Introduction

Tea is one of the most widely consumed beverages in the world, second only to water. But in Bangladesh, tea is more than a drink, it is a tradition, a daily ritual, a symbol of hospitality, and a livelihood for millions.

Whether sipped in clay cups at roadside stalls or served in ceramic mugs at corporate meetings, tea connects people from all walks of life. Yet beyond this warm familiarity lies an often-overlooked fact: this simple habit fuels a multibillion-dollar global industry and plays a strategic role in Bangladesh’s national economy.

From the lush plantations of Asia and Africa to the bustling trading floors of London, Dubai, Sylhet and Chattogram, tea fuels a global economy, generating income, employment, foreign exchange, and economic resilience across continents.

We explore the economic value of tea by tracing its international journey, historical origins, current production dynamics, export performance, labor realities, and emerging opportunities in the global marketplace.

Global History of Tea: A 5,000-Year Journey

Tea’s origins are rooted in ancient China, with the earliest documented use traced back to around 2737 BCE. Legend credits Chinese Emperor Shen Nong for accidentally discovering tea when tea leaves drifted into boiling water. Over the centuries, tea spread across Asia, eventually becoming a crucial part of social and religious rituals.

By the 16th century, Portuguese and Dutch traders brought tea to Europe, where it quickly gained popularity, especially in Britain. The British East India Company later played a major role in establishing tea plantations in its colonies, particularly in India and what is now Bangladesh.

Globally, tea became a commodity of power, trade, and diplomacy. From China’s vast green tea estates to Kenya’s black tea plantations, tea emerged as an economic engine. Today, tea is cultivated in over 50 countries and fuels a global industry worth over USD 70 billion.

The History of Tea in Bangladesh

Tea cultivation in Bangladesh began in 1840 with the establishment of the Malnicherra Tea Estate in Sylhet, one of the oldest commercial tea gardens in the subcontinent. The British introduced tea here as part of their broader expansion of tea plantations across colonial India.

After independence in 1971, Bangladesh inherited around 150 tea estates. These estates were nationalized and later diversified, giving rise to both state-owned and private plantations. Today, Bangladesh has more than 168 tea gardens spread across Sylhet, Chattogram, and the rapidly growing northern districts of Panchagarh.

Tea has since grown into a strategic agricultural industry, contributing to rural development, employment generation, and export earnings. The Bangladesh Tea Board, established in 1951, continues to regulate and promote the industry under the Ministry of Commerce.

Economic Value of Tea in Bangladesh

1. Contribution to GDP and National Economy

Tea contributes nearly 1% to Bangladesh’s GDP, amounting to around BDT 3,500 crore (approximately USD 300 million) as of 2021.

Though this percentage may seem small, tea plays a strategic role in the livelihoods of millions and the agro-industrial landscape. Bangladesh is ranked among the top ten black tea producers globally, with increasing domestic and global recognition.

2. Production and Domestic Market

-

In 2023, Bangladesh’s tea production reached a record 102.92 million kg, a 9.69% increase from 2022.

-

Over the last five years, the industry has grown at an average rate of 7%.

-

Sylhet remains the traditional tea hub, but Panchagarh and northern districts are rising stars, contributing significantly to recent production gains (86% increase over five years in the north).

-

Domestic demand now stands at 85–90 million kg per year, driven by higher disposable incomes and changing consumption patterns.

-

Despite increased production, Bangladesh has historically imported tea to meet local demand—though this trend is expected to reverse with recent bumper harvests.

-

The Bangladesh Tea Board is pushing for diversification, promoting green tea, white tea, orthodox tea, and artisanal blends to add value and meet evolving consumer preferences.

Read More: Bangladeshi Student Mahdia Rahman Wins Judges Choice Award at AYDA 2024 in Tokyo

3. Employment and Livelihoods

Tea plays a major role in rural employment:

-

Direct employment: Around 1.5 million people, many of whom are women and belong to indigenous communities.

-

Indirect employment: Through transport, packaging, distribution, auctioning, and retail sectors.

