In Monday’s trading, the country’s main stock market, Dhaka Stock Exchange (DSE), had sole dominance of Grameenphone. On that day, the company was in possession of 9 percent of the total transactions of the Dhaka market. Along with the increase in transactions, the share price is also rising. On Monday, Grameenphone traded over Rs 40 crore on the DSE, which is 9 percent of the total transactions on the DSE. The volume of transactions on DSE was Tk 444 crores. In addition to the transaction, the share price of Grameenphone rose by 5 taka 20 paisa, or about one and a half percent, to 346 taka in the Dhaka market.

In the last three months, this is the highest price of Grameenphone in the stock market. Grameenphone’s increasing share price has also had a positive effect on the market index. Based on a report by brokerage house Lankabangla Securities, the DSEX index rose nearly 3 points on Monday’s rise in Grameenphone shares in the Dhaka market. Market participants say that recently Grameenphone has declared last year’s dividend. The company declared a total of 330 percent cash dividend in two phases for the full year. That is, against each share, a shareholder will get 33 rupees. Out of that, 160 percent, or Rs 16, has been distributed as an interim dividend. The remaining 170 percent, or Tk 17 per share dividend, will be distributed after the Annual General Meeting, or AGM. February 26 is the record date for determining who will receive this dividend.

Though, those holding shares of the company on this date will get 170 percent of the dividend. Ahead of this record date, interest in the company’s shares has increased among a section of investors. This interest is especially high among institutional investors. As, in the current market conditions, the possibility of getting good profit or dividend by investing in other shares is less. Again, tax benefits are also available on cash dividends. For quite some time, bad or bad companies dominated the stock market. From there, the influence of good companies has slightly increased in the last few days in transactions and price growth. This is positive for the market. Grameenphone shares have a record date ahead. Due to this, large institutional and individual investors are interested in the shares of the company in the hope of good dividends. Grameenphone has come to the top in the transaction, Shakil Rizvi, director of DSE, said to Prothom Alo.

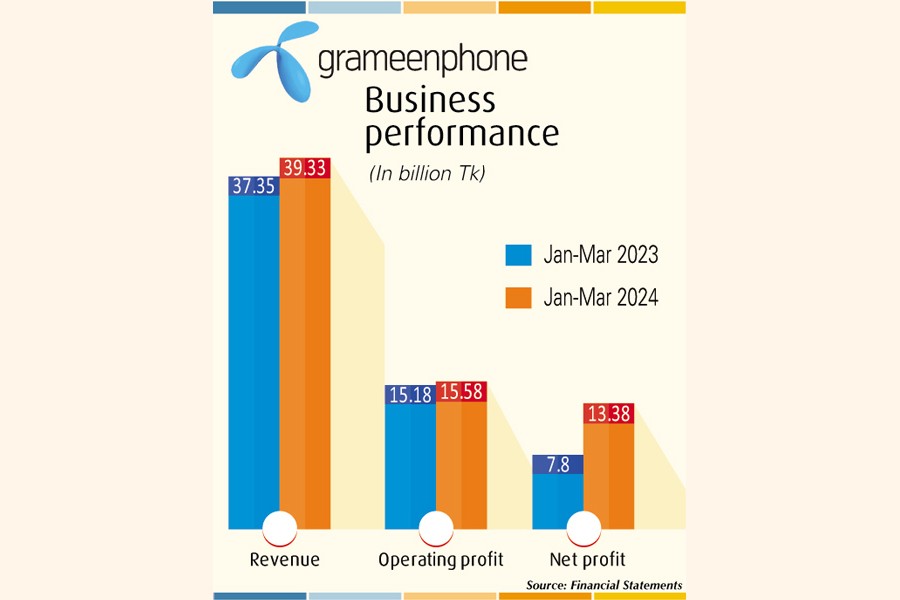

Meanwhile, based on the financial report, Grameenphone made a profit of Tk 3,631 crore at the end of last year, which is Tk 324 crore or 10 percent more than in 2023. The dividend paid by the company for the last year is more than the profit of the company. In total, for the year 2024, the company will distribute Tk 4,456 crore as a dividend to the shareholders.

Source: Prothom Alo