In 2024, Start-Up Bangladesh Limited, the government-supported venture capital fund, has done a remarkable progress in boosting the country’s startup ecosystem. With an overall investment of BDT 9.025 crore, it has funded high-potential startups in different sectors, contributing to establish Bangladesh as a growing startup hub (for doing business) in South Asia.

First established in March 2020 under the ICT Division, Start-Up Bangladesh has proven to be a major catalyst for nurturing early-stage businesses, technology innovation, and job creation. Founded with a capital base of BDT 500 crore, the company identifies and financially supports the startup companies with high growth potential, enabling them to grow and compete in local and global platforms.

Importance of Government-Supported Startup Funding

One of the biggest challenges for ventures in Bangladesh is finding capital. Immediate access to private investors are often limited for new businesses due to perceived risks, lack of infrastructure in the system , or limitation of access to global funding networks. That’s where government-supported venture capital comes into play. Global examples of similar public funding models, driving startup growth are successful. The UK’s Enterprise Investment Scheme (EIS) has delivered £29.9 billion in funding across over 37,000 businesses since 1994 and achieved success which proves how investment can help the entrepreneurship stated in The Public UK.

Investment Overview in 2024

Start-Up Bangladesh invested BDT 9.025 crore in total in 9 startups in 2024 over EdTech, FinTech, Travel, and Healthcare sectors. Startups that received investments

10 Minute School (EdTech) – The largest online learning platform in Bangladesh that helps students learn remotely.The demand for remote learning and online education has surged, especially in emerging markets. 10 Minute School offers accessible, affordable education, which appeals to a large population of students looking for quality learning opportunities outside traditional classrooms.

Sheba Platform (Digital Services) – A technology driven platform that organizes home and business services in an efficient way.Sheba provides an efficient way to connect service providers with customers, tapping into the growing demand for convenience. This makes it a strong candidate for investment as it solves problems related to service delivery in sectors like home maintenance and business services.

ShareTrip (TravelTech) – One-stop digital travel agency to ease Bangladeshis travel all over the world.TravelTech is rapidly growing globally, and ShareTrip focuses on simplifying travel for Bangladeshis. With a robust online booking system, partnerships with airlines, and hotels, it serves a large market in Bangladesh, which makes it an attractive investment opportunity.

ParentsCare (Healthcare) – Aimed at elderly care, this startup connects families with health care providers. With an aging population, there is a rising need for elderly care services. ParentsCare connects families with healthcare providers for elderly care, filling a critical gap in the healthcare sector. This aligns with the growing trend toward health tech and eldercare services.

Dubotech Digital (Robotics) – Bangladesh’s first underwater robotics and automation company. As Bangladesh’s first underwater robotics company, Dubotech is positioned at the cutting edge of robotics and automation. It has the potential to revolutionize industries like marine exploration, environmental monitoring, and even disaster management.

Shokriyo Technologies (Logistics) – Improving supply chain efficiency using AI to better manage distribution. The supply chain and logistics industry is crucial for economic growth. Shokriyo uses AI to improve supply chain management, offering efficiency gains that are highly attractive to investors. AI in logistics can reduce costs, increase speed, and improve accuracy in distribution.

English Champ (EdTech) – Empowering Kids With Middle East’s Most Engaging English Learning Digital Content. With the demand for English learning rising in many parts of the Middle East, especially for young learners, English Champ capitalizes on a growing market. Engaging, high-quality educational content tailored to children can be very lucrative in this market.

Area 71 Ventures (e-Commerce Training) – Helping individuals dominate the world of Amazon FBA. Area 71 Ventures targets the lucrative e-commerce market, particularly Amazon FBA, which offers huge potential. By providing e-commerce training, they help individuals start their own businesses, tapping into a growing trend of entrepreneurship and online retail.

Bookshinary (Online Marketplace)– Changing the way of buying or selling books in Bangladesh.The way people buy and sell books is changing. Bookshinary offers a modern solution that allows users to buy and sell books online, meeting the growing demand for convenient, digital-first shopping experiences. With the right market positioning, it has the potential to disrupt traditional bookstores in Bangladesh.

Each startup got capital to expand its operations, recruit more people, and grow its market.

Read more: Milk Vita: The Rise, Struggles, and Future of Bangladesh’s Oldest Dairy Cooperative

A Comparative Analysis of 2024 vs. 2023 Investments

In 2023, the total investment in Bangladesh’s entire startup ecosystem shared among 45 deals stands at USD 72 million. However in 2024, total funding for the wider startup ecosystem was USD 41.3 million across 37 deals, a 43% decrease from 2024.Bangladesh’s startup investments in 2024, showing a significant drop in funding compared to the previous year. A large portion of the funding comes from international sources, contributing $40.3 million, while local investment remains minimal at just $1 million. So, Political unstable conditions affect foreign investment and that’s why government supported investment decreased. Venture capital remains the dominant funding type, with $39 million allocated, while angel investment and corporate-backed funding are significantly lower at $1.1 million and $1.2 million, respectively. Out of the 37 total deals, 22 were backed by venture capital, while only four received angel investments, and the rest fell into other categories.