-

Workers often face challenges, including:

-

Low wages (Tk 170 per day as of 2023)

-

Limited access to education, healthcare, and nutrition

-

-

Tea worker communities have long been marginalized. Labor rights, wage fairness, and improved housing and sanitation remain pressing concerns for inclusive development.

4. Export and Foreign Exchange Earnings

While most tea is consumed domestically, exports play a strategic economic role:

-

2023 tea exports: USD 2.44 million, up from USD 0.78 million in 2022

-

Export volume has been inconsistent:

-

2017: 2.56 million kg (high)

-

2019: 0.6 million kg (low)

-

-

Export destinations include:

-

United Arab Emirates ($1.24M)

-

United States ($794k)

-

Pakistan, Kuwait, and Saudi Arabia

-

-

Competitive pricing helps Bangladesh penetrate export markets, though quality consistency remains a challenge.

-

The Bangladesh Tea Board has set an ambitious export target of 15 million kg by 2025.

Challenges and Opportunities

Challenges:

- Balancing local consumption and export targets

-

Improving quality control, especially in new plain-land plantations

-

Combating the effects of climate change (erratic rainfall, rising temperatures)

-

Addressing labor unrest, low wages, and living conditions

-

Enhancing processing technology and modern agricultural practices

Opportunities:

-

Exploring premium and organic tea segments

-

Expanding into specialty teas for global markets

-

Promoting sustainable farming and obtaining fair trade certifications

-

Building tea tourism in Sylhet and Panchagarh

- Creating brand identity for Bangladeshi teas internationally

Tea in the Global Economy

1. Market Size and Growth

-

The global tea market was valued at USD 70.83 billion in 2023

-

Projected to reach USD 104.21 billion by 2030, with a CAGR of 5.7%

-

Another estimate suggests the market could hit USD 98.29 billion by 2033 (CAGR 7.09%)

-

The global tea trade is worth approximately USD 9.5 billion annually

2. Leading Producers and Exporters

-

China: Largest producer of green tea (~3.4 million tonnes by 2030)

-

India: Leading producer of black tea (~1.45 million tonnes by 2030)

