.

-

Solar-powered cold boxes are being explored for rural coverage.

-

-

Marketing Spend

-

Eid promotions make up 25–30% of annual ad budgets.

-

Short-form video ads, influencer campaigns, and mobile wallet promotions dominate.

-

-

Sustainability Investment

-

Biodegradable bottles and return schemes are gaining traction.

-

Carbon emission audits are being implemented by major producers.

-

Soft Drink Market Overview: Global and Regional Insights

Globally, the soft drink market is projected to reach over USD 1.4 trillion by 2030, with a Compound Annual Growth Rate (CAGR) of nearly 5 percent. The growth in Muslim-majority regions during religious festivals like Eid ul Adha is an important contributor to this trend.

In Bangladesh, for example:

-

The annual soft drink market is valued at over BDT 5,000 crore.

-

Sales during Eid contribute nearly 25 to 30 percent of seasonal turnover.

-

The market is growing at 10 to 12 percent annually, driven by urbanization, youth culture, and heatwaves.

Similar spikes are reported in Pakistan, Indonesia, Nigeria, Egypt, and the Gulf countries.

Hype and Marketing: How Brands Capture Eid Excitement

Soft drink companies invest heavily in Eid-specific marketing campaigns, such as:

-

TV and online advertisements that evoke family unity, joy, and community.

-

Point-of-sale branding in supermarkets and corner shops.

-

Limited edition packaging with Eid greetings or religious motifs.

-

Discounts and combo offers that target family gatherings.

Social media influencers and micro-celebrities play a growing role. In Bangladesh, Pran and Mojo run TikTok campaigns featuring home chefs and Eid parties, targeting youth. These campaigns are designed not just to boost sales, but also to position soft drinks as essential to the Eid experience.

Consumer Behavior and Shifting Preferences

Consumer preferences are evolving:

-

Younger consumers prefer variety—fruity flavors, sparkling water, and vibrant packaging.

-

Health-conscious buyers lean toward sugar-free options, though demand is limited during Eid.

-

Family-size packs are more popular than single-serve cans during Eid for cost efficiency.

Brand loyalty spikes during festive seasons. Households that usually opt for cheaper alternatives may buy premium brands during Eid to offer guests.

Digital Sales and E-Commerce Opportunities

In the age of digital transformation, Eid ul Adha is no longer limited to traditional retail dynamics. Digital platforms are reshaping how soft drinks are marketed, sold, and delivered—unlocking new levels of convenience and engagement for consumers.

-

Eid-Themed Bundles and Promotions:

E-commerce platforms and online grocery retailers now curate special Eid bundles that combine soft drinks with complementary festive products such as snacks, sweets, and disposable tableware. These value-added packages often come with exclusive discounts and limited-time offers, making them attractive to busy consumers preparing for Eid gatherings. -

Rapid Delivery and Cold Chain Logistics:

Fast delivery services have revolutionized the distribution of beverages, particularly in urban areas. With same-day or even within-the-hour delivery options, consumers can now order chilled drinks just in time for a family meal or unexpected guest. Innovations in cold chain logistics ensure that even during peak summer heat, soft drinks arrive cold and ready to serve. -

Tech-Driven Consumer Engagement:

The integration of QR codes on packaging, loyalty programs, and mobile wallet cashback offers has significantly enhanced consumer interaction. Soft drink brands now engage directly with customers through apps and digital campaigns—offering instant rewards, personalized messages, and social media challenges that boost brand visibility during the Eid season. -

Rising Investment in Digital Marketing:

To capture the growing online audience, companies are increasingly shifting their advertising budgets toward digital channels. Industry forecasts suggest that investment in digital marketing by soft drink companies is expected to double by 2026, with religious festivals like Eid playing a pivotal role in driving this momentum. Influencer partnerships, short-form video content, and sponsored ads tailored to festive sentiments have become central to brand strategies.

Digital channels have thus become more than just alternative sales points they are now critical platforms for brand storytelling, real-time customer engagement, and data-driven personalization. For both global giants and regional players in the beverage industry, the fusion of e-commerce and Eid creates a strategic opportunity to build deeper consumer loyalty and tap into high-growth, tech-savvy markets.

Challenges and Supply Chain Management

While Eid ul Adha presents a lucrative opportunity for the soft drink industry, it also introduces a range of logistical and operational challenges. Meeting the sharp surge in demand without compromising product quality or delivery efficiency requires robust supply chain strategies and adaptive infrastructure.