Challenges Faced in 2024

Investments in Bangladesh’s startups dropped in 2024 with threats from political instability, economic uncertainty, and changes in the global market, compared to the previous year. The funding amount decreased by 43% from $72 million in 2023 to $41.3 million in 2024, according to the “Bangladesh Start-up Investments Report 2024: Year in Review” report released by LightCastle Partners, a management consultancy.

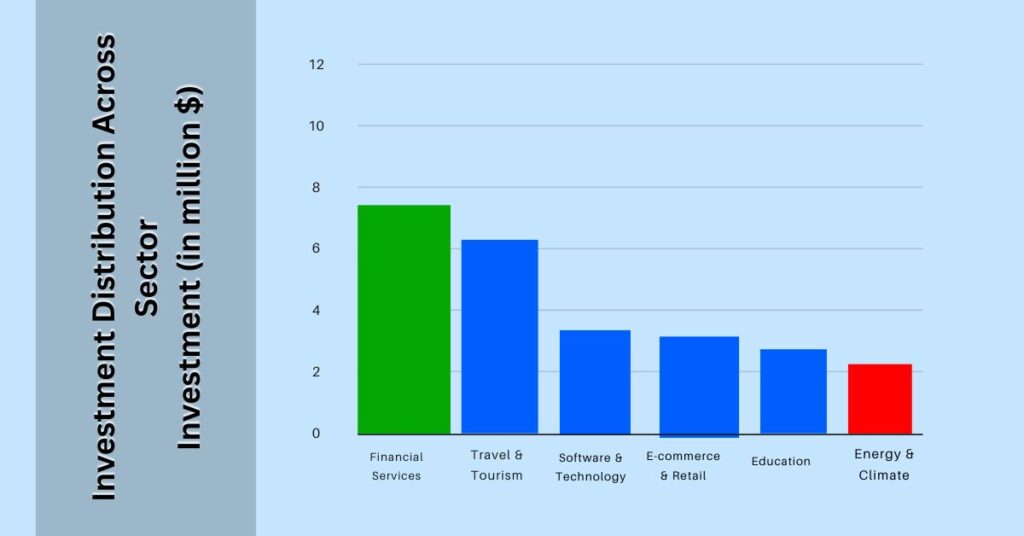

Global venture funding kept declining in 2024 as interest rates, geopolitical instability, and investor caution took their toll, the report states.Despite these headwinds, the startup ecosystem in Bangladesh continued its activity, closing 37 deals worth $41.3 million, signaling continued investor interest in the face of tough economic conditions. Still, 98% of the funding – $40.3 million – came from international investors, underscoring the ongoing reliance on foreign capital even as more local investors become involved. The sector with the largest investments in financial services received $7.7 million; travel and tourism $6.4 million; software, technology and enterprise solutions $3.4 million , e-commerce and retail $3.2 million; education $2.7 million, and energy and climate-related initiatives $2.2 million, according to the report.

What Lies Ahead for Bangladesh’s Startup Ecosystem?

Now, Start-Up Bangladesh wants to enrich its portfolio and bring in increasing number of local and foreign investment through the ecosystem. Muḥammad Yūnus, has recently been appointed as the Chief Adviser of the Bangladesh interim government and working on this factor. Bangladesh received a $2.1 billion package in investments, loans and grants during a landmark visit to China by Chief Adviser Professor Muhammad Yunus. Nearly 30 Chinese companies to invest $1 billion in the exclusive Chinese Industrial Economic Zone after Yunus urged private enterprises to make investments in Bangladesh’s manufacturing industry. The additional funds will take the form of grants and other types of lending. Chinese investment in Bangladesh will boost our economic condition and more government based investment for startups will be possible.

Future Implications

2025 is going to be an even bigger year for Bangladesh’s startups. We look forward to more private investors coming to the ecosystem, government funding programs getting more aggressive, automation and AI being integrated with business models in Bangladesh, and the startup community of Bangladesh getting recognized and rewarded globally as the startup culture matures.

Conclusion

While startup investments have taken a downturn, the entrepreneurial culture continues in full swing in Bangladesh. The government-endorsed entities such as Start-Up Bangladesh and foreign investments keep hope alive for future progression. Though 2024 was a challenging year; the foundation for a more resilient and self-sustaining startup ecosystem is being laid. With improved economic and political stability, Bangladesh could establish itself as a prominent startup hub in South Asia, attracting in both local and foreign investors in the upcoming years.

References

Startup Bangladesh Limited

The Daily Star

The Financial Express

The Business Standard