-

Kenya, Sri Lanka, Vietnam: Major exporters

-

Bangladesh: Among the top 10 black tea producers

3. Employment and Smallholder Importance

-

13 million people globally depend on tea

-

60% of tea comes from smallholder farmers, mainly in developing countries

-

Tea is critical to rural development, poverty reduction, and gender empowerment

4. Key Trends and Challenges

-

Global consumption is rising, especially in Africa, East Asia, and Latin America

-

Sustainability and climate adaptation are now priorities

-

Tea must compete with coffee and energy drinks

-

Demand is growing for organic, herbal, and functional teas

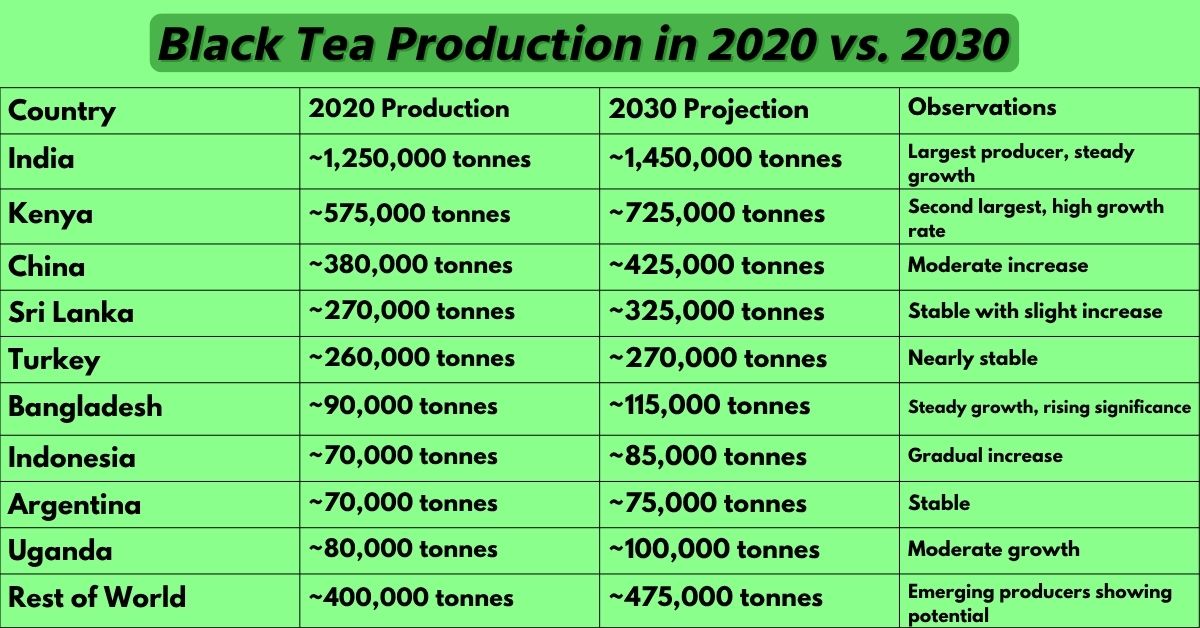

Global Tea Production Forecast (2020–2030)

Measurement Unit: Thousand Tonnes

Source: FAO/EST (2023)

This chart illustrates forecasted tea production trends from 2020 to 2030 for the world’s leading producers of black tea and green tea. It provides a clear comparison of growth patterns across key countries and highlights emerging contributors.

Key Observations:

-

India and Kenya are projected to remain the top black tea producers by 2030.

-

Bangladesh is expected to increase its production by over 25 percent, indicating a growing role in global black tea supply.

-

Most producing countries are on a positive growth path, with Kenya showing the sharpest increase among the top three.

Key Observations:

-

China will continue to dominate green tea production, accounting for more than 70 percent of global output by 2030.

-

Vietnam is emerging as a major green tea producer with a projected increase of 75 percent in output.

-

Japan maintains a stable production with slight growth, catering mostly to niche and premium global markets.

Top Tea Companies in Bangladesh

1. Ispahani Mirzapore Tea

-

Market Leader: Holds over 50% of the national branded tea market and 80% of the tea bag market.

-

Established: One of the oldest and most trusted tea brands in Bangladesh.

-

Product Range: Loose tea, tea bags, premium blends.

-

Reputation: Known for consistent quality and extensive distribution.

-

Exports: Active in global markets.

2. Kazi & Kazi Tea Estate Ltd.

-

Specialty: First and only fully certified organic tea producer in Bangladesh.

-

Location: Tetulia, Panchagarh (northern Bangladesh).

-

Product Range: Organic black, green, oolong, white, herbal and wellness teas.

-

Brand: Also markets under Teatulia internationally.

-

Export Market: Strong presence in the US, UK, and EU organic tea markets.

3. James Finlay Bangladesh

-

Origin: Subsidiary of Finlays, a UK-based company.

-

Legacy: One of the oldest tea exporters and estate owners in Bangladesh.

-

Focus: Large-scale estate production and exports.

-

Strength: High-volume, bulk supply, and sustainable sourcing.

4. Duncan Brothers (Bangladesh) Limited

-

Heritage: British-origin company with deep historical roots in the Sylhet region.

-

Production: Owns and operates several large tea estates.

-

Specialization: High-quality black teas, both for domestic and export markets.

-

Market Strategy: Bulk supply and B2B export partnerships.

5. Fresh Tea – Meghna Group of Industries (MGI)

-

Parent Group: Meghna Group, one of the largest conglomerates in Bangladesh.

-

Brand Positioning: Mass-market brand offering affordable quality tea.

-

Distribution: Strong retail presence in urban and rural Bangladesh.

-

Product: Primarily black tea, available in loose packs and bags.

6. Abul Khair Group – Tea Division

-

Business Strength: Diversified conglomerate with a major footprint in FMCG.

-

Tea Brands: Marketed under Marks Tea, among others.

-

Consumer Reach: Targeting mid- and lower-income segments.

-

Availability: Widely available in retail shops across the country.

7. Orion Group

-

Brand: Orion Tea.

-

Focus: Domestic consumption with standard and premium blends.

-

Distribution: Expanding reach through supermarkets and e-commerce.