-

Temperature Sensitivity and Short Shelf Life:

Carbonated soft drinks are highly sensitive to heat and pressure fluctuations, especially during the summer. Exposure to high temperatures during storage or transit can degrade quality, affect carbonation, and reduce shelf life posing a risk to brand reputation and customer satisfaction. -

Holiday Traffic Congestion:

The pre-Eid rush creates widespread transportation bottlenecks, particularly in urban centers and major trade routes. Delivery trucks often face delays due to traffic jams and overcrowded marketplaces, disrupting supply chains and increasing the risk of stockouts in high-demand areas. -

High Storage Costs in Rural Areas:

In rural and semi-urban outlets, access to refrigeration infrastructure remains limited. Keeping large volumes of soft drinks chilled can be expensive and logistically challenging, often requiring additional investment in energy resources or portable cooling systems. This constraint can limit product availability and sales potential in underserved regions. -

Counterfeit and Substandard Products:

In unregulated or informal markets, counterfeit soft drinks and re-used packaging remain a persistent concern. These imitations not only undermine brand integrity but also pose serious health risks to consumers. Ensuring product authenticity and safety becomes particularly critical during high-volume sales periods like Eid.

To mitigate these challenges, beverage companies are increasingly turning to technology-driven solutions:

-

Predictive Analytics:

Companies utilize demand forecasting tools to analyze historical sales data, weather patterns, and regional trends, enabling them to optimize inventory allocation and distribution ahead of the Eid season. -

Third-Party Logistics (3PL) Partnerships:

Collaborations with logistics service providers help streamline last-mile delivery, improve coverage in hard-to-reach areas, and maintain cold chain integrity under pressure. -

Tamper-Proof and Smart Packaging:

To combat counterfeit risks, some brands are investing in tamper-evident seals, QR code-based verification systems, and smart packaging technologies that ensure product authenticity and traceability across the supply chain.

Despite the seasonal challenges, the soft drink industry continues to evolve, demonstrating resilience and innovation in navigating the complex logistics landscape of Eid ul Adha. Efficient supply chain management has become not just a necessity but a competitive advantage in an increasingly dynamic consumer market.

Read More: Eid-Ul-Adha: A Holy Tradition and Its Socioeconomic Dimensions

Future Projections for Eid-Centric Beverage Marketing

As the global Muslim population approaches 2 billion, Eid ul Adha continues to evolve not only as a religious celebration but as a powerful economic engine. For the beverage industry, this annual festival offers long-term potential for innovation, localization, and sustainable growth. Looking ahead, several forward-thinking trends are poised to reshape how soft drinks are marketed and consumed during Eid:

-

Smart Vending Machines in High-Footfall Areas:

Beverage companies are exploring the deployment of AI-powered vending machines in strategic locations such as cattle markets, Eid fairs, and transportation hubs. These machines offer cashless transactions, personalized promotions, and real-time inventory monitoring—providing cold beverages in high-demand outdoor environments with minimal staffing. -

Custom-Branded Community Campaigns:

Future marketing efforts may include soft drink packaging co-branded with local mosques, schools, or Eid event organizers. Such community-level personalization fosters stronger brand affinity, especially when tied to charitable initiatives or local storytelling during the Eid season. -

Eco-Friendly and Festive Packaging:

In response to growing environmental consciousness, many companies are shifting toward biodegradable, recyclable, or reusable packaging—without compromising on festive aesthetics. Special edition bottles featuring Eid greetings, regional motifs, or messages promoting responsible consumption are expected to become mainstream in coming years. -

AI-Driven Demand Forecasting and Inventory Planning:

Artificial intelligence and machine learning will play a central role in helping brands anticipate Eid-specific consumption patterns. These tools enable accurate stock planning, reduce logistical waste, and ensure consistent supply across urban and rural distribution points—particularly during climate-sensitive holiday periods.

As digital integration, community engagement, and sustainability take center stage, the soft drink industry is increasingly aligning itself with the cultural, ethical, and environmental values of Eid. The convergence of tradition and technology will not only shape consumer behavior but also define the competitive landscape for beverage companies seeking relevance in a festival-driven global economy.

Conclusion

Soft drinks might seem like a small detail in the grand celebration of Eid ul Adha, but their presence speaks volumes. They’re not just refreshments—they’re part of the warmth we show guests, the comfort we offer family, and the joy we share during long, festive days. From the clink of bottles during a hearty meal to the chilled glass handed to a tired shopper returning from the cattle market, soft drinks quietly but meaningfully join the celebration.

What we drink during Eid reflects more than taste it reflects culture, connection, and care. The rising sales and evolving marketing strategies tell a bigger story: how a simple product can adapt to tradition, thrive in modern markets, and bring people together in moments both big and small.

From international beverage giants to small local shops, everyone plays a part in keeping this tradition alive. And for the people celebrating—families, friends, neighbors that familiar cold bottle isn’t just a drink. It’s a gesture. It’s a memory in the making. It’s part of Eid.

References:

Dhaka Tribune, Pran foods ,TBS news, RECYCLING magazine, Lawyers and jurists, CSR window