8. Transcom Group – Beverage Division

-

Brand: Tea Valley and other blends.

-

Strength: Leverages existing beverage distribution channels.

-

Positioning: Mid-range market with focus on taste and packaging.

Honorable Mentions & Emerging Players

-

Aarong Earth Tea – Premium, ethical, and artisanal tea products.

-

Halda Valley Tea – Known for exclusive handcrafted and specialty teas.

-

Sreemangal Tea – Grown and packed in the tea capital of Bangladesh.

-

ACI Tea – A growing brand from ACI Limited, focused on mass consumers.

Labour Conditions in the Tea Industry

Despite being the backbone of Bangladesh’s tea economy, tea garden workers have long remained underpaid, underrepresented, and structurally exploited. For over a century, generations of workers largely from marginalized and indigenous communities have sustained the plantations that fuel both domestic consumption and export markets.

However, the spotlight was only recently cast on their struggle when they launched a widespread protest demanding fair wages and better living conditions.

In 2022, tea workers organized a landmark protest, demanding a daily wage of BDT 300 (USD 3.15), a significant increase from the previous rate of BDT 120 (USD 1.25).

Tea workers, many of whom live in remote plantations, struggle to access proper healthcare, education, and sanitation. Most estates offer minimal rations such as 3 kg of flour per week that fail to meet nutritional standards. Social indicators also paint a grim picture: approximately 46% of adolescents in tea garden communities are subjected to child marriage, and 15% of women reportedly suffer from cervical cancer.

Historically, the tea industry’s workforce was drawn from famine-stricken and underprivileged tribal groups, enticed by promises of a better life. In practice, this established a captive labor force, one that has now toiled for five generations over the past 170 years under conditions that many rights advocates, including journalist and SEHD director Philip Gain, have called “modern-day slavery.”

Read More: “No Sales Means Ads Failed” Is It Really True?

Though plantation owners claim that workers receive additional benefits such as healthcare and retirement funds equivalent to USD 4 a day on the ground, these benefits remain inadequate and inconsistently delivered.

This labor imbalance not only reflects economic injustice but also threatens the sustainability and ethical standing of Bangladesh’s tea industry in global markets increasingly concerned with fair trade and labor rights.

Solutions to Labor Conditions in Bangladesh’s Tea Industry

1. Establish a Living Wage Benchmark

-

Problem: Current wages (BDT 170/day) do not meet living standards.

-

Solution: The government, in collaboration with independent researchers and labor economists, should set a tea-sector-specific living wage benchmark (BDT 300–400/day adjusted for inflation, cost of living, and family size).

-

Impact: Ensures tea workers can meet basic needs like food, housing, education, and health care.

2. Revise the Plantation Labor Act & Enforce Accountability

-

Problem: Outdated labor laws and weak enforcement mechanisms.

-

Solution: Reform the Plantation Labour Ordinance (1962) and integrate it with modern labor rights protections. Form a joint labor inspection unit involving government, NGOs, and local administration.

-

Impact: Legally enforces fair wages, safe working conditions, maternity benefits, and grievance redressal.

3. Introduce a Transparent Wage Negotiation Platform

-

Problem: Wages are often fixed without meaningful worker input.

-

Solution: Institutionalize a Tea Workers’ Collective Bargaining Council with equal representation from workers, tea estate owners, and government mediators.

-

Impact: Ensures fair, transparent wage setting and reduces labor unrest.

4. Improve Access to Basic Services On-Site

-

Problem: Tea garden workers lack access to essential services.

-

Solution:

-

Set up mobile clinics and partner with public health programs for cervical cancer screening and vaccinations.

-

Expand community schools within estates in partnership with the Ministry of Primary and Mass Education.

-

Ensure clean water and sanitation facilities through NGO-led infrastructure projects.

-

-

Impact: Improves health and education outcomes, especially for women and children.

5. Digitize Wage Payments for Transparency

- Problem: Manual wage payments allow underreporting, wage theft, and lack of accountability.

- Solution: Implement mobile banking (e.g., bKash, Nagad) or direct bank transfers for all wages.

- Impact: Ensures timely and full payments, improves financial inclusion, and reduces corruption.

6. Promote Women’s Leadership in Tea Estates

- Problem: Women form the majority of tea workers but lack representation in leadership and decision-making.

- Solution: Introduce quotas for women in trade unions, estate committees, and training programs on leadership.

- Impact: Empowers female workers, enhances gender equity, and addresses women’s specific health and safety needs.

7. Mandate Independent Monitoring and Certification

- Problem: Claims of benefits and fair practices often go unverified.

- Solution: Require estates to undergo annual third-party social audits and seek Fairtrade or Rainforest Alliance certification.

- Impact: Builds global consumer trust, ensures accountability, and opens up access to premium export markets.

8.Develop Skill Training and Alternate Livelihood Options

- Problem: Tea workers have limited opportunities beyond plantations.

- Solution: Set up vocational training centers (e.g., tailoring, handicrafts, food processing) in tea gardens.

- Impact: Reduces dependency on low-wage tea labor, empowers youth, and enhances community resilience.

Align the Tea Sector with Sustainable Development Goals (SDGs)

Problem:

Despite its socio-economic importance, the tea industry is often left out of national development strategies and policy frameworks. As a result, the unique struggles of tea workers—such as poverty, gender-based discrimination, and lack of decent work—remain under-addressed in broader development planning. This exclusion hampers targeted investment and limits access to national and international support programs aimed at reducing inequality and improving livelihoods.

Solution:

To bridge this gap, the tea sector must be formally integrated into Bangladesh’s Sustainable Development Goals (SDG) tracking and implementation frameworks. Specific alignment can be made with:

-

SDG 1 – No Poverty: Tea workers are among the most impoverished in the country. Recognizing them in poverty alleviation programs ensures targeted social protection, income support, and access to essential services.

-

SDG 5 – Gender Equality: With women making up a significant portion of the tea workforce, gender-focused programs like maternal health care, equal pay, and leadership training can directly benefit tea communities.

-

SDG 8 – Decent Work and Economic Growth: Enforcing fair wages, safe working conditions, and opportunities for skill development can improve productivity and long-term growth in the sector.

-

SDG 10 – Reduced Inequalities: By including marginalized tea workers often from indigenous or low-income backgrounds in national equity programs, the state can work toward reducing systemic exploitation and discrimination.

Impact:

Aligning the tea sector with SDG frameworks not only elevates tea workers’ issues to the national agenda but also unlocks new avenues for policy support, international funding, and public-private partnerships.

It ensures that the rights, dignity, and well-being of tea workers are central to Bangladesh’s development story. This strategic move helps build a more inclusive, ethical, and globally respected tea industry one where economic growth does not come at the expense of human rights.

Conclusion: A Call to Conscience

Tea is more than a beverage in Bangladesh. It’s a gesture of welcome, a morning ritual, a companion in conversation. From humble roadside stalls to polished corporate boardrooms, tea connects people are quietly threading itself into the rhythm of our daily lives.

Yet behind the comfort of every cup lies the silent labor of thousands women and men who rise before dawn, toil under the sun, and return home with barely enough to live on. These workers are not just hands that pick leaves; they are the heartbeat of an industry that contributes to our economy, exports, employment, and identity.

Bangladesh’s tea story is one of resilience and opportunity, but also of injustice and imbalance. Despite record-breaking production and ambitious export targets, the people who make it all possible often live without access to fair wages, education, healthcare, or basic human dignity. Their struggles are not new but they are no longer invisible.

The future of our tea economy must be rooted in fairness. As global markets shift toward ethical sourcing and conscious consumption, Bangladesh has an opportunity not just to grow more tea, but to grow better, more justly. From field to factory, from policy table to international auction house, change is both possible and overdue.

To build a truly sustainable tea industry, we must look beyond profit margins and production charts. We must see the faces behind the leaves the mothers, the daughters, the generations who have built this sector from the ground up.

Because at the end of the day, tea doesn’t just warm our bodies it must also reflect the warmth of our values. A cup of Bangladeshi tea should not come at the cost of human suffering. It should be a symbol of dignity, inclusion, and shared prosperity.

Let us not just drink tea. Let us honor it.

References: